A Request for Loan Deferment allows borrowers to temporarily postpone or reduce their loan payments due to financial hardship or other qualifying circumstances. This process often requires submission of supporting documentation and approval from the lender to ensure compliance with terms. Loan deferment can provide crucial relief by preventing default and maintaining credit standing during difficult times.

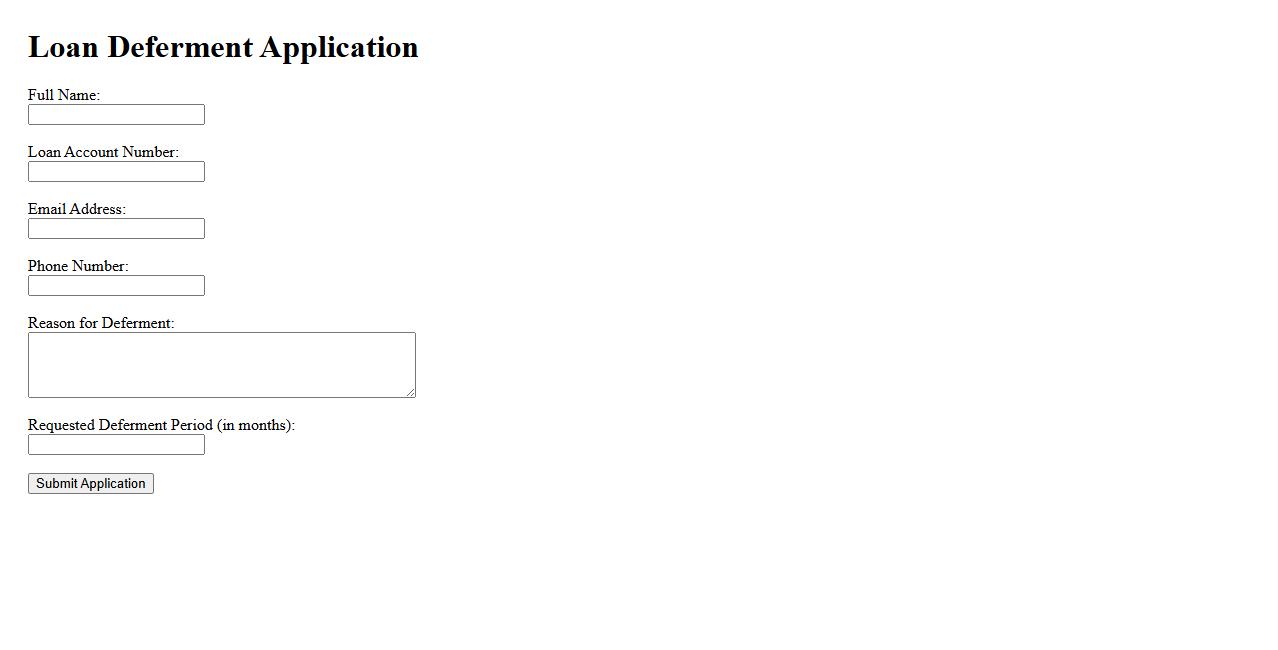

Loan Deferment Application

The Loan Deferment Application allows borrowers to temporarily postpone loan payments without penalties. This process is ideal for individuals experiencing financial hardships or unexpected life events. Applying for deferment ensures continued credit protection while easing immediate financial burdens.

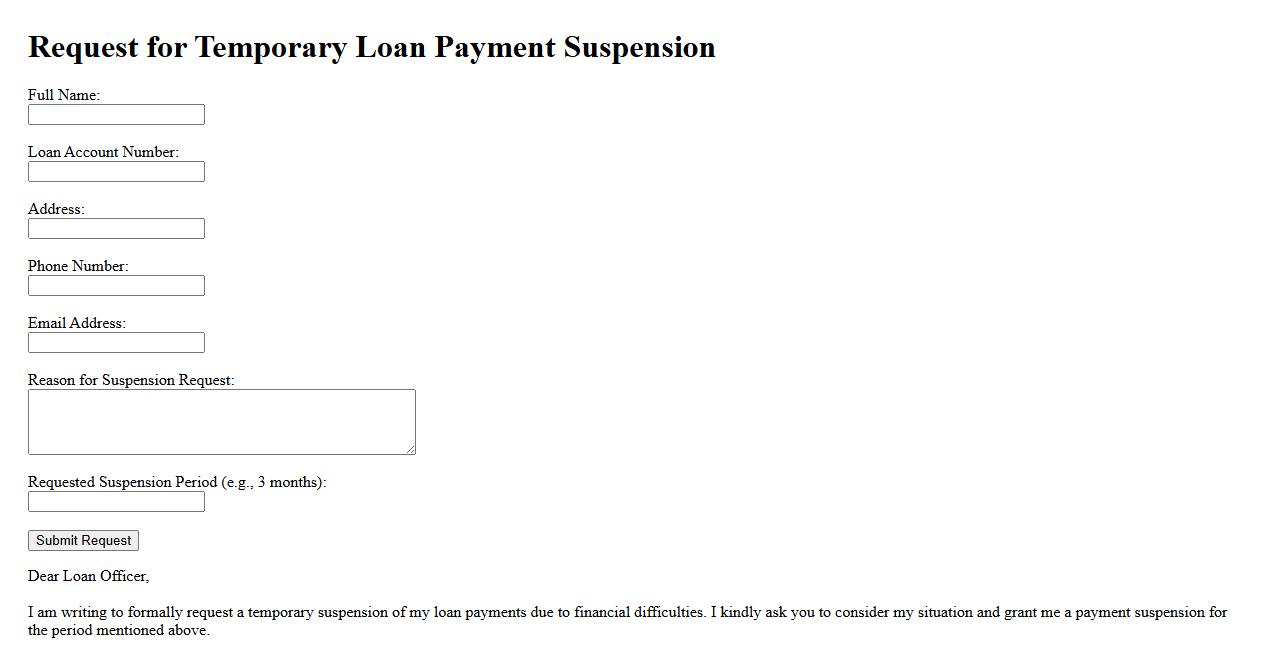

Request for Temporary Loan Payment Suspension

Submitting a Request for Temporary Loan Payment Suspension allows borrowers to pause their loan payments for a limited period due to financial hardship. This option helps maintain good standing without accruing penalties during the suspension. Contact your lender to understand eligibility and application procedures for this relief.

Loan Repayment Postponement Form

The Loan Repayment Postponement Form allows borrowers to request a temporary delay in their loan payments due to financial hardships or unforeseen circumstances. This form streamlines the process of applying for extended repayment terms, helping to maintain good credit standing. Completing the form accurately ensures timely review and approval by the lending institution.

Application for Payment Deferral

An Application for Payment Deferral allows individuals or businesses to request a postponement of upcoming payments due to financial hardship. This process provides temporary relief by extending payment deadlines without penalties. It is essential to submit the application promptly and include all required documentation to support the request.

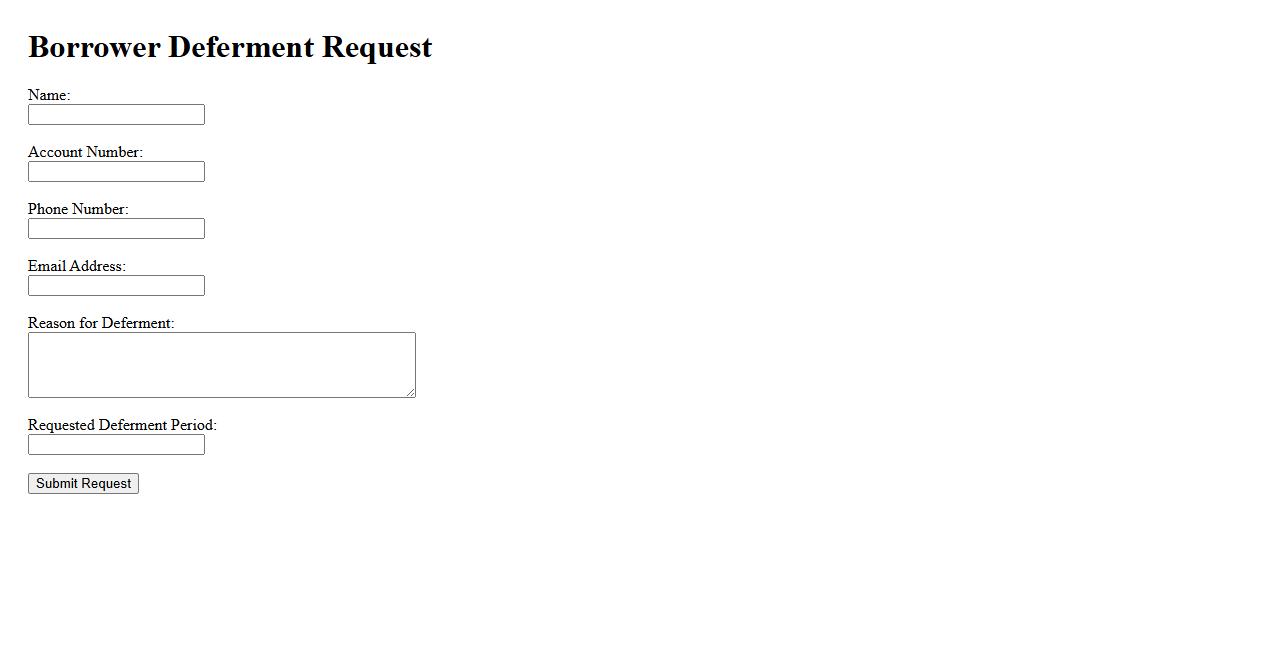

Borrower Deferment Request

A Borrower Deferment Request allows individuals to temporarily postpone loan payments due to financial hardship or other qualifying circumstances. This process helps borrowers avoid default by extending the repayment period without accruing additional penalties. Timely submission of the request is essential to maintain loan status and financial stability.

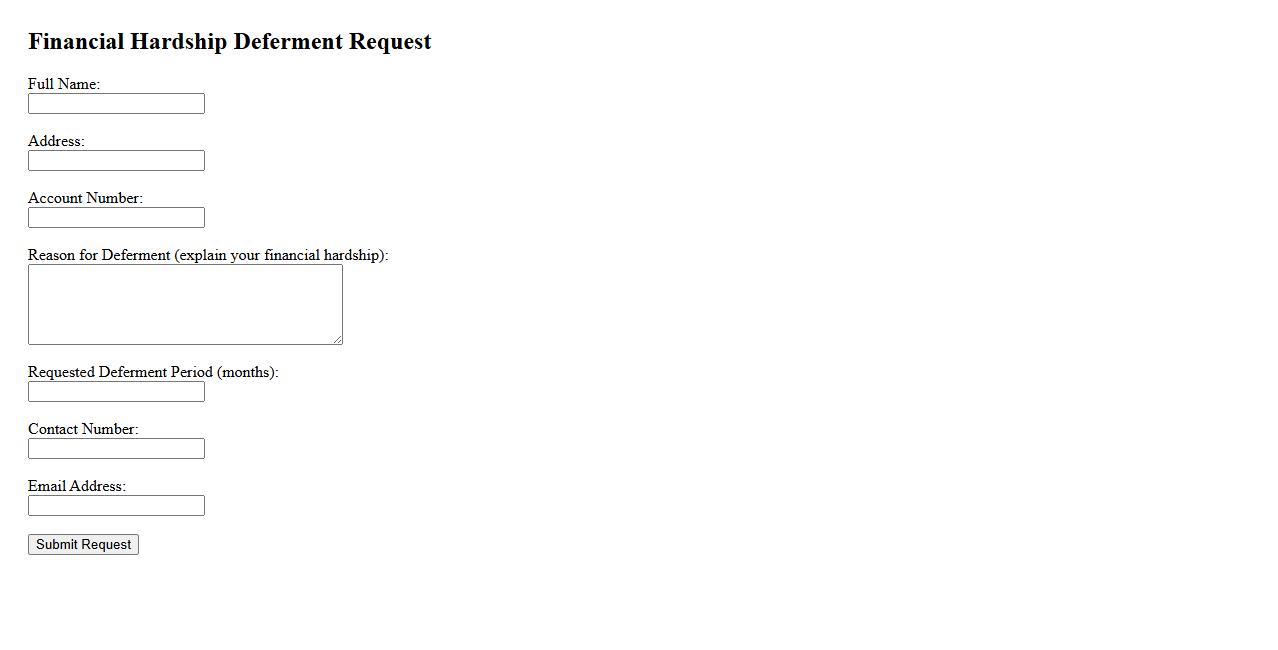

Financial Hardship Deferment Request

If you are experiencing financial difficulties, a Financial Hardship Deferment Request allows you to temporarily postpone loan payments. This option helps reduce immediate financial stress by pausing payments while maintaining your loan in good standing. Contact your loan servicer to understand eligibility and application procedures.

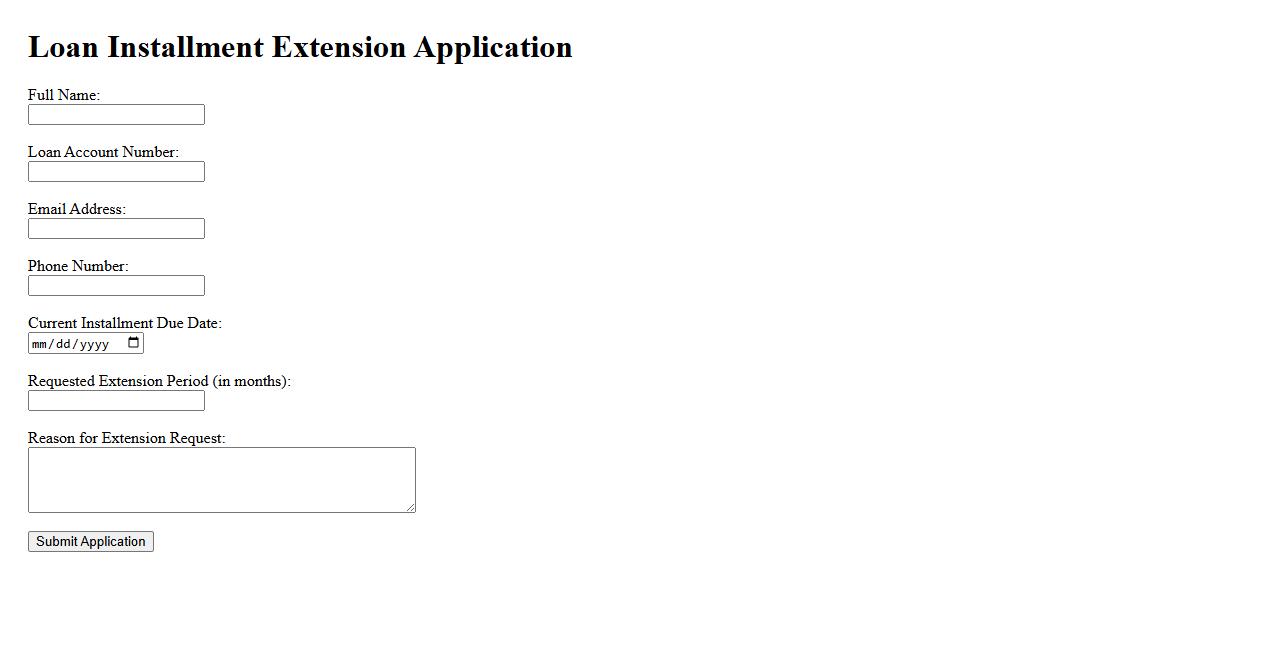

Loan Installment Extension Application

The Loan Installment Extension Application allows borrowers to request additional time for repayment of their loan installments. This application helps manage financial challenges by providing flexibility in payment schedules. Timely submission of the form ensures consideration for extended repayment terms.

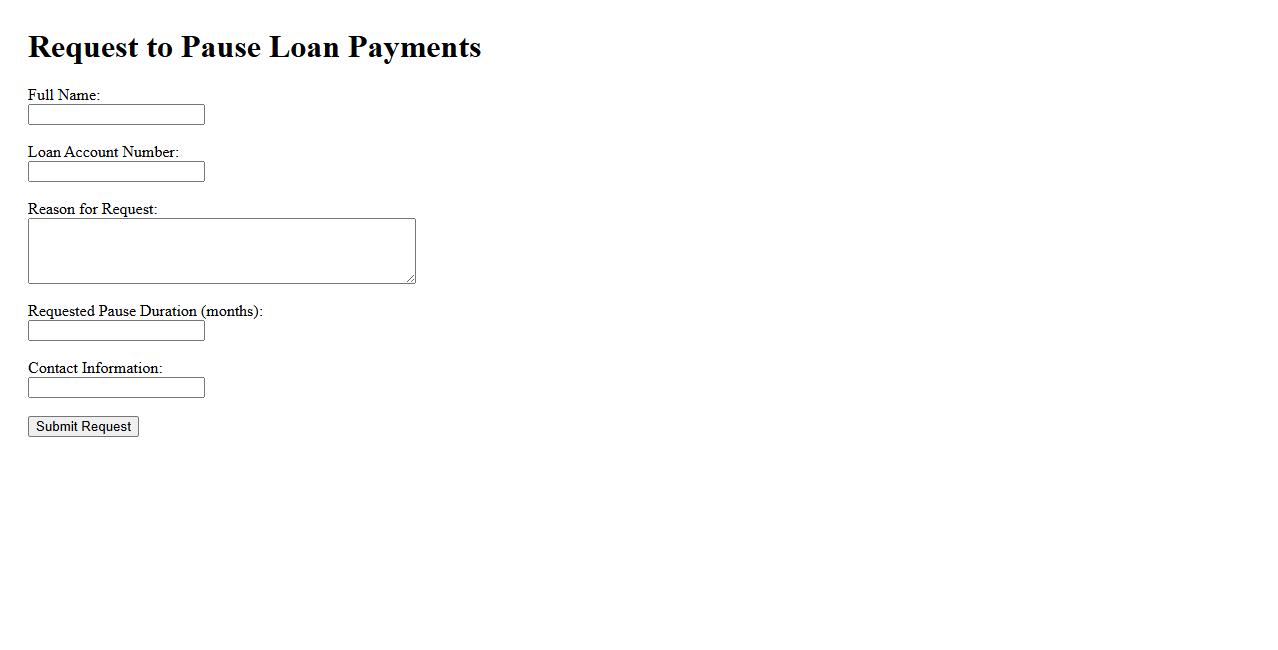

Request to Pause Loan Payments

A Request to Pause Loan Payments allows borrowers to temporarily stop making loan repayments due to financial hardship or unforeseen circumstances. This option helps manage cash flow without accumulating penalties during the pause period. Typically, lenders require formal approval before suspending payments.

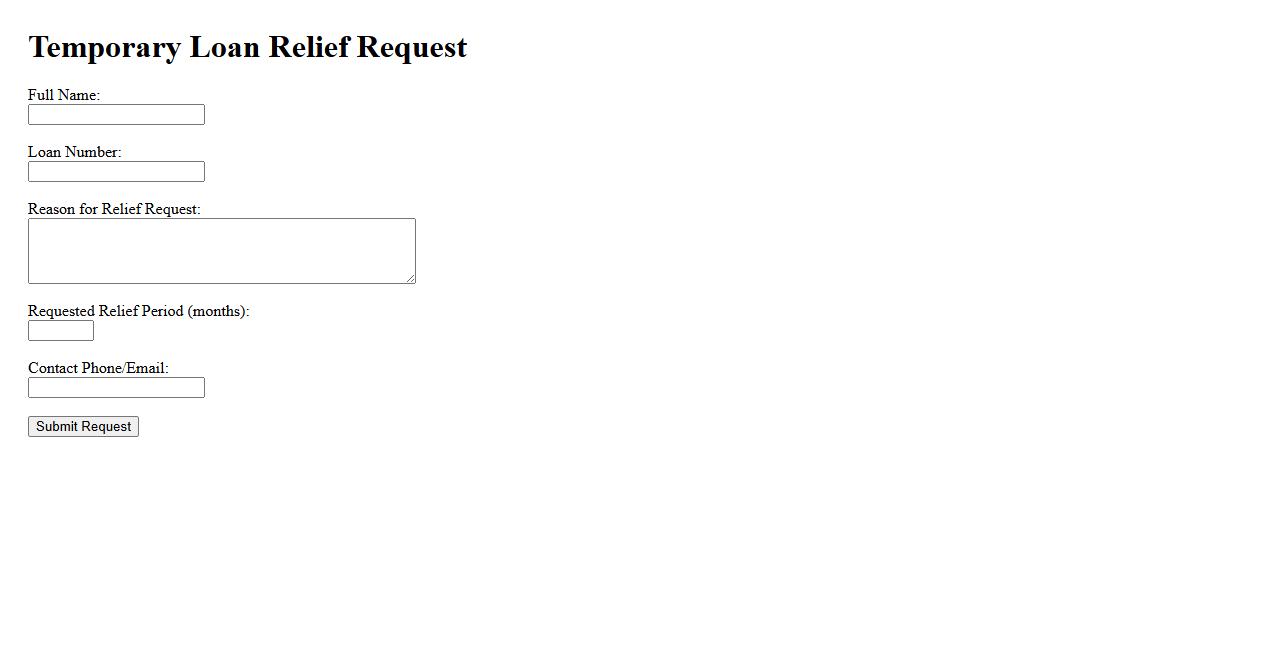

Temporary Loan Relief Request

If you are facing financial difficulties, a Temporary Loan Relief Request allows you to pause or reduce your loan payments for a specified period. This option helps ease your financial burden while you regain stability. It is important to contact your lender promptly to discuss available relief options.

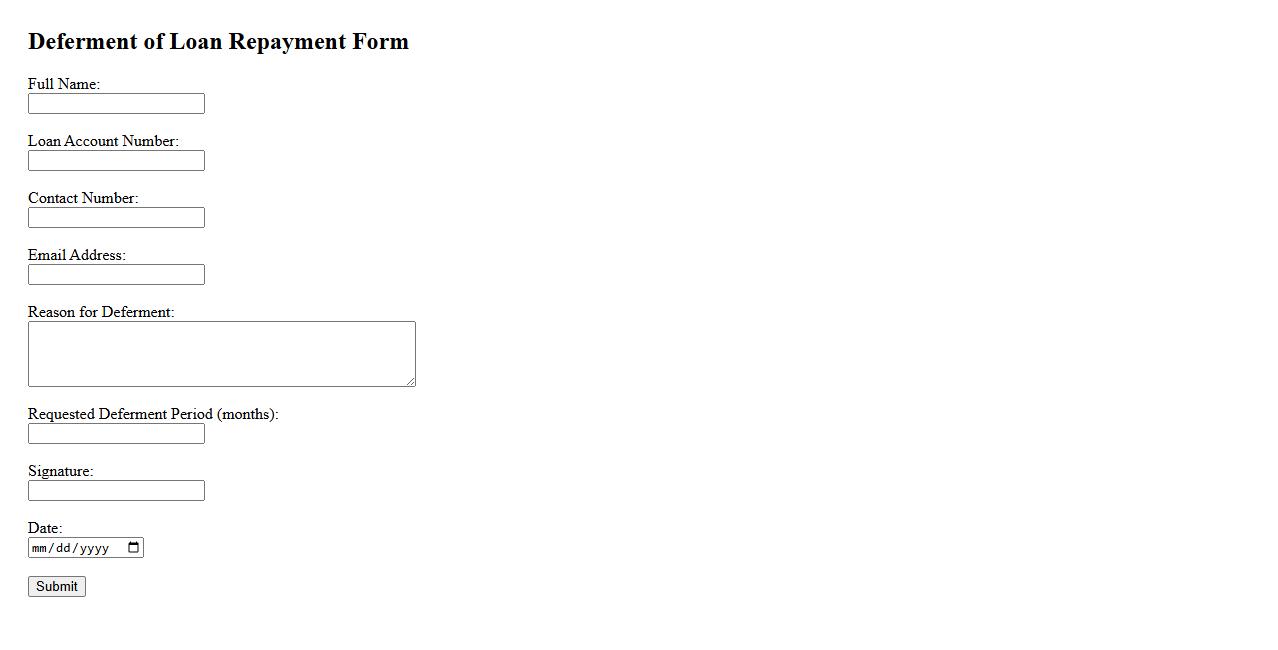

Deferment of Loan Repayment Form

The Deferment of Loan Repayment Form allows borrowers to temporarily postpone their loan payments during financial difficulties. This form must be completed and submitted to the lender for evaluation and approval. It helps manage loan obligations without affecting credit standing when timely payments are not feasible.

What is the main reason for submitting this loan deferment request?

The main reason for submitting a loan deferment request is often due to temporary financial hardship. Borrowers may face unexpected events such as job loss, medical emergencies, or other economic challenges. The deferment helps alleviate immediate financial pressure by pausing loan repayments.

Which specific loan(s) are being requested for deferment in this document?

The specific loan(s) requested for deferment must be clearly identified in the document. This can include types such as student loans, personal loans, or mortgage loans. Precise clarification ensures that the deferment request is applied to the correct loan account.

What is the requested period or duration for the deferment?

The requested period for loan deferment varies based on borrower needs and lender policies. Typically, deferment periods last from a few months up to a year or more. Defining the exact duration is crucial for managing expectations and loan repayment schedules.

What supporting documents or evidence are required to approve the deferment request?

Supporting documents are essential to validate the borrower's claim for deferment. Common documents include income statements, medical records, unemployment proof, or financial hardship statements. These help lenders assess the legitimacy and urgency of the request.

What are the potential impacts on the loan terms if the deferment is granted?

The impacts on loan terms after deferment approval may include the accrual of interest during the pause period. Additionally, the overall loan repayment timeline may be extended. Borrowers should fully understand these changes before agreeing to deferment.