A Waiver of Debt is a legal agreement where a creditor voluntarily relinquishes the right to collect an owed amount from a debtor. This waiver can occur in various financial contexts, including loans, credit agreements, or business transactions. It provides relief to the debtor by eliminating the obligation to repay the specified debt.

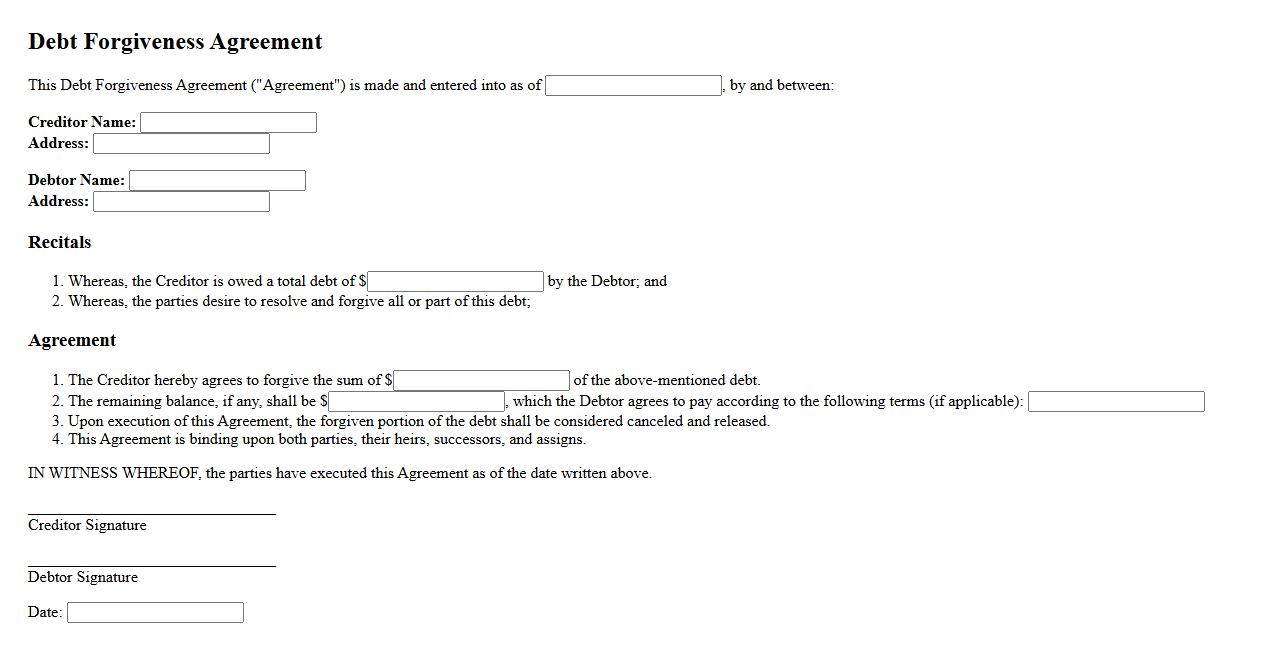

Debt Forgiveness Agreement

A Debt Forgiveness Agreement is a legal contract in which a creditor agrees to forgive all or part of a debtor's outstanding debt. This agreement helps relieve financial burdens and can prevent further legal action. It is essential for both parties to clearly outline the terms and conditions to avoid future disputes.

Loan Cancellation Form

The Loan Cancellation Form is a crucial document used to formally request the termination of a loan agreement. It ensures that both the lender and borrower have a clear record of the loan cancellation. Submitting this form helps prevent any future misunderstandings or obligations related to the canceled loan.

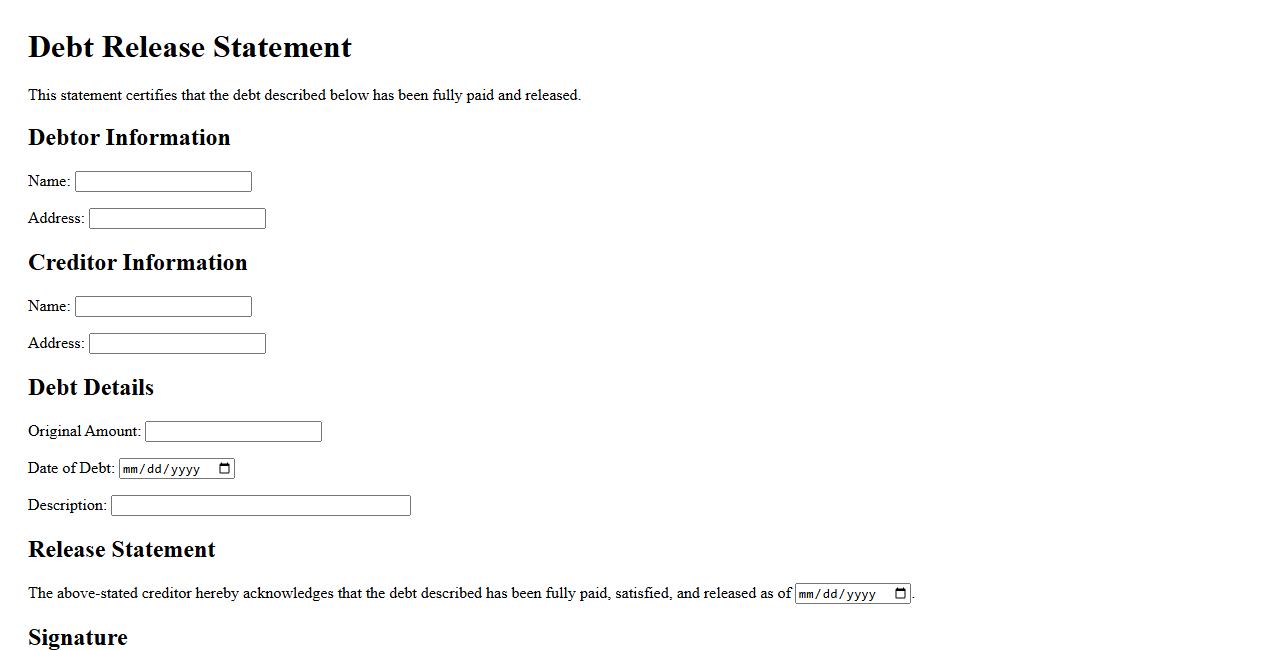

Debt Release Statement

A Debt Release Statement is a formal document issued by a creditor confirming that a debtor has fully paid off their outstanding debt. It serves as proof that the borrower no longer owes any money and releases them from any future claims related to that specific debt. This statement is essential for maintaining clear financial records and resolving disputes.

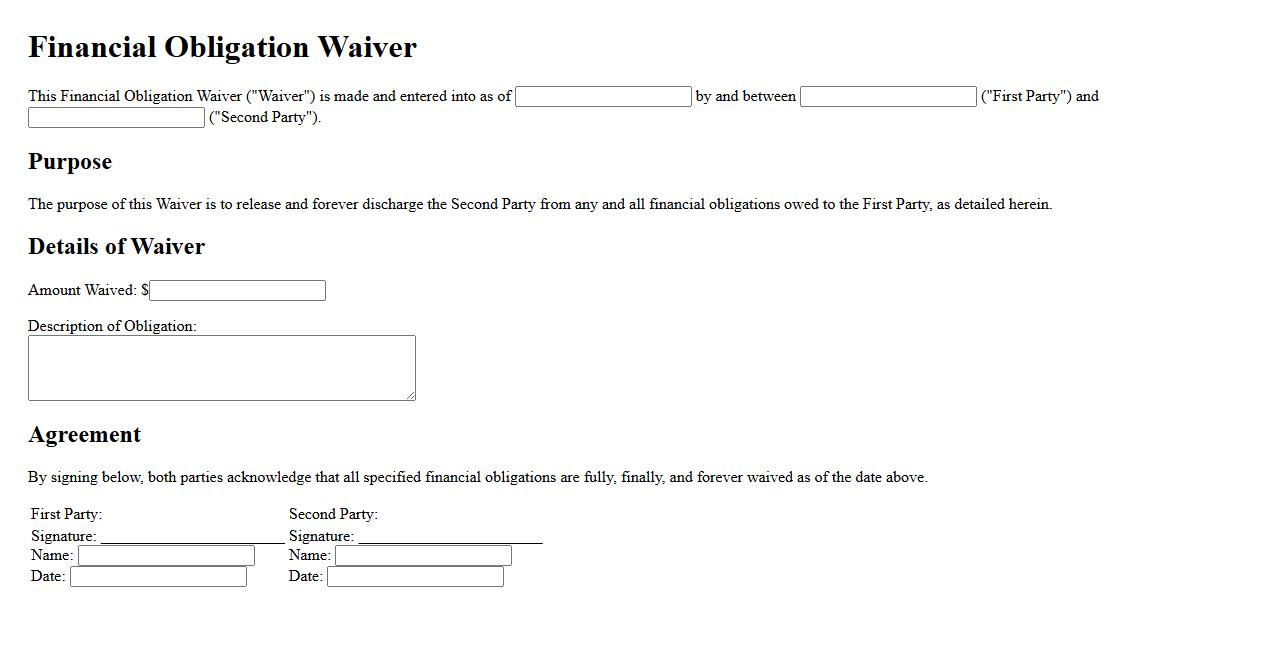

Financial Obligation Waiver

A Financial Obligation Waiver is a formal agreement that releases an individual from the responsibility of paying certain debts or fees. This waiver is often granted under specific conditions to ease financial burdens. It provides legal relief by forgiving outstanding financial liabilities.

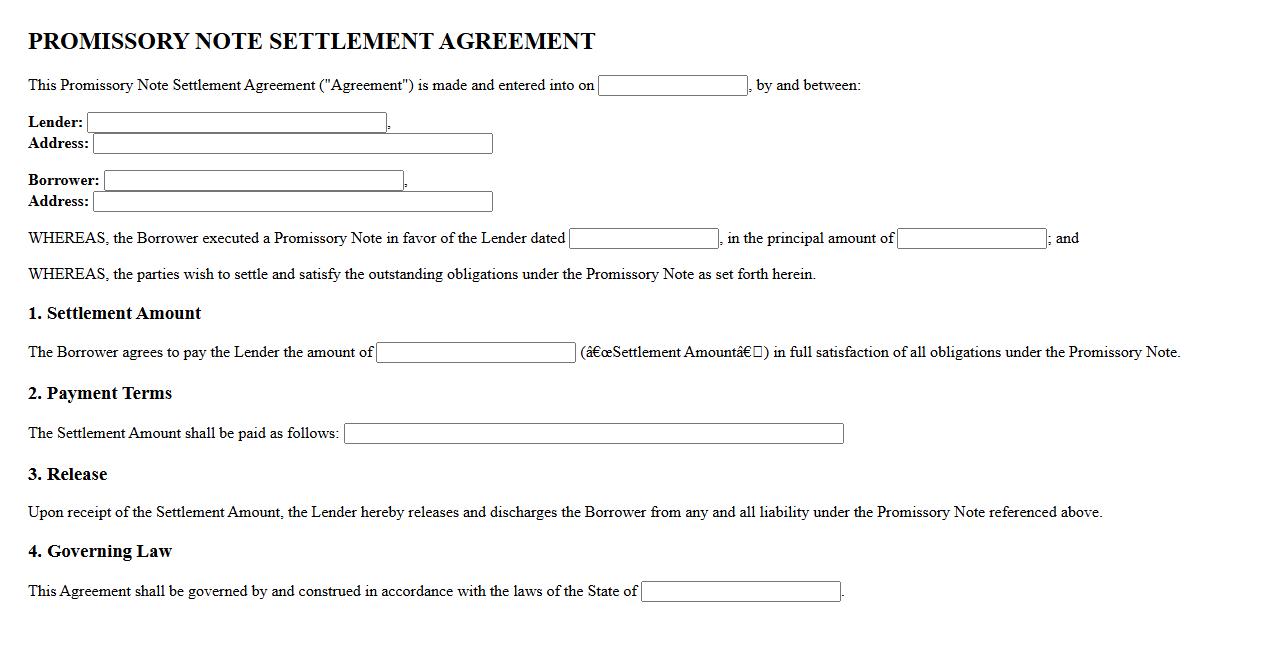

Promissory Note Settlement

A Promissory Note Settlement is a legal agreement where the borrower and lender agree on the terms to repay a debt outlined in a promissory note. This settlement can involve negotiating the payment amount, timeline, or other conditions to resolve outstanding obligations. It ensures both parties have a clear and enforceable arrangement for fulfilling the debt.

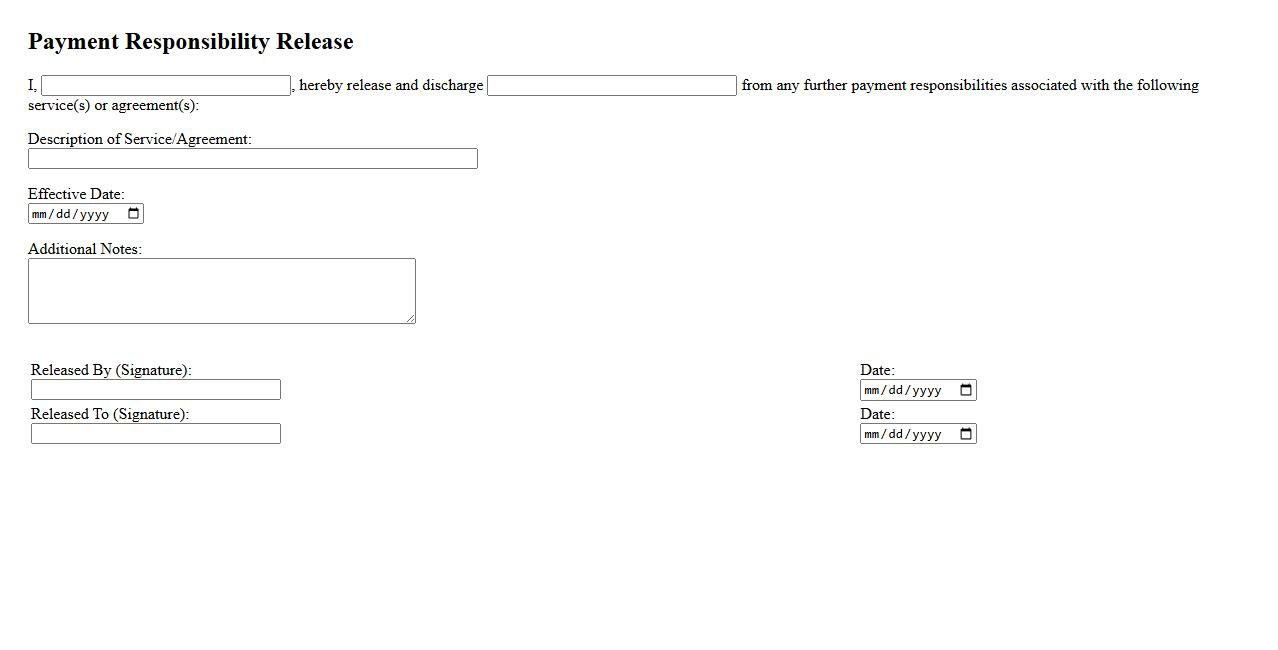

Payment Responsibility Release

Payment Responsibility Release is a legal document that absolves an individual or entity from future payment obligations. It clearly specifies the terms under which the payer is released from responsibility for charges incurred. This release helps avoid disputes by ensuring all parties understand their financial responsibilities.

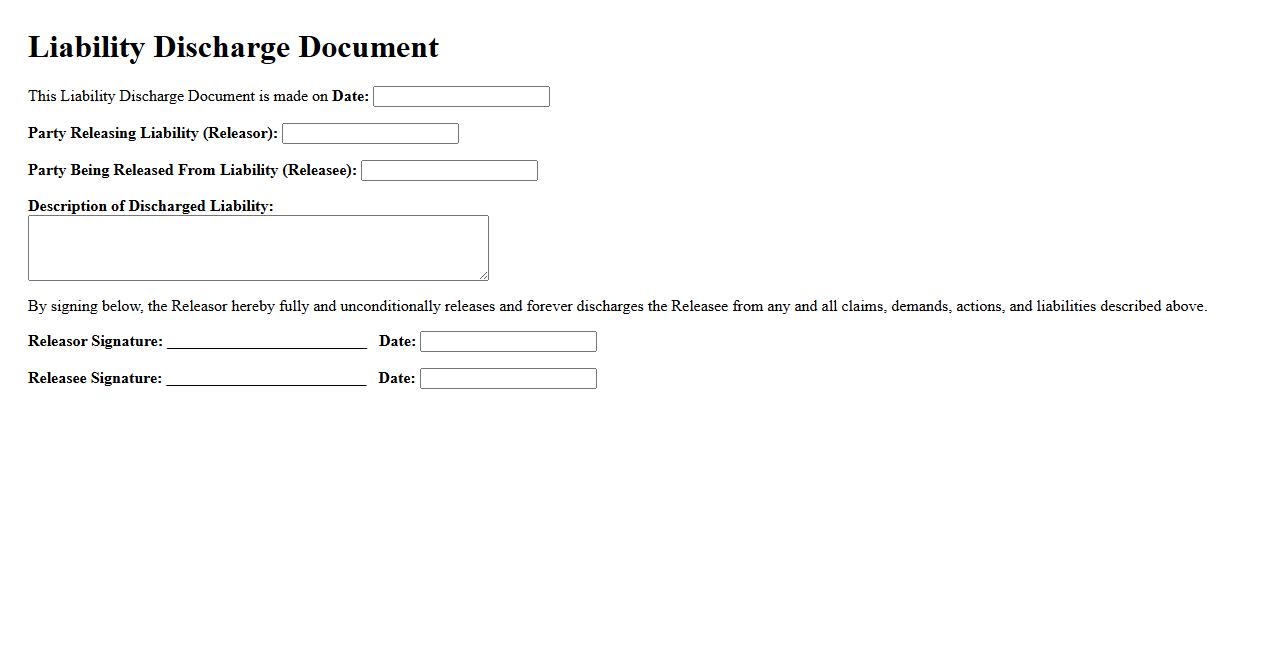

Liability Discharge Document

The Liability Discharge Document is a legal form used to release a party from responsibility for potential claims or damages. It ensures that the signer acknowledges and accepts the risks involved. This document is essential for protecting businesses and individuals from future liability.

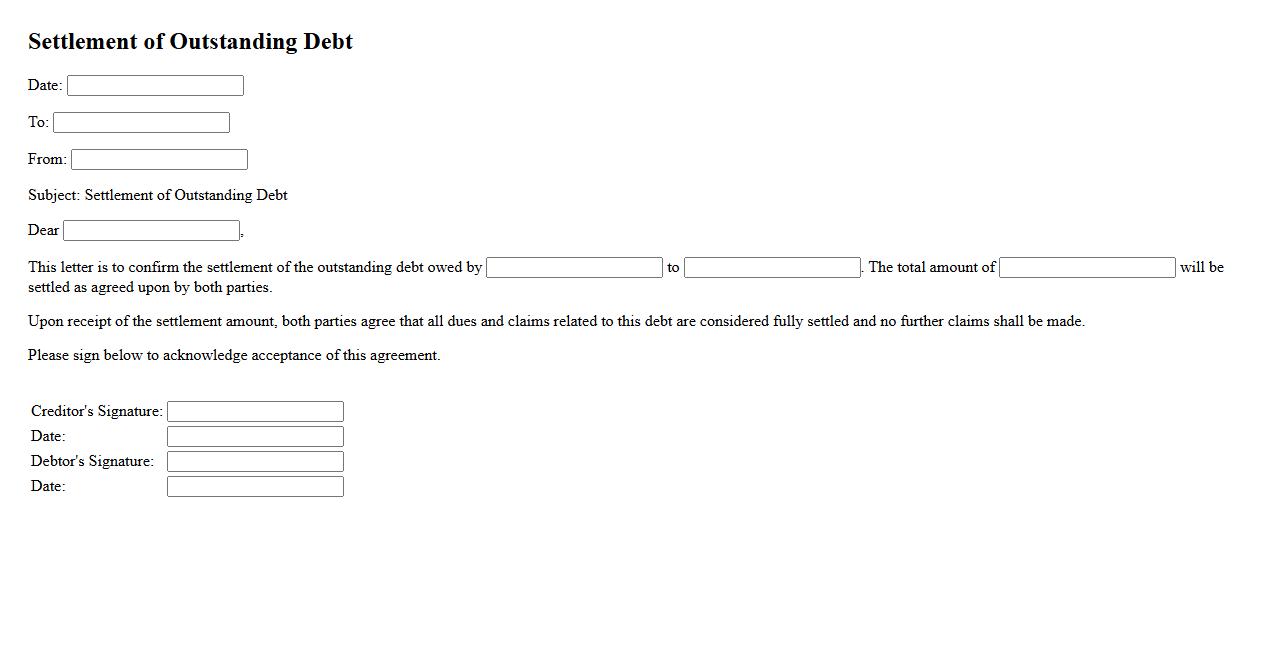

Settlement of Outstanding Debt

Settlement of outstanding debt refers to the process of negotiating and paying off a debt for less than the full amount owed. This financial strategy can help individuals and businesses avoid bankruptcy and improve credit standing. Effective settlement involves clear communication with creditors and a formal agreement to finalize the payment terms.

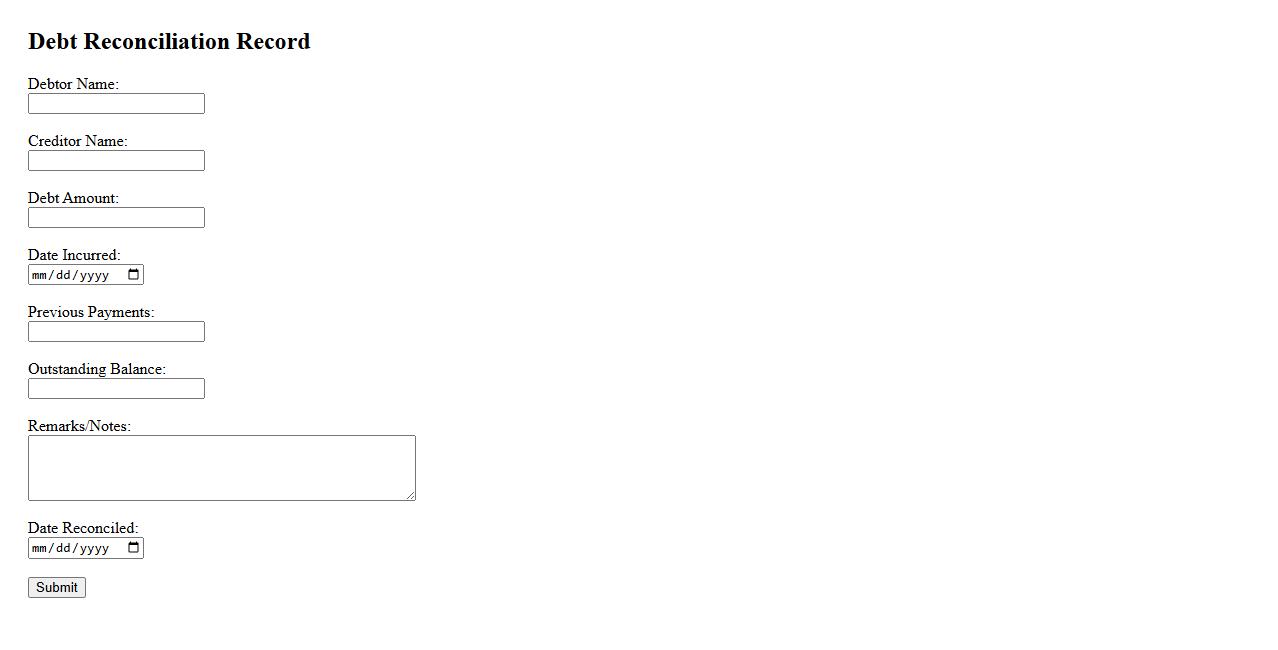

Debt Reconciliation Record

The Debt Reconciliation Record is a crucial document used to track and verify the status of outstanding debts between parties. It ensures accuracy by comparing balances from different sources to identify discrepancies. Maintaining this record helps promote transparency and financial accountability.

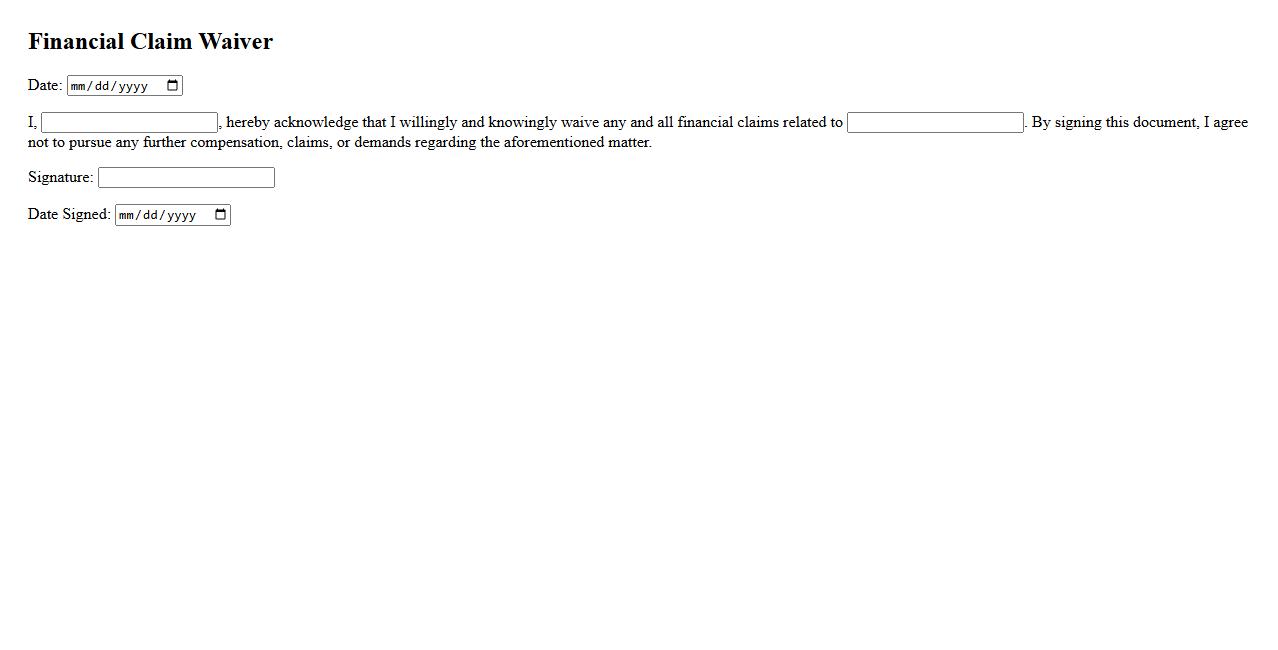

Financial Claim Waiver

A Financial Claim Waiver is a legal document that releases one party from the right to make financial claims against another. It is commonly used in settlement agreements to prevent future disputes regarding payments or debts. This waiver ensures clarity and finality in financial transactions.

Specific Conditions for Waiver of Debt

The waiver of debt must meet stringent criteria established within the document, including clear proof of financial hardship or error. It requires that all due obligations have been reviewed and confirmed for eligibility under the waiver policy. Additionally, the debt in question must not be subject to any contradictory legal proceedings or claims.

Authorized Parties for Approval or Denial

The document specifies that only designated authorizing officials have the power to approve or deny waiver requests. These parties typically include senior management or specific committee members named within the text. Their decisions are binding and must be documented to ensure accountability and transparency.

Consequences of Falsely Claimed Waiver

A falsely claimed waiver of debt can lead to serious penalties, including legal action and financial restitution. The document outlines that any intentional misrepresentation may result in denial of future waiver requests. Furthermore, there are provisions for recovery of waived amounts if fraud is detected post-approval.

Required Documentation for Waiver Application

Applicants must submit comprehensive evidence supporting their waiver claim, such as financial statements, proof of hardship, or relevant correspondence. The document insists on documented verification to validate the debt's circumstances and applicant eligibility. Failure to provide sufficient evidence can lead to rejection of the waiver request.

Scope and Duration of Debt Waiver

The document clearly defines the scope of debt eligible for waiver, specifying the types and amounts covered under the policy. It also details the duration for which the waiver is effective, often linked to specific time frames or conditions. These parameters ensure clarity on the limits and temporal application of the debt relief granted.