A Statement of No Loss is a formal document issued by an insurance company confirming that no claims have been made during a specified period under an insurance policy. This statement helps policyholders demonstrate a claim-free record, which can lead to benefits such as premium discounts or enhanced coverage terms. It serves as proof of risk-free behavior and is often required when renewing or purchasing new insurance.

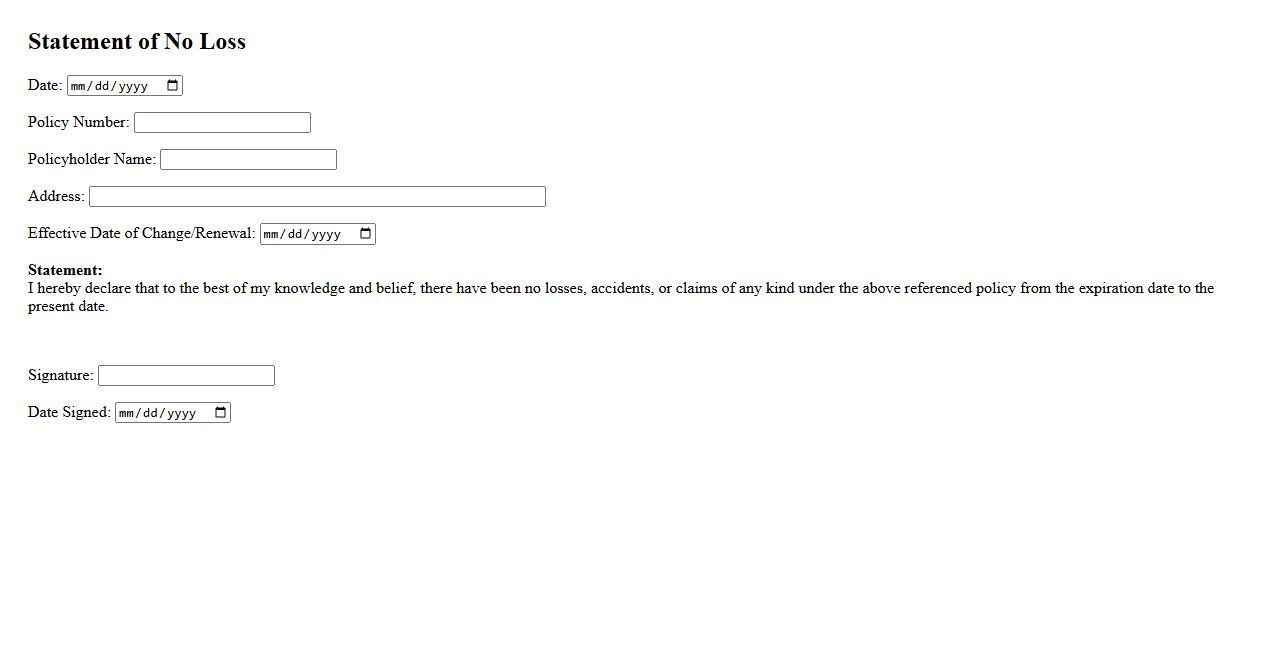

Statement of No Loss Letter

A Statement of No Loss Letter is a formal document issued to confirm that no losses have occurred during a specific period or under certain conditions. This letter is commonly used in insurance and financial sectors to verify the absence of claims or damages. It serves as proof of good standing and risk-free status for individuals or organizations.

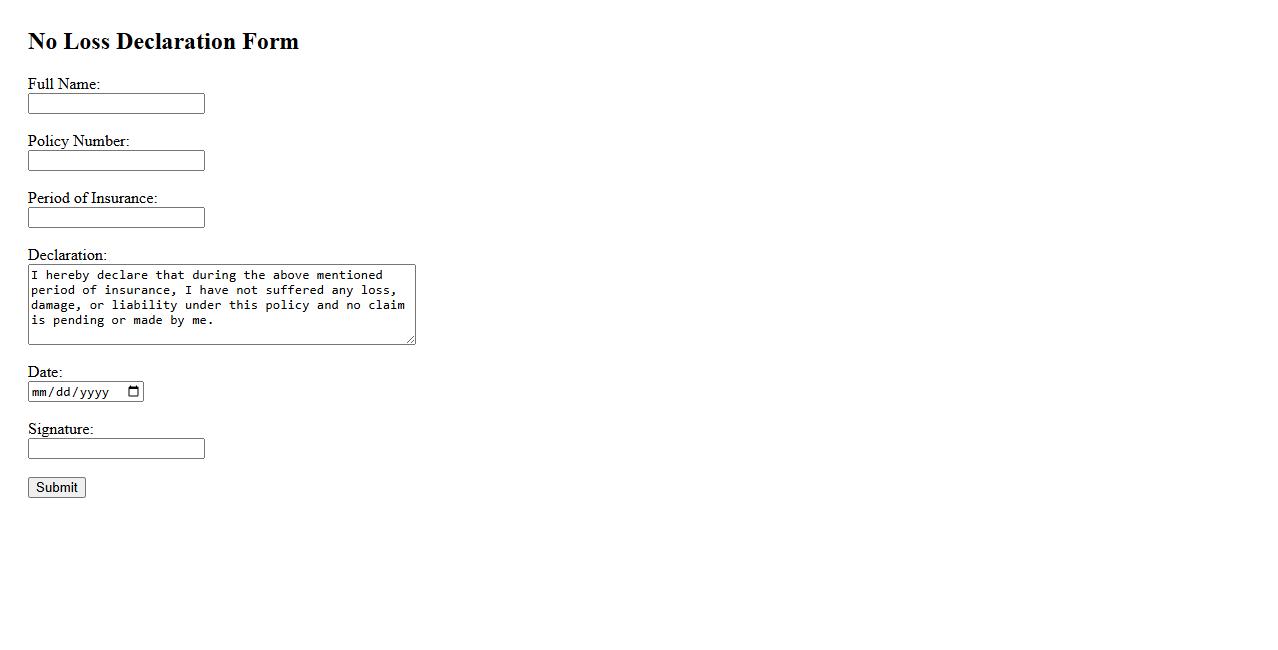

No Loss Declaration Form

The No Loss Declaration Form is an important document used to confirm that no losses or damages have occurred during a specific period. It helps streamline claims processing and ensures accurate record-keeping for insurance purposes. Submitting this form promptly can prevent unnecessary disputes and delays.

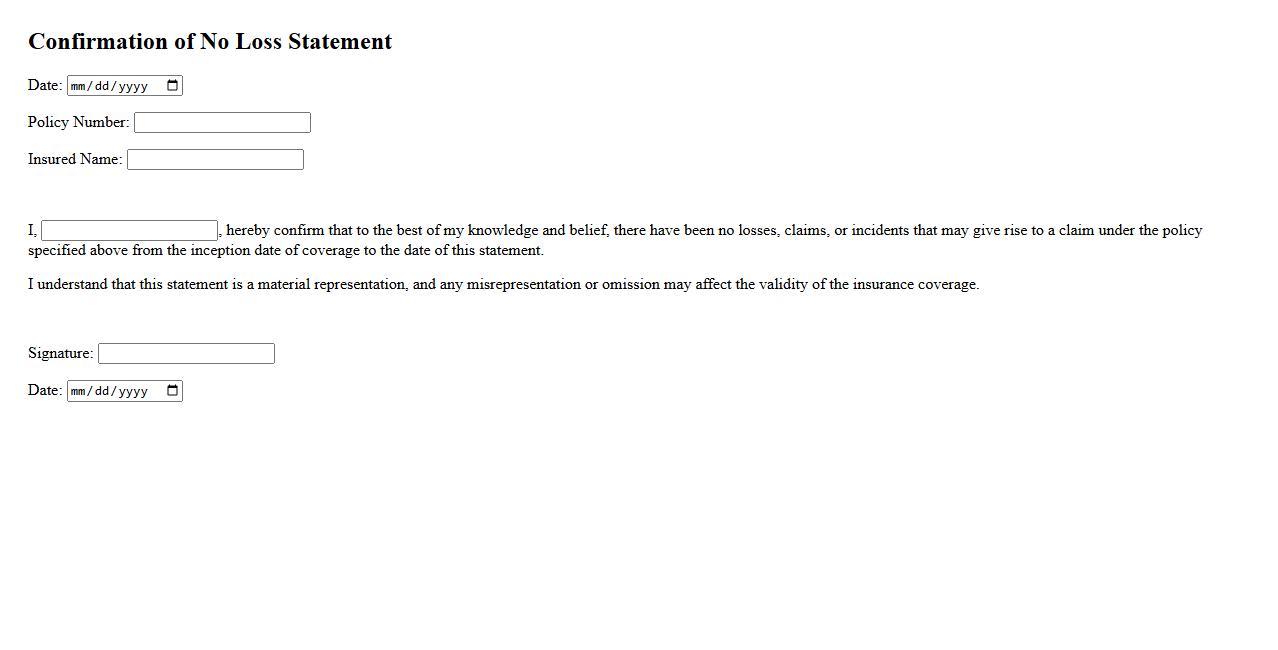

Confirmation of No Loss Statement

The Confirmation of No Loss Statement is a crucial document used to verify that there have been no claims or losses within a specified period. It provides assurance to insurers or stakeholders about the risk status of an individual or entity. This statement is often required during policy renewals or new insurance applications to ensure accurate risk assessment.

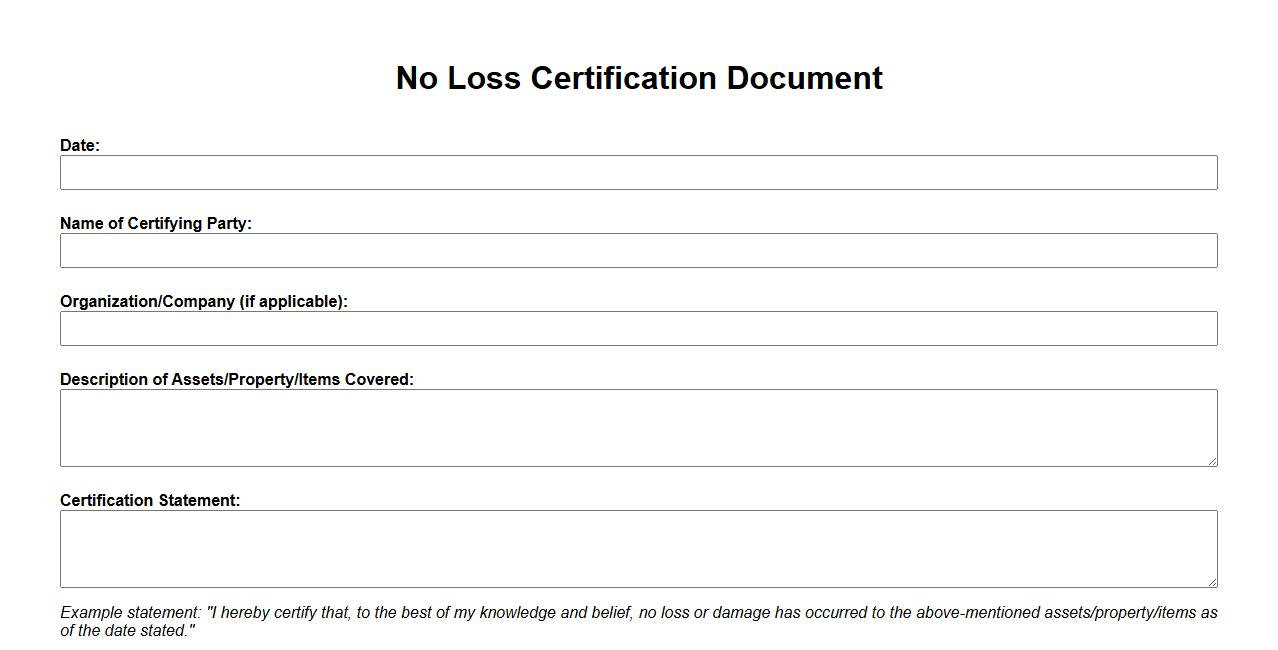

No Loss Certification Document

The No Loss Certification Document is an essential legal paper that verifies an individual or entity has not incurred any losses during a specified period. It serves as proof for compliance and financial auditing purposes, ensuring transparency and accountability. This document is often required in business transactions and regulatory processes to confirm the absence of claims or damages.

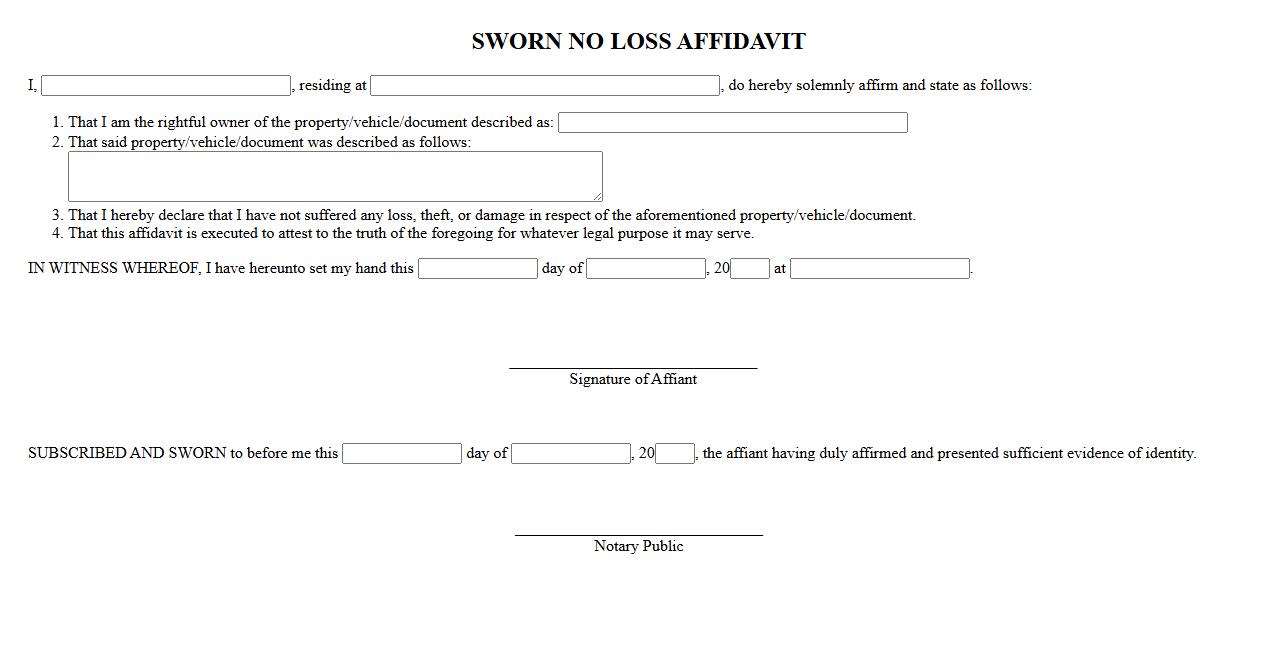

Sworn No Loss Affidavit

A Sworn No Loss Affidavit is a formal legal document used to declare that no loss or damage has occurred to a specific item or property. This affidavit serves as an official statement, often required in insurance claims, property disputes, or legal proceedings to confirm the integrity of the subject. It is signed under oath, ensuring the accuracy and truthfulness of the declaration.

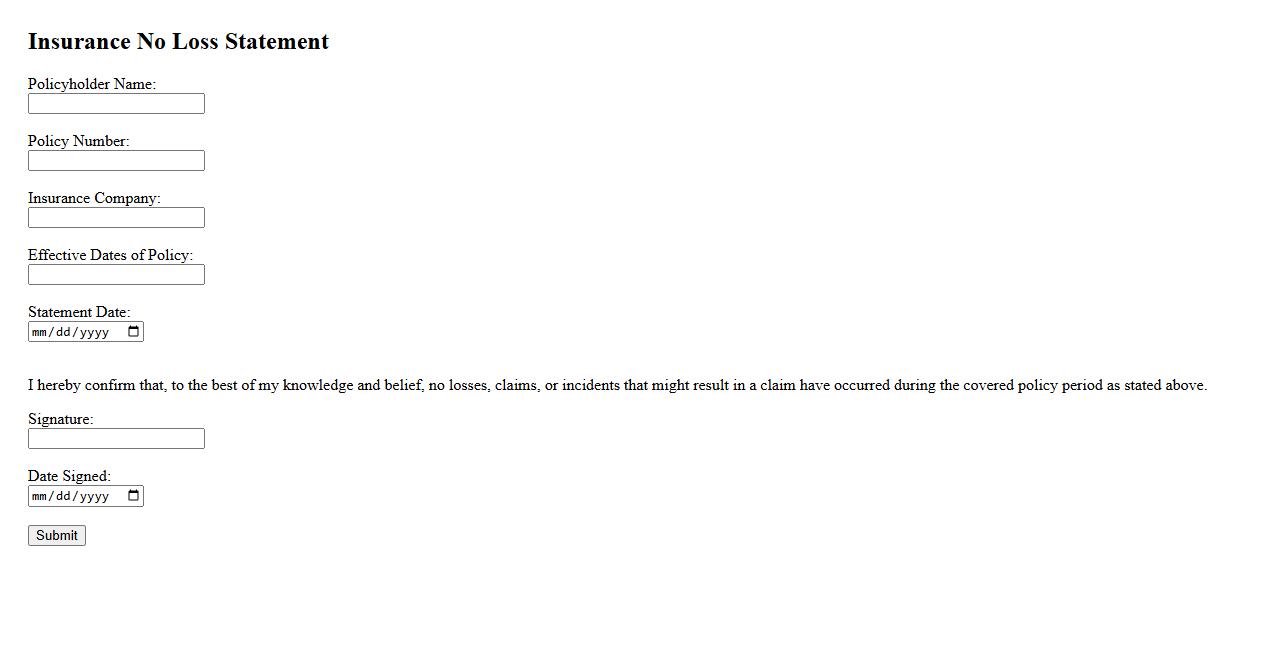

Insurance No Loss Statement

An Insurance No Loss Statement is a document provided by policyholders to confirm that no claims have been made during a specific period. It is often required when renewing or transferring insurance policies to validate the policyholder's clean record. This statement helps insurers assess risk and determine premium rates accurately.

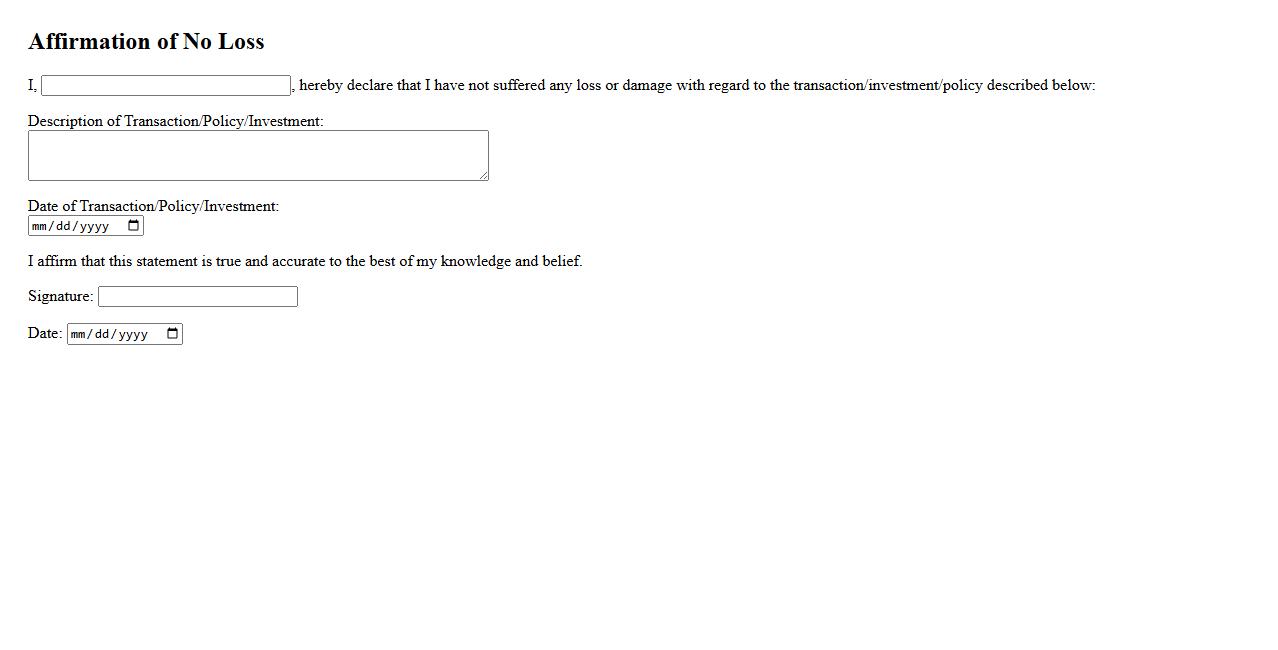

Affirmation of No Loss

The Affirmation of No Loss is a critical document that certifies no damages or losses have occurred during a transaction or process. It provides assurance to all involved parties by confirming the integrity of goods or services delivered. This affirmation helps maintain trust and accountability within business operations.

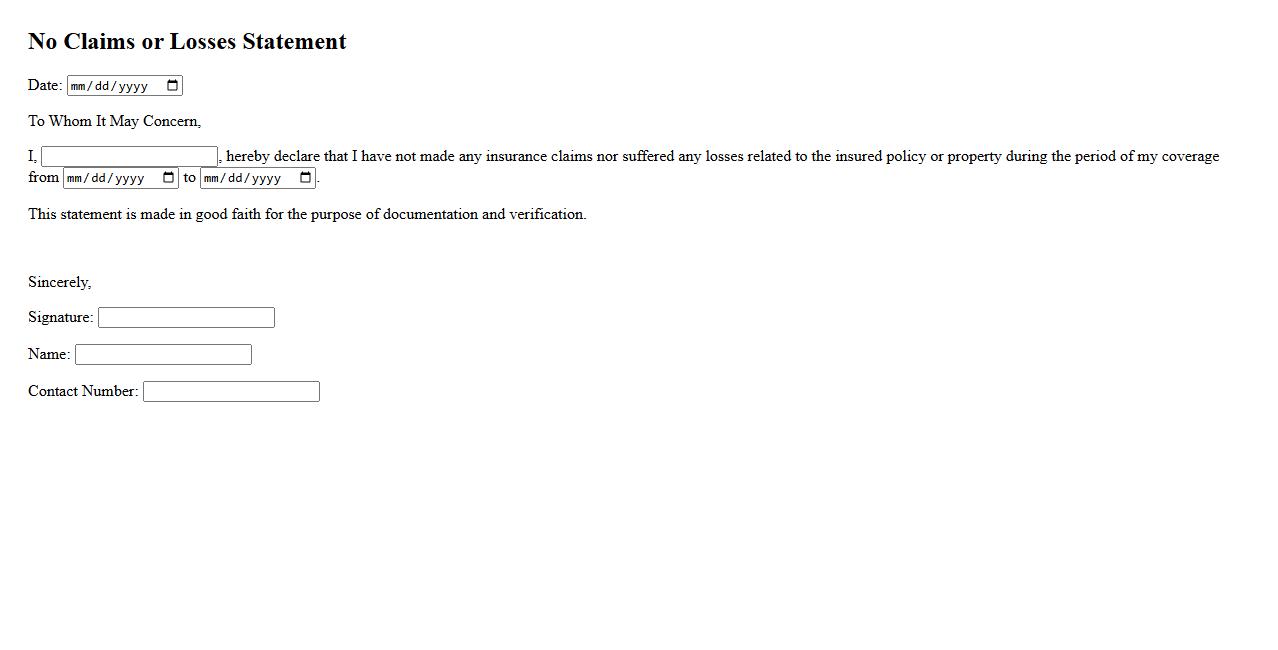

No Claims or Losses Statement

A No Claims or Losses Statement is a declaration confirming that an individual or entity has not made any insurance claims or experienced any losses during a specified period. This statement is often required by insurers to assess risk and determine premium rates. Providing an accurate No Claims or Losses Statement can help secure better insurance terms and discounts.

Warranty of No Loss

The Warranty of No Loss ensures customers are protected against any financial loss in specified transactions. This guarantee provides peace of mind, knowing your investment is safeguarded under agreed terms. It is a critical feature for risk-averse buyers seeking secure purchasing options.

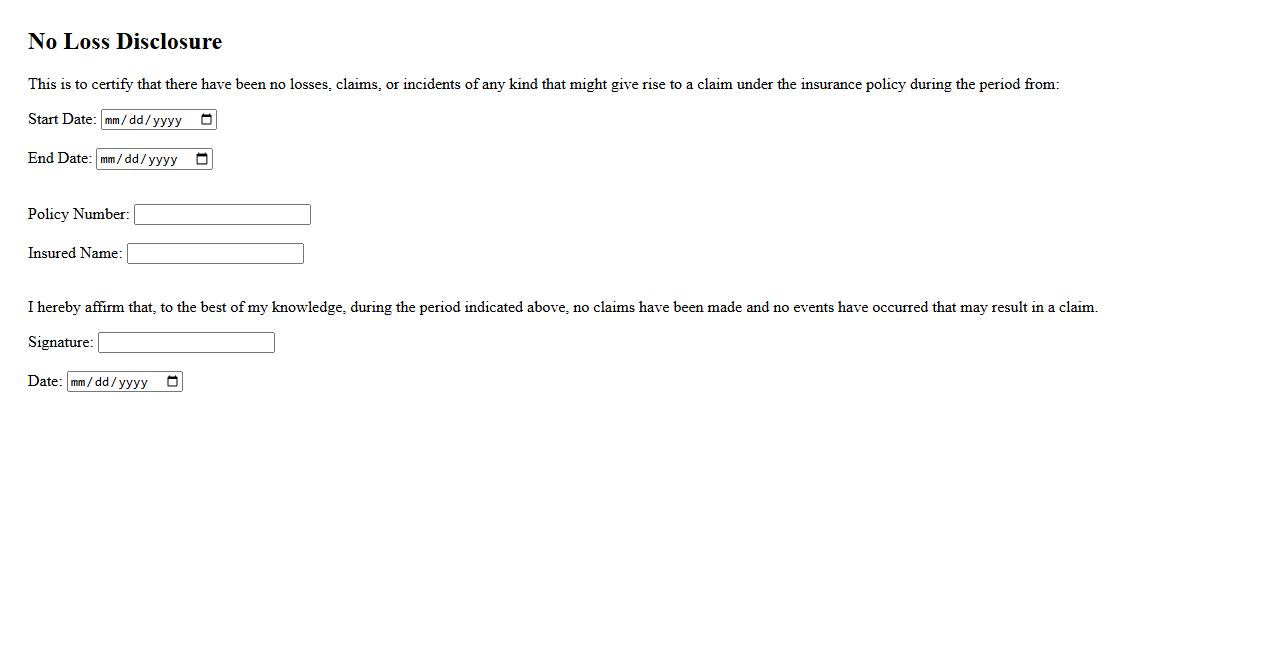

Signed No Loss Disclosure

The Signed No Loss Disclosure is a vital document ensuring transparency in financial transactions. It confirms that the signer acknowledges no losses have occurred related to the subject matter. This disclosure safeguards all parties by providing clear accountability and trust.

What does a "Statement of No Loss" confirm regarding the insured property or entity?

A Statement of No Loss confirms that the insured property or entity has not experienced any loss during a specified period. It serves as evidence that no claims have been made or incidents reported. This statement ensures the insurance company that the risk remains unchanged.

Why is a "Statement of No Loss" required before activating or reinstating an insurance policy?

A Statement of No Loss is required to verify that no losses have occurred since the policy was last active or before issuing a new policy. It helps the insurer assess the current risk status accurately. This requirement prevents fraudulent claims and protects the insurer from unexpected liabilities.

Who is authorized to sign and submit a "Statement of No Loss"?

The insured party or an authorized representative is responsible for signing and submitting the Statement of No Loss. In some cases, a company official such as a director or authorized signatory may also submit it. This ensures accountability and legality of the statement.

What are the potential consequences of providing false information on a "Statement of No Loss"?

Providing false information on a Statement of No Loss can lead to policy cancellation or denial of claims. It may also result in legal penalties or financial liabilities for the insured. Accuracy is critical to maintain trust and compliance with insurance regulations.

During which insurance processes is a "Statement of No Loss" commonly requested?

A Statement of No Loss is commonly requested during policy renewal, reinstatement, or activation processes. It is also needed when changing insurers or modifying coverage terms. This document helps insurers validate the current status of the risk involved.