A Notice of Intent to Fine is a formal document issued by regulatory agencies indicating that an entity may be subject to a monetary penalty due to non-compliance with specific laws or regulations. This notice outlines the alleged violations, the proposed fine amount, and the steps the recipient can take to respond or contest the penalty. Receiving a Notice of Intent to Fine often initiates a legal or administrative process to resolve the dispute.

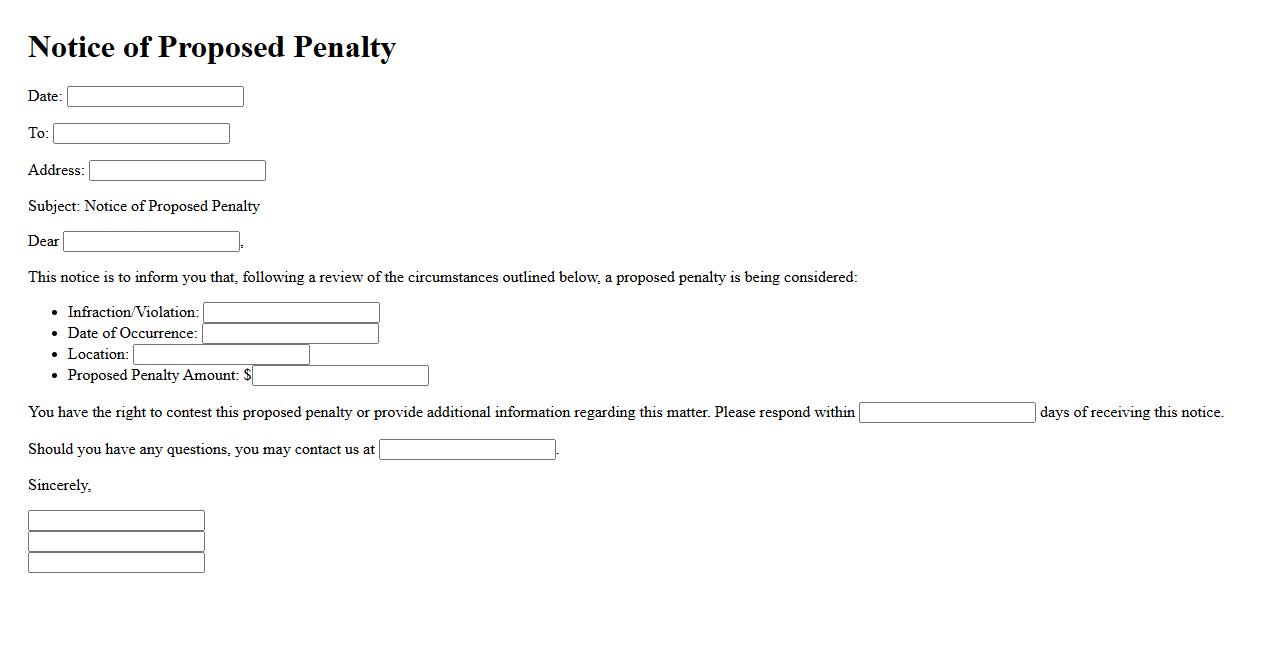

Notice of Proposed Penalty

The Notice of Proposed Penalty is a formal document issued to inform an individual or organization of a potential fine due to non-compliance with regulations. It outlines the nature of the violation and the amount of the proposed penalty. Recipients have the opportunity to respond or appeal before the penalty is finalized.

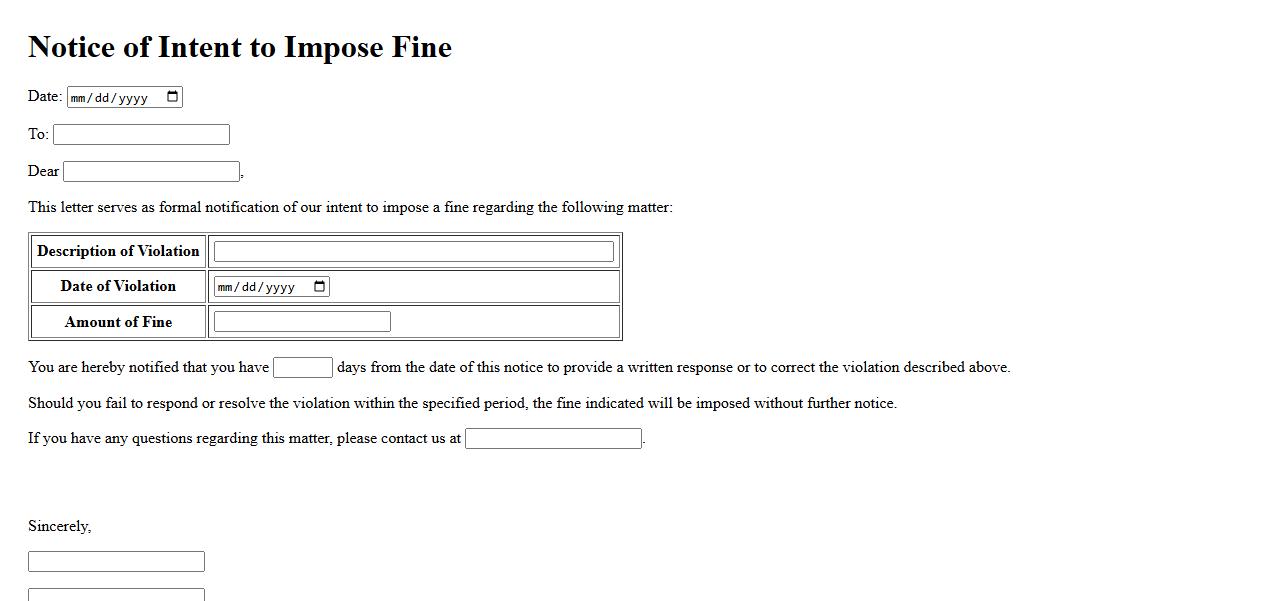

Intent to Impose Fine

An Intent to Impose Fine is a formal notification issued by an authority indicating the preliminary decision to levy a penalty. It provides the recipient an opportunity to respond or contest the allegations before the fine is finalized. This notice ensures transparency and fairness in regulatory or legal proceedings.

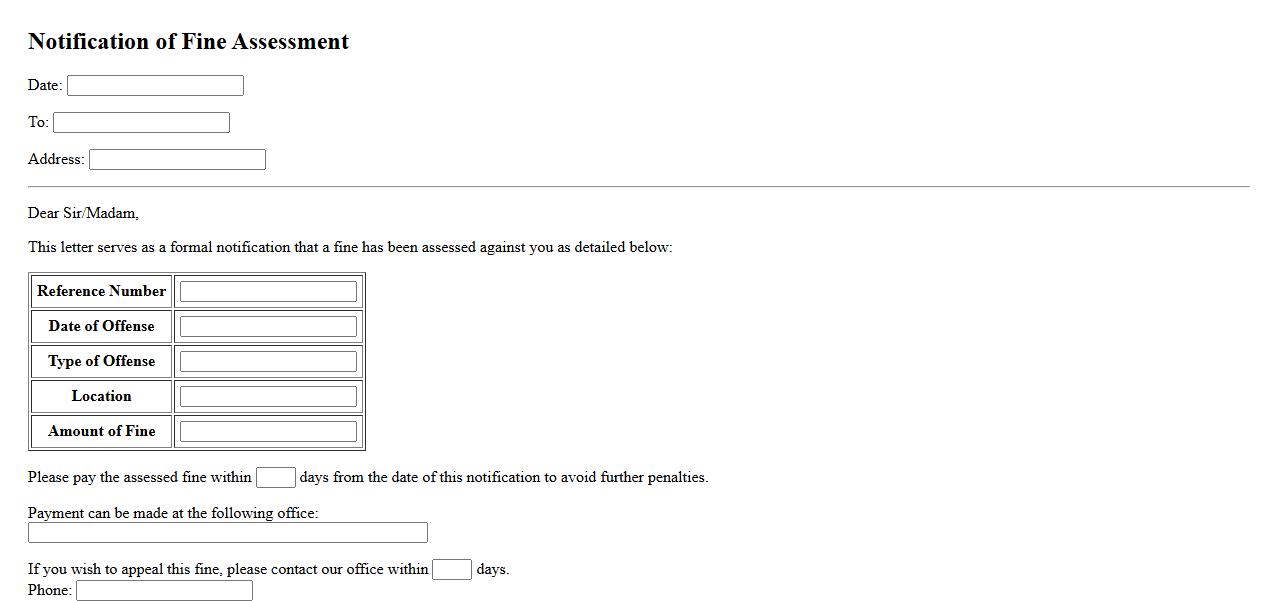

Notification of Fine Assessment

The Notification of Fine Assessment is an official document informing an individual or entity of a penalty imposed due to a violation or non-compliance. It details the amount of the fine, the reason for the assessment, and the payment deadline. Recipients should review the notification carefully to understand their obligations and possible appeal options.

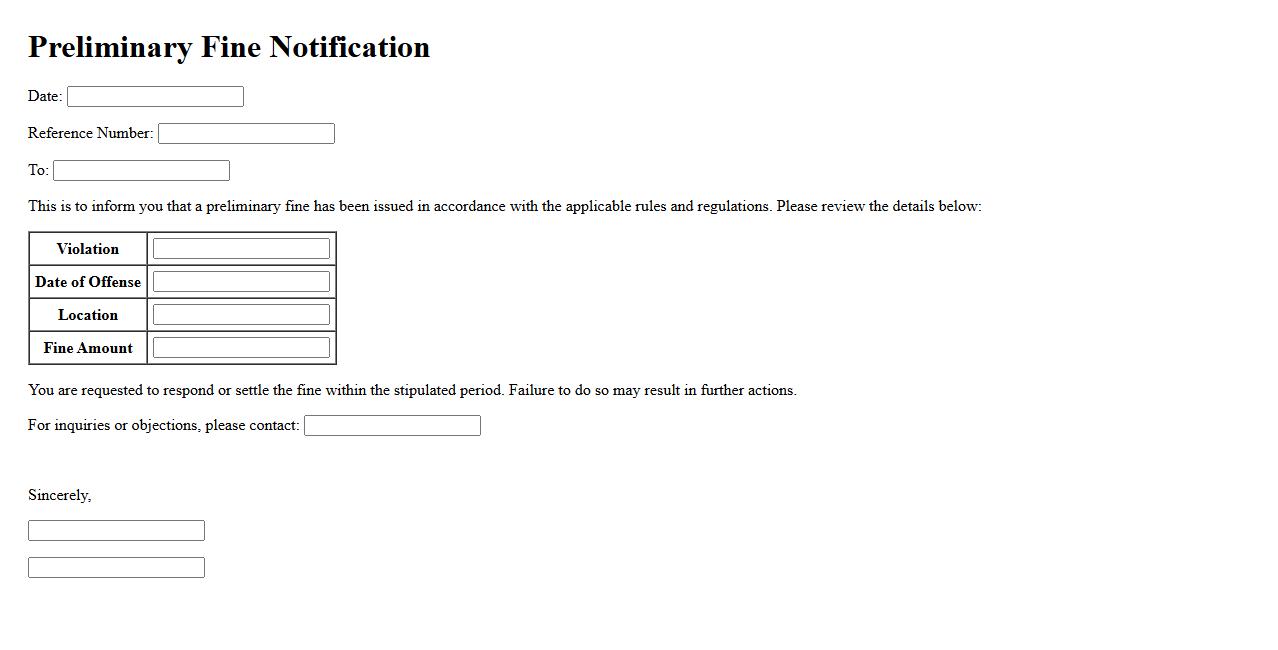

Preliminary Fine Notification

A Preliminary Fine Notification serves as an initial alert to inform individuals or organizations of a potential violation. It provides details about the alleged infraction and the possible penalties involved. This notification allows recipients to review the case and respond before any formal fine is imposed.

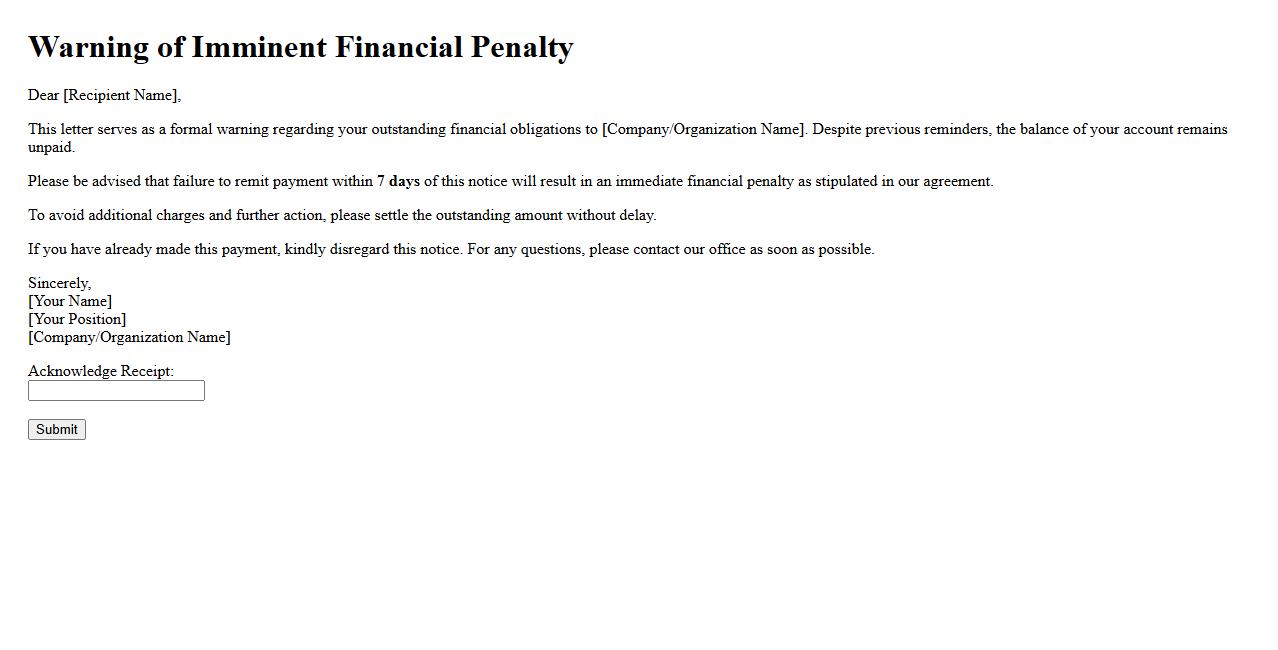

Warning of Imminent Financial Penalty

Warning of Imminent Financial Penalty alerts individuals or organizations about impending monetary consequences due to non-compliance or violation of rules. It serves as a critical notice to take immediate corrective action to avoid costly fines. Timely attention to this warning can prevent significant financial losses.

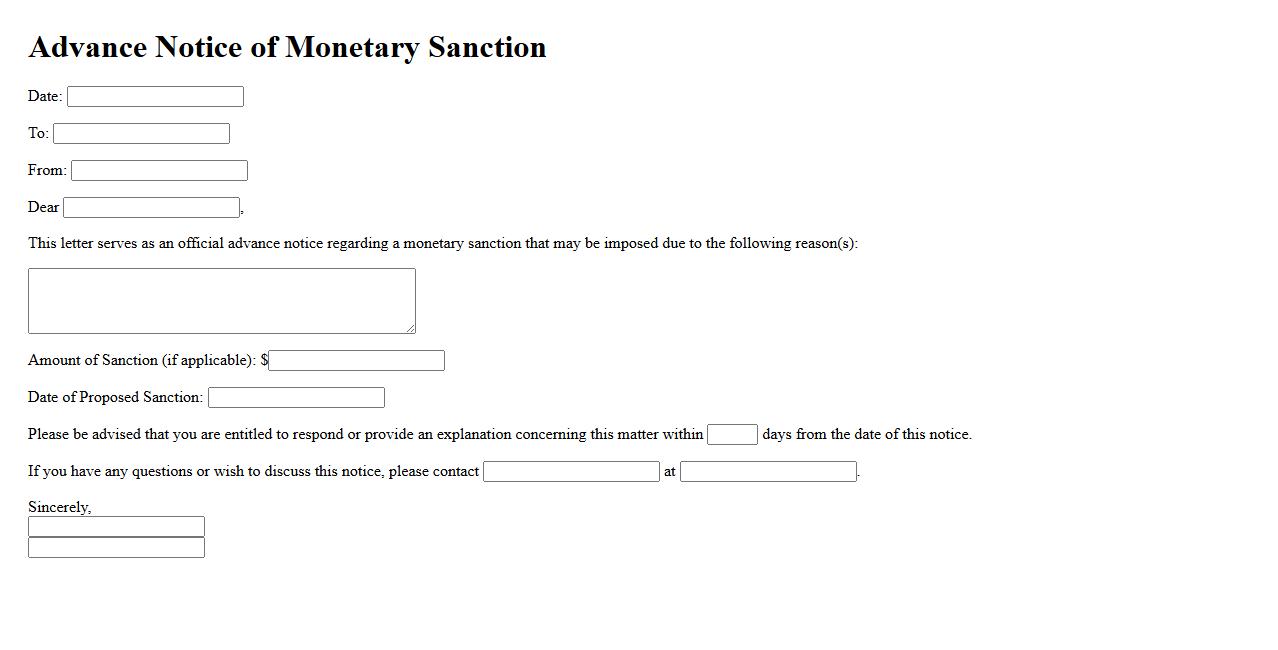

Advance Notice of Monetary Sanction

An Advance Notice of Monetary Sanction informs individuals or organizations about impending financial penalties due to non-compliance with regulations. This notice ensures transparency and provides an opportunity to address or contest the proposed sanctions before enforcement. Timely communication helps maintain fair and effective regulatory processes.

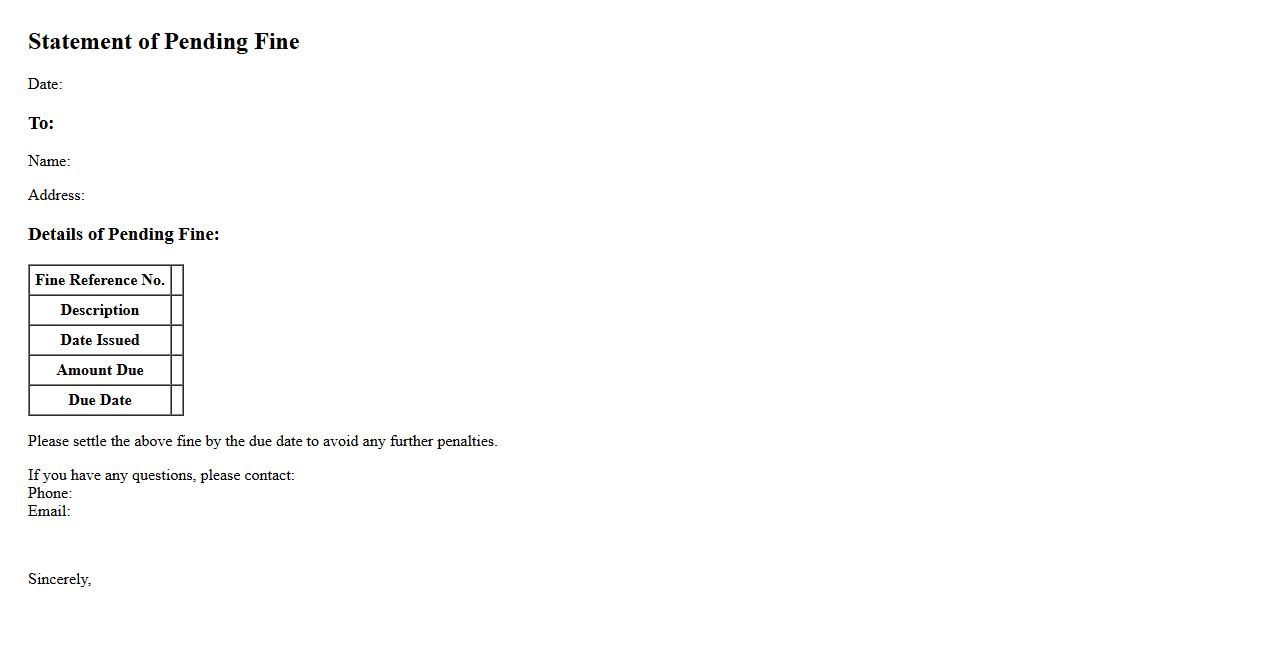

Statement of Pending Fine

The Statement of Pending Fine provides a detailed overview of any outstanding penalties or fines that are currently unresolved. It serves as an official document to inform individuals or entities about due payments and deadlines. This statement helps ensure transparency and timely resolution of financial obligations.

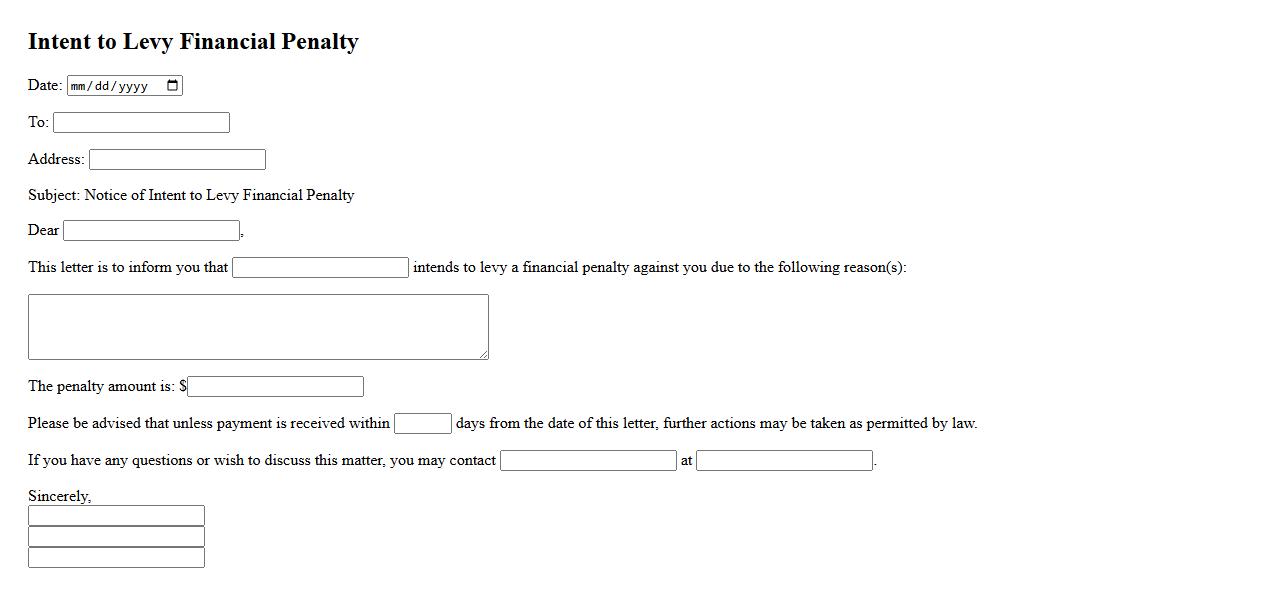

Intent to Levy Financial Penalty

An Intent to Levy Financial Penalty is a formal notice issued by tax authorities indicating their plan to seize assets to satisfy an unpaid tax debt. This warning allows the taxpayer an opportunity to resolve the debt before enforcement actions begin. It serves as a crucial step in the collection process to ensure compliance with tax obligations.

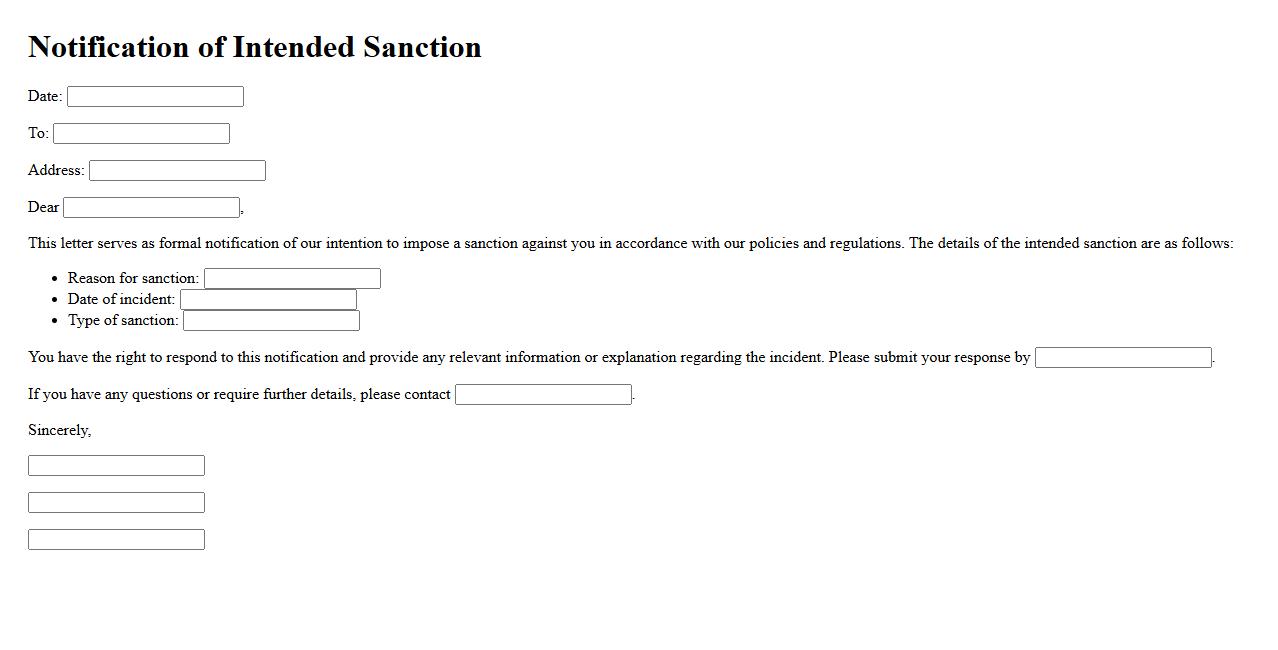

Notification of Intended Sanction

The Notification of Intended Sanction is a formal communication informing an individual or organization about a proposed disciplinary action. It outlines the reasons for the sanction and provides an opportunity to respond before final decisions are made. This process ensures transparency and fairness in enforcing policies.

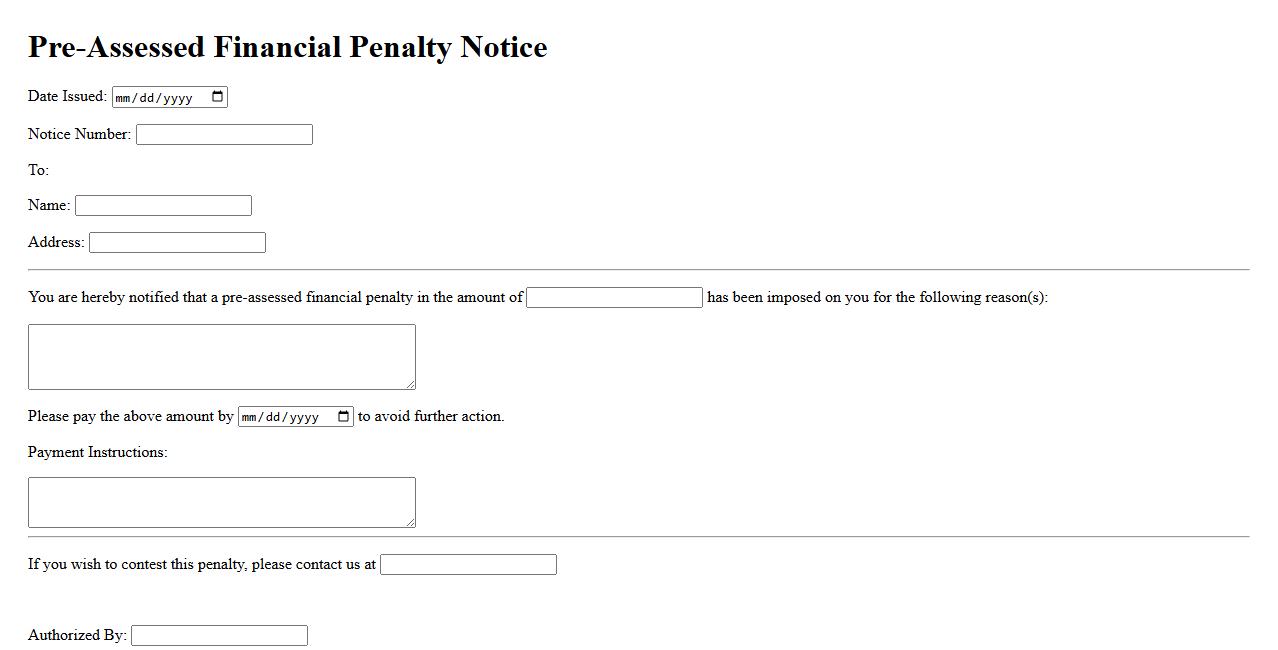

Pre-Assessed Financial Penalty Notice

The Pre-Assessed Financial Penalty Notice is an official document issued to inform individuals or businesses of a preliminary monetary fine. It outlines the violation details and the amount to be paid before further legal action. This notice serves as a warning and an opportunity to address the penalty promptly.

What is the primary purpose of a Notice of Intent to Fine?

The primary purpose of a Notice of Intent to Fine is to formally inform an individual or organization about a potential financial penalty due to a violation. It serves as an official notification before the fine is imposed, allowing the recipient to understand the nature of the alleged infraction. This notice emphasizes the seriousness of the compliance issue and the imminent consequences if unresolved.

Which entity or authority issues a Notice of Intent to Fine?

A Notice of Intent to Fine is typically issued by a regulatory or governmental authority responsible for enforcement in a specific sector. Examples include environmental agencies, workplace safety boards, or financial regulatory bodies. These authorities have the legal jurisdiction to monitor compliance and impose penalties for violations.

What legal rights does the recipient have upon receiving a Notice of Intent to Fine?

Upon receiving a Notice of Intent to Fine, the recipient has the legal right to contest or appeal the proposed fine within a specified timeframe. They are entitled to review the evidence, provide additional information, or request a hearing to dispute the violation. These rights ensure due process and fair treatment under the law.

What specific violations or actions typically trigger a Notice of Intent to Fine?

Common triggers for a Notice of Intent to Fine include violations such as safety breaches, environmental infractions, regulatory non-compliance, or failure to meet legal standards. These infractions usually relate to laws or regulations enforced by the issuing authority. The intention is to correct behavior and enforce adherence to established rules.

What are the required elements or information included in a Notice of Intent to Fine?

A Notice of Intent to Fine must include key elements such as the details of the violation, the amount of the proposed fine, and the legal basis for the penalty. It should also outline the recipient's rights, instructions for responding, and deadlines for compliance or appeal. Clear and precise information ensures transparency and facilitates the enforcement process.