Authorization for Direct Deposit is a formal permission granted by an individual to a company or financial institution, allowing their paycheck or payments to be electronically deposited directly into their bank account. This process eliminates the need for physical checks and ensures faster, secure access to funds. Typically, the authorization requires providing bank details and signing a consent form to initiate the electronic transfer.

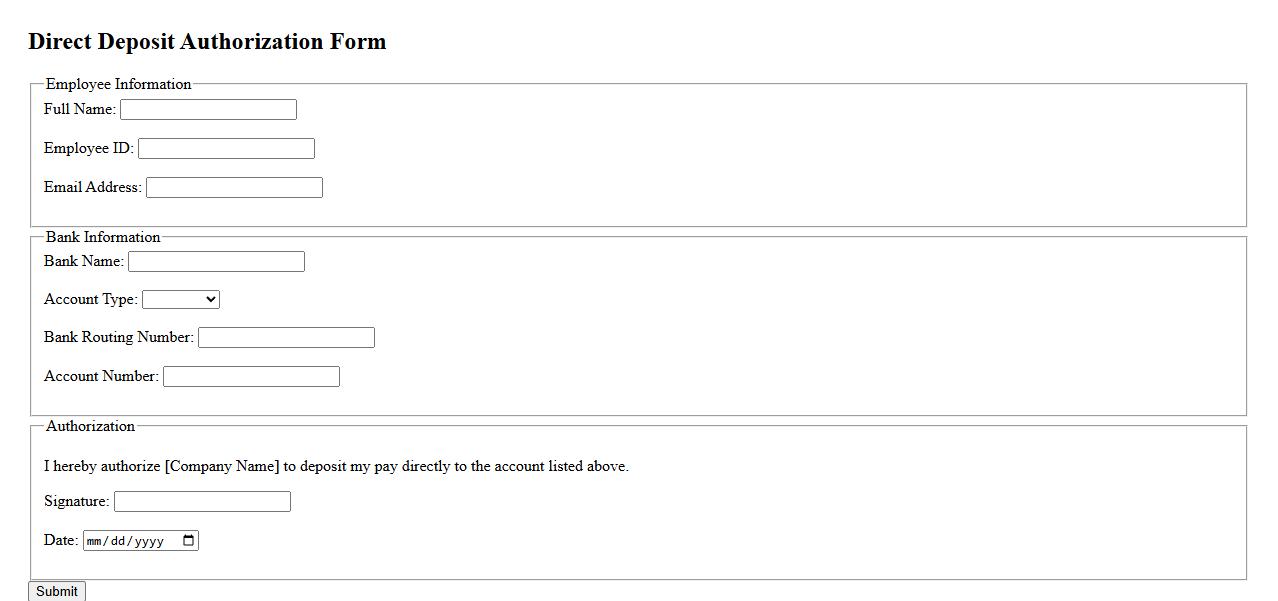

Direct Deposit Authorization Form

The Direct Deposit Authorization Form is a secure document that allows individuals to designate a bank account for electronic funds transfer. It simplifies payment processes by ensuring timely and accurate deposits directly into the recipient's account. This form is essential for payroll, government benefits, and other automated payments.

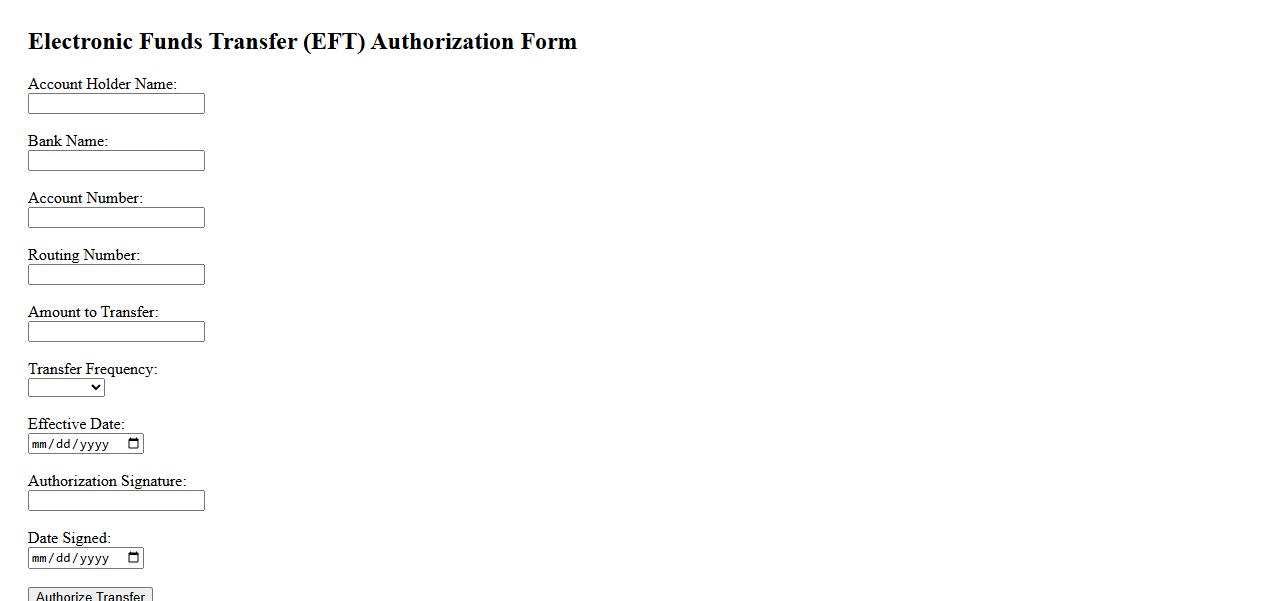

Electronic Funds Transfer Authorization

Electronic Funds Transfer Authorization is a secure process that permits the transfer of funds between bank accounts electronically. It ensures convenience and efficiency in managing payments and transactions without the need for physical checks. This authorization is essential for businesses and individuals to streamline financial operations and maintain accurate records.

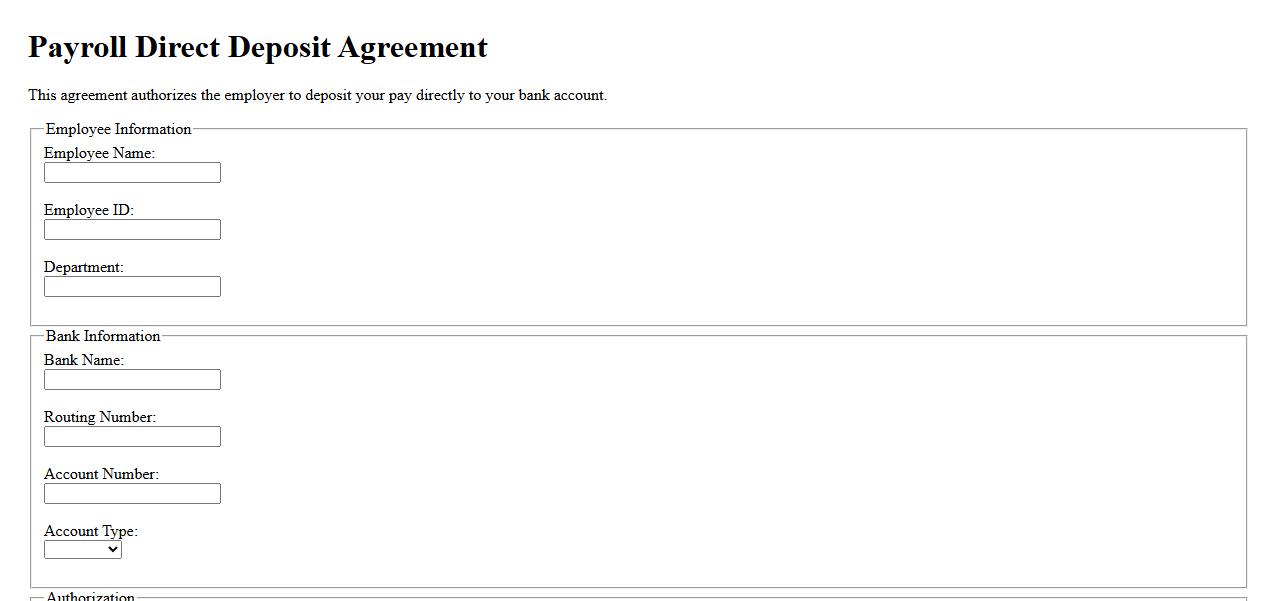

Payroll Direct Deposit Agreement

The Payroll Direct Deposit Agreement authorizes an employer to deposit an employee's salary directly into their bank account. This process ensures timely, secure, and convenient payment without the need for physical checks. Employees benefit from immediate access to funds and reduced risk of lost or stolen payments.

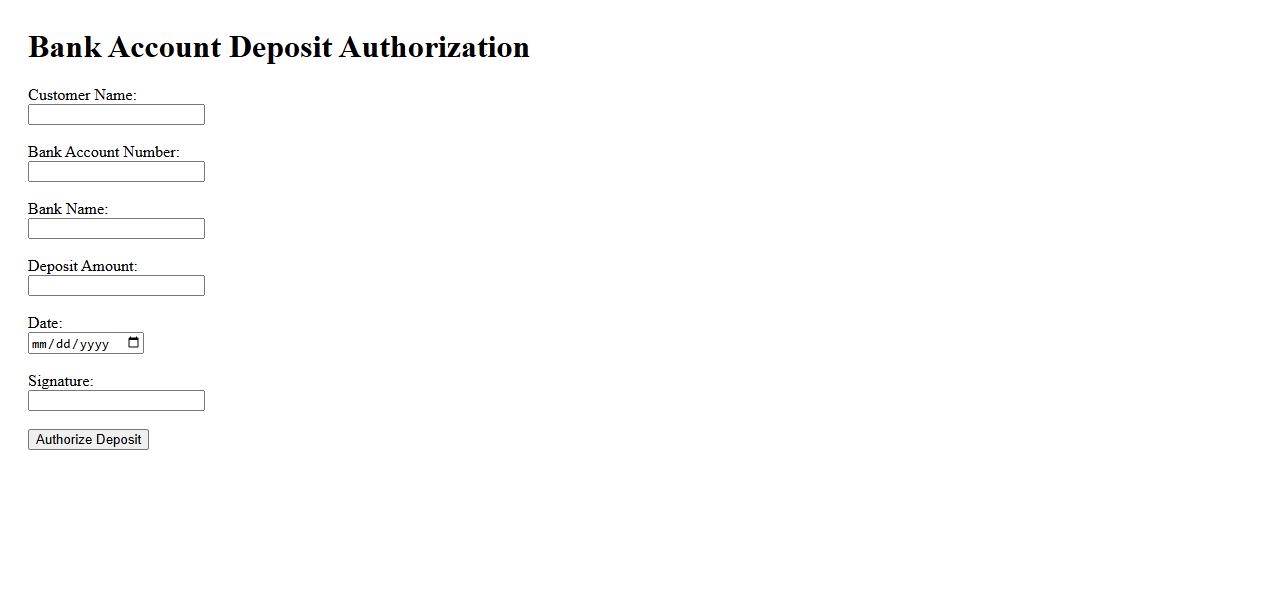

Bank Account Deposit Authorization

The Bank Account Deposit Authorization form allows individuals or businesses to grant permission for direct deposits into their bank accounts. This secure process ensures timely and accurate transfers of funds such as payroll, refunds, or other payments. Proper authorization helps streamline transactions while maintaining financial control and privacy.

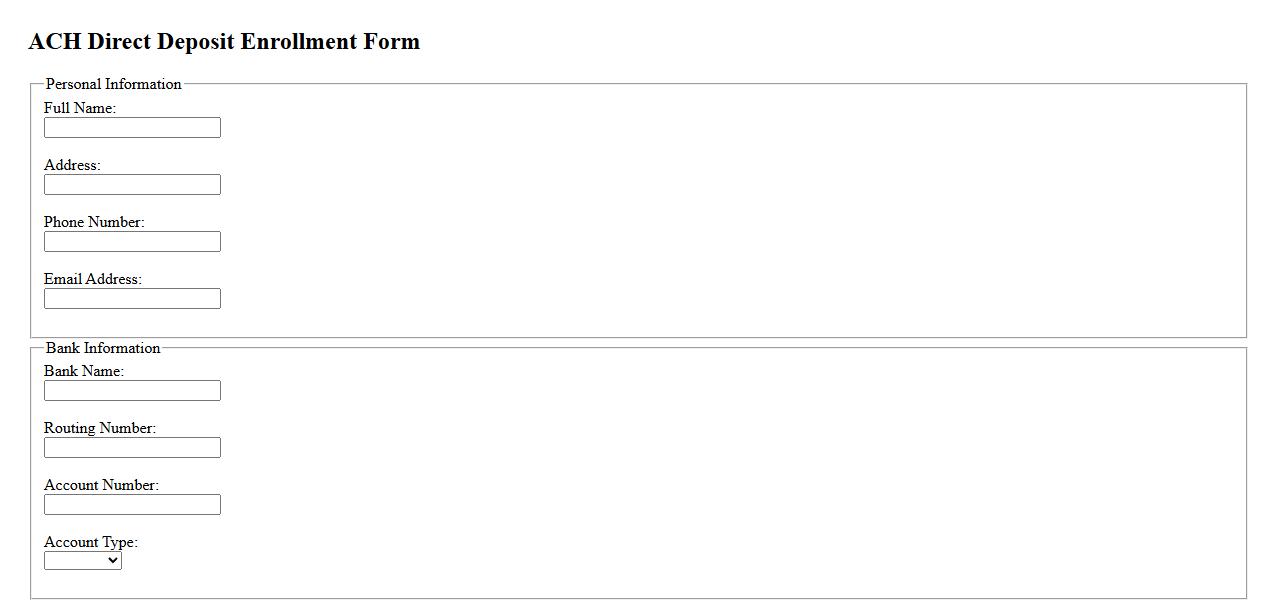

ACH Direct Deposit Enrollment

ACH Direct Deposit Enrollment allows employees to securely and efficiently receive their paychecks electronically. By opting for ACH Direct Deposit Enrollment, funds are automatically transferred to a bank account, reducing the risk of lost or delayed payments. This method ensures timely access to wages while promoting convenience and financial management.

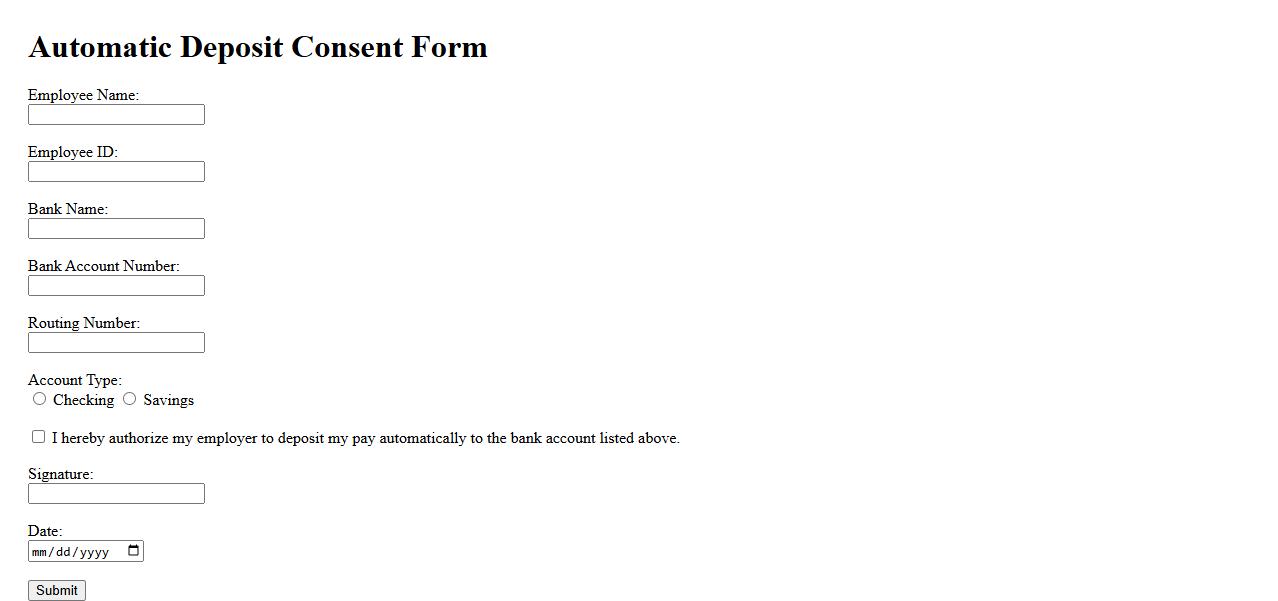

Automatic Deposit Consent Form

The Automatic Deposit Consent Form authorizes a business or individual to electronically deposit funds directly into their bank account. This form ensures a secure and efficient transaction process by eliminating the need for physical checks. It simplifies payment management and accelerates the receipt of funds.

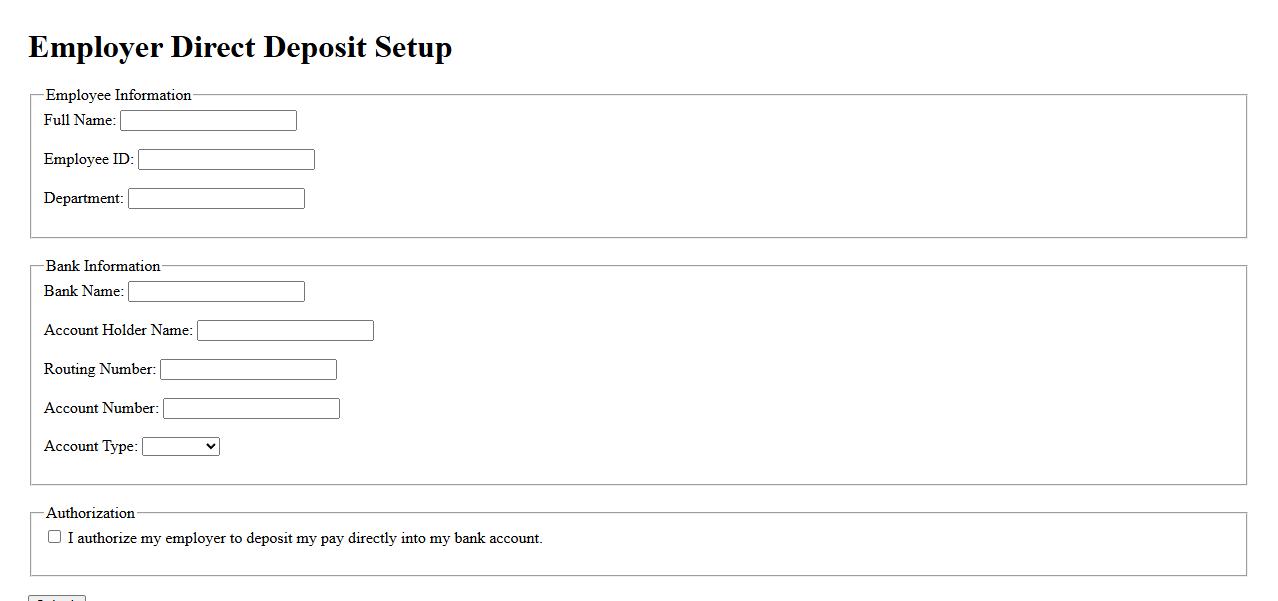

Employer Direct Deposit Setup

Setting up Employer Direct Deposit allows employees to receive their paychecks electronically, ensuring faster and more secure payments. This convenient method eliminates the need for physical checks and reduces the risk of delays or lost funds. Employers can streamline payroll processes while employees enjoy easy access to their earnings.

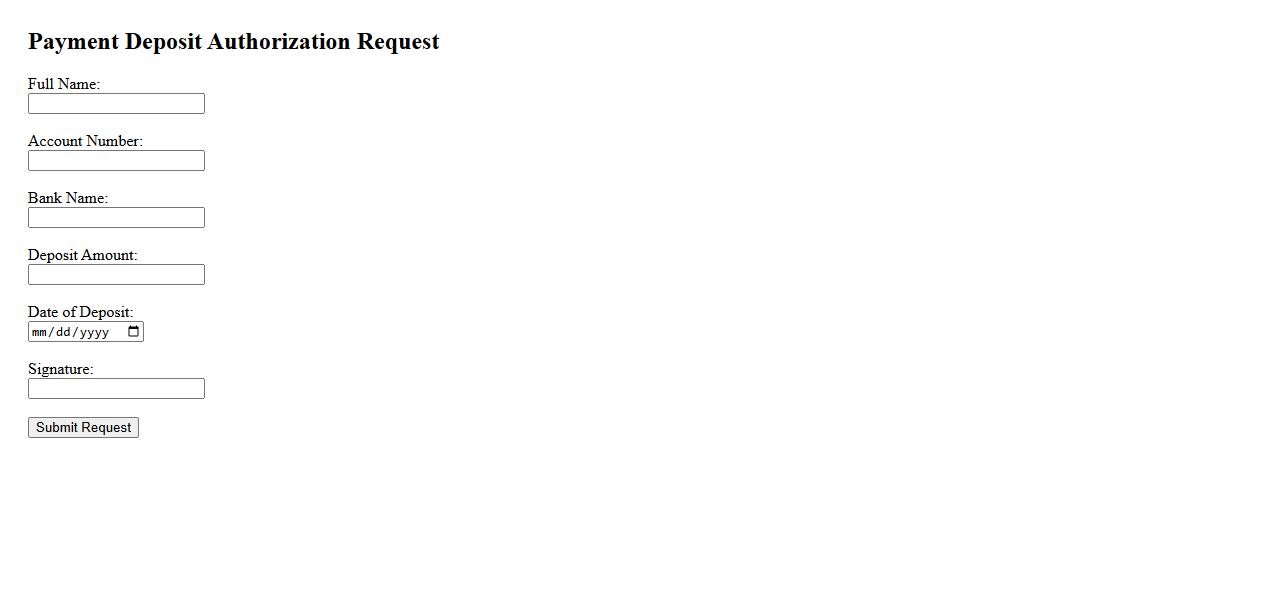

Payment Deposit Authorization Request

The Payment Deposit Authorization Request is a formal document that grants permission to process a payment transaction. It ensures secure and authorized deposits into specified accounts. This request helps maintain transparent financial operations and protects both parties involved.

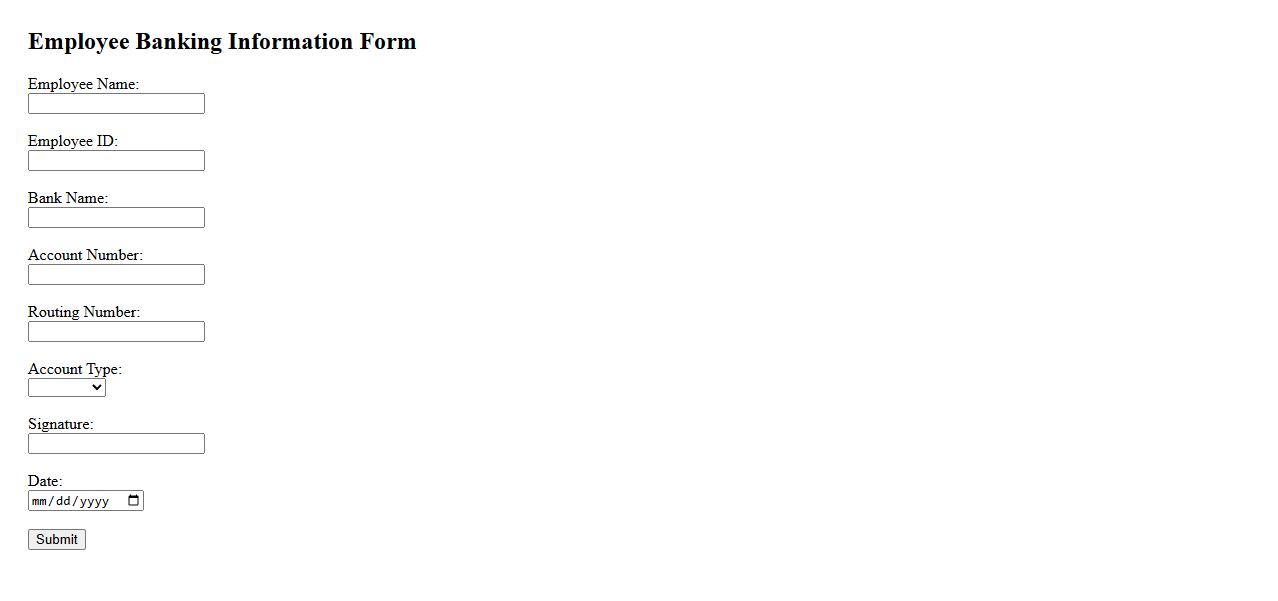

Employee Banking Information Form

The Employee Banking Information Form is essential for securely collecting and verifying an employee's bank details to ensure accurate and timely salary deposits. This form typically includes fields for account number, bank name, and branch details, facilitating seamless payroll processing. Proper completion of this document helps prevent payment errors and supports efficient financial management within the organization.

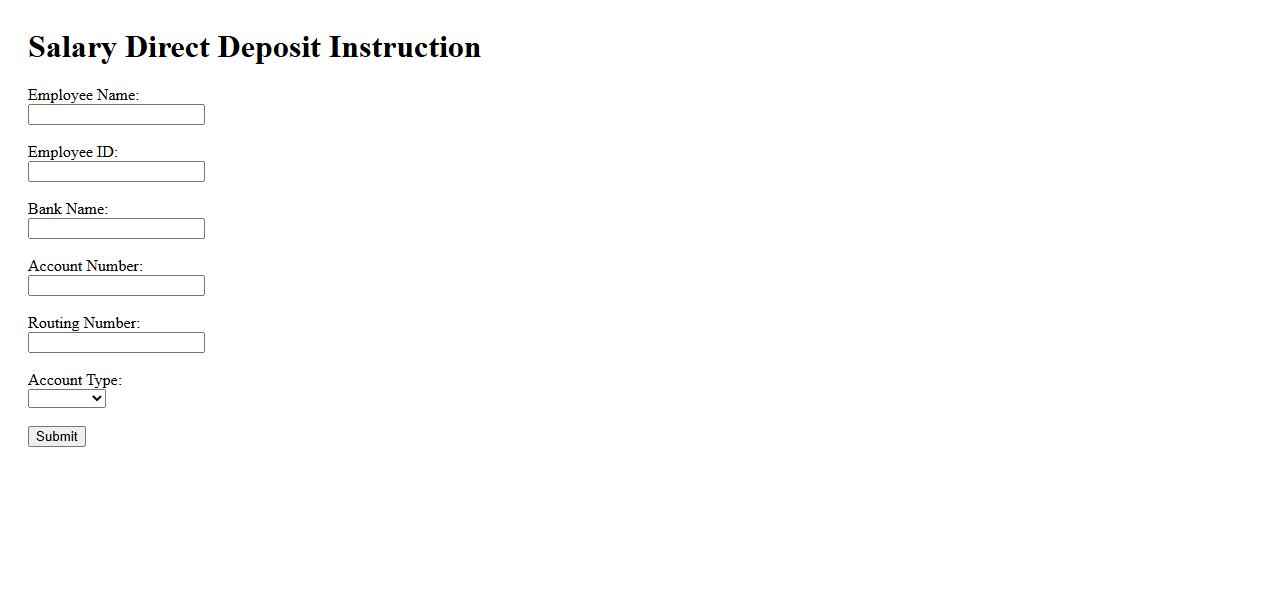

Salary Direct Deposit Instruction

Setting up Salary Direct Deposit Instruction ensures your paycheck is automatically deposited into your bank account, providing convenience and security. This process eliminates the need for paper checks, allowing timely and guaranteed access to your funds. Employers typically require bank details to initiate the direct deposit arrangement efficiently.

What is the purpose of the Authorization for Direct Deposit document?

The Authorization for Direct Deposit document allows an individual to permit their employer or payor to deposit funds directly into a specified bank account. This eliminates the need for physical checks, ensuring timely and secure transfer of payments. It also streamlines the payroll or payment process, reducing administrative tasks.

Which types of bank account information are required for setting up direct deposit?

To set up direct deposit, the form typically requires the bank account number and the routing number. Additionally, the type of bank account, such as checking or savings, must be specified. Accurate details ensure the funds are transferred to the correct account without delays.

Who is authorized to access and update direct deposit details on this form?

Only the individual who owns the bank account or an authorized representative is permitted to access and update the direct deposit details. Employers or payors generally do not have the authority to change the information without consent. Proper authorization protects the individual's financial information and prevents unauthorized transactions.

What actions does signing the document permit the employer or payor to take?

By signing the Authorization for Direct Deposit document, the individual consents to the employer or payor depositing payments directly into the designated bank account. This authorization also allows the employer to initiate corrections or adjustments to the deposit if necessary. It serves as a legal agreement, reducing the risk of payment errors or delays.

How can the authorization for direct deposit be modified or revoked?

The authorization for direct deposit can be modified or revoked by submitting a written request to the employer or payor. This typically involves filling out an updated authorization form or providing a formal notice of termination. Timely communication ensures that changes are processed before the next scheduled payment.