A Report of Fraud or Identity Theft involves notifying relevant authorities about unauthorized use of personal information or financial accounts. This report helps initiate investigations, prevent further damage, and protect victims from ongoing fraudulent activities. Filing promptly is crucial to minimize financial loss and restore one's identity.

Incident Summary

The Incident Summary provides a concise overview of an event or situation that has occurred, highlighting essential details for quick understanding. It includes key information such as the nature of the incident, affected parties, and immediate impact. This summary helps stakeholders assess the situation efficiently and determine necessary actions.

Complainant Information

The Complainant Information section gathers essential details about the individual submitting a complaint. This includes personal identification, contact details, and relevant background information. Accurate data ensures efficient communication and resolution processing.

Alleged Date of Occurrence

The Alleged Date of Occurrence refers to the specific day an event is claimed to have happened. It is crucial in legal and investigative contexts for establishing timelines. Accurate documentation of this date helps ensure proper case handling and evidence evaluation.

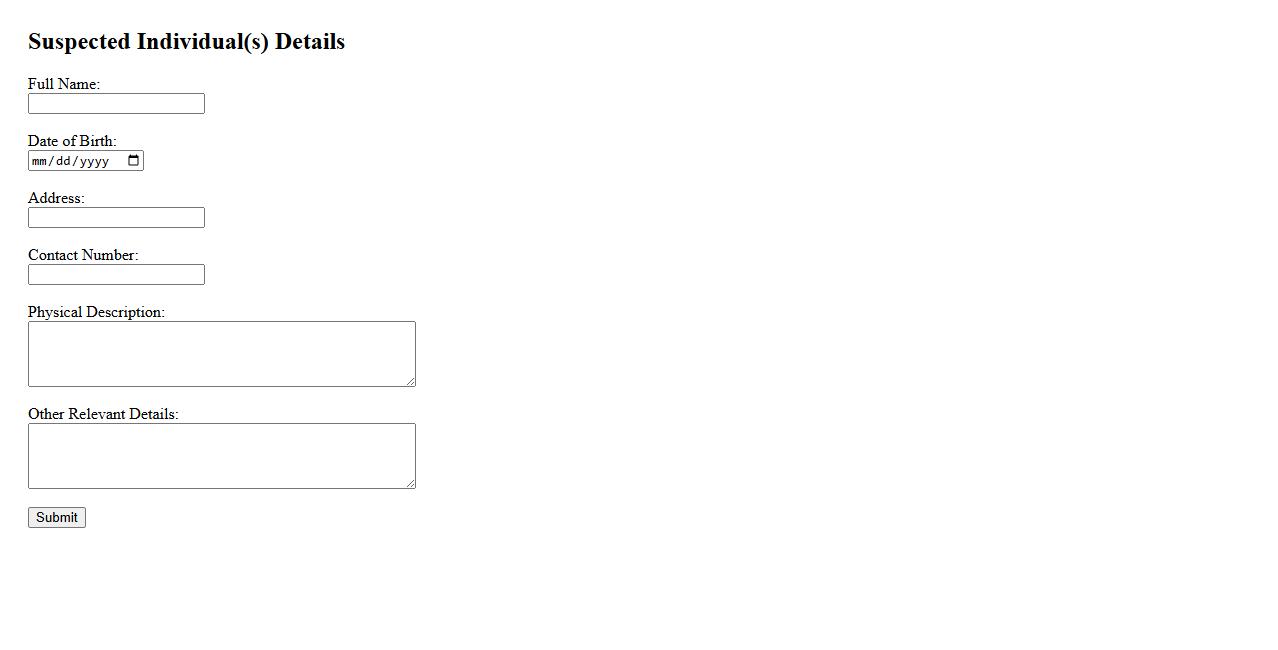

Suspected Individual(s) Details

The Suspected Individual(s) Details section provides essential information about persons believed to be involved in an incident. It includes identifying characteristics, behaviors, and any relevant background information. This data aids in investigations and enhances case accuracy.

Description of Fraudulent Activity

Description of Fraudulent Activity involves any intentional act of deception or misrepresentation made for personal gain or to cause a loss to another party. This behavior can include identity theft, phishing, or false claims in financial transactions. Understanding these activities is essential for preventing and addressing potential risks in various industries.

Evidence Collected

The evidence collected plays a crucial role in establishing the facts of any investigation. It includes physical objects, digital data, and witness testimonies gathered systematically to ensure accuracy and reliability. Proper documentation and preservation of this evidence are essential for its admissibility in court.

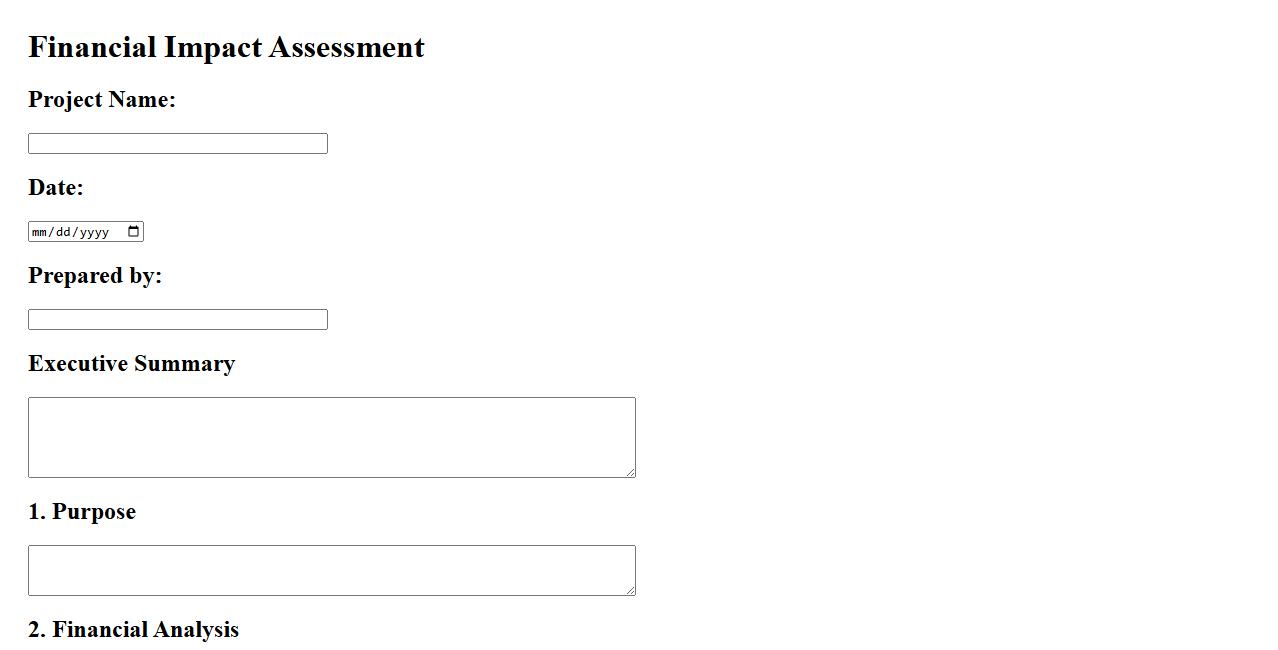

Financial Impact Assessment

A Financial Impact Assessment evaluates the economic consequences of business decisions, projects, or policies. It helps organizations understand potential risks and benefits to make informed choices. This analysis ensures strategic planning aligns with financial goals.

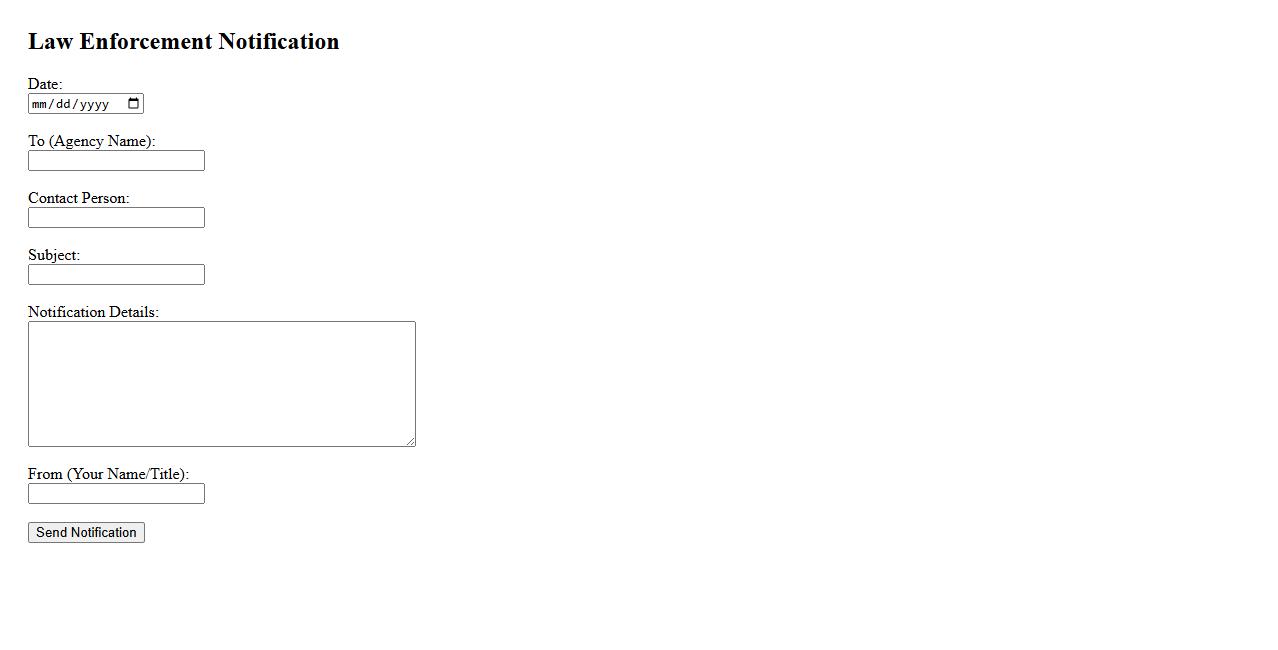

Law Enforcement Notification

Law Enforcement Notification is a crucial process that ensures timely communication between agencies during emergencies or investigations. This system helps in coordinating responses, sharing vital information, and enhancing public safety. Effective notification protocols minimize delays and improve overall law enforcement efficiency.

Corrective Actions Taken

Corrective actions taken are crucial steps implemented to address and resolve identified issues or non-conformities. These actions aim to eliminate the root cause of problems to prevent recurrence and improve overall processes. Effective corrective actions ensure continuous improvement and compliance with standards.

Signature and Verification

Signature and Verification are essential processes in digital security ensuring data authenticity and integrity. A digital signature confirms the sender's identity, while verification validates that the message remains unchanged. Together, they protect information from tampering and impersonation.

What specific fraudulent activity or identity theft is being reported in the document?

The document reports a case of credit card fraud involving unauthorized transactions. It details the use of stolen personal information to make fraudulent purchases. This activity is classified under identity theft exploiting financial data.

Which parties or entities have been affected by the fraud or identity theft according to the report?

The primary victims include the individual cardholder and the issuing bank. Additionally, the credit card processing companies have been indirectly impacted. Both personal and institutional entities suffer from financial and reputational damage.

What evidence or documentation is provided within the report to substantiate the claim of fraud or identity theft?

The report includes transaction records flagged as suspicious by the bank's monitoring system. It also presents copies of unauthorized charges and a statement from the cardholder denying these transactions. Surveillance footage and IP address logs help support the claim.

What actions have been taken or are recommended in the report to address or resolve the incident?

The report recommends immediate card cancellation and reissuance to prevent further unauthorized use. It also suggests contacting law enforcement for a formal investigation. The affected parties are advised to monitor their accounts regularly for unusual activity.

What dates and timelines are referenced in the report concerning the occurrence and discovery of the fraud or identity theft?

The fraudulent activities were detected between March 10 and March 15, 2024. The cardholder reported suspicious transactions on March 16, 2024. This timely reporting allowed for a swift response by the bank and authorities.