A Statement of Gift is a formal document used to declare the voluntary transfer of assets or property from one person to another without compensation. It outlines the nature, value, and intent of the gift to ensure legal clarity and prevent future disputes. This statement is often required for tax purposes and to establish ownership rights legally.

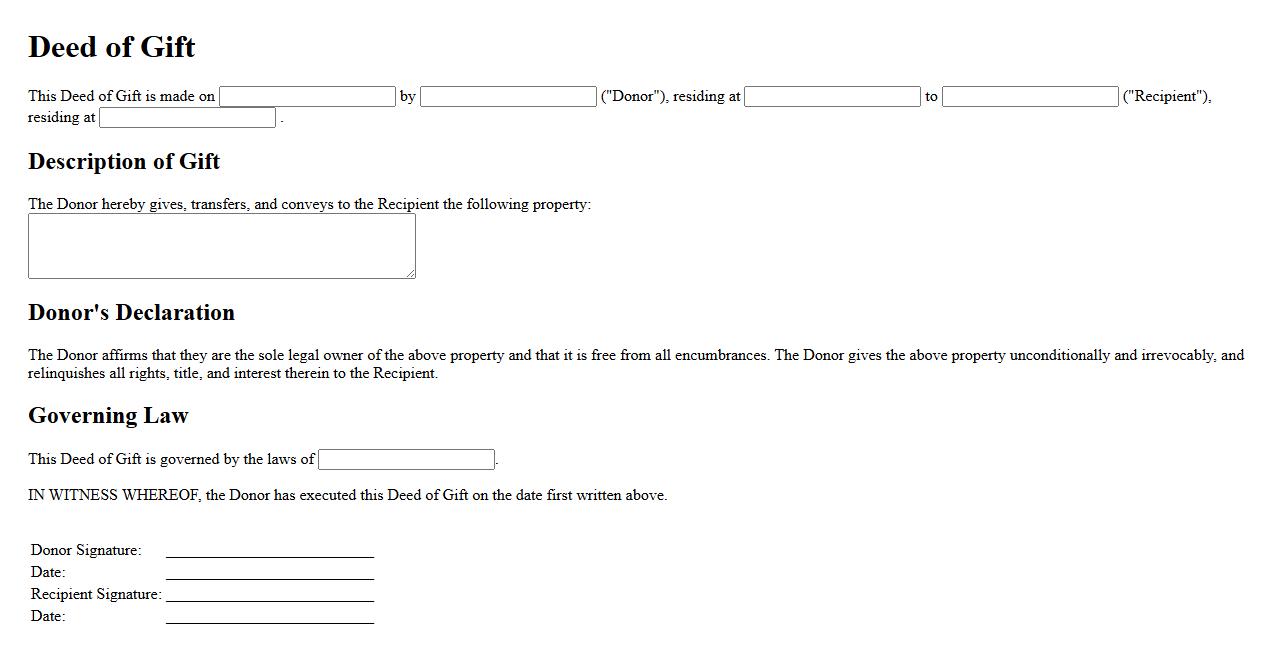

Deed of Gift

A Deed of Gift is a legal document that formally transfers ownership of property or assets from one party to another without any exchange of money. It ensures the gift is recognized and can be used as proof of transfer in legal matters. This document is commonly used in estate planning and charitable donations.

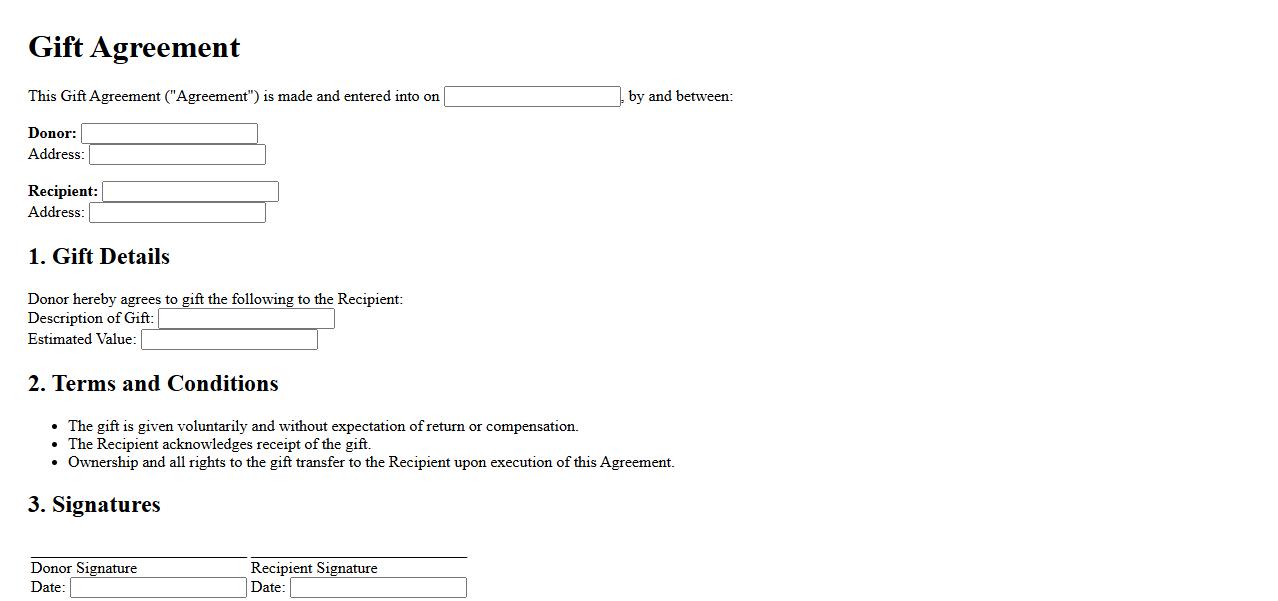

Gift Agreement

A Gift Agreement is a legally binding document outlining the terms and conditions of a gift transfer between parties. It ensures clarity and mutual understanding by specifying the nature, value, and purpose of the gift. This agreement protects both the donor and recipient by formalizing the transaction.

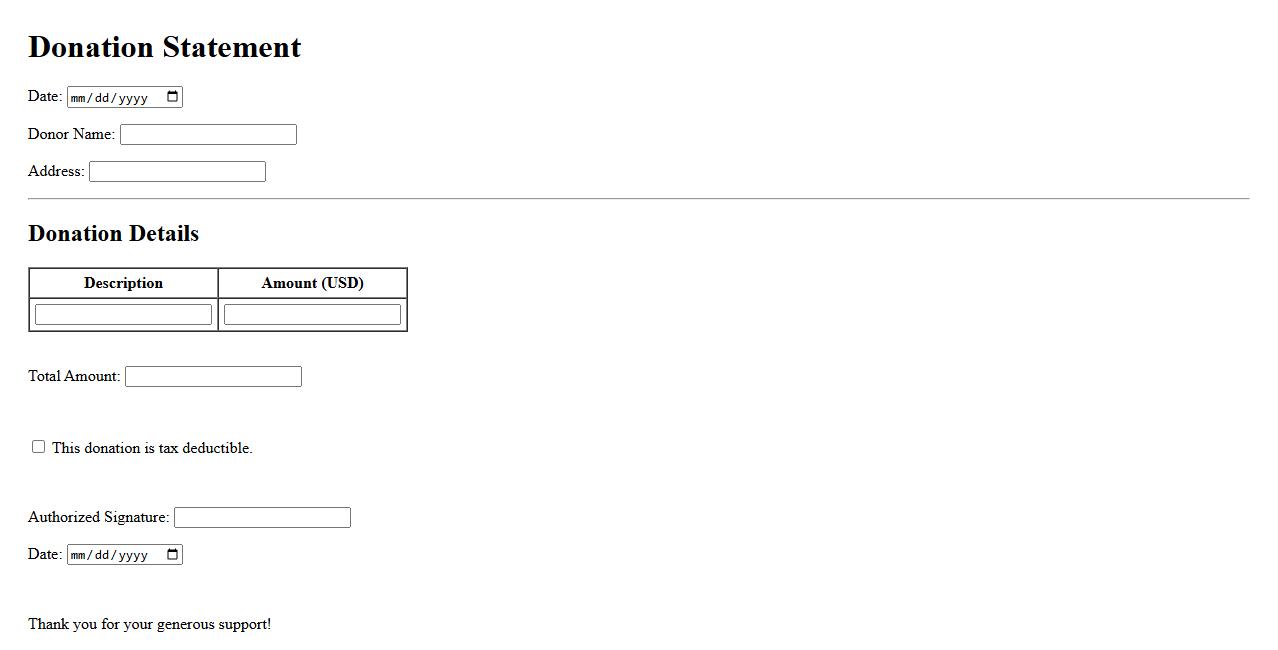

Donation Statement

A Donation Statement is a document that provides a detailed record of contributions made to a charity or organization. It serves as proof for tax deductions and helps donors keep track of their generosity throughout the year. This statement typically includes the donation amount, date, and recipient details for transparency and accountability.

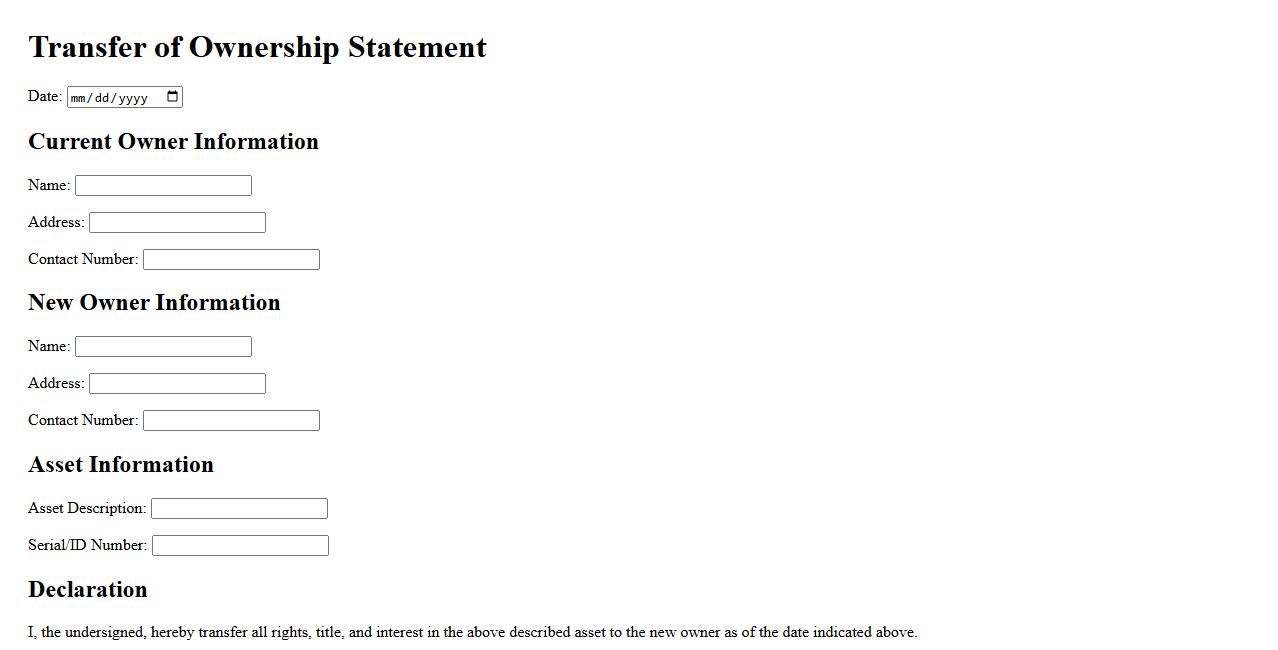

Transfer of Ownership Statement

The Transfer of Ownership Statement is a legal document used to officially record the change of ownership of an asset or property. It ensures that all rights and responsibilities are properly transferred from the seller to the buyer. This statement is essential for maintaining accurate records in property or asset transactions.

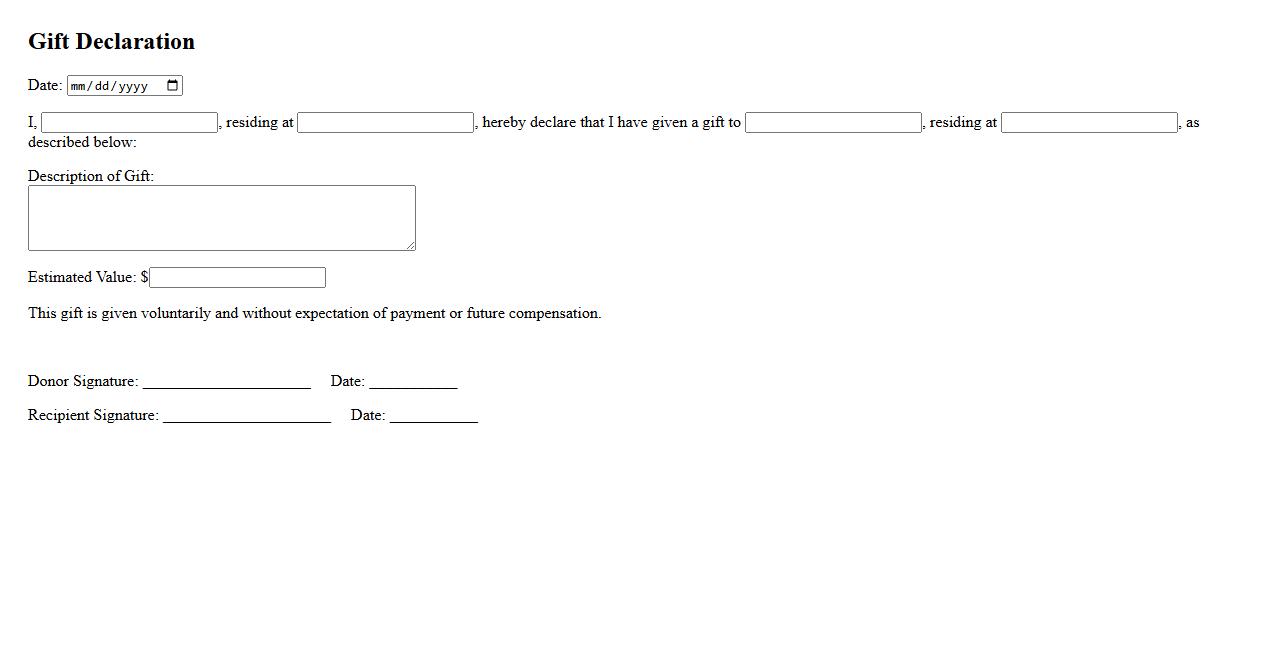

Gift Declaration

A Gift Declaration is an official statement used to disclose the details of a gift received, ensuring transparency in financial and legal matters. It helps in tracking the origin and value of gifts for taxation or regulatory compliance. Properly filing this declaration can prevent misunderstandings and legal issues related to gift transfers.

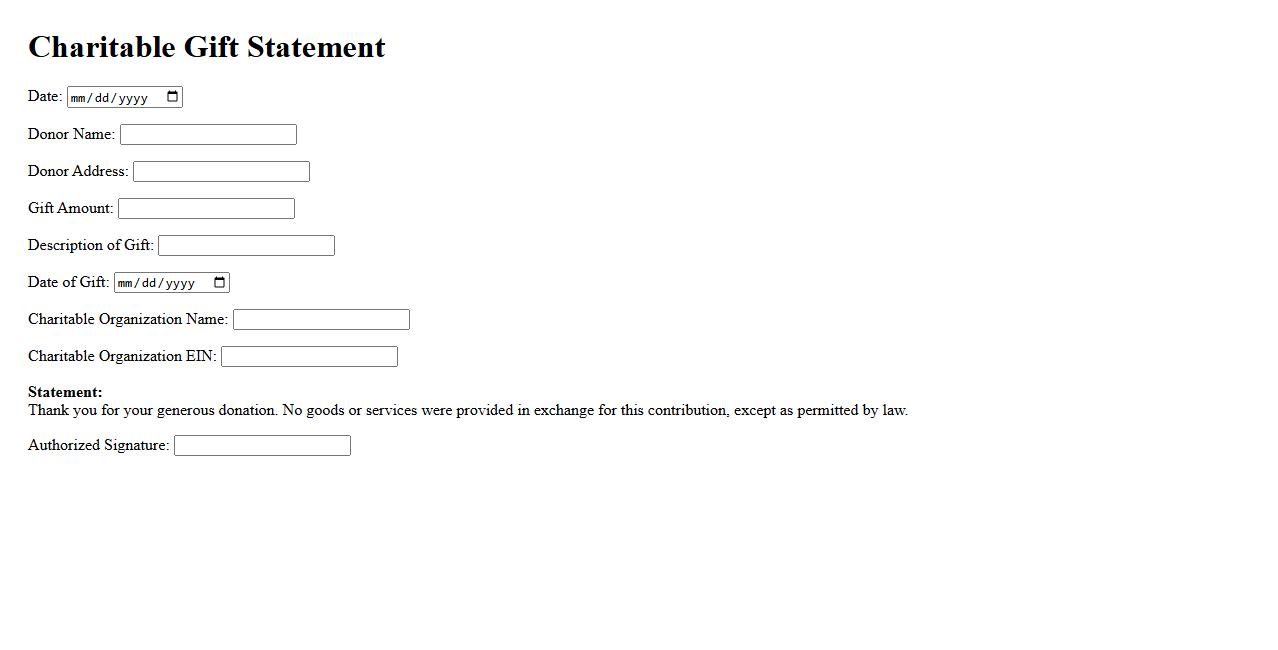

Charitable Gift Statement

A Charitable Gift Statement is an important document provided by nonprofits to donors, detailing the contributions made within a specific period. It serves as proof for tax deductions and helps in maintaining transparent records of donations. This statement ensures both the donor and the organization comply with legal and financial regulations.

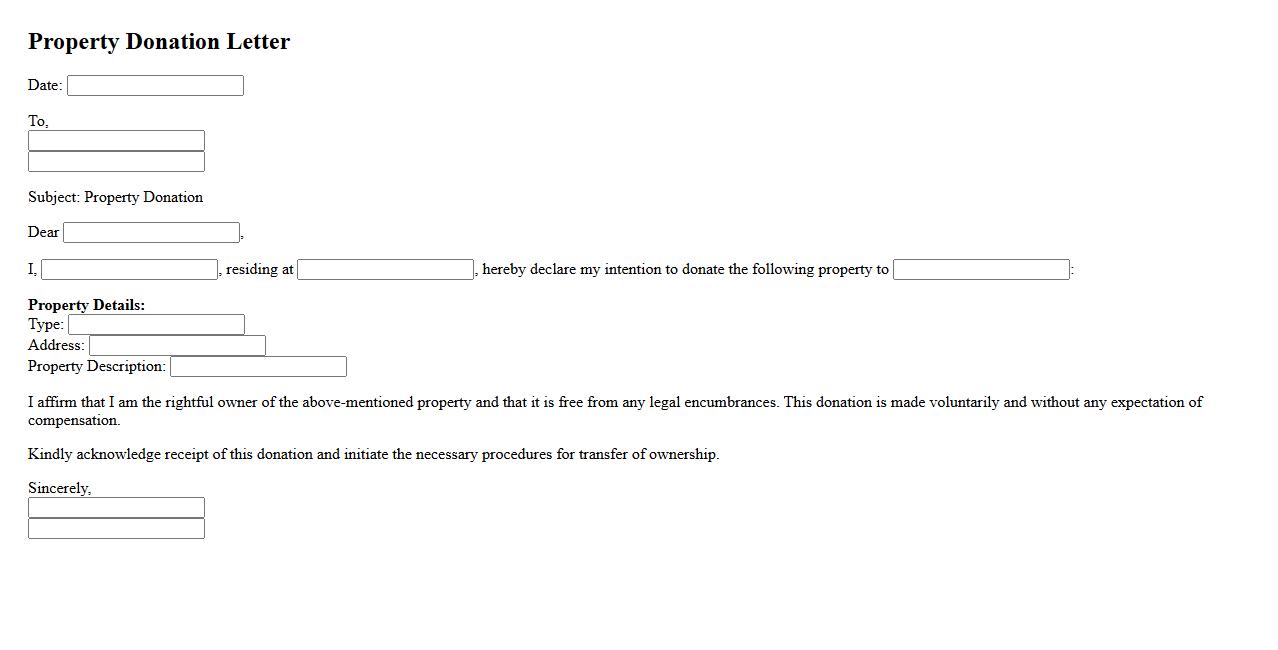

Property Donation Letter

A Property Donation Letter is a formal document used to transfer ownership of real estate from one party to another without monetary exchange. This letter outlines the details of the property, the donor, and the recipient to ensure legal clarity. It serves as proof of the donation and is often required for legal and tax purposes.

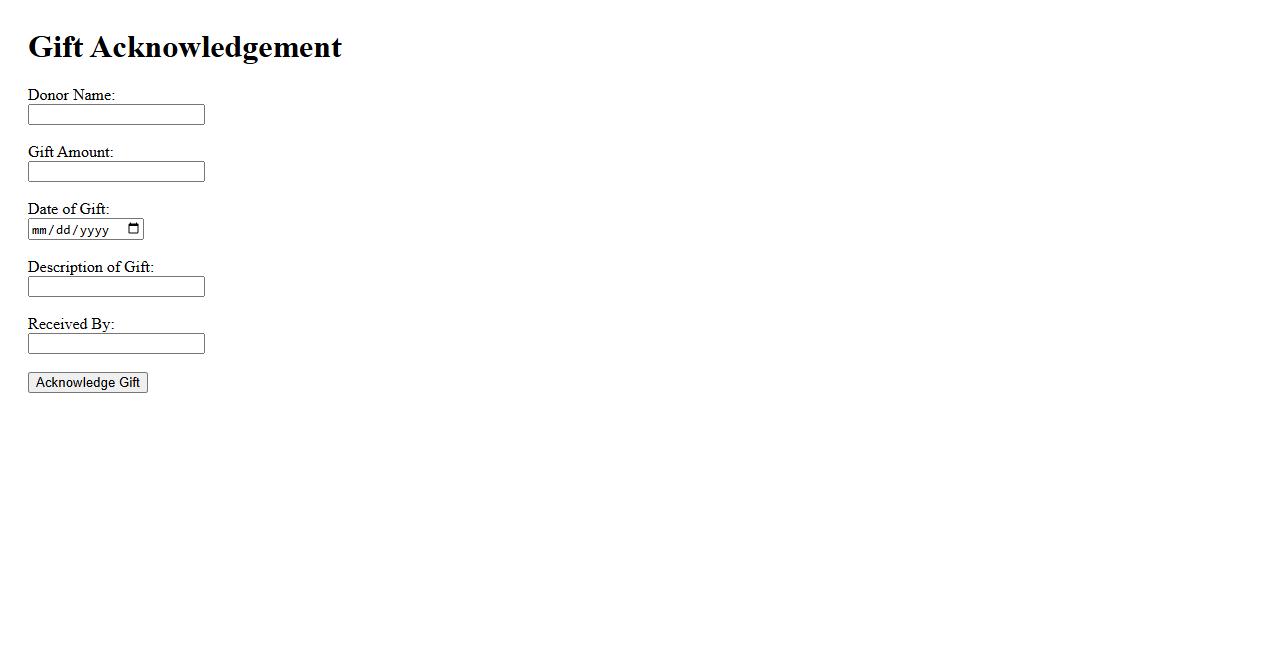

Gift Acknowledgement

Gift Acknowledgement is an essential part of expressing gratitude to donors and supporters. It ensures that every contribution is recognized with sincerity and appreciation. A well-crafted Gift Acknowledgement fosters strong relationships and encourages continued generosity.

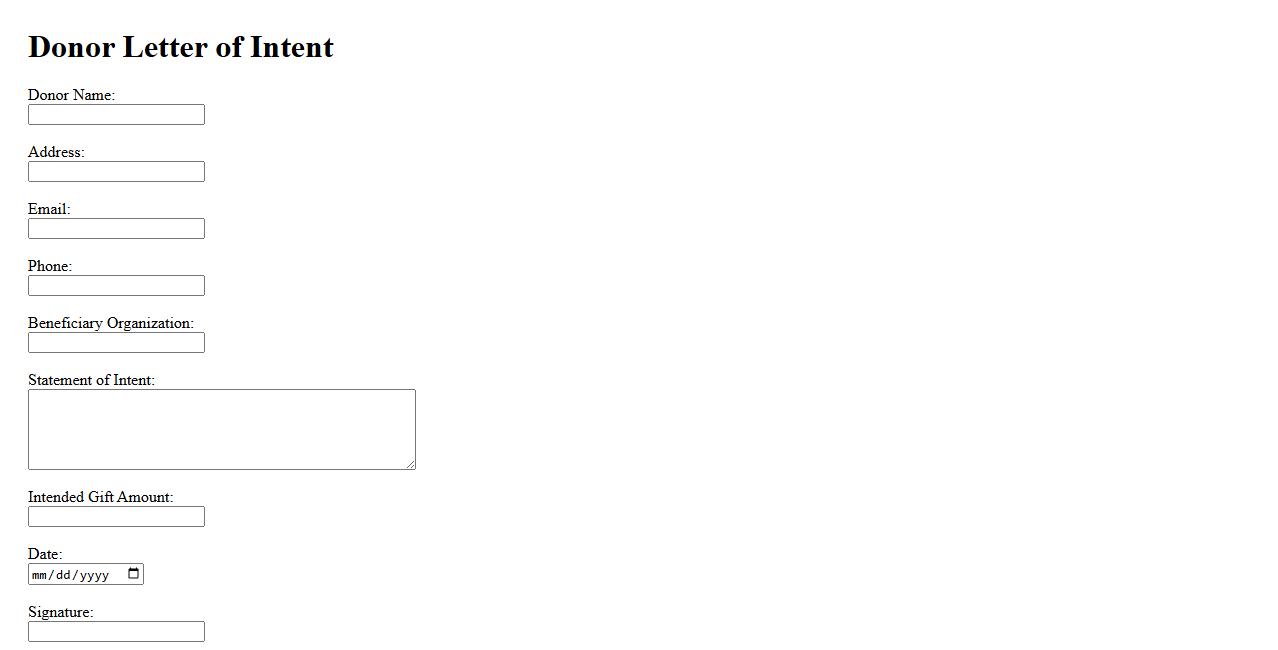

Donor Letter of Intent

A Donor Letter of Intent is a formal document expressing a donor's commitment to contribute to a cause or organization. It outlines the donor's intentions, including the amount and purpose of the donation. This letter helps organizations plan and acknowledge future donations effectively.

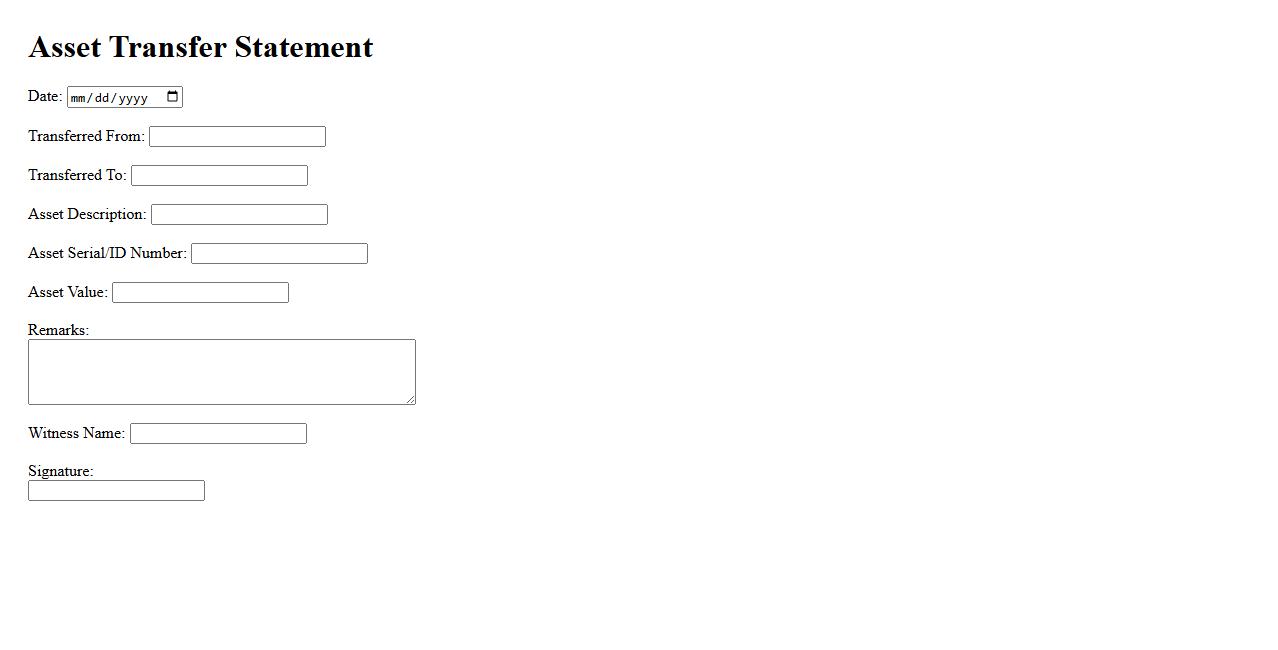

Asset Transfer Statement

An Asset Transfer Statement is a formal document that details the transfer of ownership or custody of assets between parties. It ensures clear communication and legal acknowledgment of the asset movement. This statement is essential for maintaining accurate financial and legal records.

What is the primary purpose of a Statement of Gift in documentation?

The primary purpose of a Statement of Gift is to formally document the transfer of ownership of an item or funds without compensation. It serves as evidence that a gift has been voluntarily given from one party to another. This ensures clarity and prevents future disputes regarding the ownership or intentions behind the gift.

Which parties are typically involved and identified in a Statement of Gift?

A Statement of Gift typically identifies both the donor (the person giving the gift) and the recipient (the person receiving the gift). Clear identification is crucial for legal and administrative purposes. Both parties' full names and contact details are usually included to establish the legitimacy of the transaction.

What essential details must be included for legal validity in a Statement of Gift?

For legal validity, a Statement of Gift must include a clear description of the gifted item or funds, the intention to gift, and the date of transfer. It should also mention the lack of consideration, confirming that the gift is not a sale or exchange. Additionally, signatures of both donor and recipient are typically required to formalize the agreement.

How does a Statement of Gift clarify conditions or restrictions, if any, on the gifted item or funds?

If there are any conditions or restrictions attached to the gift, the Statement of Gift explicitly outlines these terms. This might include stipulations on the use, transfer, or disposal of the gifted property. Clearly stating such conditions helps prevent misunderstandings and ensures compliance with the donor's wishes.

In what situations is a Statement of Gift commonly required or requested?

A Statement of Gift is commonly required in legal, financial, and administrative contexts where proof of transfer is necessary. Examples include property transfers, charitable donations, or gifts of significant value. Institutions such as banks, tax authorities, and courts often request this document to validate the transaction.