A Declaration of Sole Proprietorship is a formal document filed to legally establish an individual as the exclusive owner of a business. This declaration registers the business name and provides the authority to operate under that name within a specific jurisdiction. Filing this document ensures compliance with local regulations and enables the proprietor to conduct business activities officially.

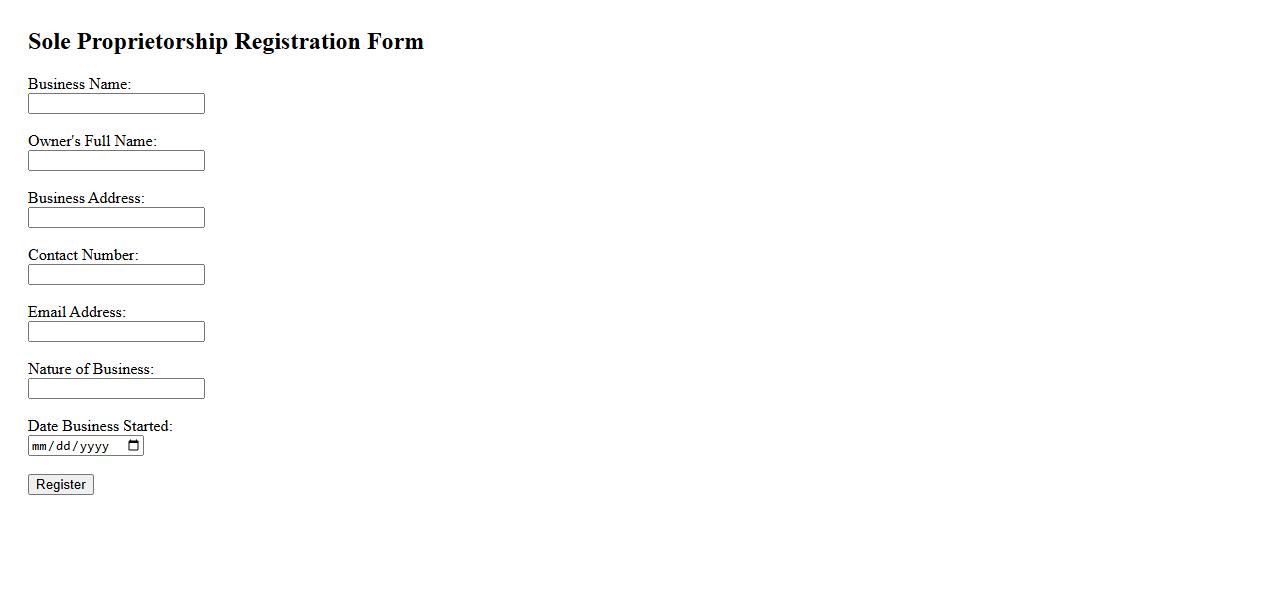

Sole Proprietorship Registration Form

The Sole Proprietorship Registration Form is a crucial document for individuals looking to establish their own business. It simplifies the process of registering a sole proprietorship, ensuring legal recognition and compliance. Completing this form accurately helps entrepreneurs launch their business operations smoothly and officially.

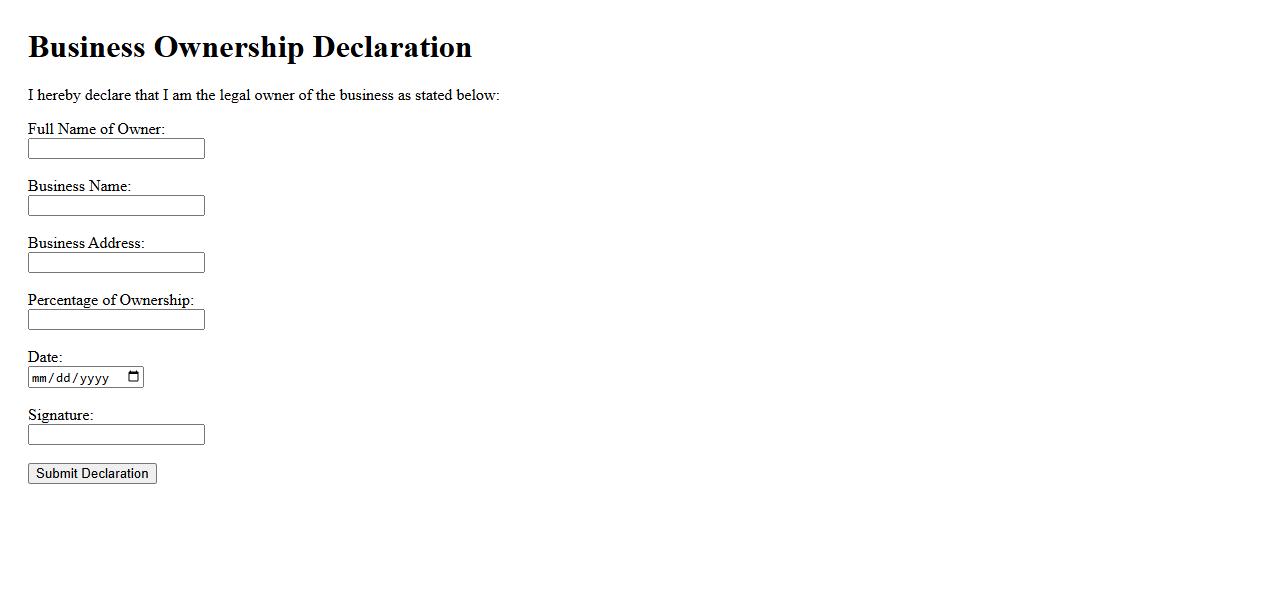

Business Ownership Declaration

The Business Ownership Declaration is a formal statement that identifies the legal owner or owners of a business entity. It ensures transparency and clarity in ownership structure for regulatory and operational purposes. This declaration is essential for legal compliance and securing business credibility.

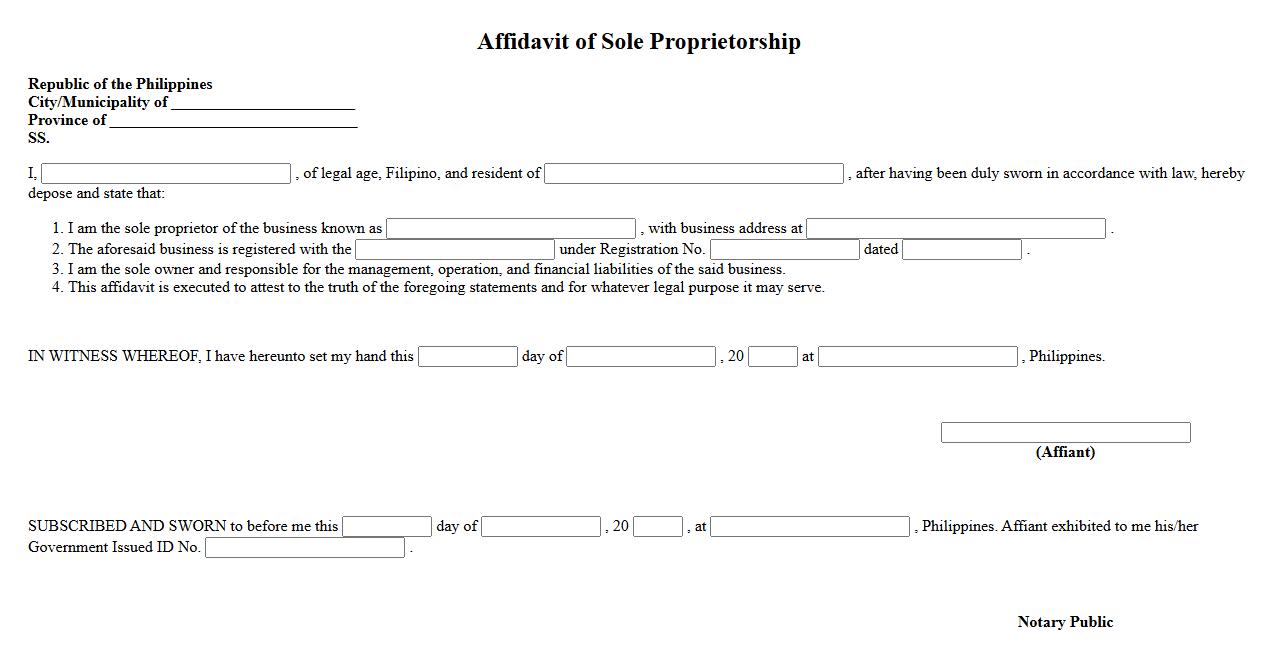

Affidavit of Sole Proprietorship

An Affidavit of Sole Proprietorship is a legal document that verifies an individual's ownership of a business. It serves as proof that the business is solely owned and operated by one person. This affidavit is often required for banking, licensing, or contractual purposes.

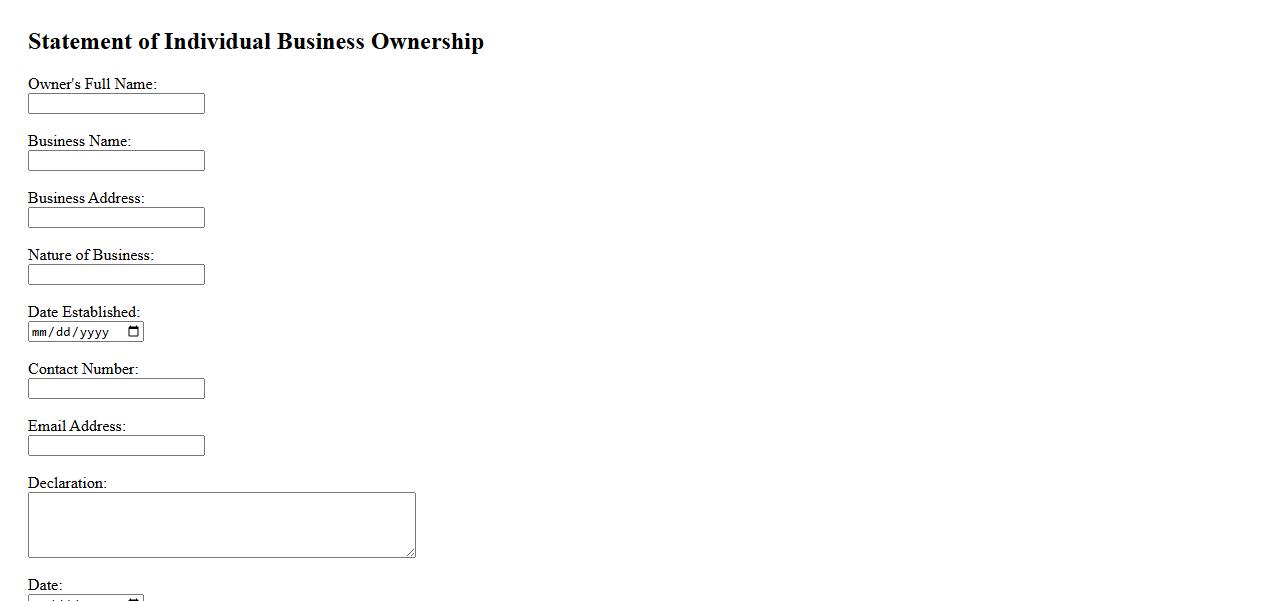

Statement of Individual Business Ownership

The Statement of Individual Business Ownership is a legal document that verifies the identity and ownership details of a sole proprietor. It serves as proof of ownership for business transactions and regulatory purposes. This statement is essential for establishing accountability and clarity in business operations.

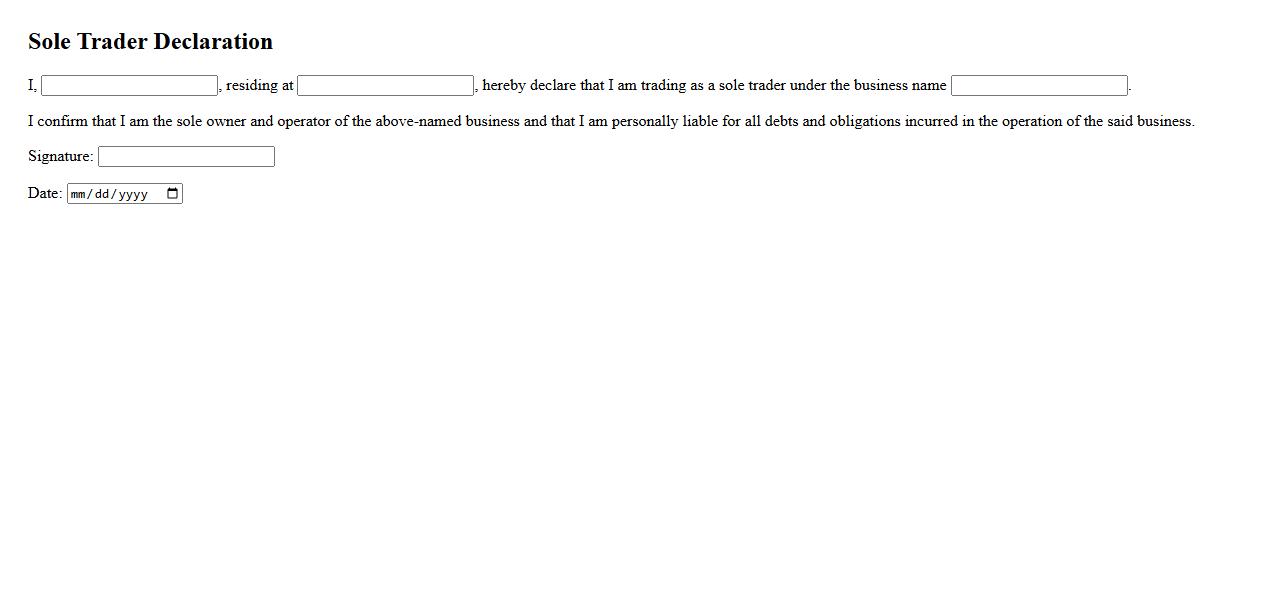

Sole Trader Declaration

The Sole Trader Declaration is a formal statement used by individuals operating their own business. It confirms that the person is the sole owner and responsible for all aspects of the enterprise. This declaration is essential for legal and tax purposes to establish clear business ownership.

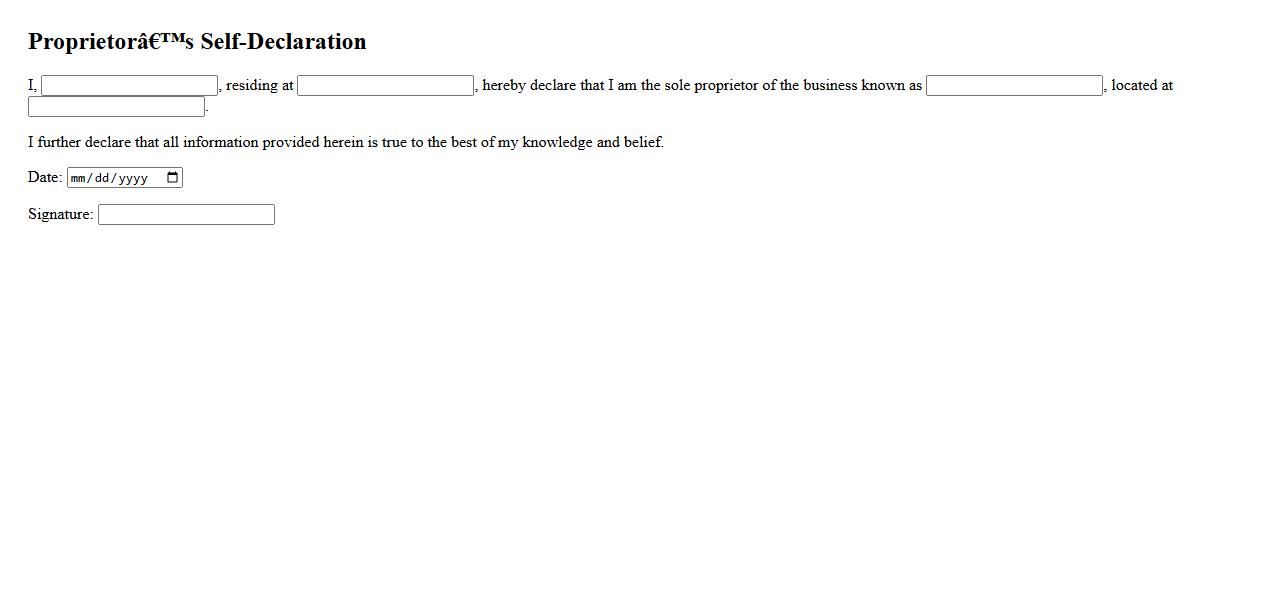

Proprietor’s Self-Declaration

The Proprietor's Self-Declaration is a formal statement provided by the business owner affirming the accuracy of information related to their enterprise. This declaration is essential for legal and regulatory compliance, ensuring transparency and accountability. It serves as a vital document in various official and administrative procedures.

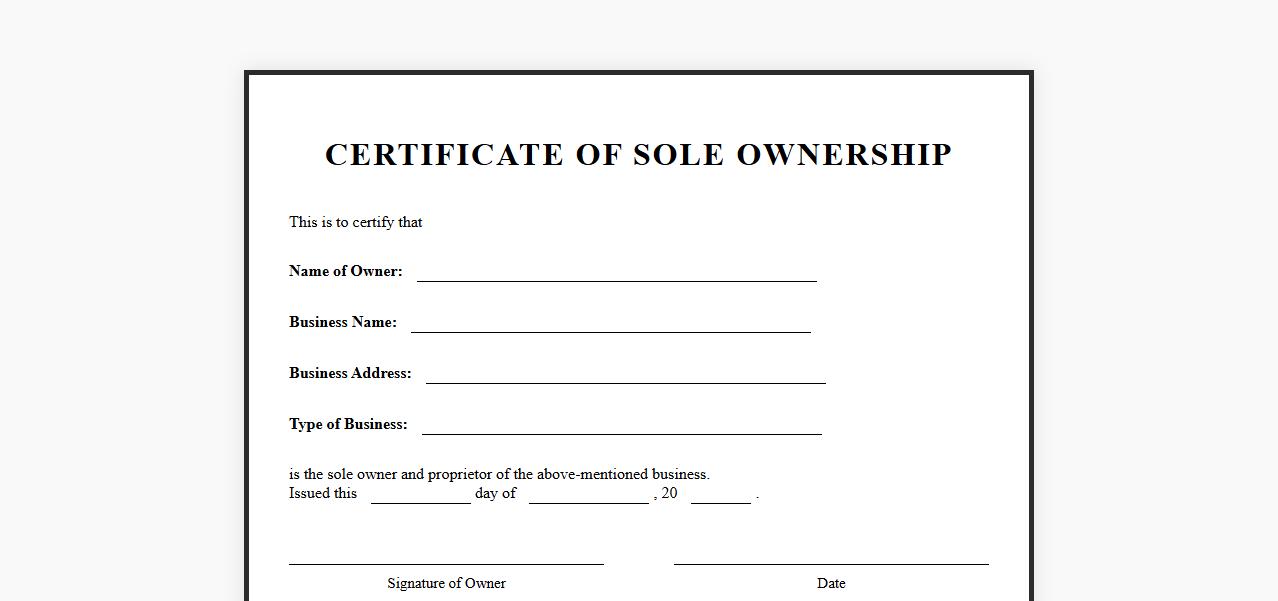

Certificate of Sole Ownership

A Certificate of Sole Ownership is an official document that verifies an individual as the exclusive owner of a property or asset. It serves as legal proof of ownership without shared interests or joint claims. This certificate is essential for establishing clear title and rights to the property.

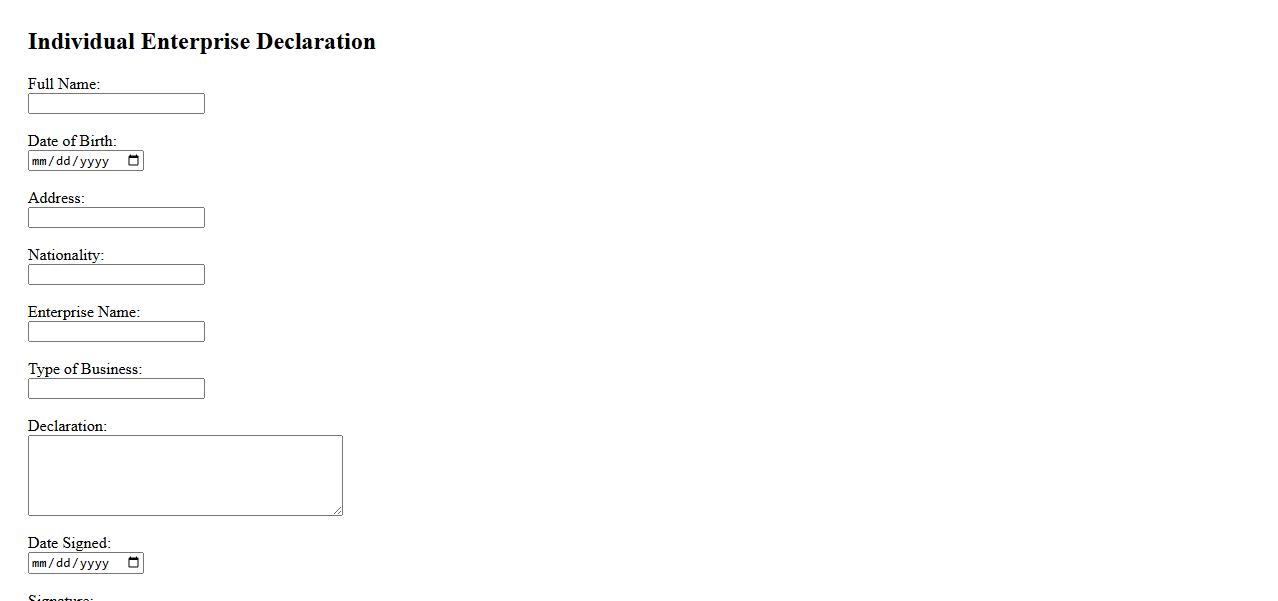

Individual Enterprise Declaration

An Individual Enterprise Declaration is a formal statement submitted by a sole proprietor to outline key business details. It serves as an official record for regulatory and tax purposes, ensuring compliance with local laws. This declaration helps establish the legitimacy and operational framework of the individual enterprise.

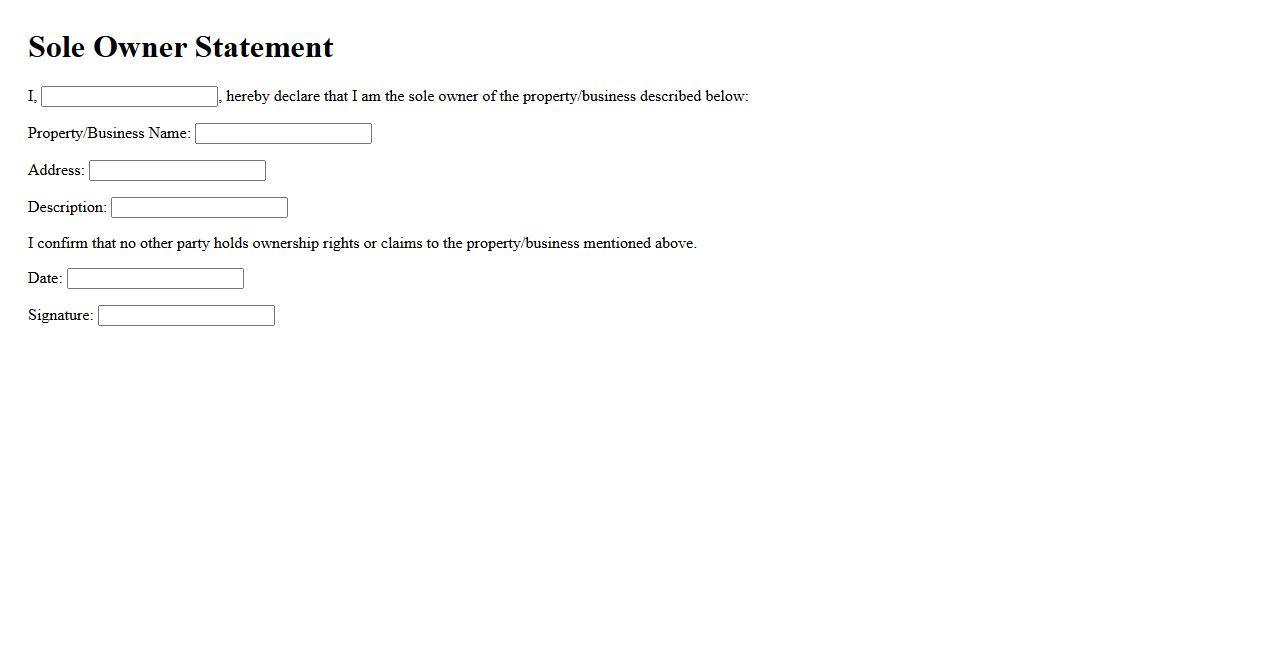

Sole Owner Statement

The Sole Owner Statement is a legal document that verifies sole ownership of a property or business. It provides clear evidence that the individual named holds exclusive rights without any partners. This statement is essential for transactions and official records requiring proof of ownership.

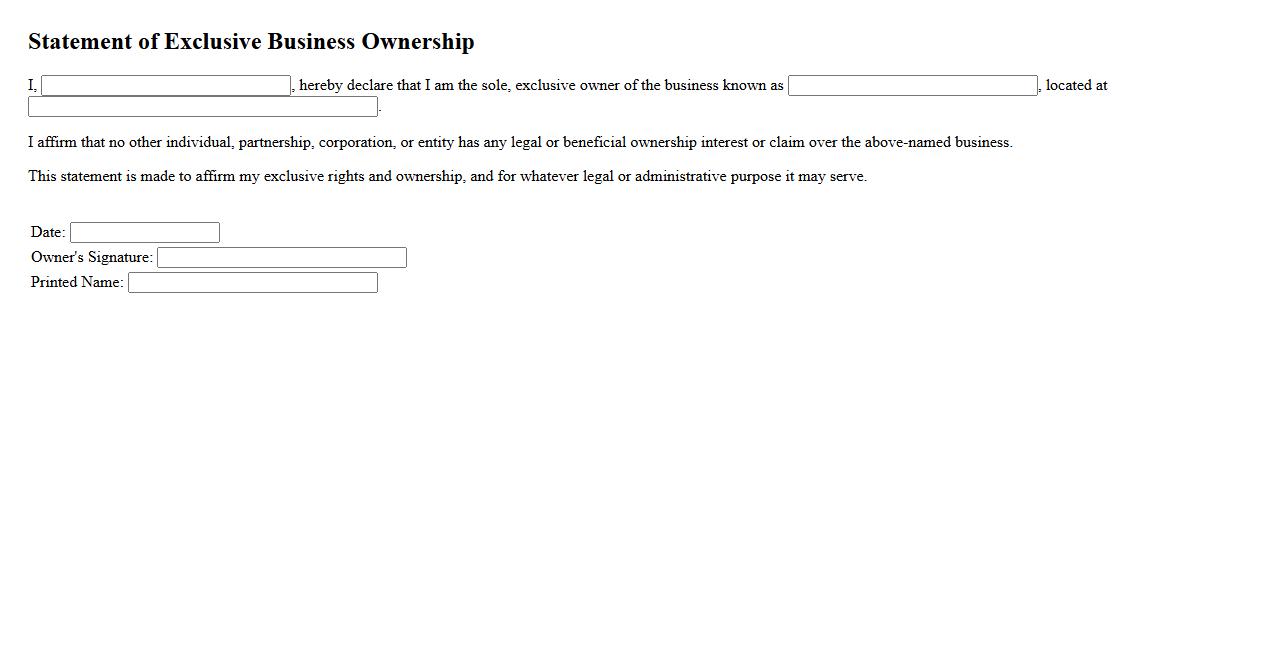

Statement of Exclusive Business Ownership

The Statement of Exclusive Business Ownership is a legal document that certifies a business is owned solely by one individual. It clearly defines the owner's rights and responsibilities, ensuring no shared interests or partnerships. This statement is essential for maintaining personal control and liability over the business operations.

What is the primary purpose of a Declaration of Sole Proprietorship?

The primary purpose of a Declaration of Sole Proprietorship is to formally announce the existence of a single-owner business. This document serves as official recognition of the business and the individual's role as the sole proprietor. It helps establish legitimacy and provides a clear record for both legal and tax purposes.

Which key details must be included to verify sole ownership in the document?

To verify sole ownership, the Declaration must include the full name of the owner, the business name, and the address of the principal place of business. Additionally, it should state the nature of the business and confirm that there are no partners involved. This information ensures the document distinctly points to one individual responsible for the business.

How does a Declaration of Sole Proprietorship establish legal responsibility for business activities?

The Declaration explicitly identifies the owner as the sole party legally responsible for all business operations and obligations. It makes clear that the proprietor assumes full liability for any debts, contracts, or legal actions involving the business. This accountability aligns with the legal framework governing sole proprietorships.

In what situations is a Declaration of Sole Proprietorship typically required or requested?

This Declaration is often required when opening a business bank account, registering the business with local authorities, or applying for licenses and permits. It is also requested by tax agencies to confirm the business structure for compliance and reporting. Such formal documentation helps streamline administrative processes for new sole proprietors.

How does this declaration differentiate a sole proprietorship from other business entities?

The Declaration highlights that the business is owned and operated by a single individual, distinguishing it from partnerships, corporations, or LLCs. It emphasizes the lack of separate legal identity, meaning the owner and the business are legally the same. This distinction affects taxation, liability, and regulatory requirements uniquely for sole proprietorships.