A Order for Payment Plan allows individuals or businesses to settle outstanding debts through structured, manageable installments. This arrangement helps avoid legal actions by ensuring consistent payments over a specified period. It provides clarity and protection for both creditors and debtors.

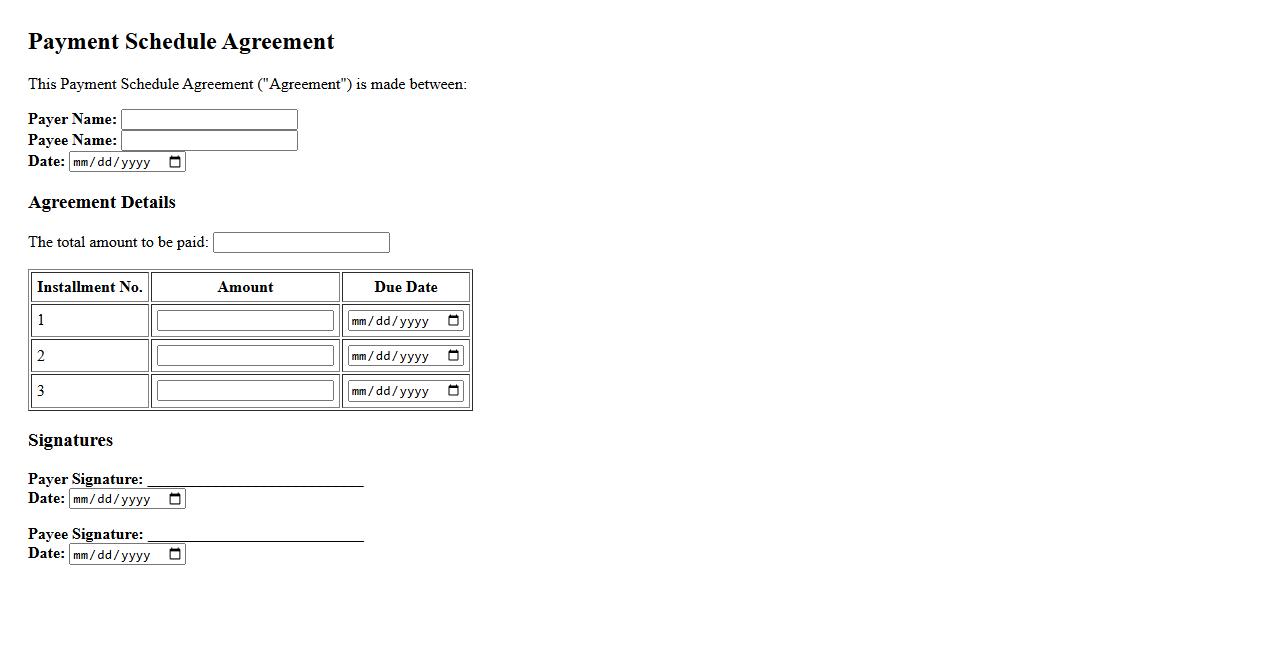

Payment Schedule Agreement

A Payment Schedule Agreement outlines the specific dates and amounts for payments between parties involved. It ensures clarity and mutual understanding, preventing disputes over payment timing. This agreement is essential for managing financial obligations efficiently.

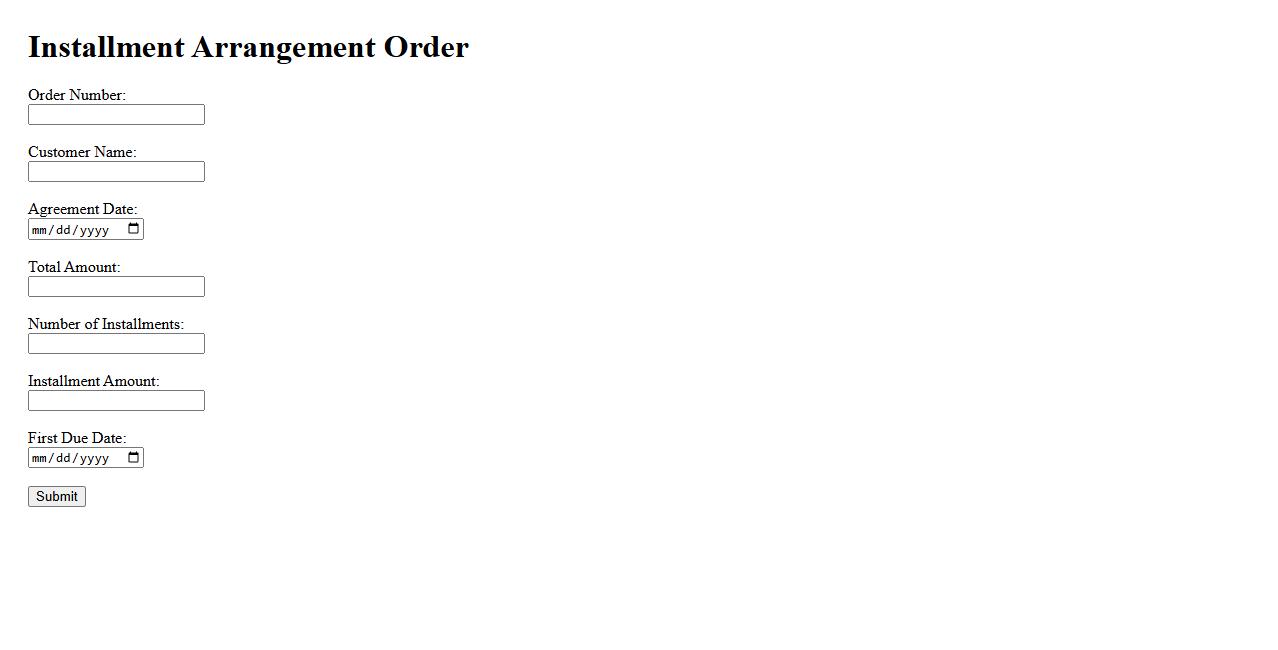

Installment Arrangement Order

An Installment Arrangement Order allows individuals or businesses to pay off a debt in smaller, manageable payments over time. This legal agreement helps avoid immediate full repayment, providing financial relief and preventing further penalties. It ensures structured payments while maintaining compliance with creditors or authorities.

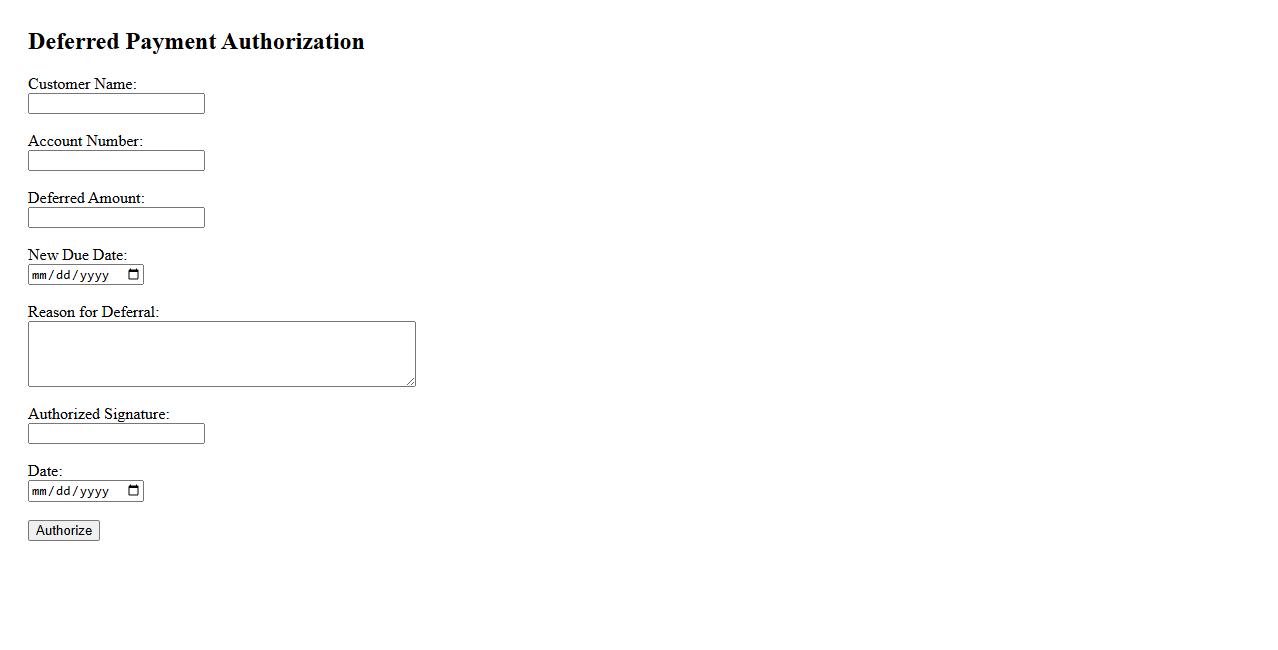

Deferred Payment Authorization

Deferred Payment Authorization allows customers to complete transactions with payments scheduled for a later date. This method enhances cash flow flexibility and simplifies budgeting by postponing immediate charges. It is commonly used in various industries to improve customer convenience and increase sales.

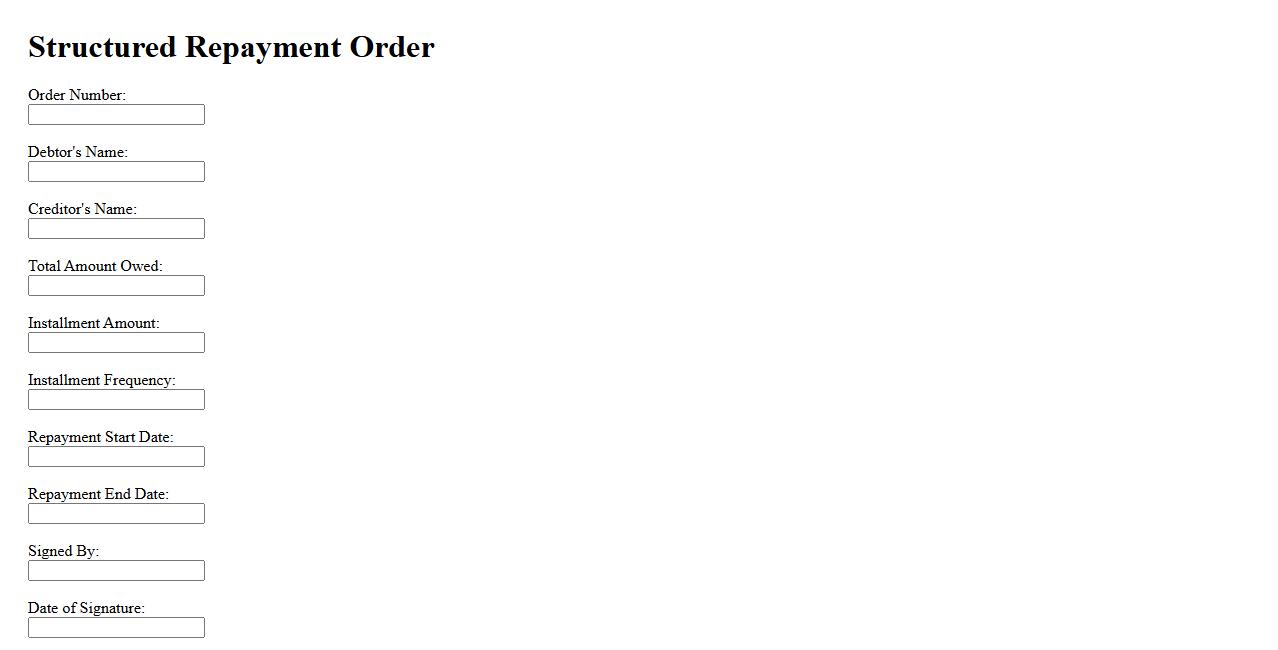

Structured Repayment Order

A Structured Repayment Order is a legally binding arrangement that outlines a clear schedule for repaying a debt. It ensures borrowers make consistent payments over a specified period, promoting financial stability and accountability. This order benefits both creditors and debtors by providing a transparent repayment framework.

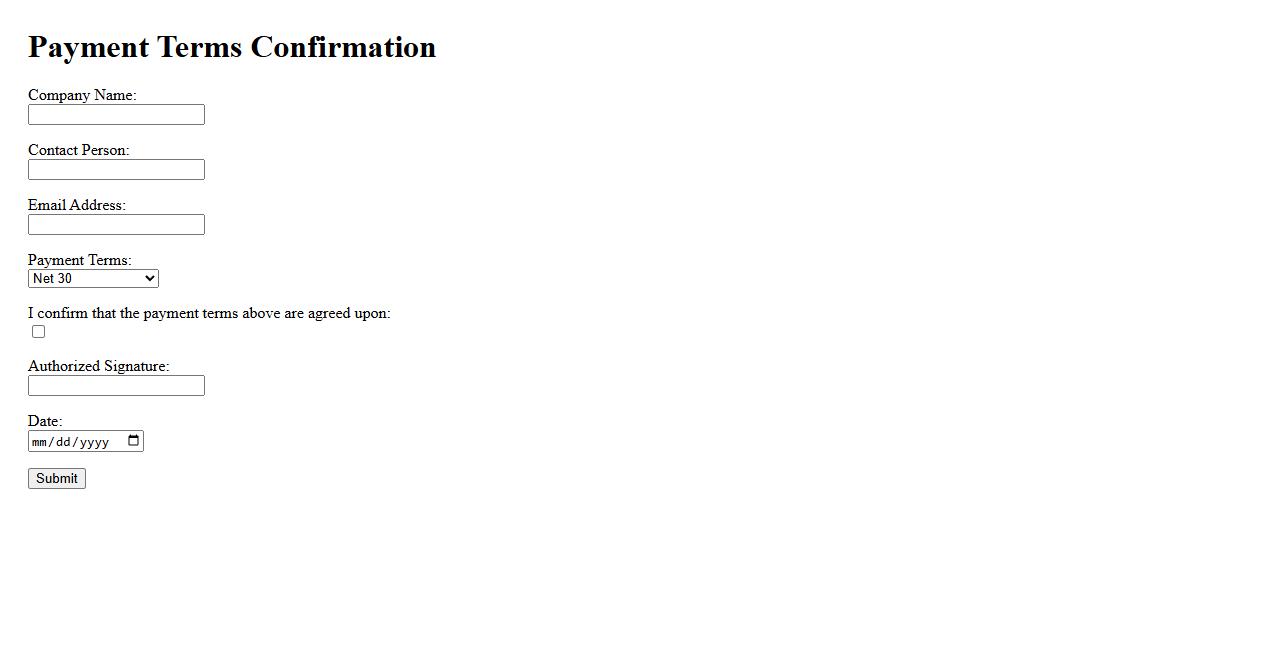

Payment Terms Confirmation

Payment Terms Confirmation ensures that both parties agree on the specific conditions of payment before proceeding. It outlines the payment schedule, methods, and any penalties for late payments. This process helps to avoid disputes and maintain clear financial communication.

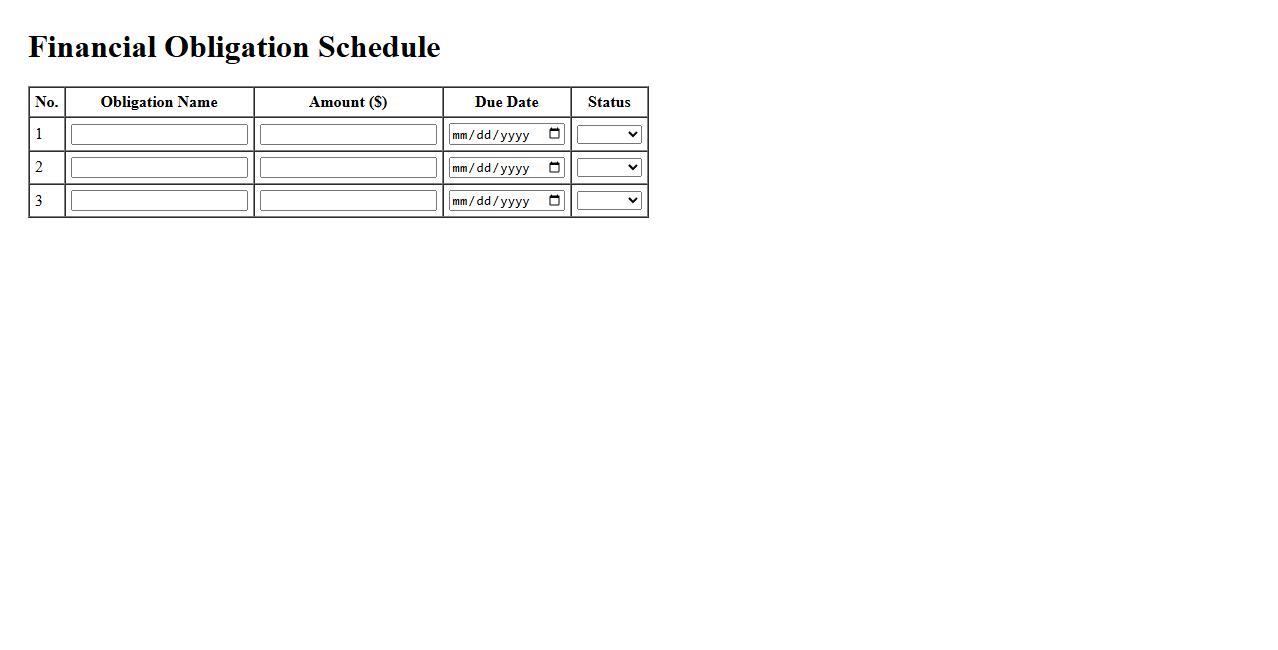

Financial Obligation Schedule

The Financial Obligation Schedule outlines the timeline and amounts of payments required to fulfill financial commitments. It helps individuals and organizations manage their budgets by providing a clear view of upcoming liabilities. This schedule ensures timely payments and avoids potential penalties.

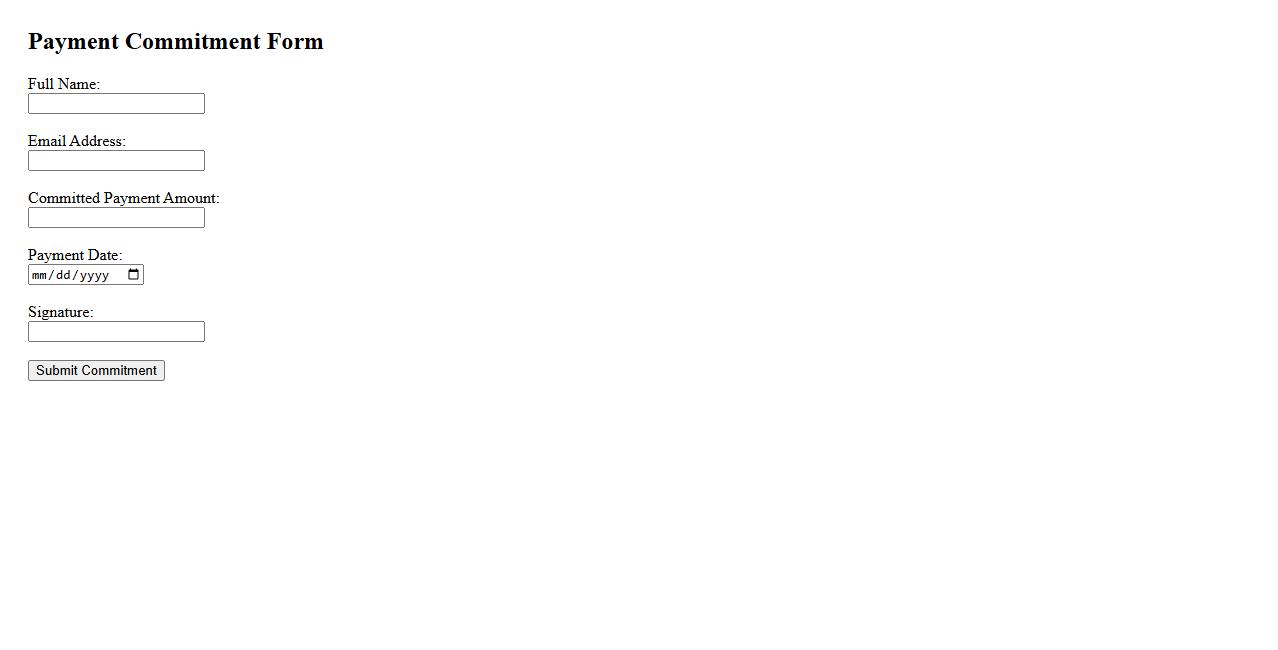

Payment Commitment Form

The Payment Commitment Form is a critical document used to outline an agreement between parties regarding payment terms. It ensures clarity and mutual understanding of the obligations involved. This form helps prevent disputes by clearly specifying payment amounts, deadlines, and conditions.

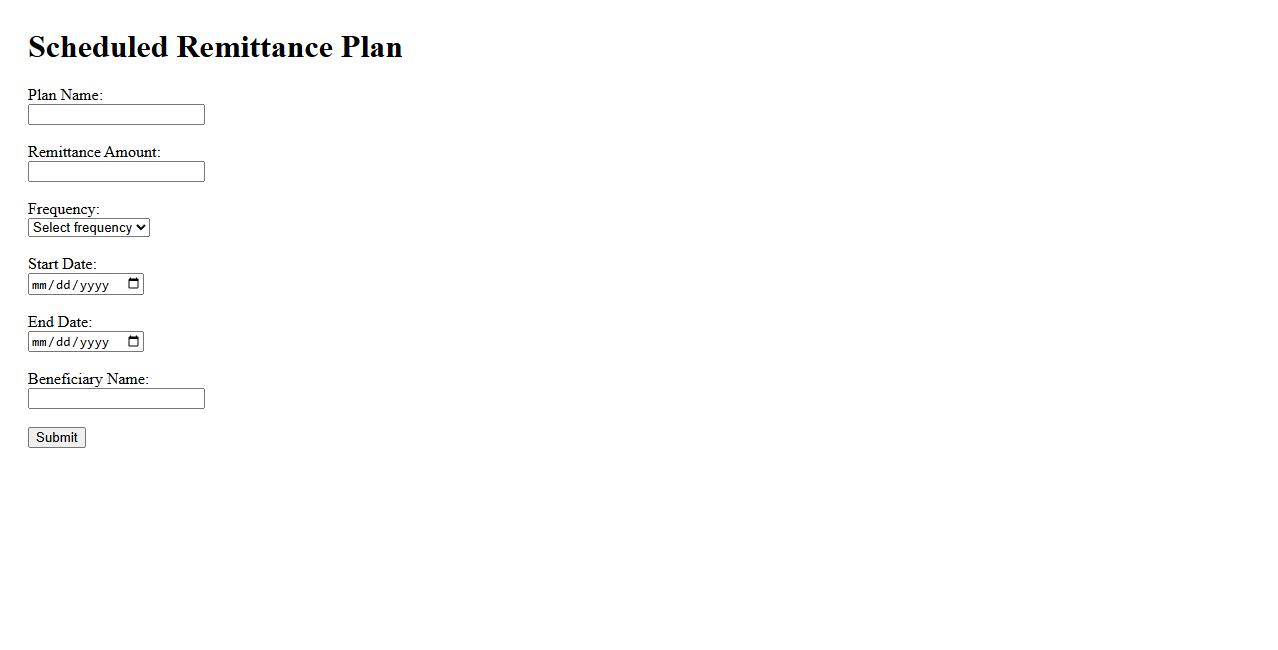

Scheduled Remittance Plan

The Scheduled Remittance Plan is a financial service that allows clients to automate regular payments, ensuring timely and consistent fund transfers. This plan is ideal for managing recurring expenses or sending money abroad without the hassle of manual transactions. By setting up a schedule, users can enjoy convenience and peace of mind with every remittance.

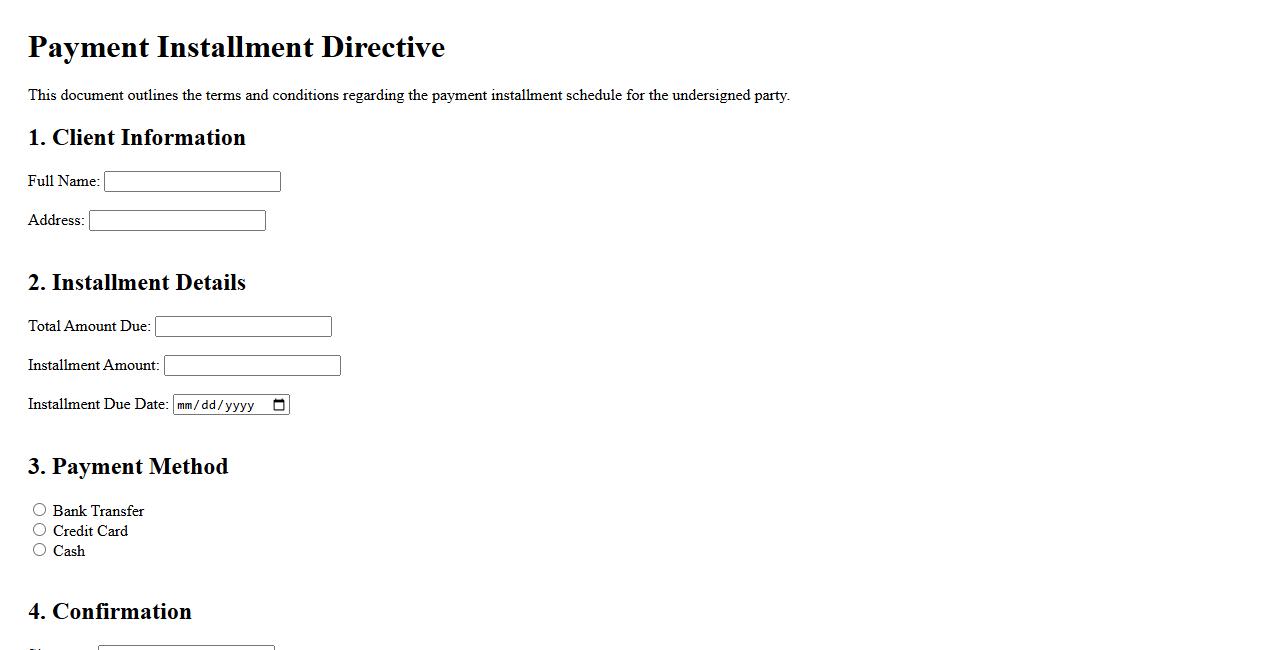

Payment Installment Directive

The Payment Installment Directive is a legal framework designed to regulate the terms and conditions under which consumers can pay for goods or services in installments. It aims to protect consumers by ensuring transparency and fairness in installment agreements. This directive helps promote responsible lending and borrowing practices across various markets.

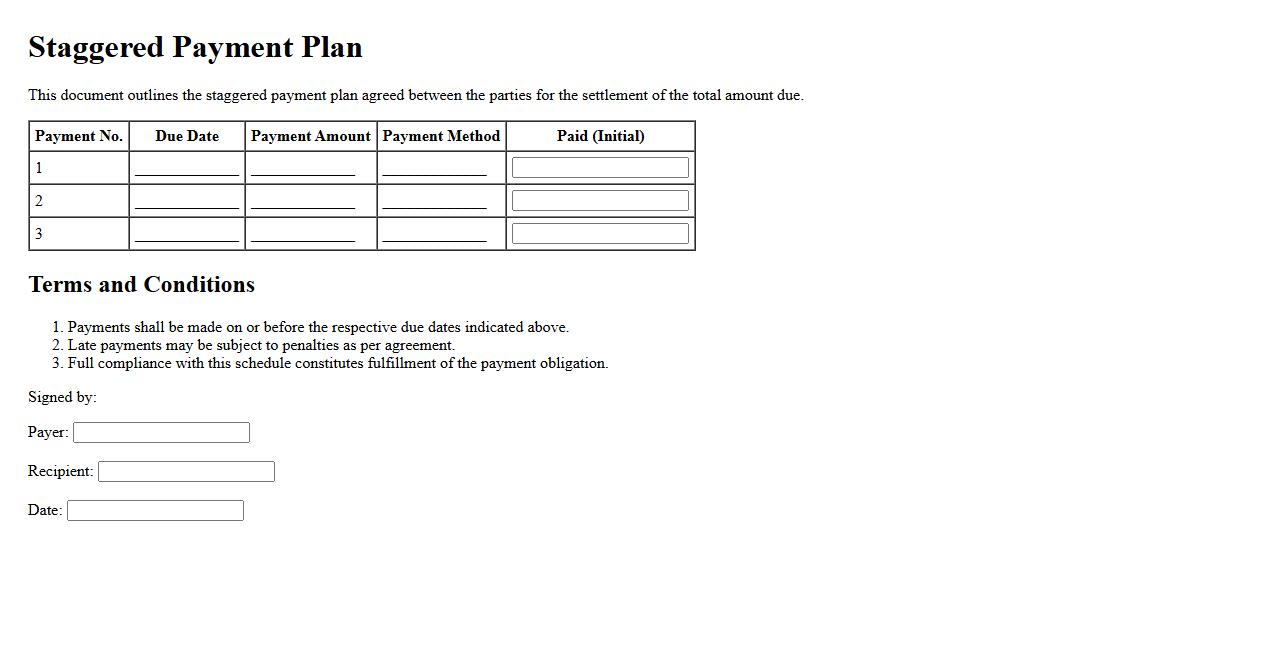

Staggered Payment Plan

The Staggered Payment Plan allows customers to make payments in multiple installments over a set period, easing financial burden. This flexible approach enhances affordability and financial planning. It is ideal for managing large purchases without immediate full payment.

Key Terms and Conditions in the Order for Payment Plan

The Order for Payment Plan outlines the binding agreement between involved parties regarding systematic payments. It specifies the amount due, installment schedule, and conditions under which payments must be made. Also included are terms on default, dispute resolution, and applicable legal frameworks.

Parties Involved and Their Obligations

The primary parties in the payment plan generally include the debtor and the creditor. The debtor is obligated to make payments according to the agreed schedule, while the creditor must accept them and uphold any negotiated terms. Both parties must communicate promptly about any issues or changes in the payment process.

Total Amount and Installment Schedule

The total amount to be paid is clearly stated in the document, along with the breakdown of installment payments. The payment timeline specifies due dates for each installment, ensuring consistency and clarity. This structured schedule helps both parties manage financial obligations effectively.

Penalties and Actions for Missed or Late Payments

Strict penalties are often detailed for missed or late installments, which may include additional fees or interest. The document may also specify actions such as suspension of services, reporting to credit agencies, or legal proceedings. These measures encourage timely compliance with the payment plan.

Modification or Termination of the Payment Plan

The conditions under which the payment plan can be modified or terminated are also included. Modifications usually require mutual consent and written agreement, while termination may occur if obligations are not met or through a legal process. This ensures flexibility while protecting the interests of both parties.