A Notice of SAFE Act Compliance confirms that a mortgage loan originator or lender meets the standards established by the Secure and Fair Enforcement for Mortgage Licensing Act (SAFE Act). This notice ensures that all involved parties follow mandatory licensing, registration, and background check requirements to promote transparency and protect consumers. Compliance with the SAFE Act helps maintain accountability and trust within the mortgage industry.

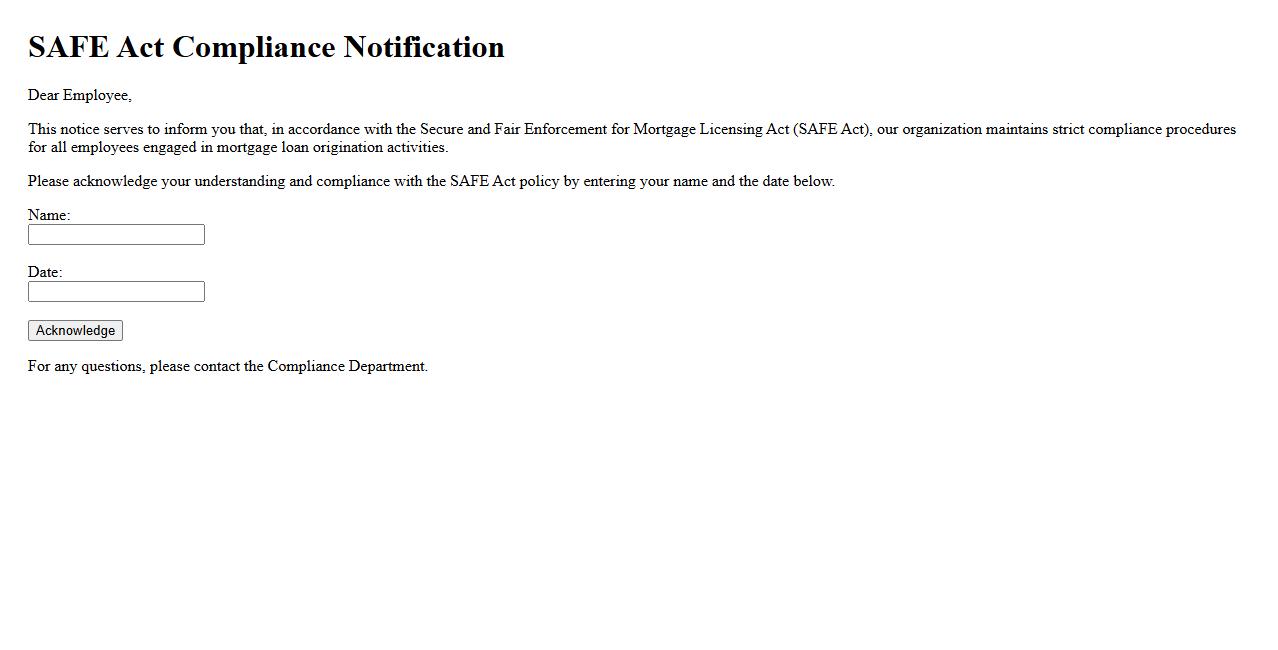

SAFE Act Compliance Notification

The SAFE Act Compliance Notification ensures that businesses adhere to federal safety and security regulations. It serves as an official alert regarding necessary actions to maintain compliance and avoid legal penalties. Timely acknowledgment of this notification is crucial for operational integrity.

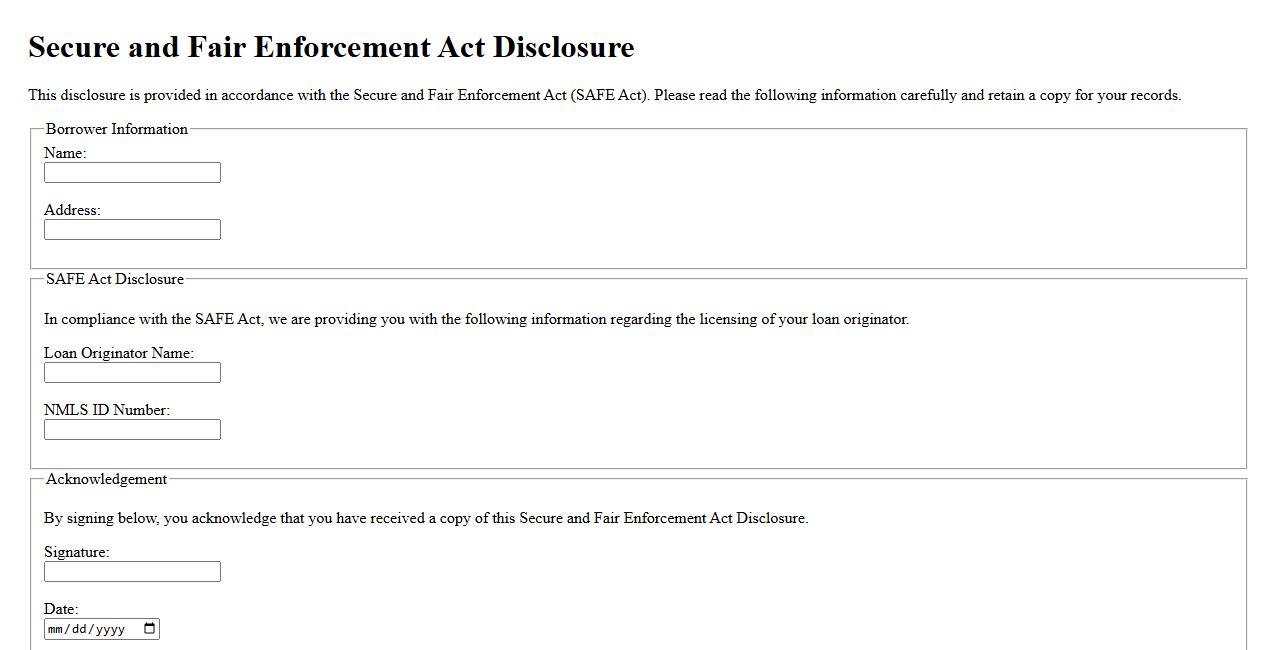

Secure and Fair Enforcement Act Disclosure

The Secure and Fair Enforcement Act Disclosure ensures transparency and fairness in securities transactions. It mandates comprehensive information sharing to protect investors from fraud. This act promotes trust and accountability in financial markets.

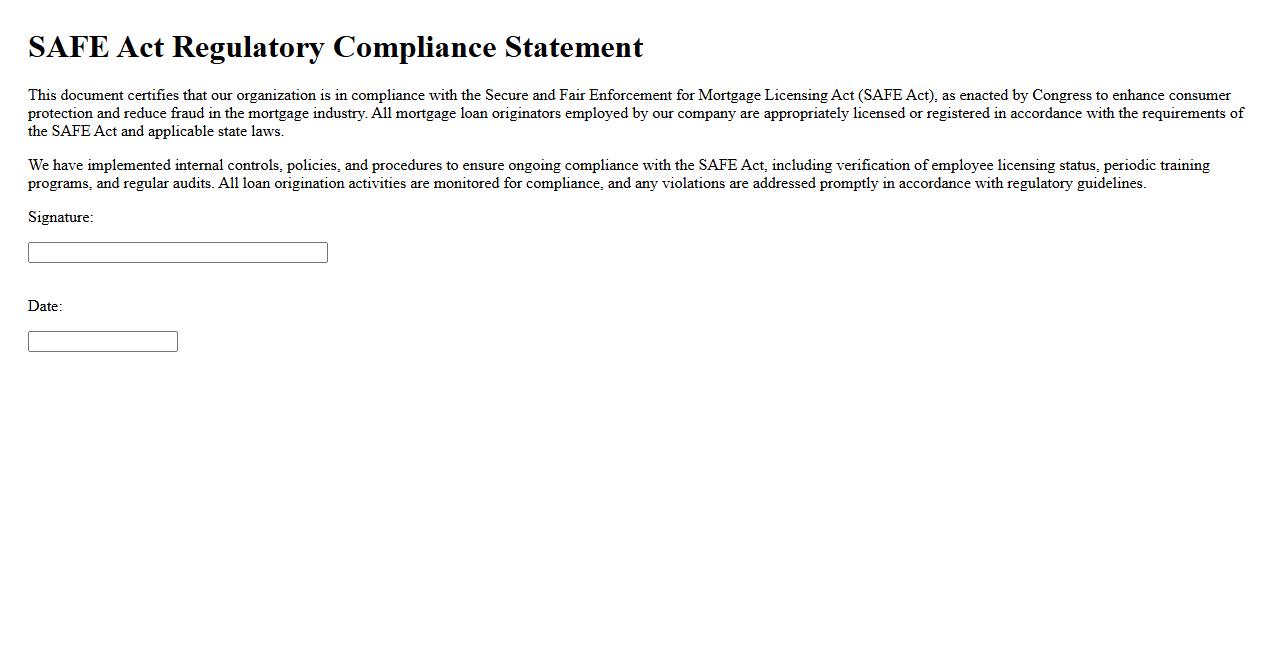

SAFE Act Regulatory Compliance Statement

The SAFE Act Regulatory Compliance Statement ensures that mortgage loan originators adhere to federal standards designed to protect consumers. This statement confirms that all licensing requirements and background checks have been met to maintain transparency and trust. Compliance with the SAFE Act promotes professionalism and accountability within the mortgage industry.

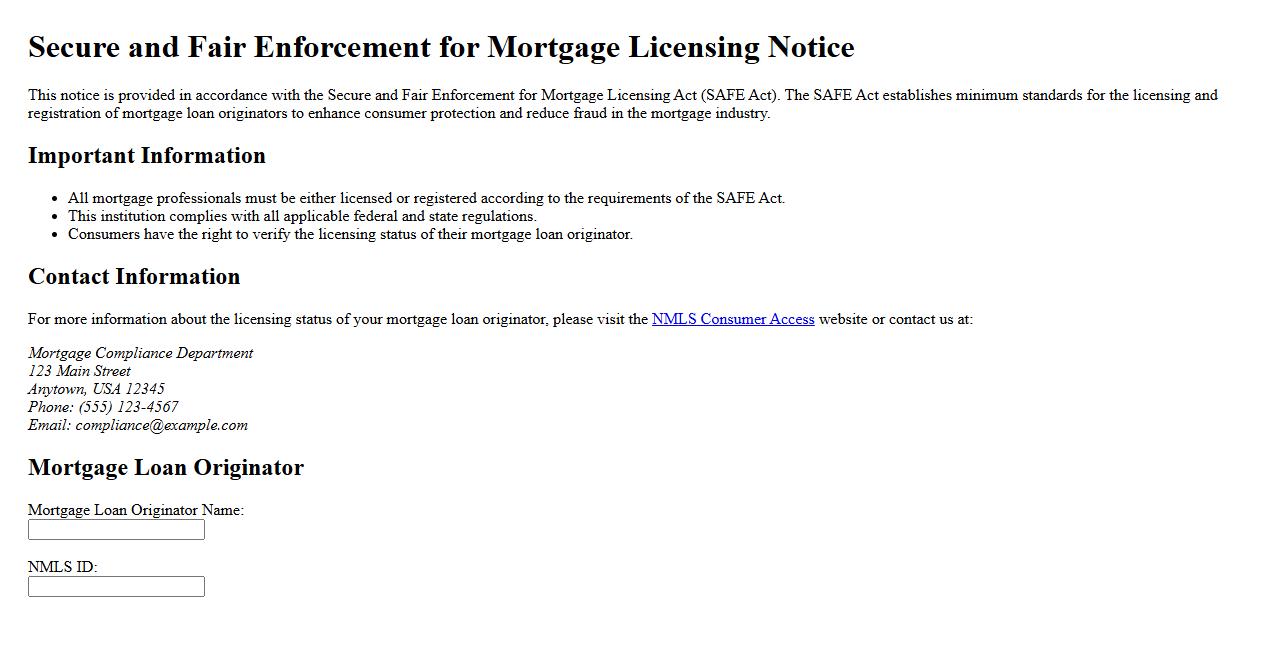

Secure and Fair Enforcement for Mortgage Licensing Notice

The Secure and Fair Enforcement for Mortgage Licensing Notice ensures transparency and compliance in mortgage lending. It protects consumers by enforcing strict licensing requirements for mortgage professionals. This notice promotes a fair and secure mortgage market for all parties involved.

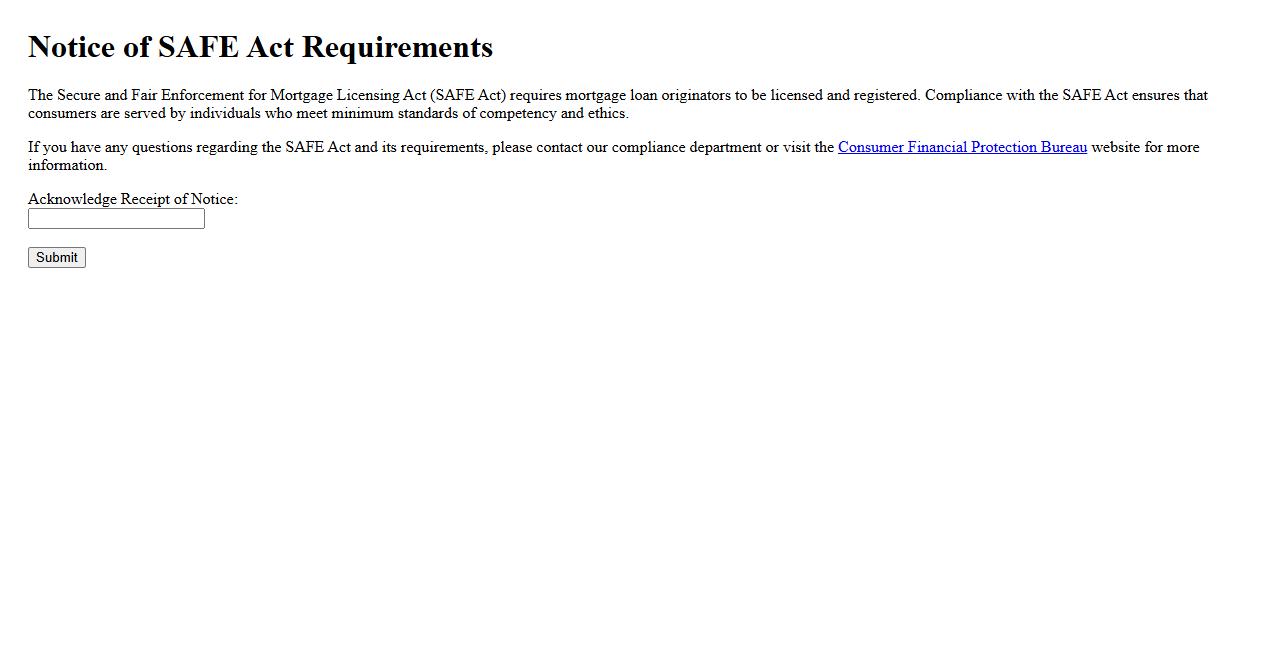

Notice of SAFE Act Requirements

The Notice of SAFE Act Requirements informs mortgage loan originators about federal and state regulations designed to enhance consumer protection. It outlines mandatory licensing, registration, and education prerequisites to ensure industry compliance. Understanding these requirements is essential for lawful and ethical mortgage practices.

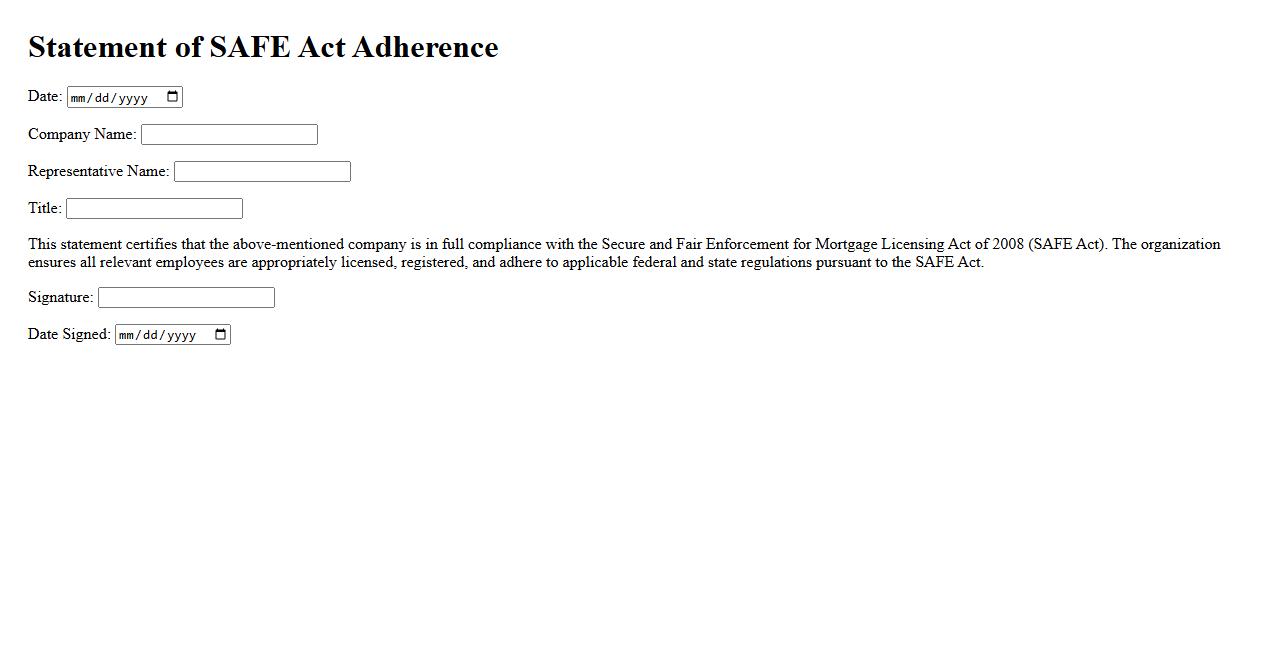

Statement of SAFE Act Adherence

The Statement of SAFE Act Adherence ensures compliance with the Secure and Fair Enforcement (SAFE) Act regulations. This statement confirms that all activities meet the required legal standards for mortgage loan originators. Adhering to these guidelines promotes transparency and protects consumers throughout the lending process.

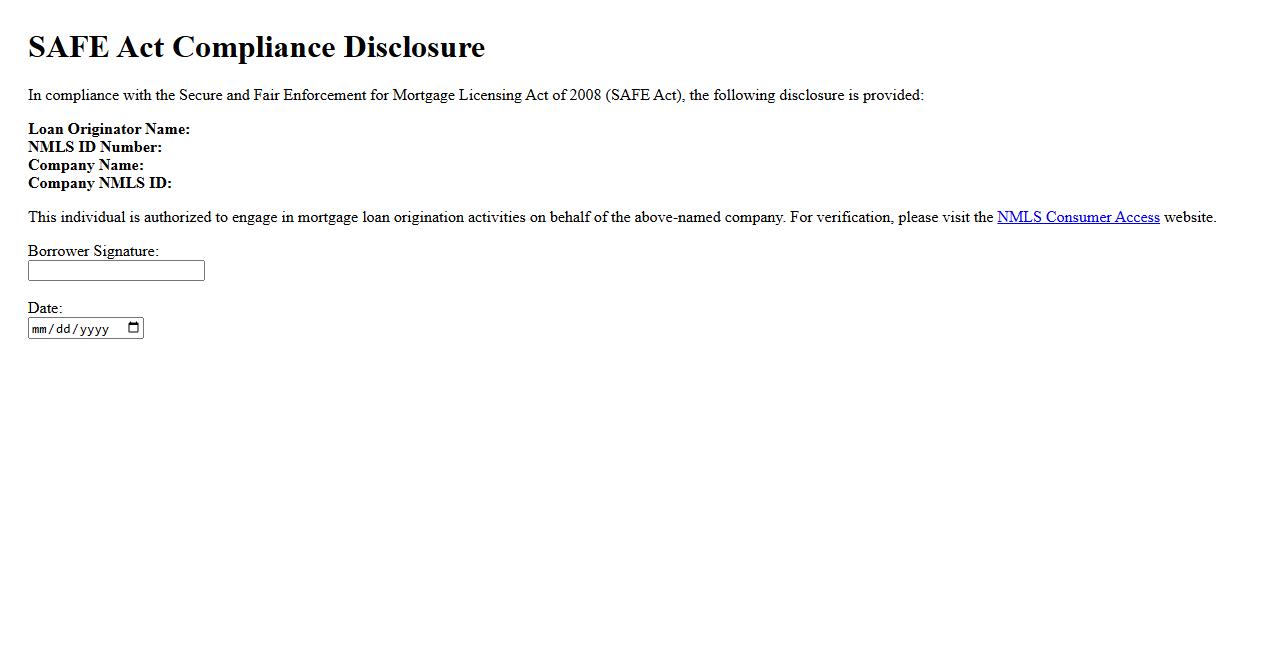

SAFE Act Compliance Disclosure

The SAFE Act Compliance Disclosure is a mandatory statement ensuring transparency in mortgage loan origination. It protects consumers by verifying that loan originators meet federal and state regulatory standards. This disclosure promotes trust and accountability within the lending process.

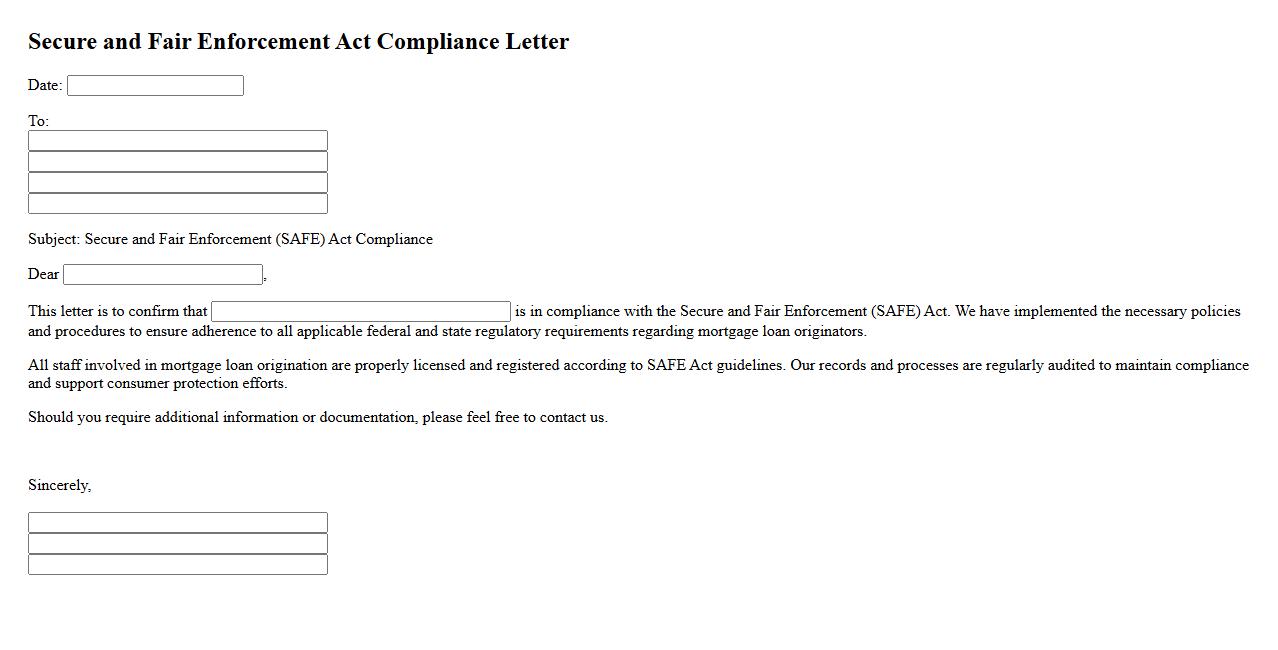

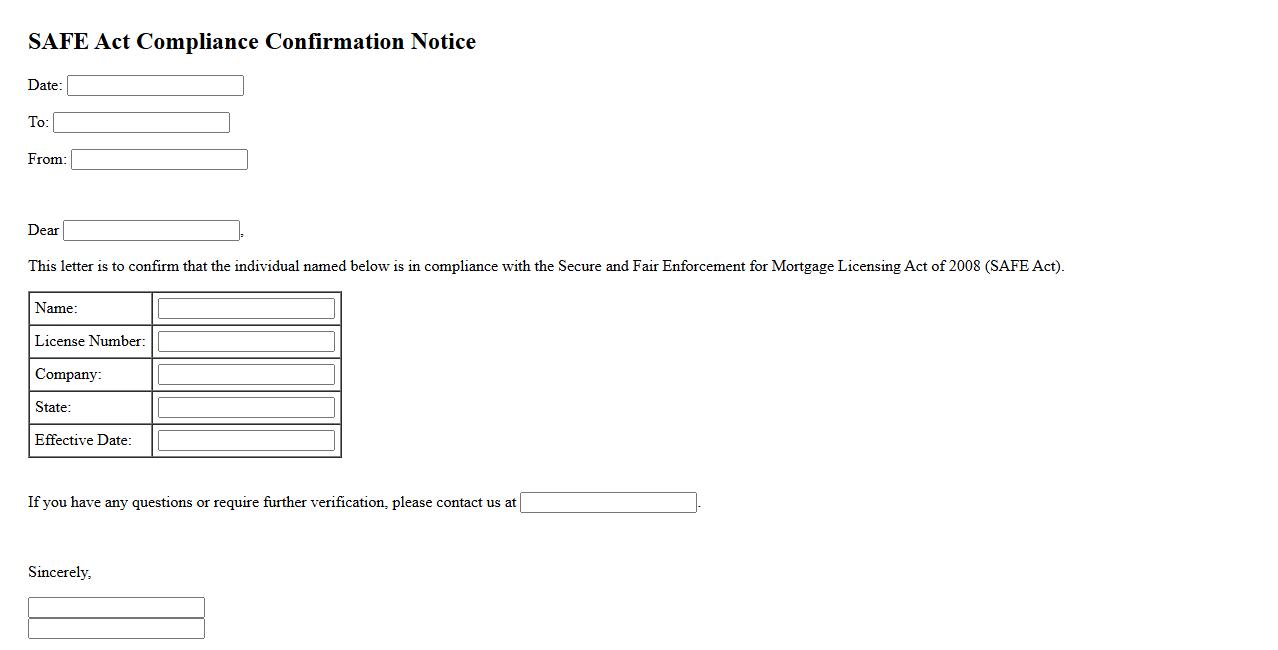

Secure and Fair Enforcement Act Compliance Letter

The Secure and Fair Enforcement Act Compliance Letter is a crucial document demonstrating adherence to regulatory standards. It ensures businesses operate within legal frameworks, promoting transparency and trust. Obtaining this letter helps safeguard both companies and consumers in the marketplace.

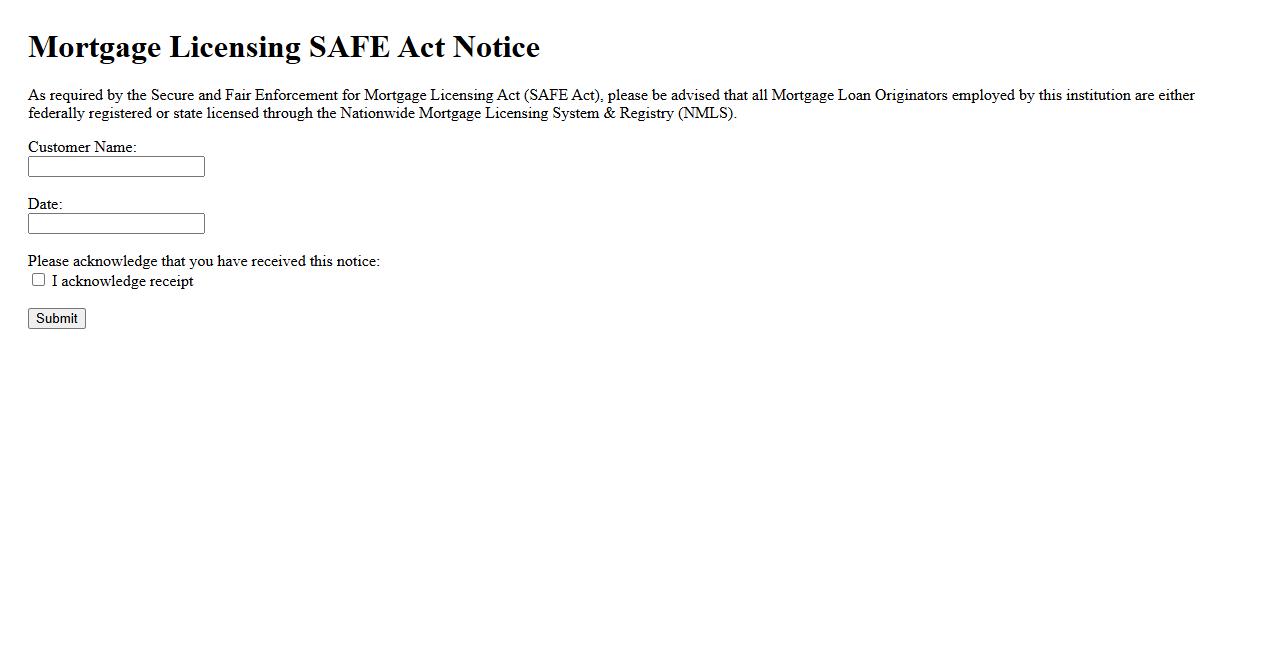

Mortgage Licensing SAFE Act Notice

The Mortgage Licensing SAFE Act Notice ensures transparency and compliance in the mortgage industry by informing borrowers about the licensing requirements for mortgage loan originators. This notice helps protect consumers by promoting accountability and ethical conduct. It is a crucial component in maintaining trust between lenders and applicants.

SAFE Act Compliance Confirmation Notice

The SAFE Act Compliance Confirmation Notice ensures that mortgage loan originators meet federal licensing and registration requirements. This notice helps borrowers verify that their lenders comply with the Secure and Fair Enforcement for Mortgage Licensing Act (SAFE Act). Staying informed about compliance protects consumers and promotes transparency in the mortgage industry.

What is the primary purpose of the Notice of SAFE Act Compliance in mortgage transactions?

The primary purpose of the Notice of SAFE Act Compliance is to inform consumers that the mortgage loan originator (MLO) is adhering to the requirements set forth by the Secure and Fair Enforcement for Mortgage Licensing Act. This notice ensures transparency and helps maintain trust in mortgage transactions. It also promotes accountability by confirming the MLO is properly licensed and regulated.

How does the SAFE Act impact licensing requirements for mortgage loan originators?

The SAFE Act mandates that all mortgage loan originators must obtain a state-specific license through the Nationwide Mortgage Licensing System (NMLS). This requirement ensures MLOs meet minimum standards of education, background checks, and testing. The Act enhances oversight and uniformity in licensing, reducing fraud and protecting consumers.

Which parties are mandated to issue or acknowledge the Notice of SAFE Act Compliance?

The Notice of SAFE Act Compliance must be issued by mortgage loan originators or their employing institutions. It is also acknowledged by consumers during the mortgage transaction process. This communication ensures both parties are aware of compliance with federal and state licensing laws.

What critical disclosures must be included in a Notice of SAFE Act Compliance?

The notice must disclose the mortgage loan originator's licensing status, including their unique NMLS identifier. It should also provide information on how consumers can verify this status through the NMLS Consumer Access website. These disclosures enable consumers to confirm the legitimacy and qualifications of the MLO.

How does the Notice of SAFE Act Compliance ensure consumer protection in financial documentation?

The Notice of SAFE Act Compliance safeguards consumers by promoting transparency about the MLO's credentials and adherence to regulatory standards. It helps consumers make informed decisions by verifying the originator's legitimacy before finalizing a mortgage. Ultimately, it reduces risks associated with fraud and unlicensed loan originators.