A Request for Payment Plan is a formal document submitted by a debtor to a creditor, proposing a structured schedule to repay outstanding debts. This plan outlines the payment amounts, frequency, and duration to make debt repayment manageable. Clear communication in the Request for Payment Plan can help prevent penalties and maintain a positive credit relationship.

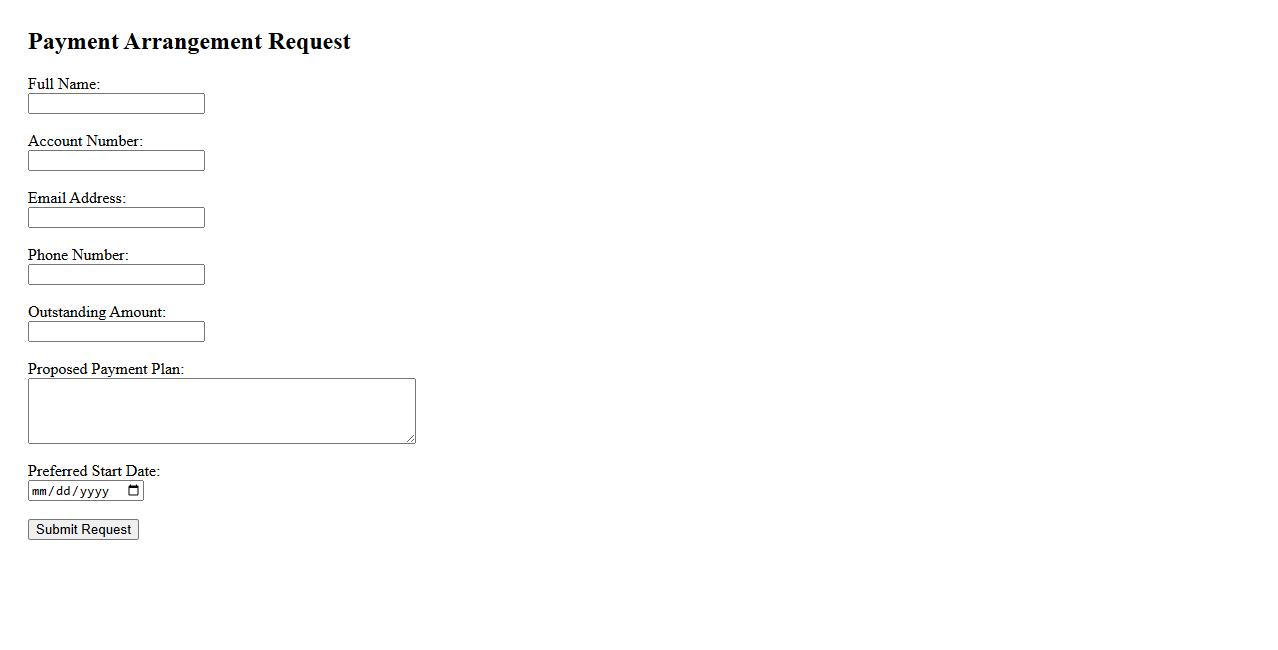

Payment Arrangement Request

A Payment Arrangement Request is a formal appeal made by a customer to negotiate a revised payment plan with a creditor or service provider. This request helps individuals manage their financial obligations by setting up manageable installment payments. It promotes clear communication and prevents potential account delinquency.

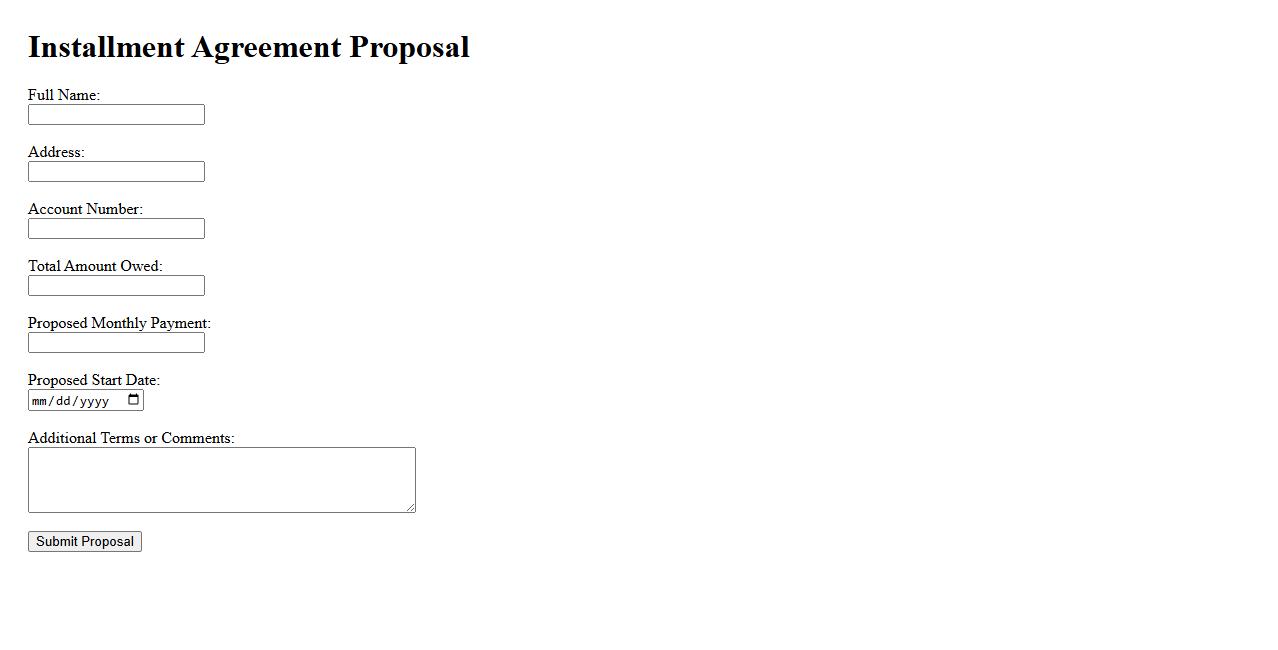

Installment Agreement Proposal

An Installment Agreement Proposal is a formal request to pay a debt in manageable monthly payments. It allows individuals or businesses to settle their obligations without facing immediate full payment. This proposal outlines the terms and conditions for repayment to ensure clear communication between parties involved.

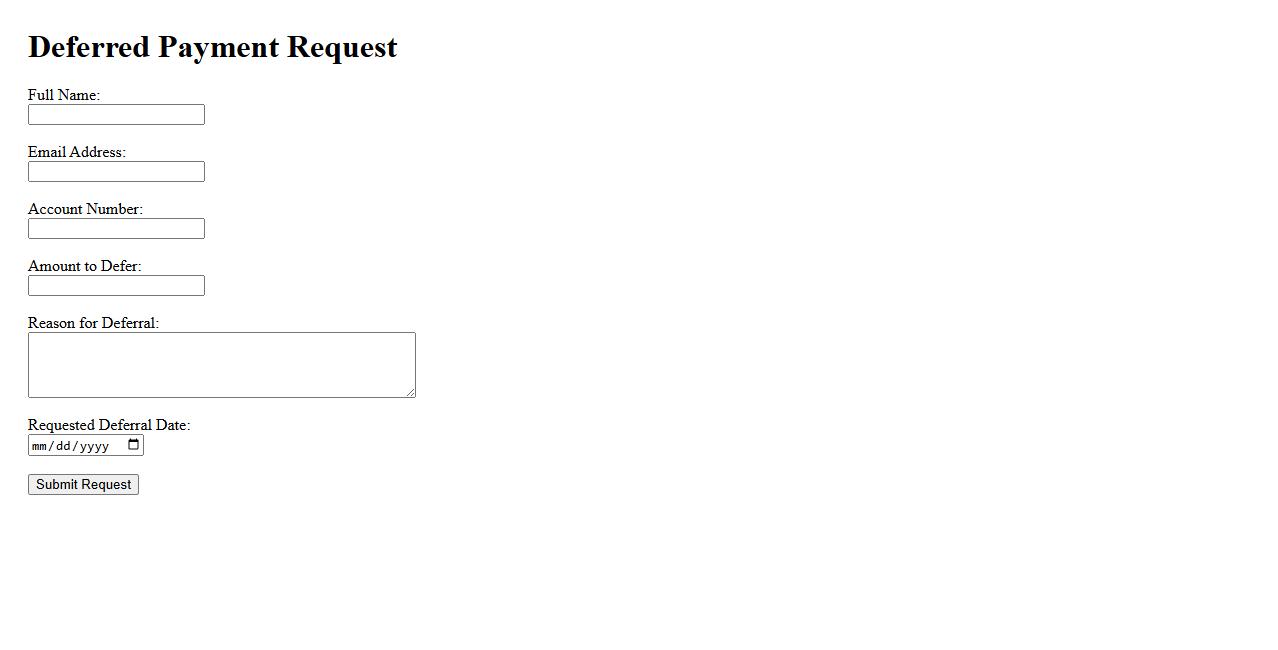

Deferred Payment Request

A Deferred Payment Request allows customers to delay their payment to a later date while still receiving goods or services immediately. This option provides financial flexibility and improved cash flow management for businesses and individuals alike. It is commonly used in financing agreements and purchase arrangements to enhance convenience.

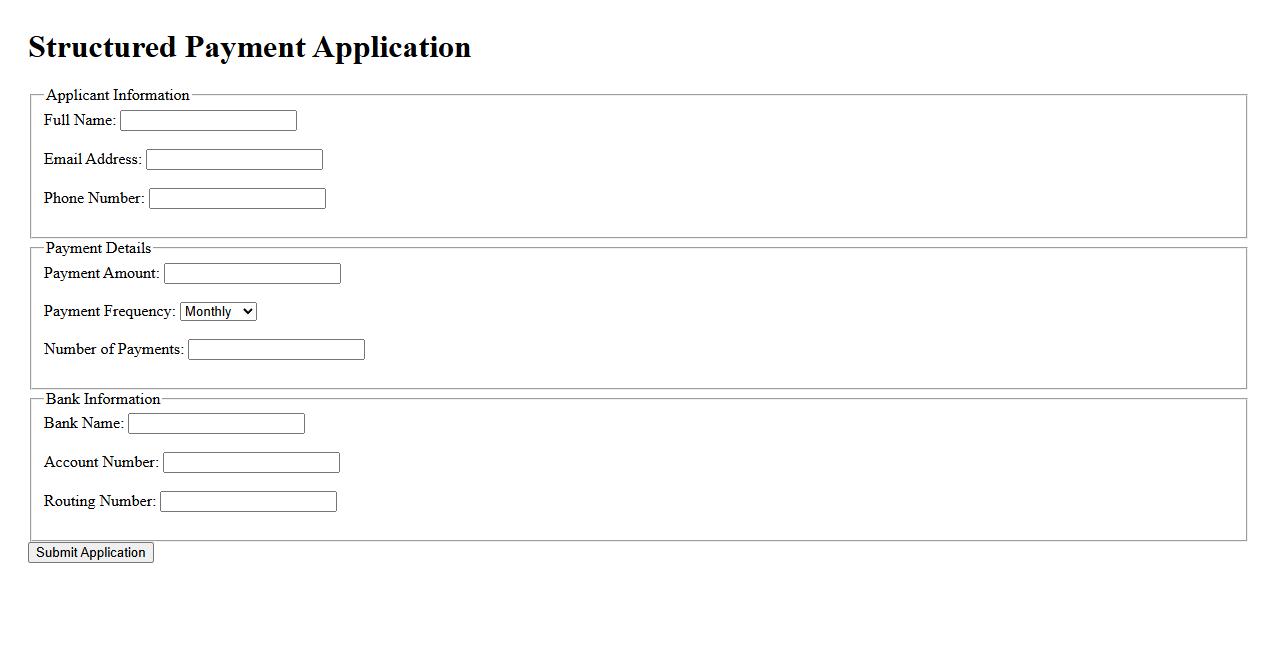

Structured Payment Application

A Structured Payment Application is a financial tool designed to organize and schedule payments systematically, ensuring timely and accurate transactions. It helps businesses and individuals manage their cash flow by breaking down large payments into manageable installments. This approach enhances budget control and reduces the risk of missed payments.

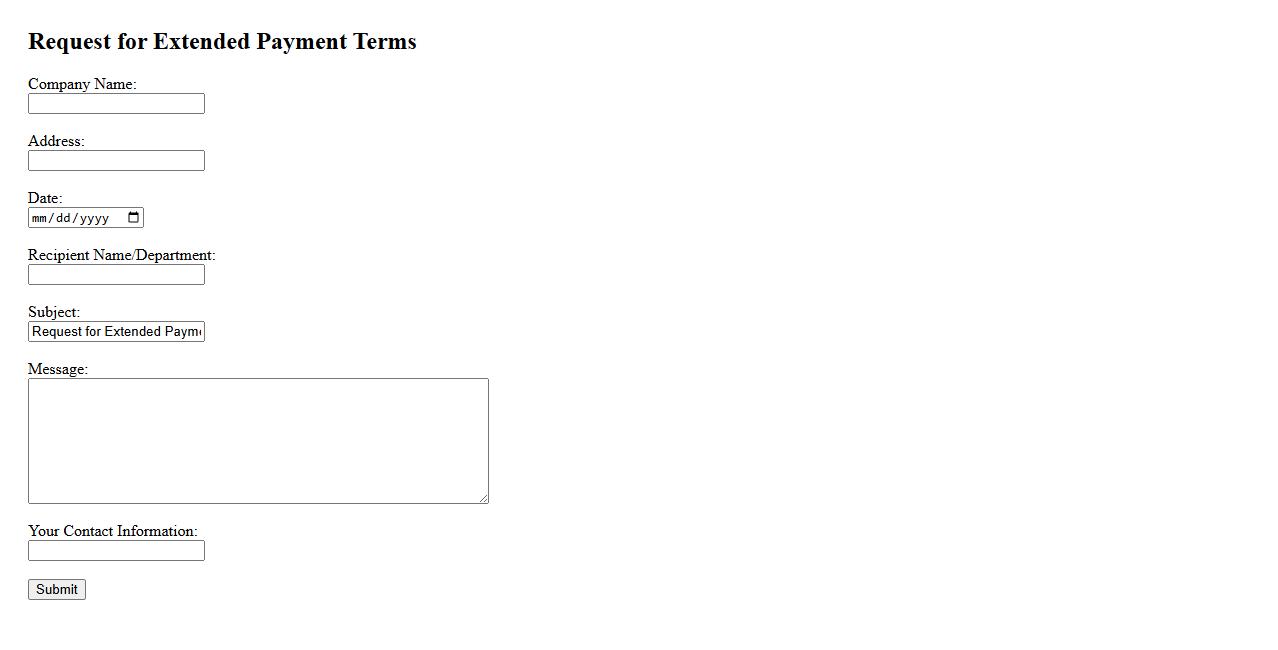

Request for Extended Payment Terms

Submitting a Request for Extended Payment Terms allows businesses to negotiate longer periods for settling invoices. This flexibility helps improve cash flow management and strengthens vendor relationships. Clear communication and justification are essential for approval of extended payment arrangements.

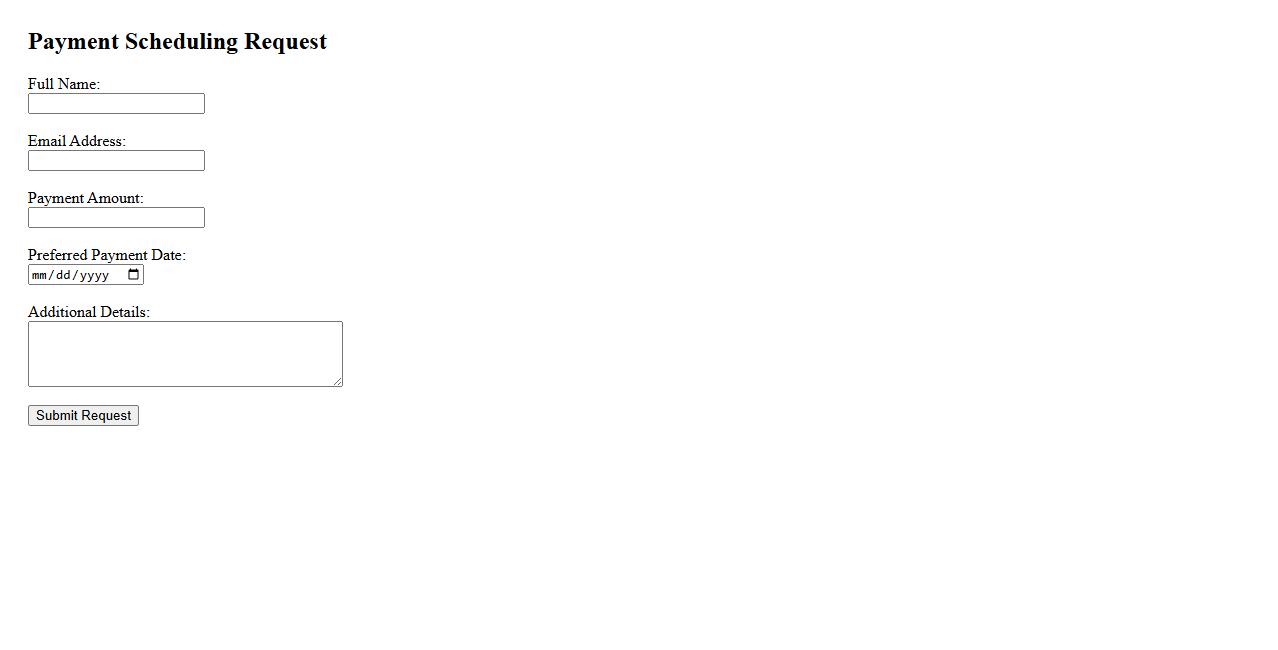

Payment Scheduling Request

A Payment Scheduling Request allows users to set specific dates for automatic payments, ensuring timely transactions without manual intervention. This feature improves financial management by providing control and convenience over when payments are processed. It helps avoid late fees and simplifies budgeting by organizing payment timelines in advance.

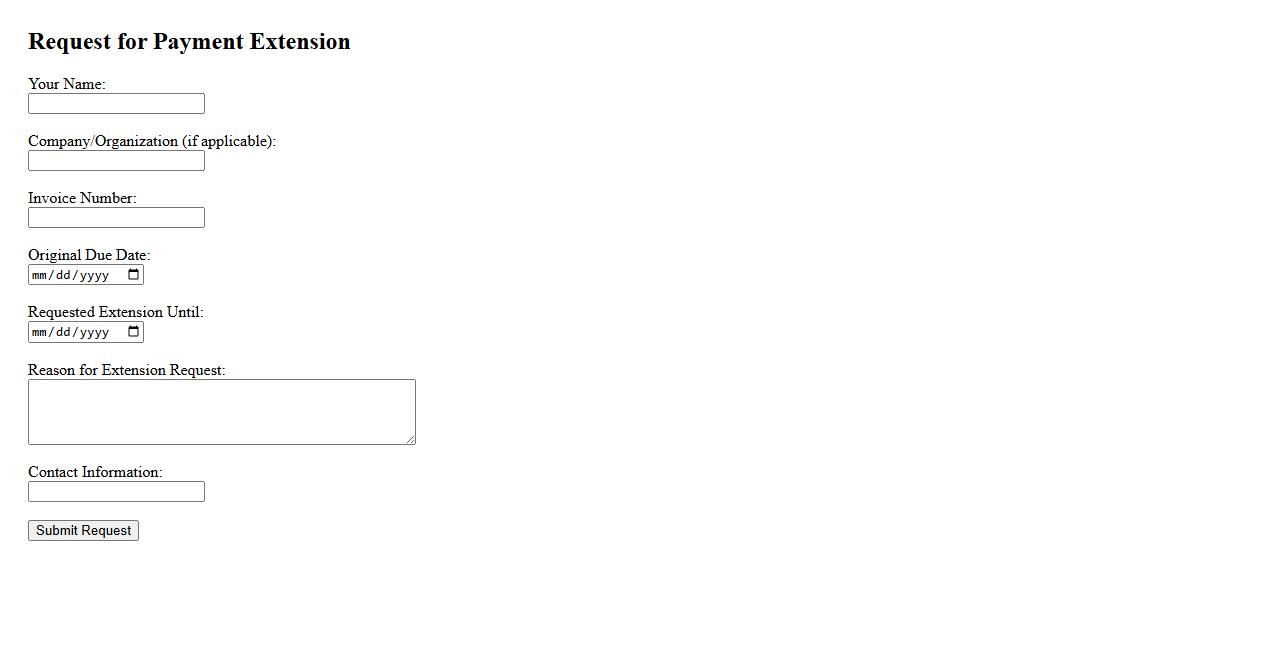

Request for Payment Extension

A Request for Payment Extension is a formal appeal to delay a due payment beyond the original deadline. It is commonly used by individuals or businesses facing temporary financial difficulties. This request helps maintain a positive relationship with creditors while providing additional time to fulfill payment obligations.

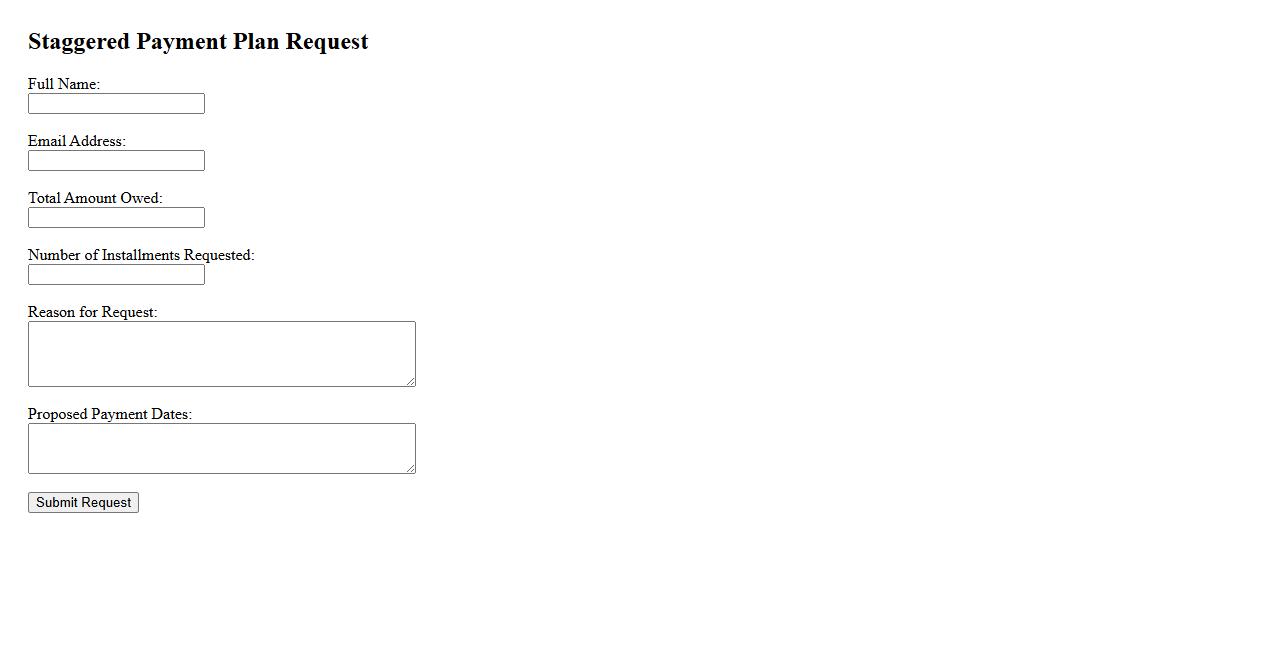

Staggered Payment Plan Request

A Staggered Payment Plan Request allows customers to divide their total payment into smaller, manageable installments over a specified period. This flexible approach helps improve cash flow and reduces financial strain. It's an ideal solution for budgeting large expenses without immediate full payment.

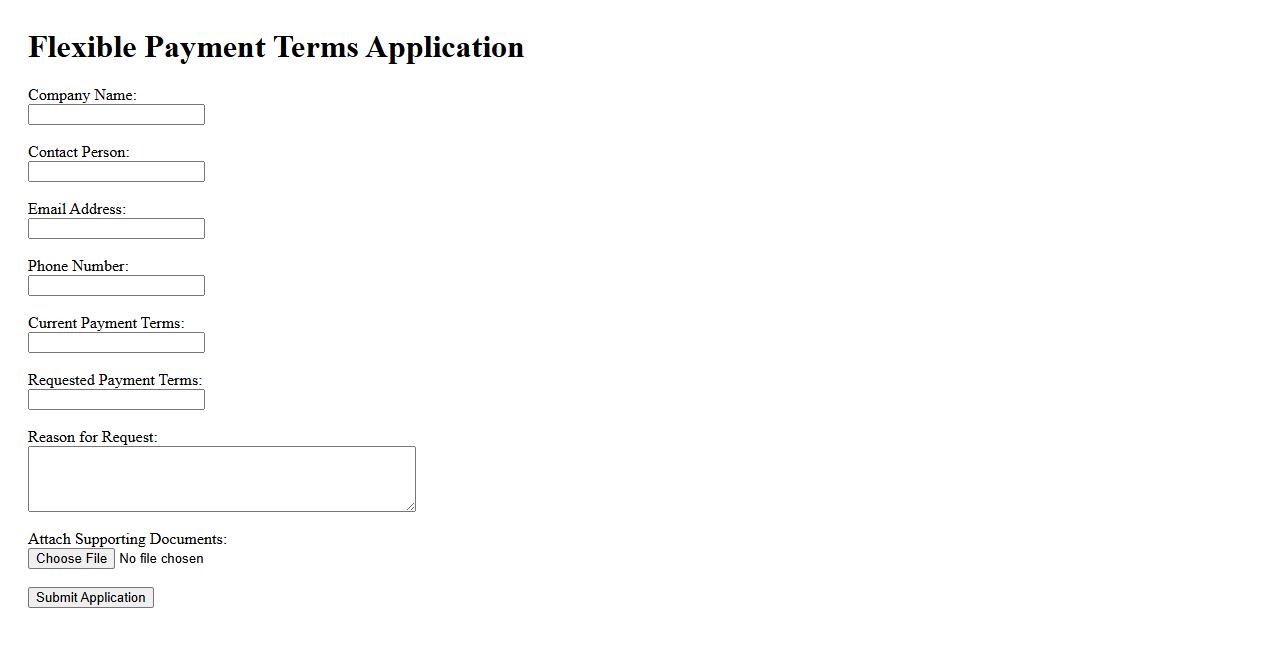

Flexible Payment Terms Application

Our Flexible Payment Terms Application allows businesses to customize payment schedules to fit their cash flow needs. This solution simplifies financial management by offering adaptable options for invoicing and installment plans. Streamline transactions while improving customer satisfaction with flexible payment arrangements.

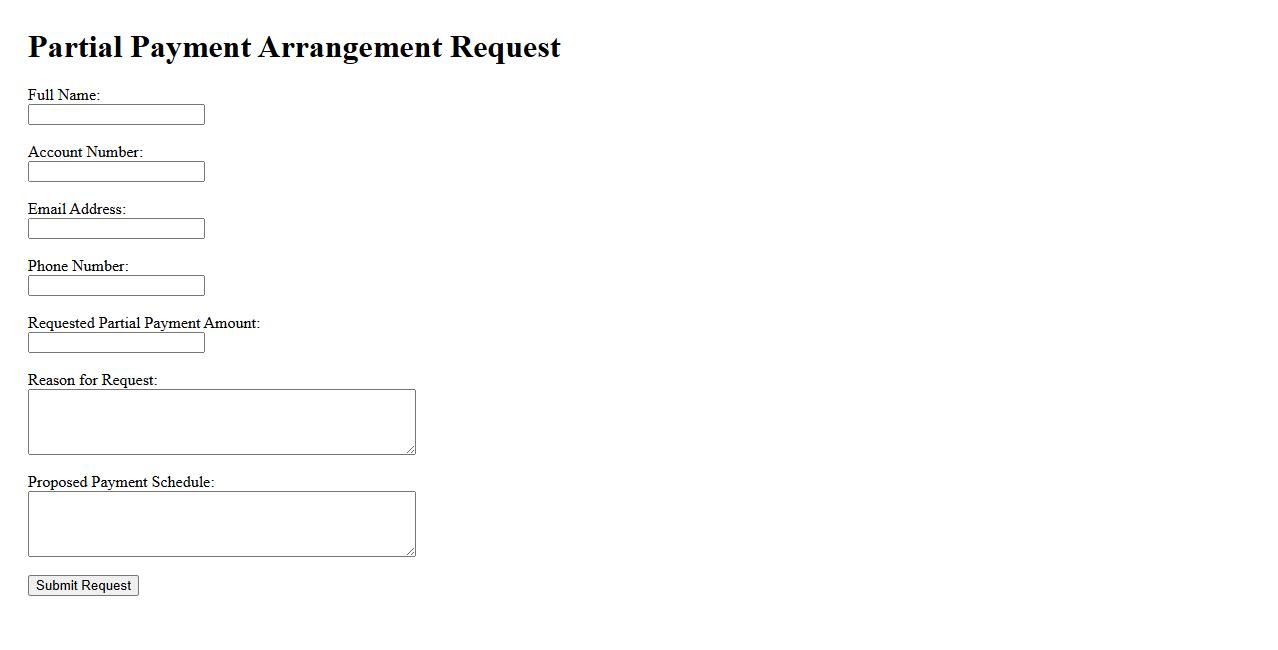

Partial Payment Arrangement Request

A Partial Payment Arrangement Request allows individuals or businesses to propose paying a portion of a owed amount rather than the full balance immediately. This option helps manage financial obligations while maintaining positive communication with creditors. It is essential to clearly outline payment terms and timelines to ensure mutual agreement and avoid misunderstandings.

What specific amount is being requested for the payment plan?

The payment plan request specifies a precise amount to be settled over time. This amount reflects the total outstanding balance that needs to be cleared. Ensuring clarity on this figure is essential for both parties involved in the agreement.

What are the proposed payment schedule and duration for repayment?

The proposed schedule outlines a structured timeline for repayments, typically broken into manageable installments. The duration varies depending on the total amount and the payer's financial capacity. This approach facilitates consistent payments until the full amount is repaid.

What reasons or circumstances necessitate the payment plan request?

Payment plan requests often arise due to temporary financial difficulties or unforeseen expenses. The need for flexibility helps avoid defaulting on obligations while managing cash flow. Such circumstances justify negotiating alternate payment terms.

What methods of payment are acceptable under the proposed plan?

The plan specifies acceptable payment methods to ensure smooth transactions and record keeping. These may include electronic transfers, checks, or credit card payments. Clear guidelines reduce confusion and facilitate timely payments.

What consequences will apply if the payment plan terms are not met?

Failure to adhere to the payment plan terms can trigger penalties or legal action, depending on the agreement. These consequences ensure compliance and protect the creditor's interests. Understanding these terms motivates punctual payment and accountability.