An invoice for goods purchased is a detailed document issued by a seller to a buyer, listing the items purchased along with their quantities and prices. It serves as a formal request for payment and includes essential information such as the purchase date, payment terms, and total amount due. This document is crucial for accounting records and ensures transparency in commercial transactions.

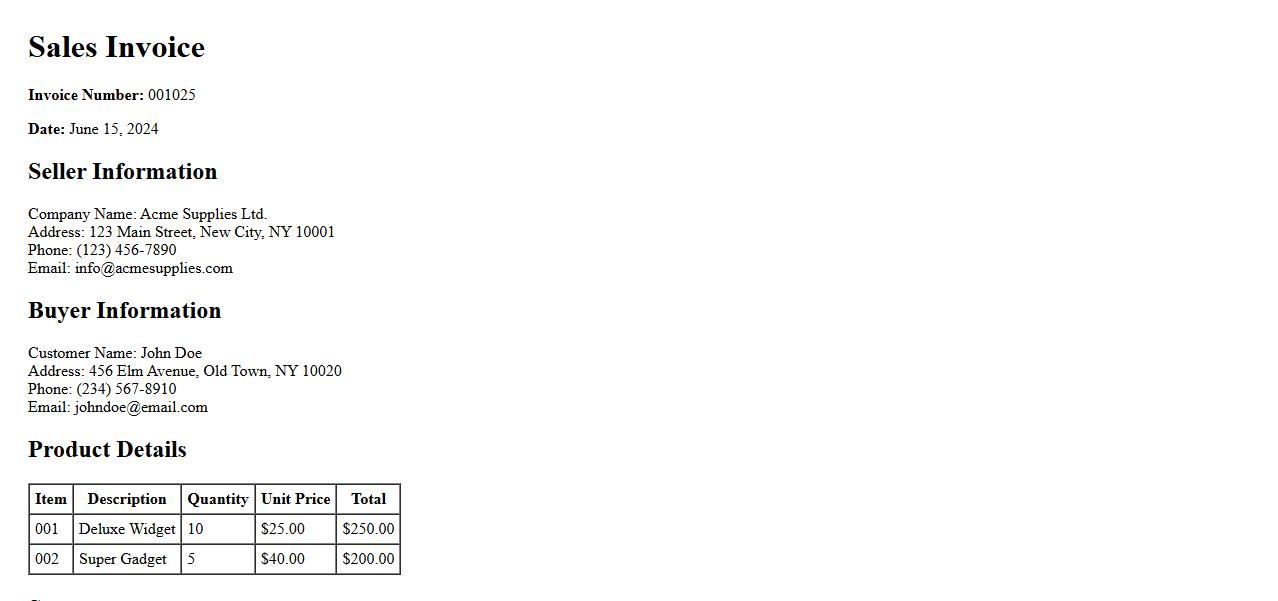

Sales Invoice for Product Acquisition

A Sales Invoice for Product Acquisition is a detailed document issued by a seller to a buyer, outlining the products purchased along with their quantities and prices. It serves as an official record for both parties, ensuring transparency and facilitating payment processing. This invoice is crucial for accounting and inventory management purposes.

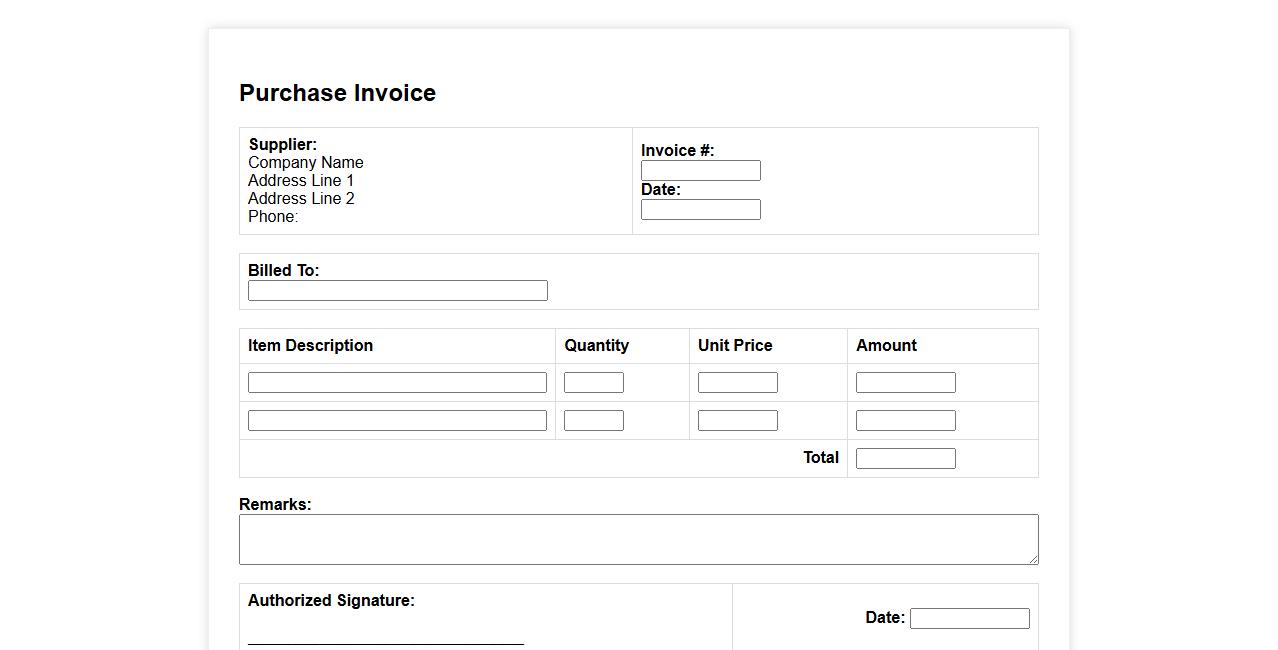

Purchase Invoice for Merchandise

A Purchase Invoice for Merchandise is a critical document that itemizes goods acquired from a supplier. It details quantities, prices, and terms of sale, ensuring accurate financial records. This invoice facilitates inventory management and payment processing within a business.

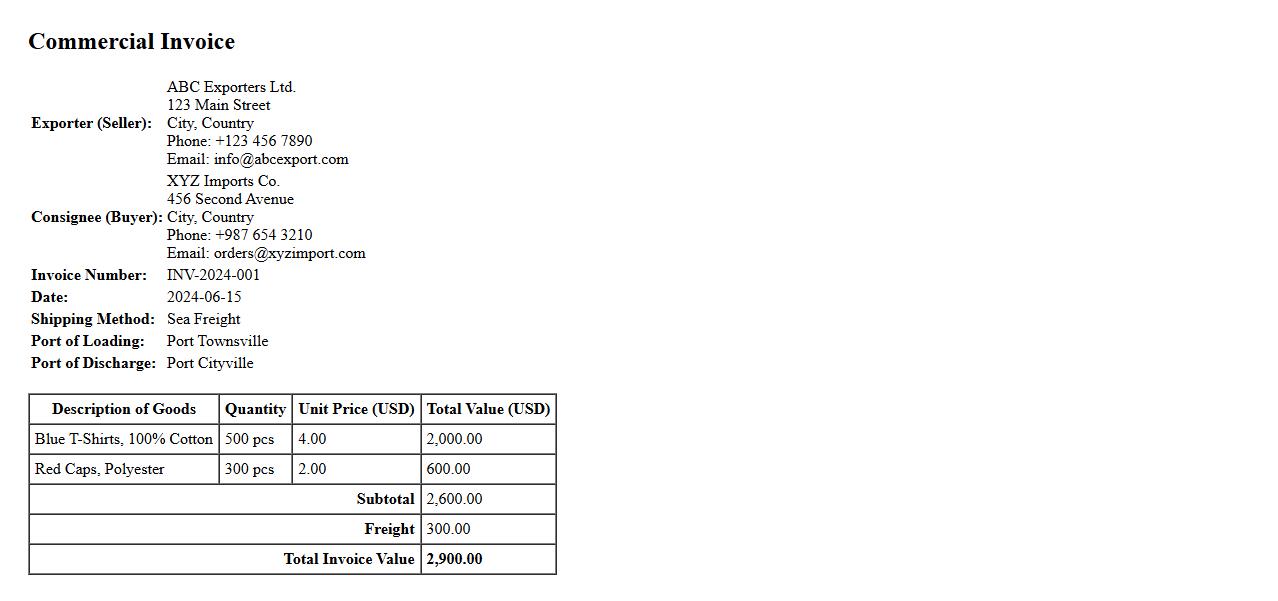

Commercial Invoice for Goods Supplied

A Commercial Invoice for Goods Supplied is a crucial document detailing the transaction between the seller and buyer, including product descriptions, quantities, prices, and terms of sale. It serves as proof of sale for customs clearance and financial accounting. Accurate and clear information on the invoice ensures smooth international trade and payment processing.

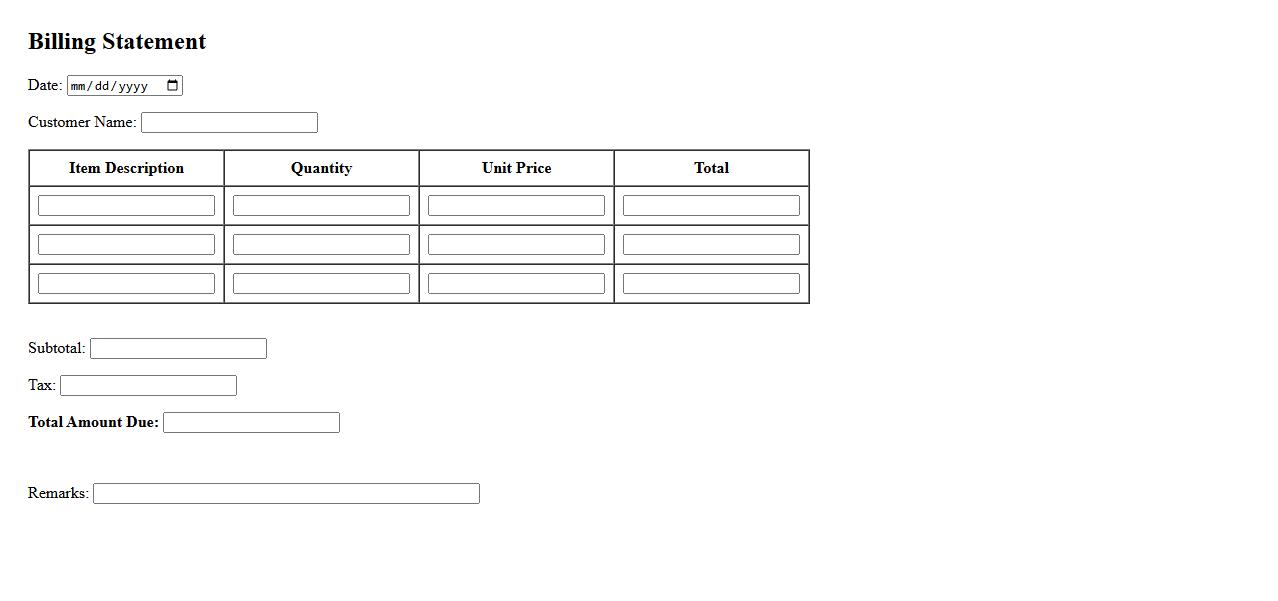

Billing Statement for Items Bought

The Billing Statement for items bought provides a detailed summary of all purchased products, including quantities and prices. It ensures transparency by itemizing each cost and calculating the total amount due. This document is essential for record-keeping and payment verification.

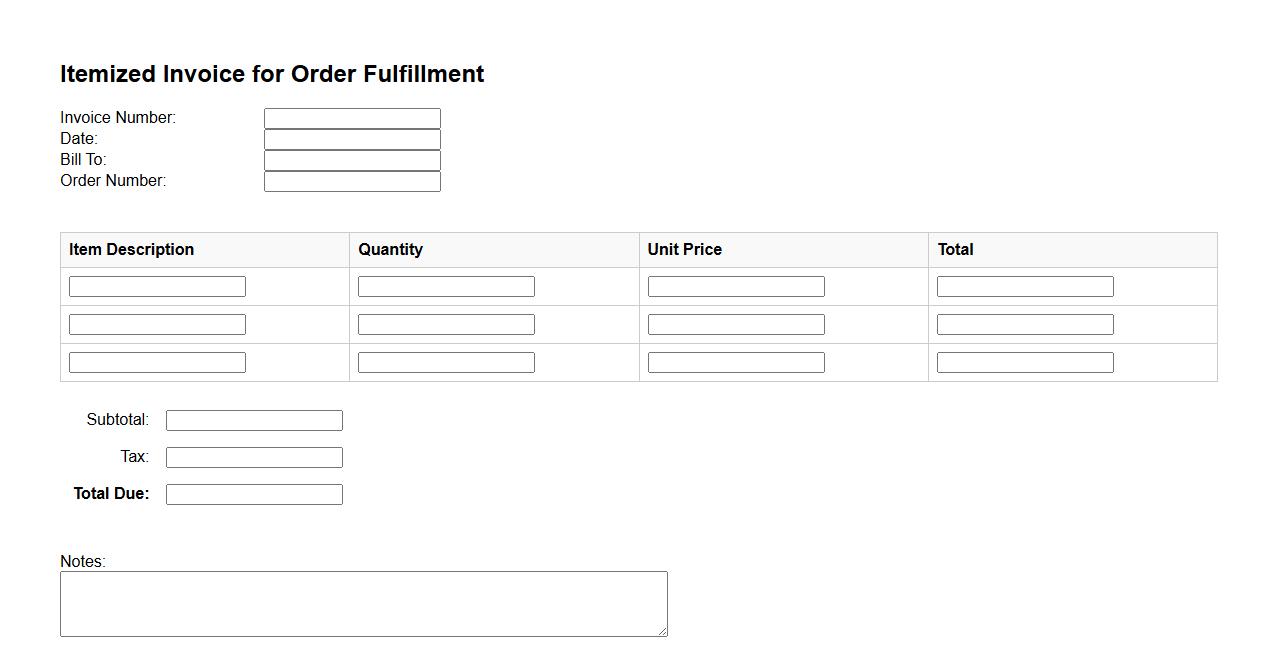

Itemized Invoice for Order Fulfillment

An Itemized Invoice for Order Fulfillment provides a detailed breakdown of products or services delivered, including quantities, prices, and total costs. This document ensures transparency and accuracy in billing, facilitating smooth transaction processing. It serves as a crucial record for both sellers and buyers in managing orders effectively.

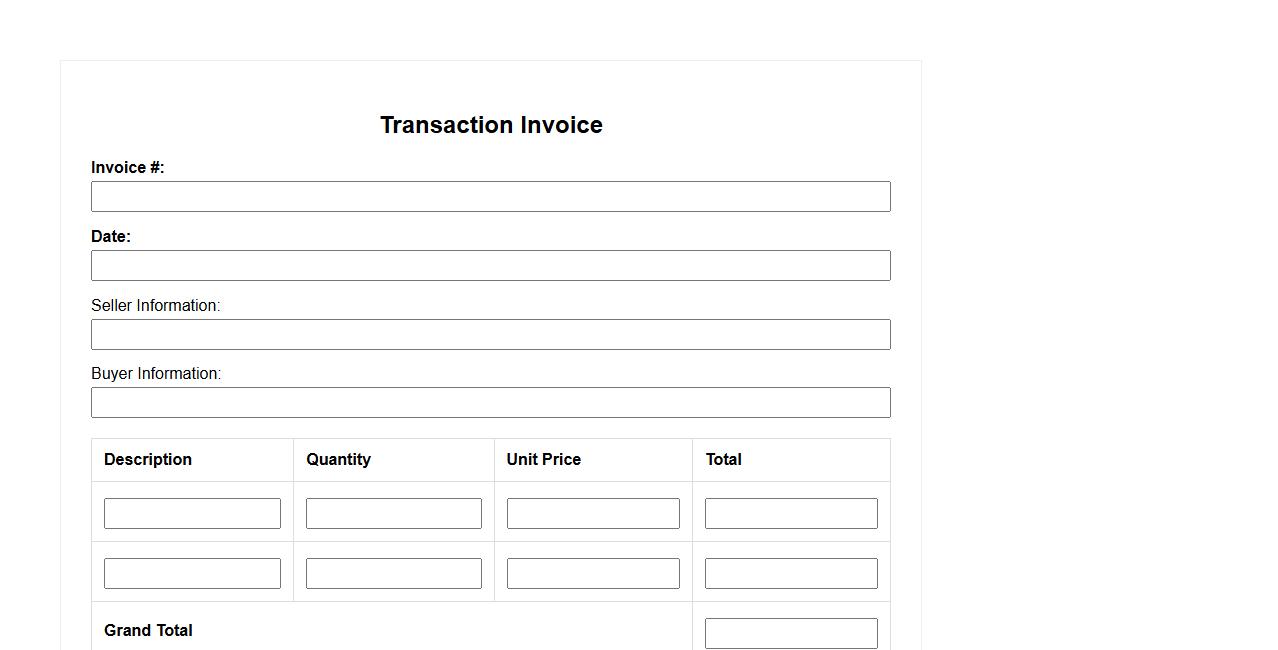

Transaction Invoice for Acquired Goods

The Transaction Invoice for Acquired Goods serves as a detailed record of purchased items, ensuring accurate documentation for both the buyer and seller. It includes essential information such as item description, quantity, price, and payment terms. This invoice facilitates transparent financial transactions and supports inventory management.

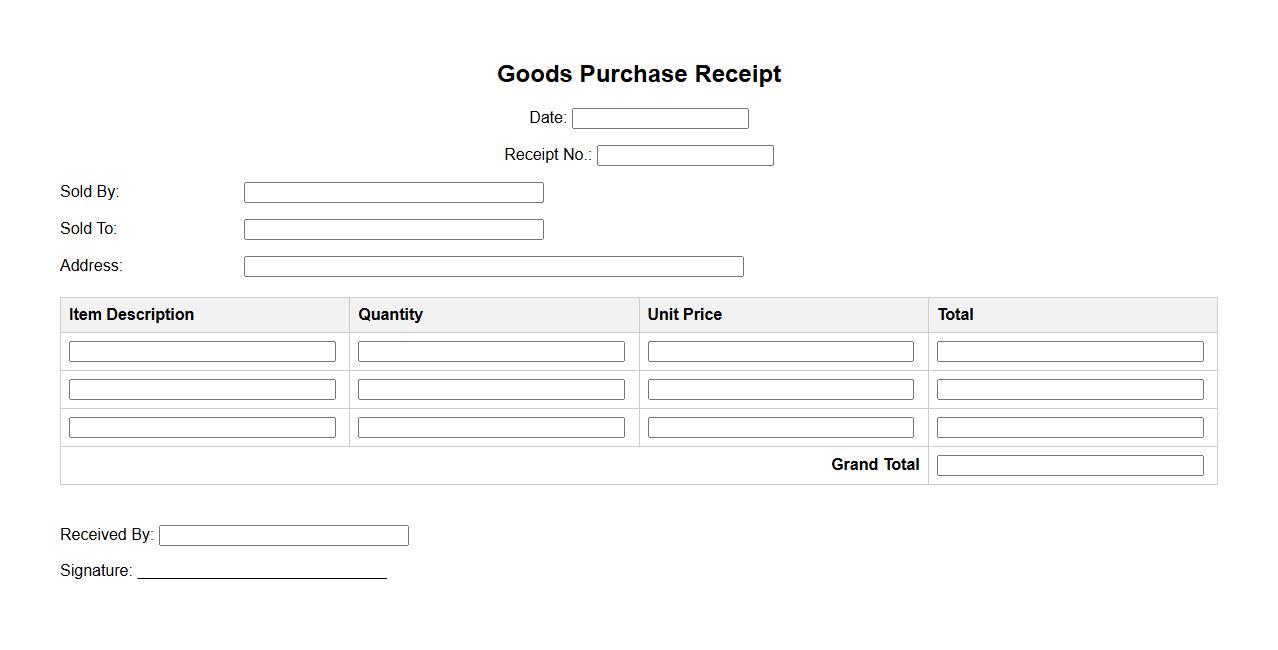

Goods Purchase Receipt

The Goods Purchase Receipt serves as an official document confirming the receipt of purchased items. It details the quantity, description, and condition of goods delivered to the buyer. This receipt is essential for inventory management and financial record-keeping.

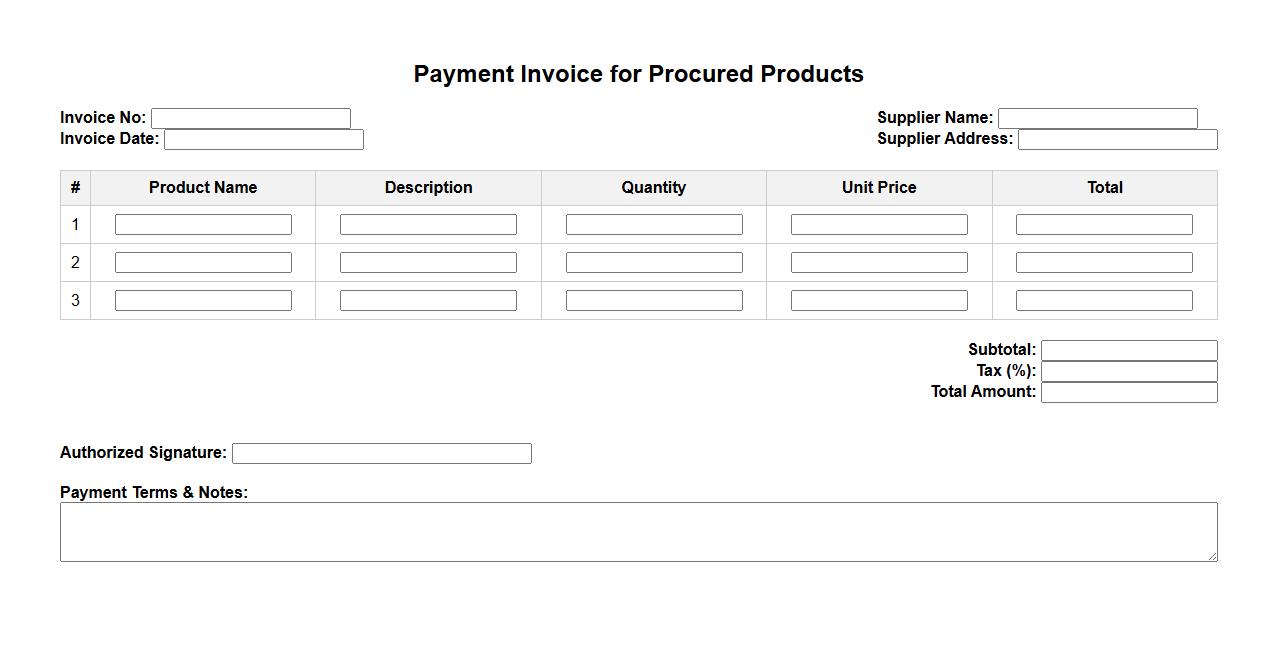

Payment Invoice for Procured Products

The Payment Invoice for procured products serves as a detailed document outlining the transaction between the buyer and seller. It includes essential information such as product descriptions, quantities, prices, and payment terms. This invoice ensures transparency and facilitates smooth financial transactions for both parties.

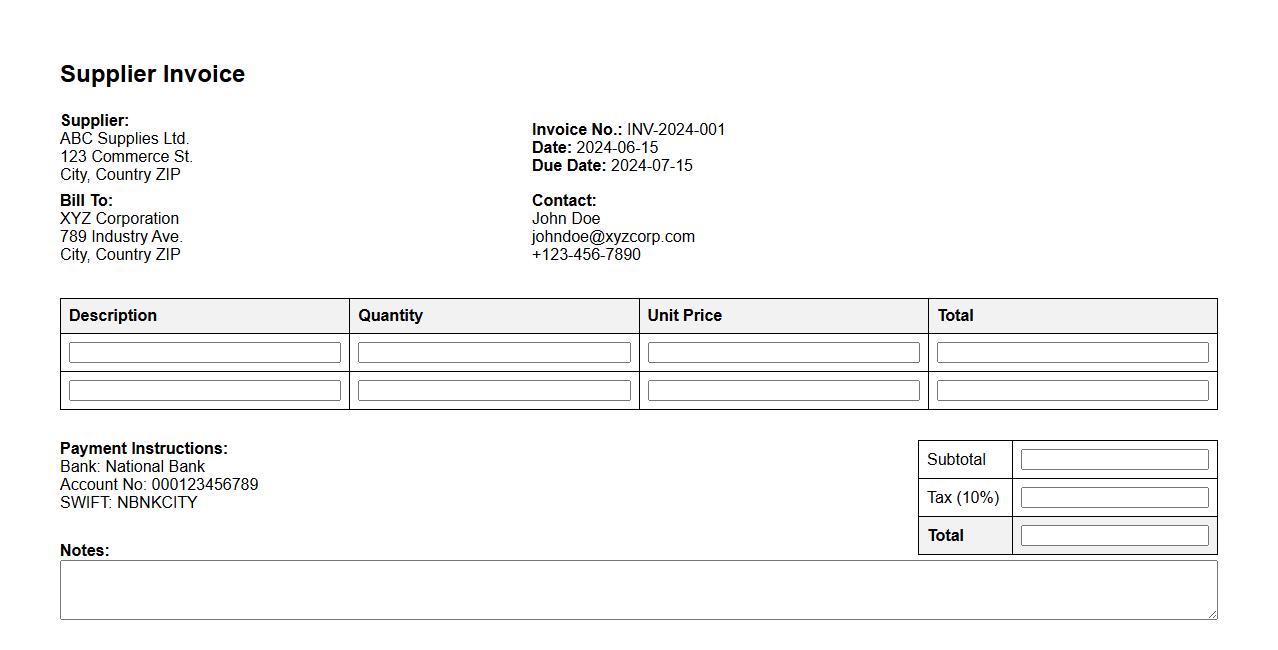

Supplier Invoice for Delivered Goods

The Supplier Invoice for Delivered Goods is a critical document that details the items supplied, quantities, and the total cost payable. It serves as proof of delivery and facilitates accurate payment processing between the buyer and the supplier. Timely issuance of this invoice ensures smooth financial transactions and inventory management.

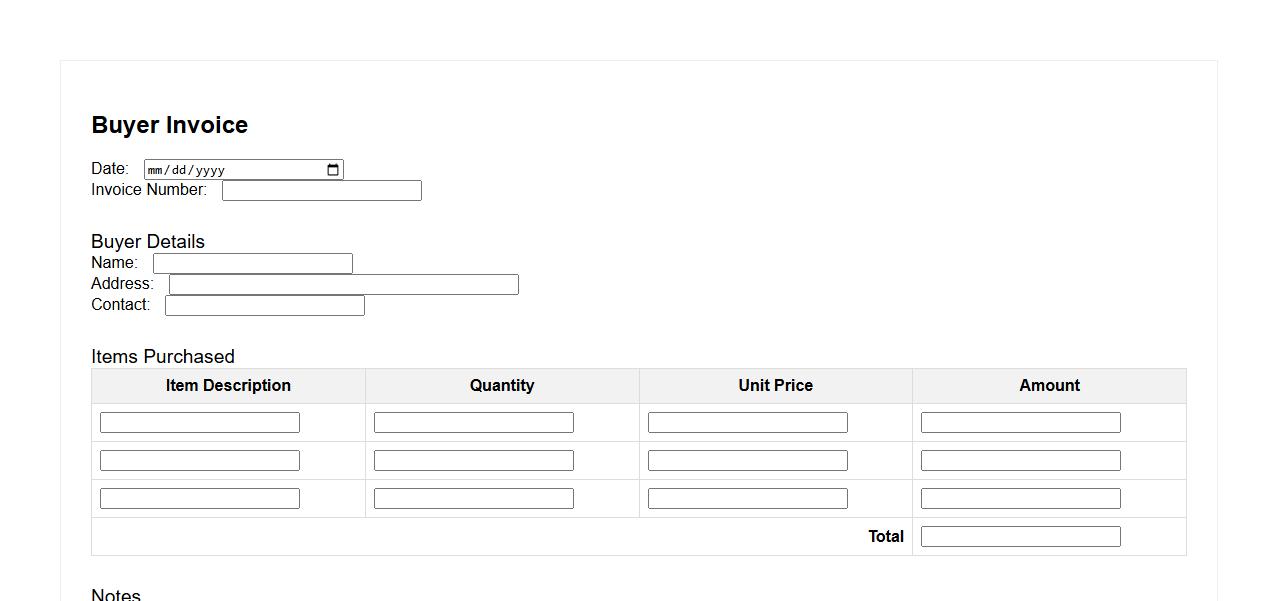

Buyer Invoice for Purchased Items

The Buyer Invoice for Purchased Items serves as an essential document detailing the transaction between the buyer and seller. It includes item descriptions, quantities, prices, and payment information, ensuring clarity and transparency. This invoice is crucial for record-keeping and future reference in case of disputes or returns.

What essential information must be included on an invoice for goods purchased?

An invoice must include the seller's and buyer's contact details along with the date of issue. It should clearly state the description of goods, unit prices, and quantities. Additionally, a unique invoice number is essential for proper identification.

How does an invoice indicate payment terms and due dates?

The payment terms are typically shown near the bottom or top of the invoice, specifying when payment is expected. Terms like "Net 30" or specific due dates clarify the timeline for payment. This helps both parties understand their financial obligations clearly.

What is the purpose of listing itemized goods with descriptions and quantities on an invoice?

Itemizing goods with detailed descriptions and quantities ensures transparency and prevents disputes. It allows the buyer to verify exactly what has been purchased and in what amounts. This detailed breakdown also facilitates accurate accounting and inventory tracking.

How does an invoice differentiate between net amount, taxes, and total payable?

The invoice separates the net amount (subtotal) from applicable taxes, clearly displaying each figure. Tax rates and calculated tax amounts are shown to ensure clarity regarding additional charges. The sum of net amount plus taxes results in the total payable by the buyer.

Why is the invoice number important for tracking and reference?

An invoice number serves as a unique identifier facilitating efficient record-keeping and payment tracking. It helps both seller and buyer reference specific transactions in communications or audits. Without it, managing multiple invoices would become confusing and error-prone.