A Certificate of Income is an official document that verifies an individual's earnings over a specified period. It is commonly required for loan applications, visa processing, and financial assessments. Employers or authorized agencies typically issue this certificate to confirm income details accurately.

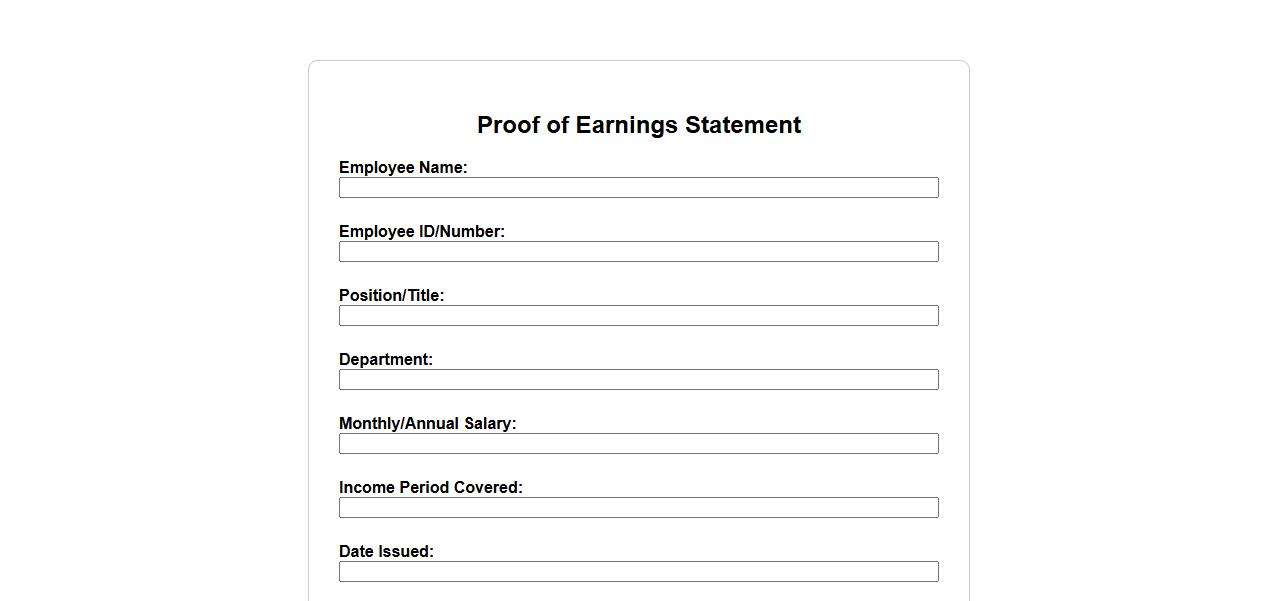

Proof of Earnings Statement

A Proof of Earnings Statement is a document that verifies an individual's income over a specific period. It is commonly used for loan applications, rental agreements, and financial assessments. This statement helps establish financial credibility by providing accurate and official income records.

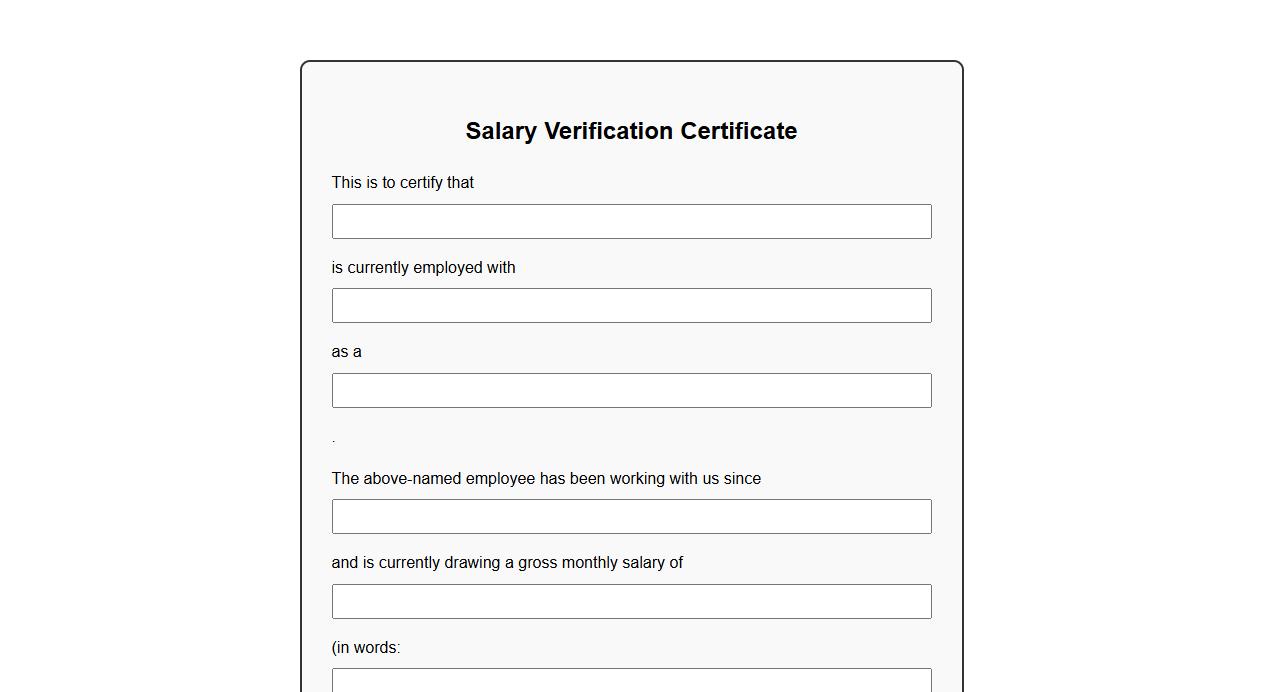

Salary Verification Certificate

A Salary Verification Certificate is an official document issued by an employer to confirm an employee's income details. It serves as proof of salary for loan applications, visa processing, and other financial transactions. This certificate typically includes the employee's name, designation, monthly or annual salary, and employment tenure.

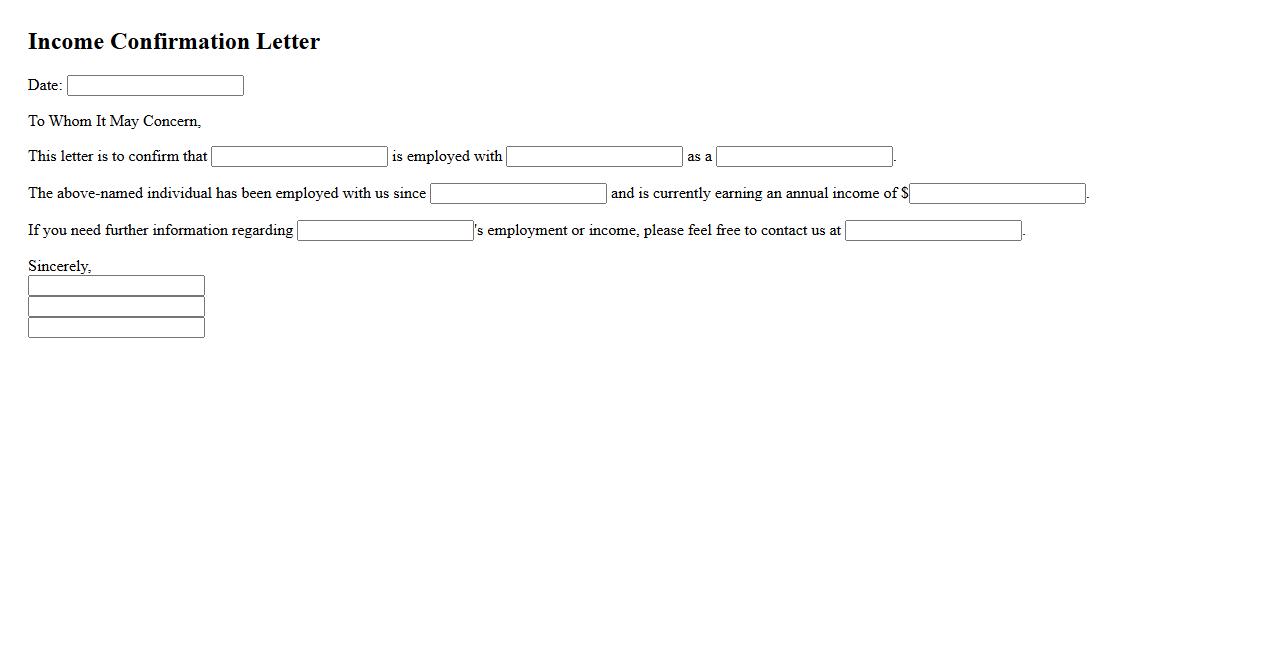

Income Confirmation Letter

An Income Confirmation Letter is an official document used to verify an individual's earnings for various purposes such as loan applications or rental agreements. It typically includes details about salary, employment status, and payment frequency. This letter helps institutions assess financial stability and credibility.

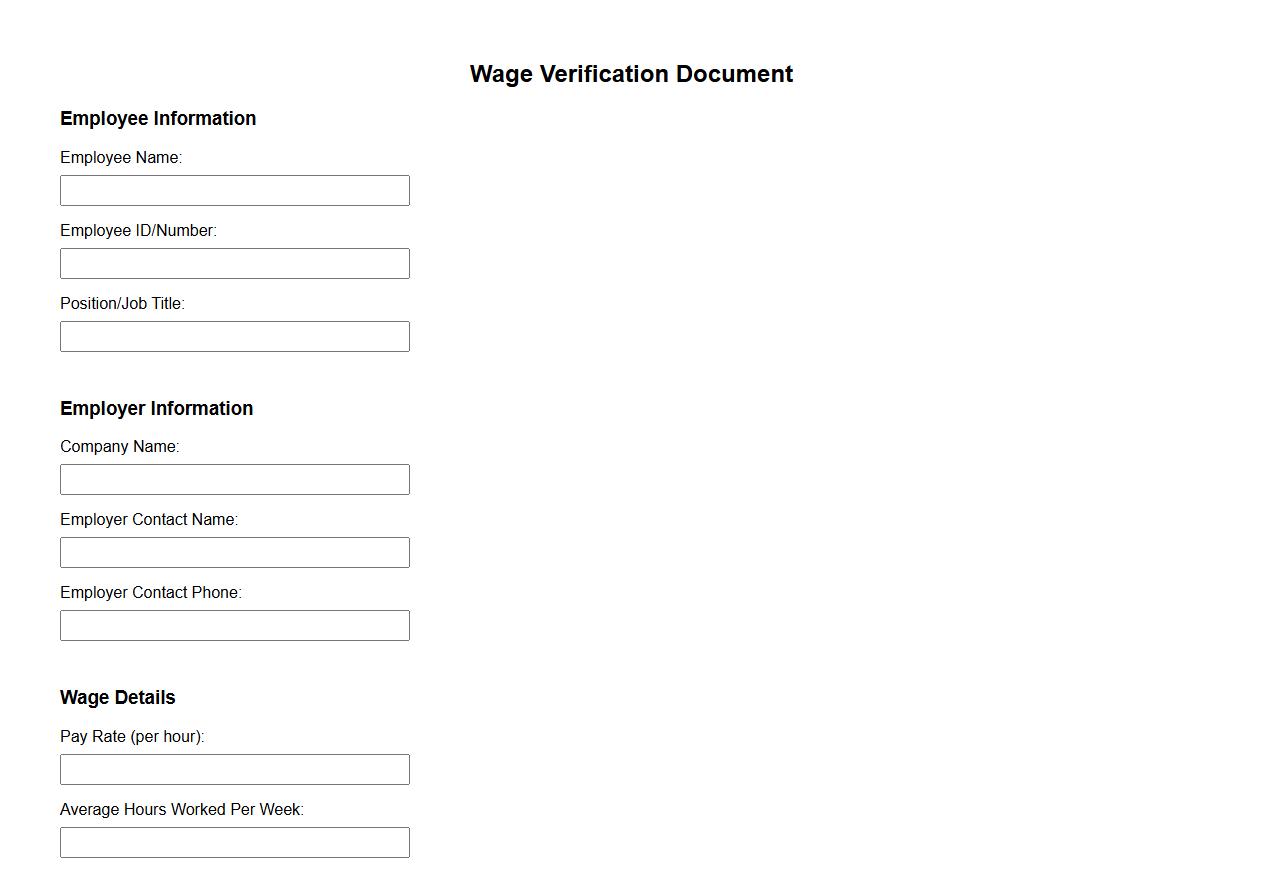

Wage Verification Document

The Wage Verification Document is an official record used to confirm an employee's income and employment details. It is commonly required by lenders, landlords, or government agencies to verify financial stability. This document ensures accuracy and trust in income validation processes.

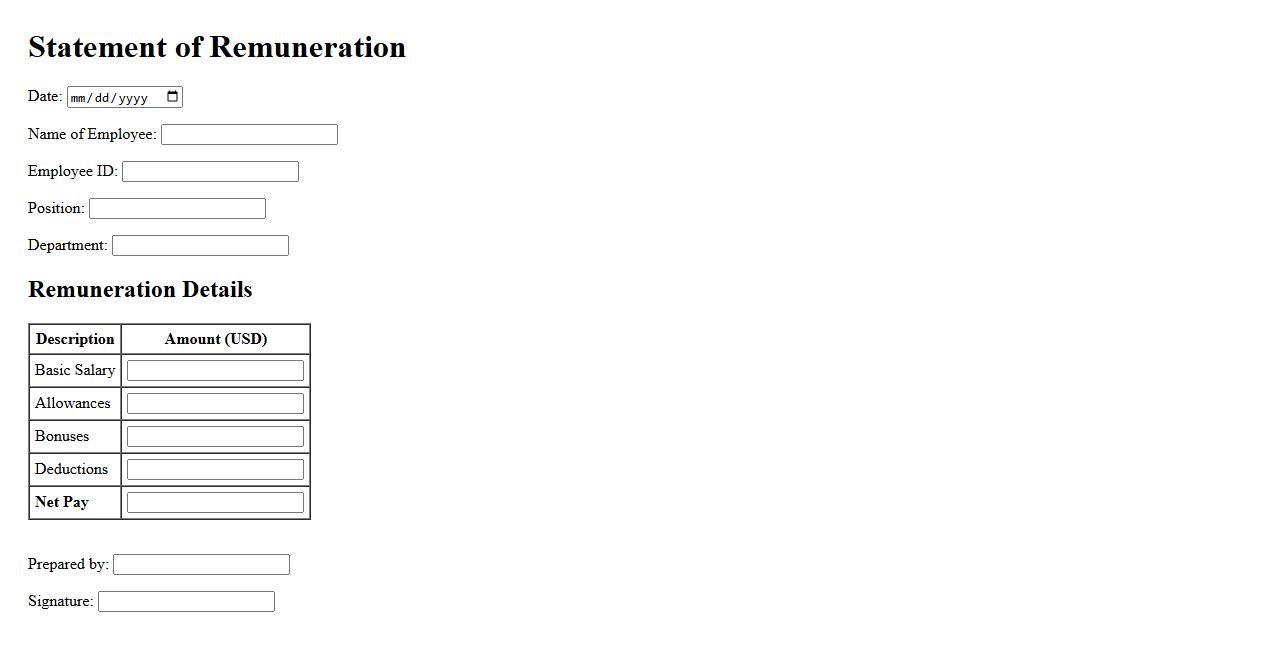

Statement of Remuneration

The Statement of Remuneration provides a detailed summary of an employee's earnings over a specific period. It includes information such as salary, bonuses, deductions, and taxes paid. This document is essential for both employees and employers for transparency and record-keeping purposes.

Income Verification Form

The Income Verification Form is a crucial document used to confirm an individual's earnings for various purposes, such as loan applications or government assistance. It provides accurate and reliable income details to ensure eligibility and financial transparency. Completing this form helps streamline the approval process by verifying income sources efficiently.

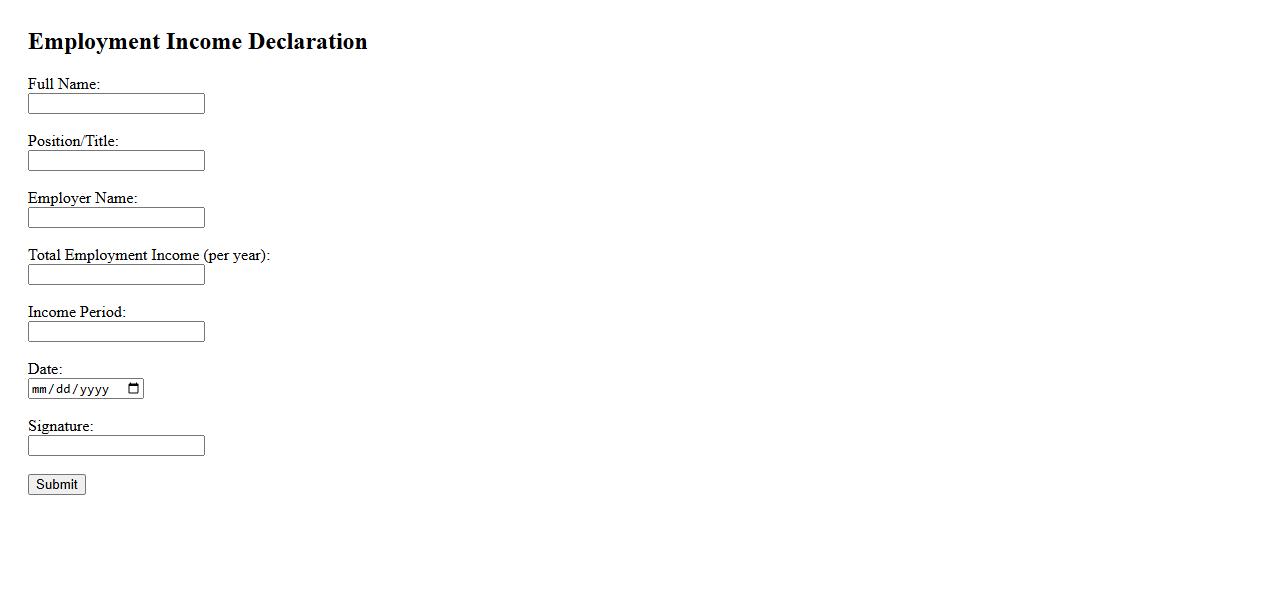

Employment Income Declaration

An Employment Income Declaration is an official document where an individual states their earnings from employment. It is commonly used for tax reporting, loan applications, and financial assessments. This declaration helps verify income stability and eligibility for various financial services.

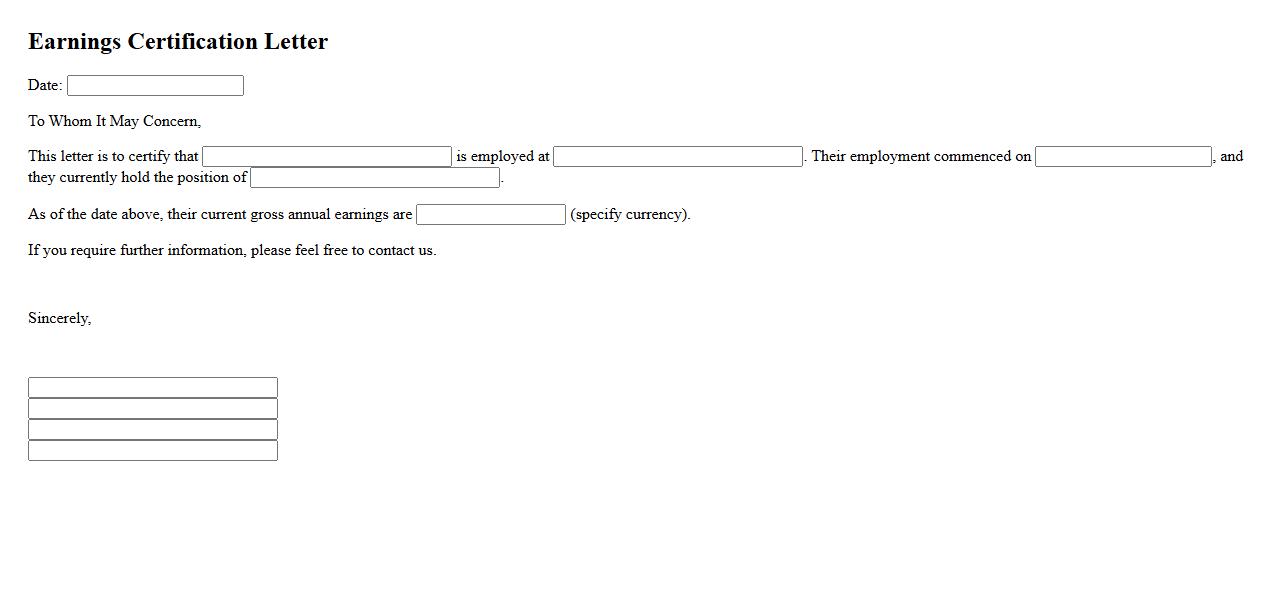

Earnings Certification Letter

An Earnings Certification Letter is an official document that verifies an individual's income from their employer. It is commonly required for loan applications, rental agreements, or financial aid processes to confirm the applicant's financial status. This letter typically includes details like salary amount, employment dates, and job title to ensure accurate income verification.

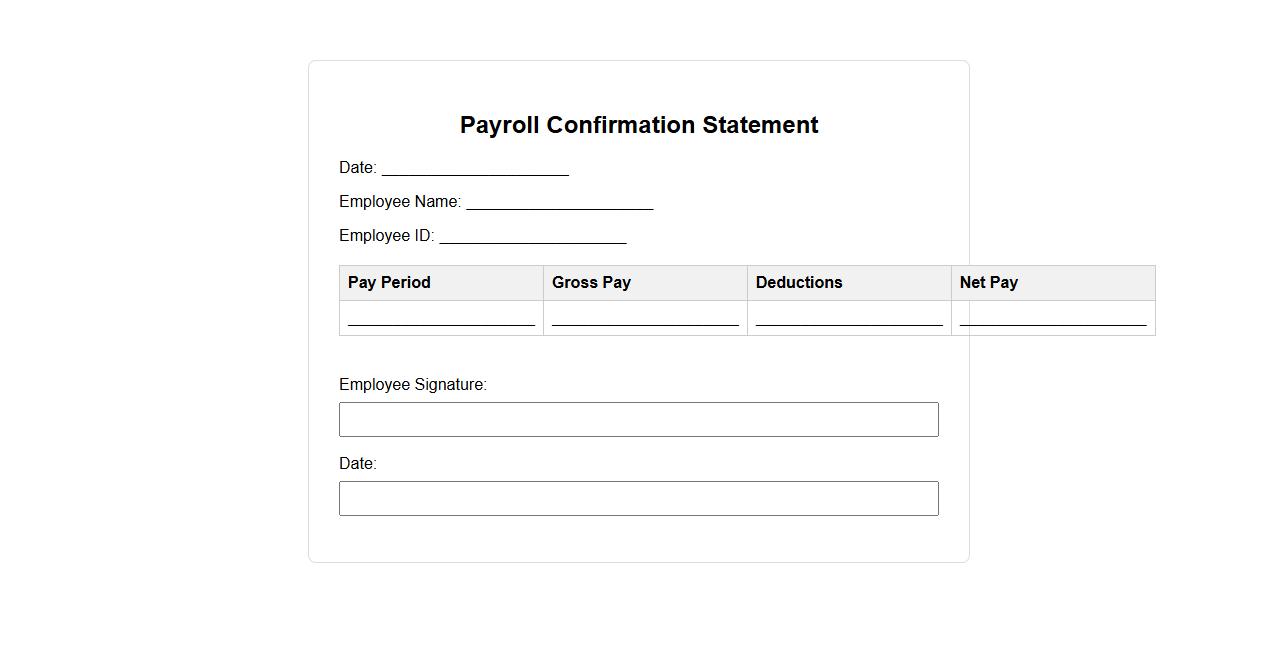

Payroll Confirmation Statement

The Payroll Confirmation Statement is an essential document that verifies accurate employee salary details and tax deductions. It ensures compliance with legal regulations by confirming the amounts processed during each pay period. This statement helps maintain transparent and organized payroll records for both employers and employees.

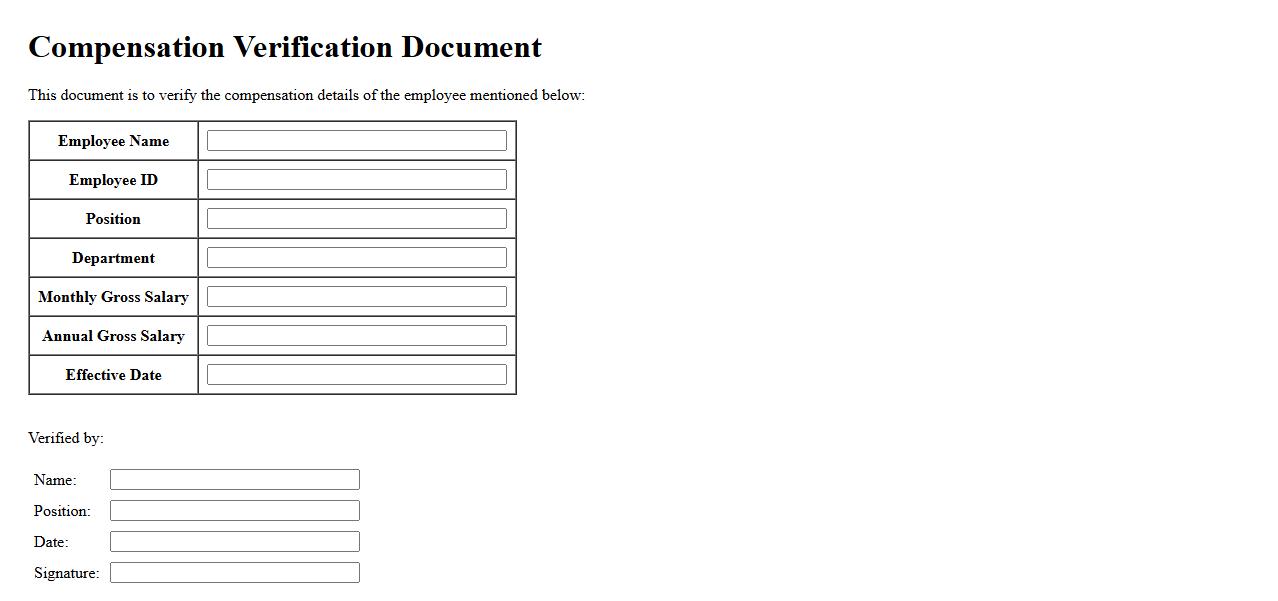

Compensation Verification Document

A Compensation Verification Document is an official record used to confirm an individual's salary or wages. It is often required by employers, lenders, or government agencies to verify income details. This document ensures transparency and accuracy in financial assessments or employment verification processes.

What is the primary purpose of a Certificate of Income?

The primary purpose of a Certificate of Income is to officially document an individual's or entity's earnings over a specific period. This certificate serves as proof of income for various financial and legal transactions. It ensures transparency and accuracy regarding declared earnings.

Who is authorized to issue a Certificate of Income?

A Certificate of Income is typically issued by authorized entities such as employers, government agencies, or certified accountants. Only recognized authorities with access to accurate income records can provide this documentation. This guarantees the certificate's authenticity and reliability.

What essential information must be included in a Certificate of Income?

The certificate must contain critical details such as the individual's full name, total income earned, and the specific period the income covers. Additional elements include the issuer's name, signature, and official seal. Including these ensures the document is valid and verifiable.

How is the validity period of a Certificate of Income determined?

The validity period of a Certificate of Income depends on the issuing authority and the purpose of use. Generally, the certificate is valid for a few months, often three to six months, to reflect current financial status. This helps prevent outdated or inaccurate income representations.

In which scenarios is a Certificate of Income commonly required?

Certificate of Income is commonly required for loan applications, visa processes, and rental agreements. It serves as evidence to lenders, immigration authorities, and landlords of the applicant's financial stability. This document facilitates approval by confirming the applicant's income credentials.