The Report of Nonemployee Compensation is a tax form used by businesses to report payments made to independent contractors and freelancers. It details the income paid to nonemployees, which must be reported to the IRS and provided to the recipient for accurate tax filing. Proper documentation ensures compliance with tax regulations and helps avoid penalties.

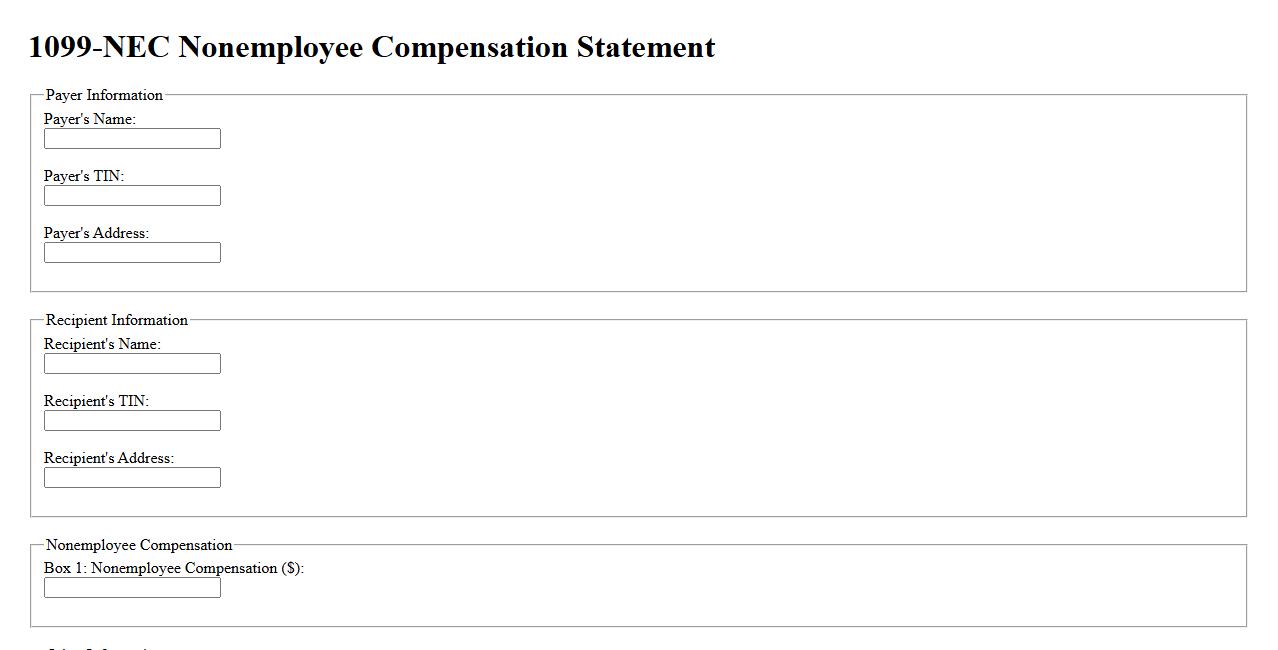

1099-NEC Nonemployee Compensation Statement

The 1099-NEC Nonemployee Compensation Statement is a tax form used to report payments made to independent contractors and nonemployees. It details the total compensation paid during the year, which is crucial for accurate tax filing. Businesses must provide this form to recipients and the IRS to comply with tax regulations.

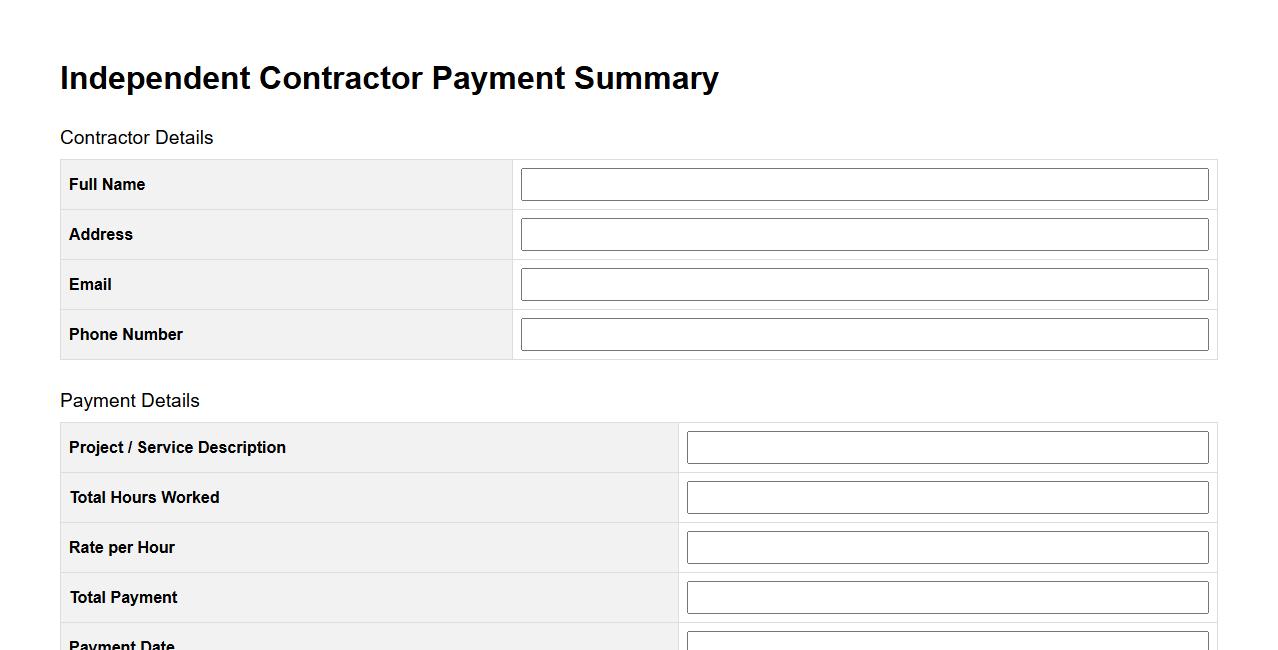

Independent Contractor Payment Summary

The Independent Contractor Payment Summary provides a detailed overview of payments made to contractors for their services. It includes total amounts paid, dates, and transaction details for accurate record-keeping. This summary helps both parties ensure transparent and organized financial tracking.

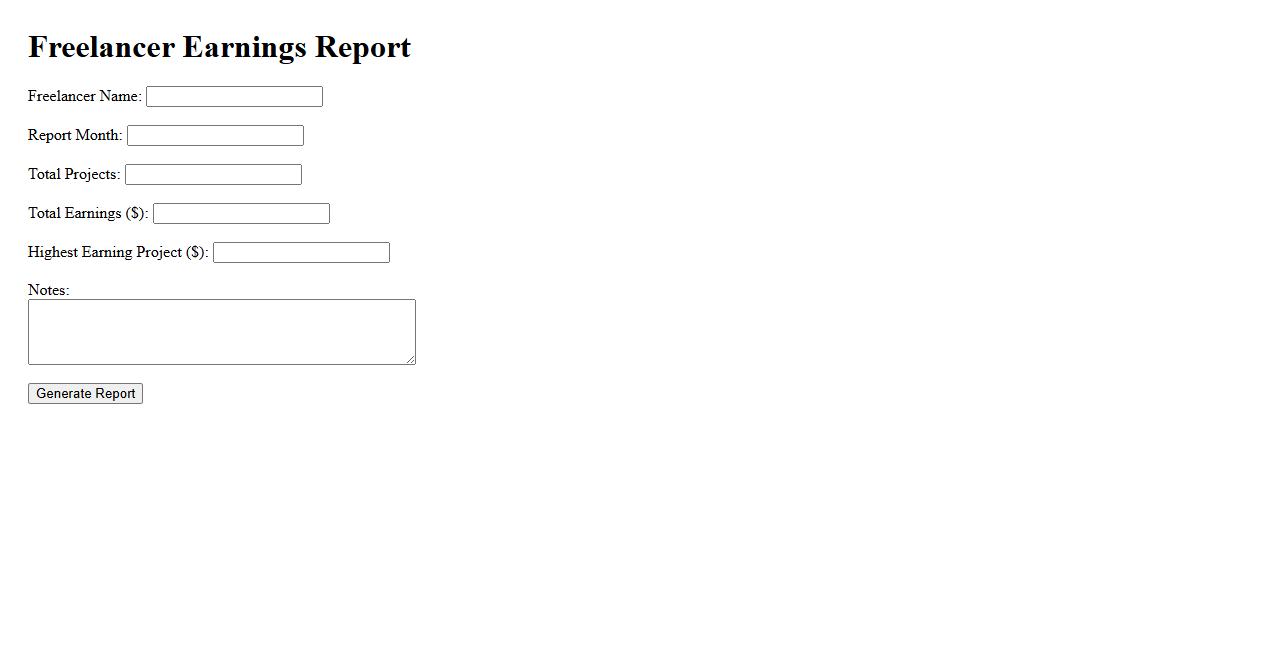

Freelancer Earnings Report

The Freelancer Earnings Report provides a detailed analysis of income trends across various freelance industries. It offers valuable insights into average earnings, growth opportunities, and market demand. This report helps freelancers make informed decisions to optimize their income potential.

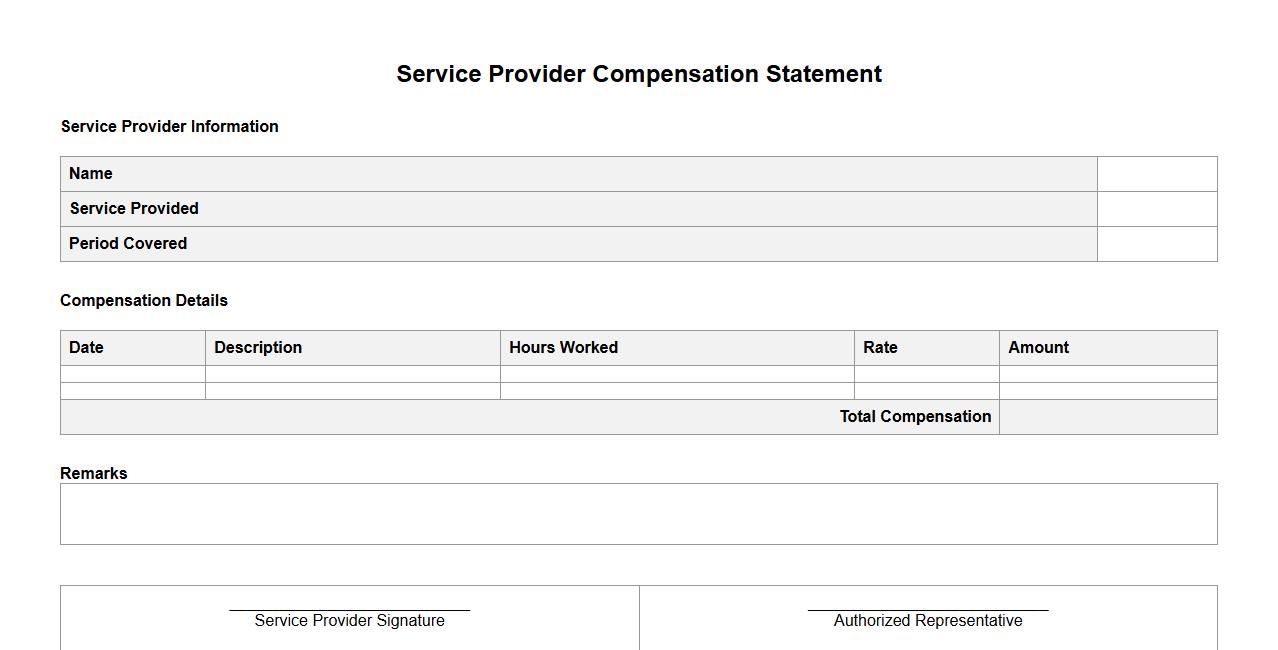

Service Provider Compensation Statement

The Service Provider Compensation Statement details the payment terms, rates, and conditions agreed upon between a service provider and client. It ensures transparency and clarity regarding compensation for services rendered. This document helps prevent misunderstandings and facilitates smooth financial transactions.

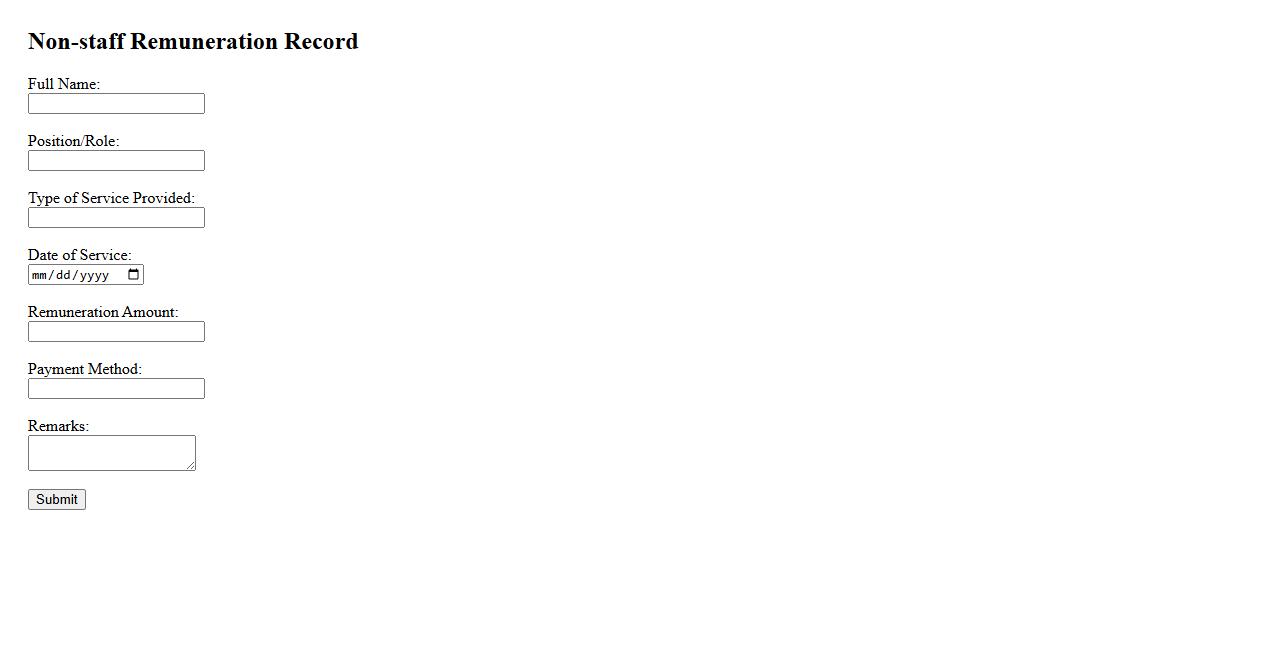

Non-staff Remuneration Record

The Non-staff Remuneration Record is a detailed document used to track payments made to individuals who are not regular employees. This record ensures accuracy in financial management and compliance with tax regulations. It is essential for maintaining transparent and efficient payroll processes.

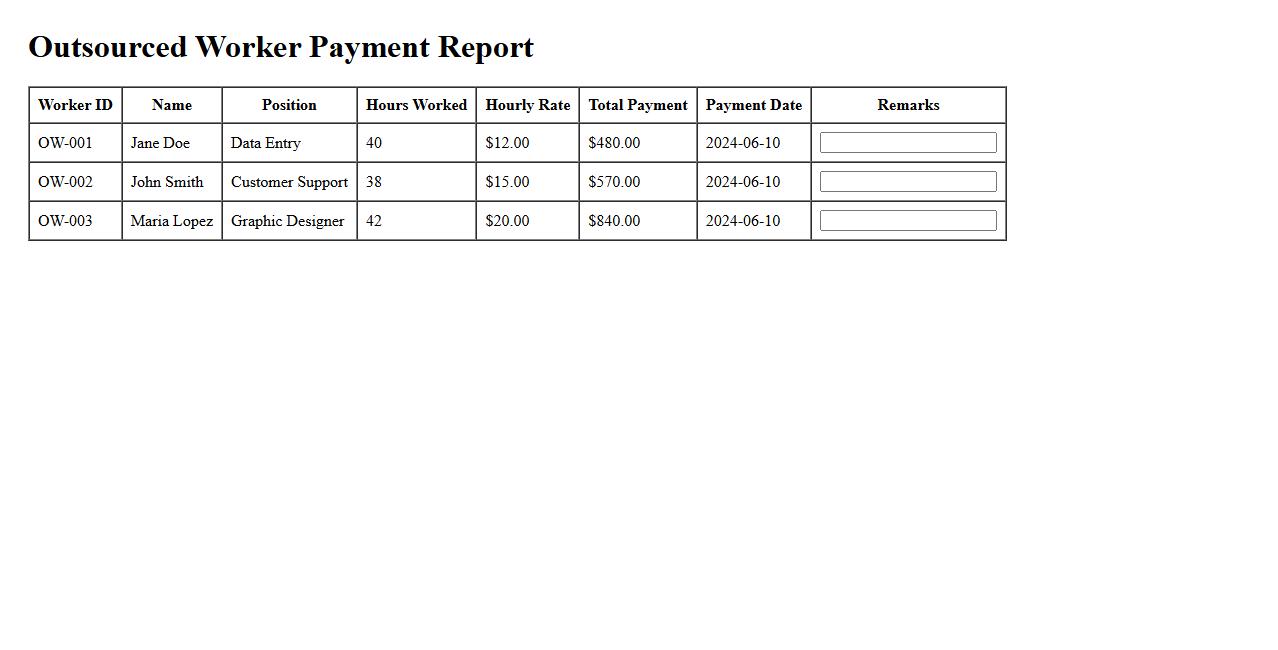

Outsourced Worker Payment Report

The Outsourced Worker Payment Report provides a comprehensive summary of all payments made to external contractors and freelancers. It helps organizations track expenses, ensure timely payments, and maintain accurate financial records. This report is essential for transparent accounting and efficient payroll management.

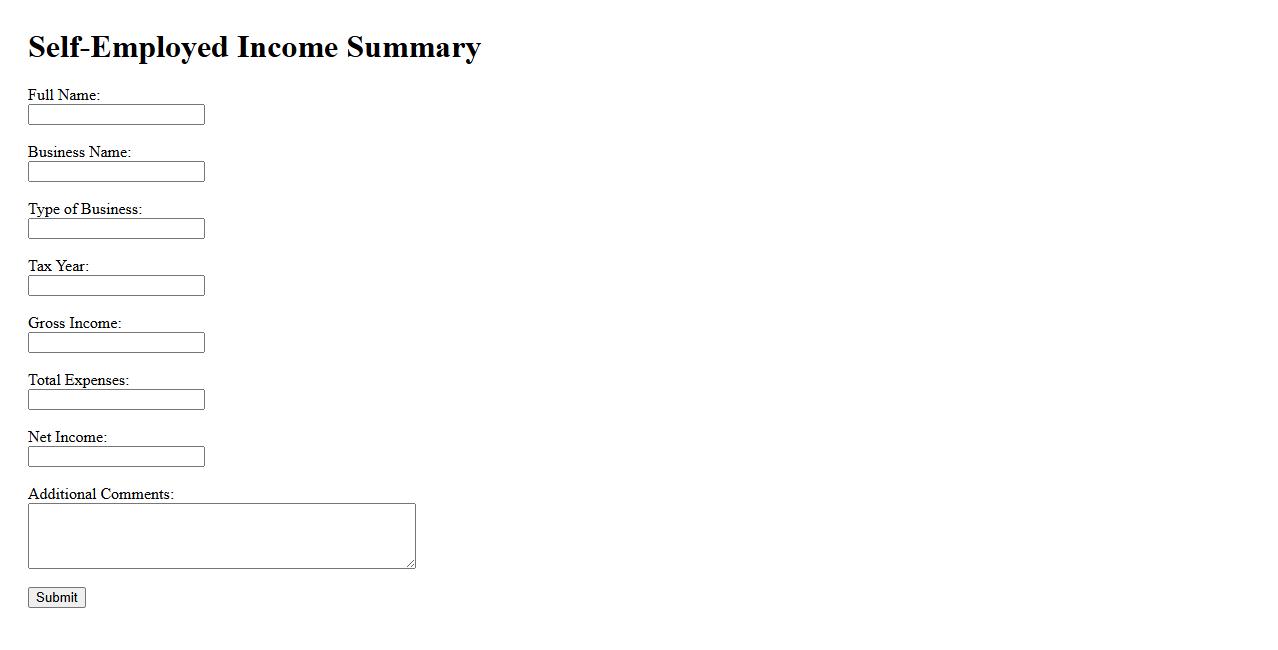

Self-Employed Income Summary

The Self-Employed Income Summary provides a clear overview of earnings generated through independent work or freelancing activities. It highlights total income, expenses, and net profit, offering valuable insights for financial planning and tax purposes. This summary is essential for accurately reporting income and managing personal finances effectively.

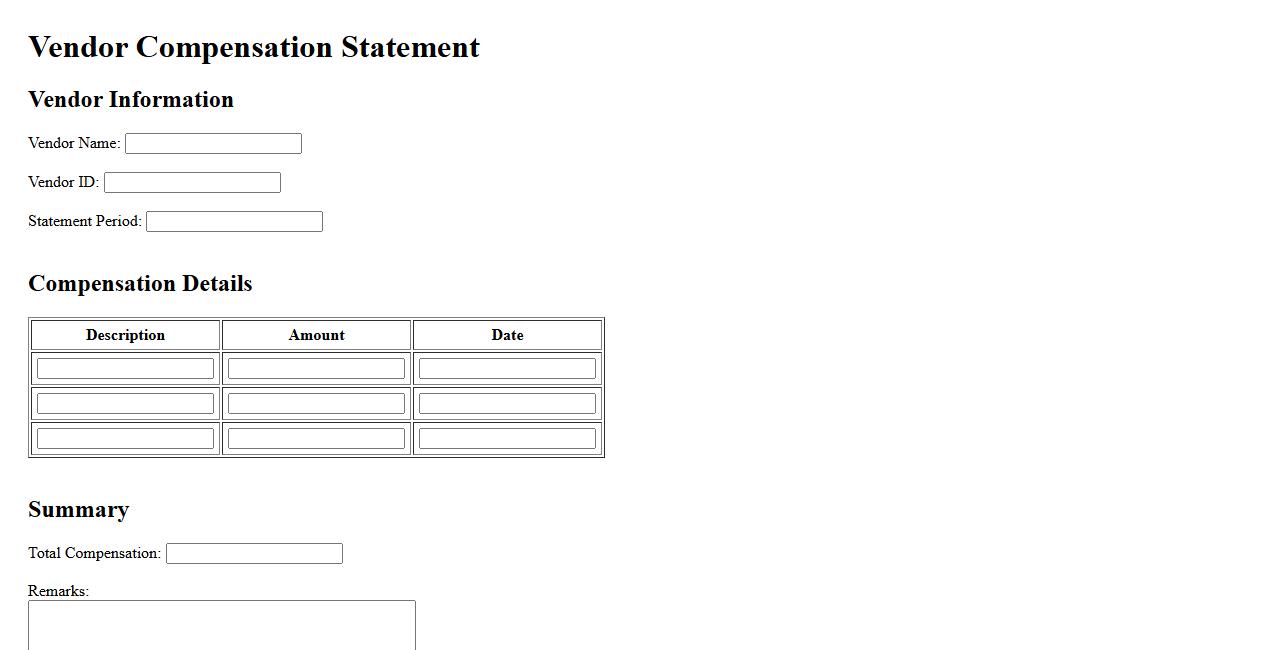

Vendor Compensation Statement

The Vendor Compensation Statement outlines the fees and commissions paid to vendors for their services or products. It ensures transparency and clarity in financial transactions between businesses and their suppliers. This document helps maintain accurate records and supports compliance with regulatory standards.

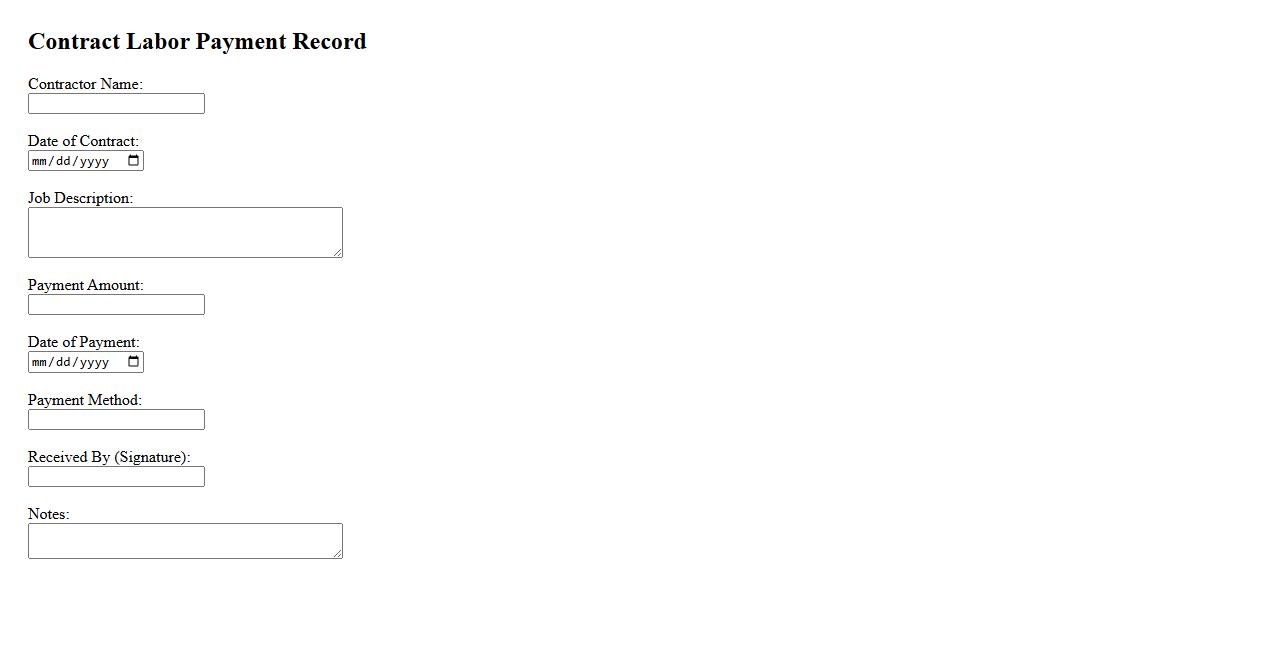

Contract Labor Payment Record

The Contract Labor Payment Record is a crucial document that tracks payments made to contract workers for their services. It ensures accurate financial management and compliance with labor regulations. Maintaining this record helps organizations monitor expenses and verify payment details efficiently.

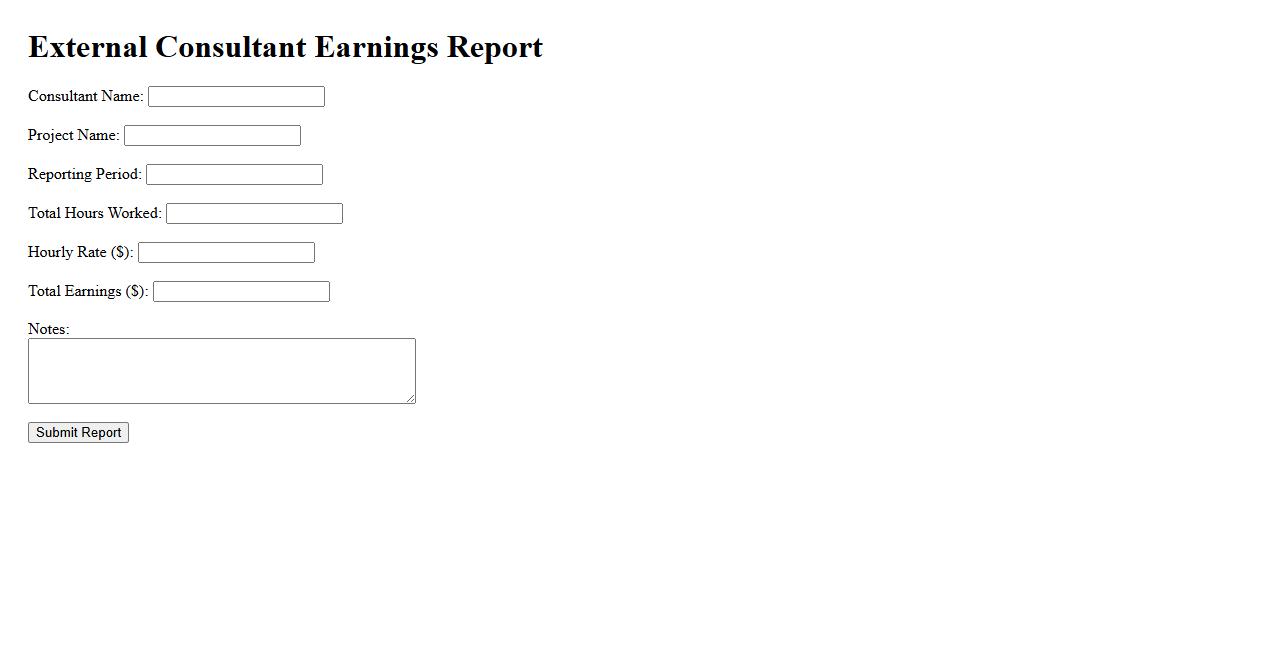

External Consultant Earnings Report

The External Consultant Earnings Report provides a comprehensive overview of the financial performance and compensation details for consultants hired from outside the organization. This document highlights key earnings metrics, trends, and comparisons to ensure transparency and informed decision-making. It is essential for budgeting and evaluating consultant contributions accurately.

What qualifies as nonemployee compensation for reporting purposes?

Nonemployee compensation refers to payments made to individuals who are not employees, such as independent contractors, freelancers, or consultants. This compensation typically includes fees, commissions, prizes, awards, and other forms of compensation for services rendered. The key factor is that the recipient provides services without being on the company's payroll.

Which IRS form is used to report nonemployee compensation?

The IRS Form 1099-NEC is specifically used to report nonemployee compensation. This form must be filed by businesses that pay independent contractors or other nonemployees for services during the tax year. It replaced Form 1099-MISC for reporting such payments starting in the tax year 2020.

What is the minimum payment amount that mandates reporting nonemployee compensation?

The IRS requires reporting on Form 1099-NEC if the total payments to a nonemployee meet or exceed $600 in a calendar year. Payments below this threshold generally are not reported unless there are specific exceptions. This minimum reporting amount ensures transparency and tax compliance for significant payments.

Who is responsible for issuing the Report of Nonemployee Compensation?

The payer or business that made payments to the nonemployee is responsible for issuing the Form 1099-NEC. They must provide a copy to the payee by January 31st following the end of the tax year. Additionally, the payer must file the form with the IRS to report the payments accurately.

What information is required to complete the Report of Nonemployee Compensation?

To complete Form 1099-NEC, the payer must collect the recipient's name, address, and Taxpayer Identification Number (TIN). The total amount paid to the nonemployee during the year must also be reported. Other necessary details include the payer's information and the tax year of the reported payments.