Authorization to Share Insurance Information allows authorized parties to access and disclose an individual's insurance details for processing claims or coordinating benefits. This consent ensures that sensitive data is shared securely and in compliance with privacy regulations. It streamlines communication between insurers, healthcare providers, and other relevant entities.

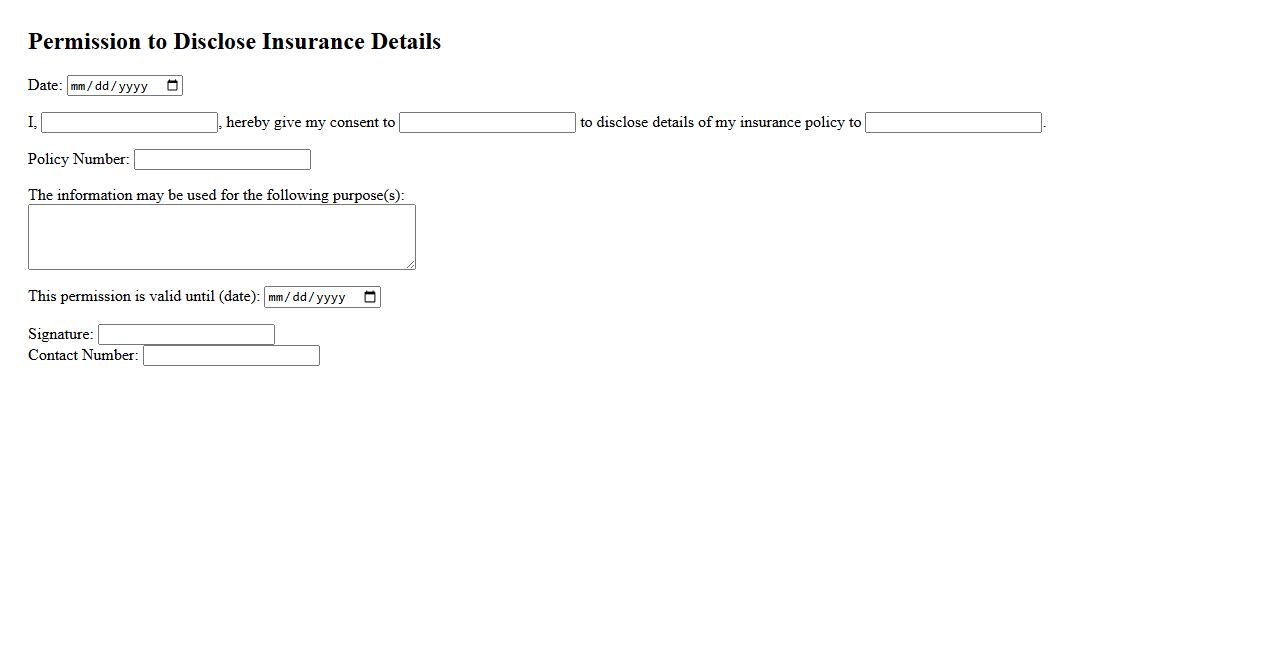

Permission to Disclose Insurance Details

Permission to Disclose Insurance Details is a formal consent granted by an individual allowing an organization or third party to access their insurance information. This authorization ensures compliance with privacy laws while facilitating necessary communication between insurers and relevant parties. Obtaining explicit permission protects personal data and streamlines the processing of claims or verifications.

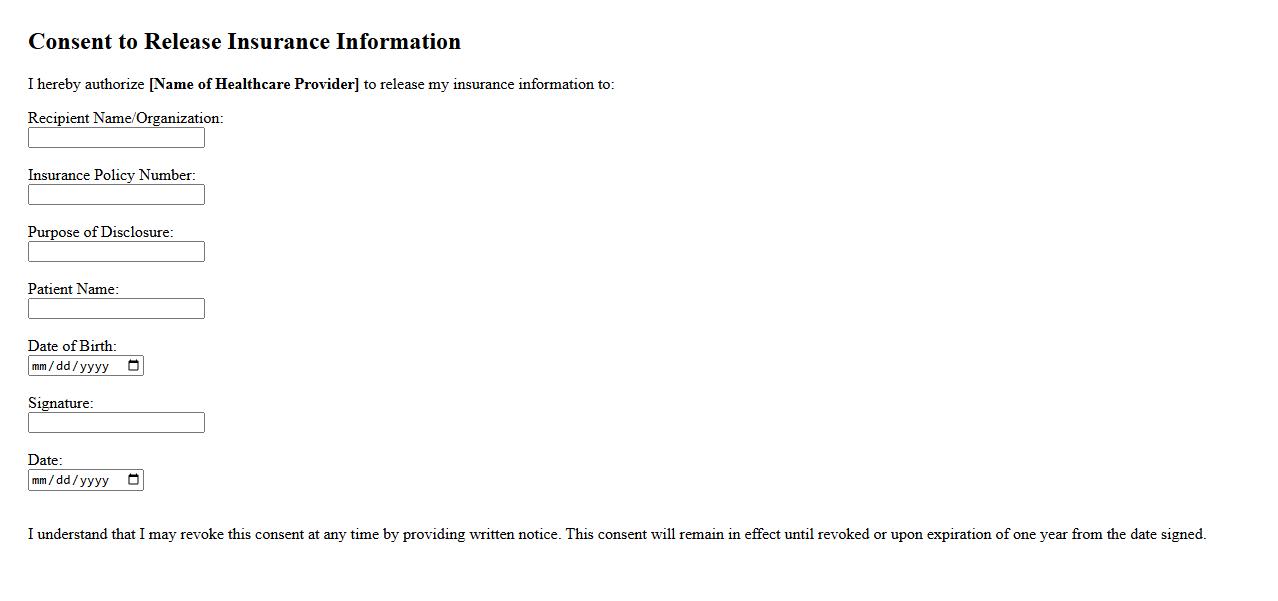

Consent to Release Insurance Information

Consent to Release Insurance Information is a crucial authorization that allows healthcare providers to share a patient's insurance details with relevant parties. This consent ensures smooth communication between medical professionals and insurance companies for billing purposes. Obtaining this permission helps protect patient privacy while facilitating accurate and timely insurance claims processing.

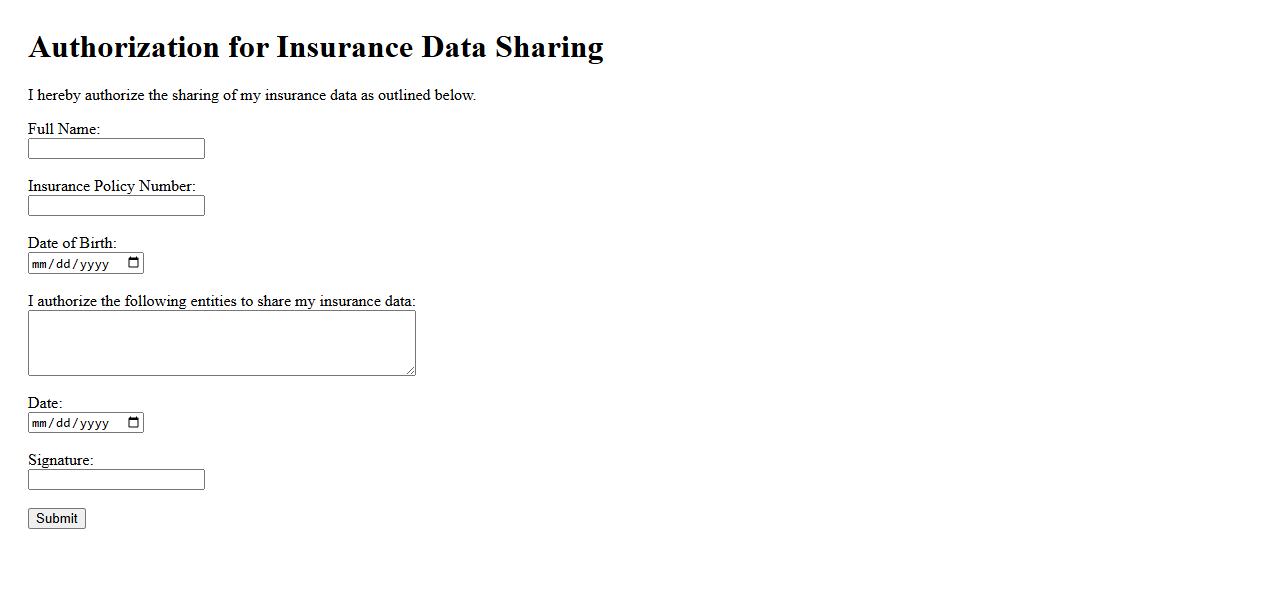

Authorization for Insurance Data Sharing

Authorization for Insurance Data Sharing ensures that an individual or entity grants permission to share personal insurance information with specified parties. This consent protects privacy and complies with legal regulations. Proper authorization facilitates efficient processing and verification of insurance-related claims and services.

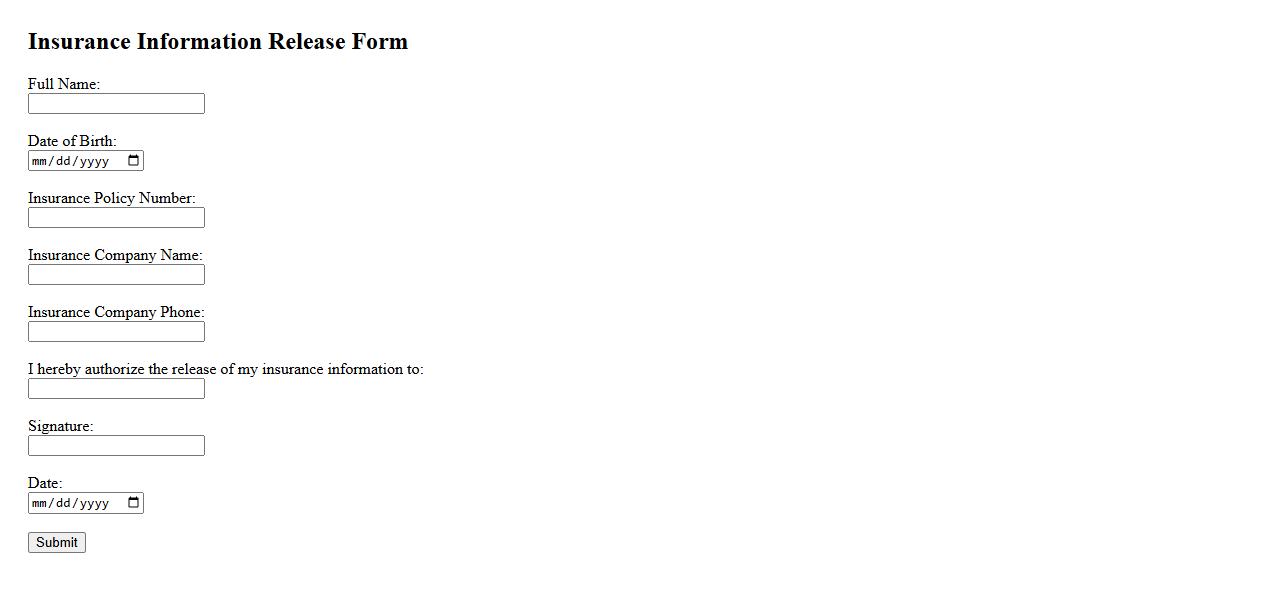

Insurance Information Release Form

The Insurance Information Release Form is a vital document that authorizes the sharing of personal insurance details between parties. It ensures compliance with privacy laws while facilitating smooth communication for claims or coverage inquiries. This form protects both the insured and the insurer by clearly outlining consent and information access boundaries.

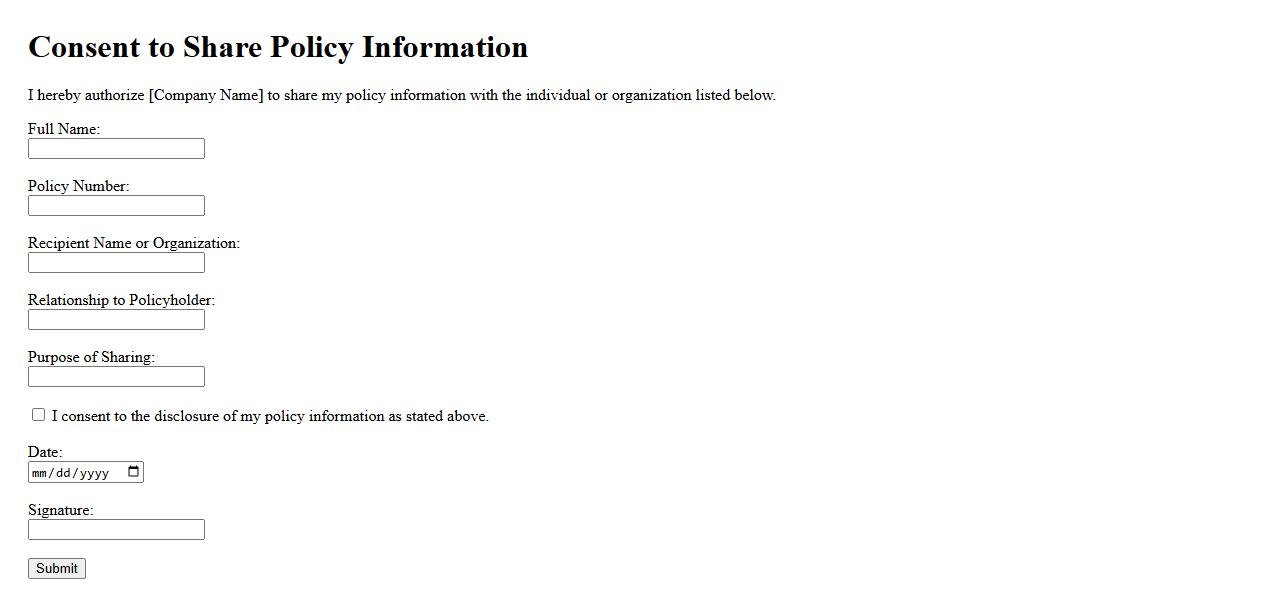

Consent to Share Policy Information

Our Consent to Share Policy Information ensures that your data is handled securely and shared only with authorized parties. By agreeing, you allow us to communicate necessary information to improve services and maintain transparency. Your privacy and trust remain our highest priorities throughout this process.

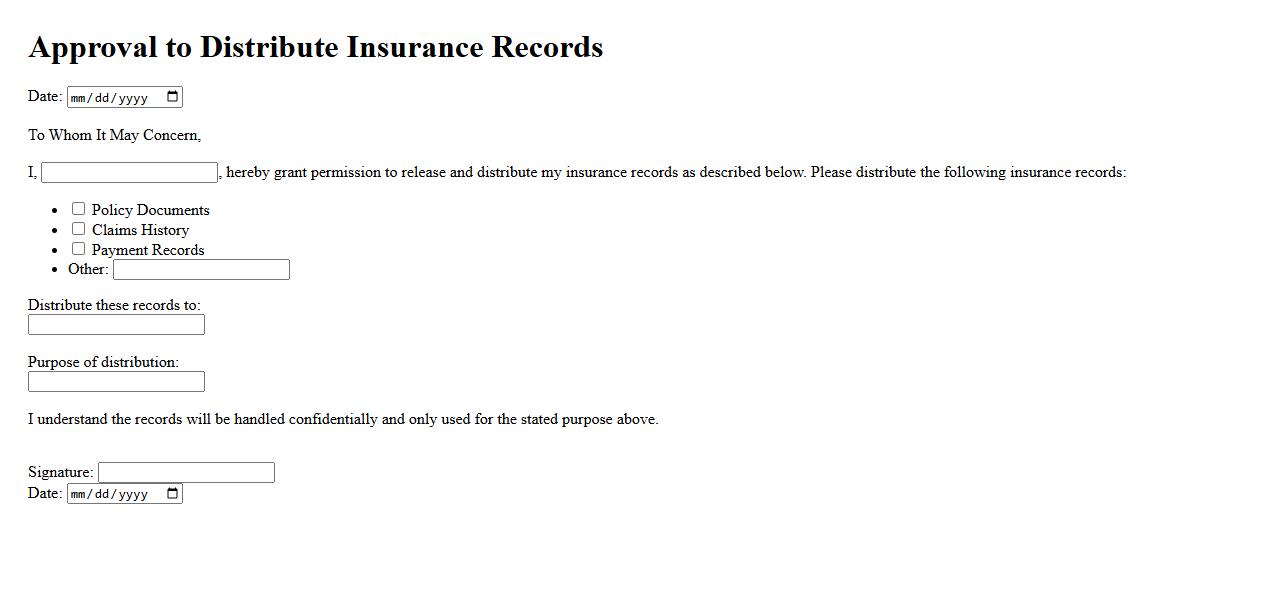

Approval to Distribute Insurance Records

Approval to Distribute Insurance Records is a crucial step that ensures sensitive information is shared only with authorized parties. This process protects policyholder privacy while allowing efficient communication between insurers, agents, and clients. Proper approval safeguards against unauthorized access and maintains compliance with regulatory standards.

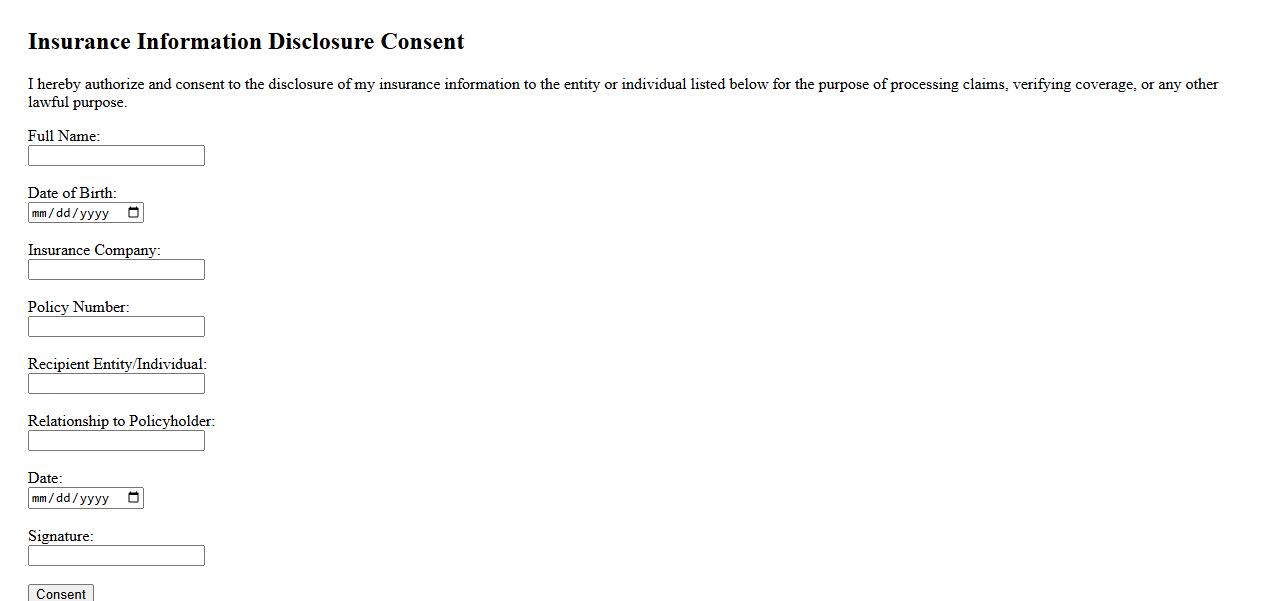

Insurance Information Disclosure Consent

Insurance Information Disclosure Consent is a legal agreement that allows companies to share your insurance details with authorized parties. This consent ensures transparency and protects your privacy while facilitating claims or policy management. Granting this consent helps streamline communication between insurers and service providers.

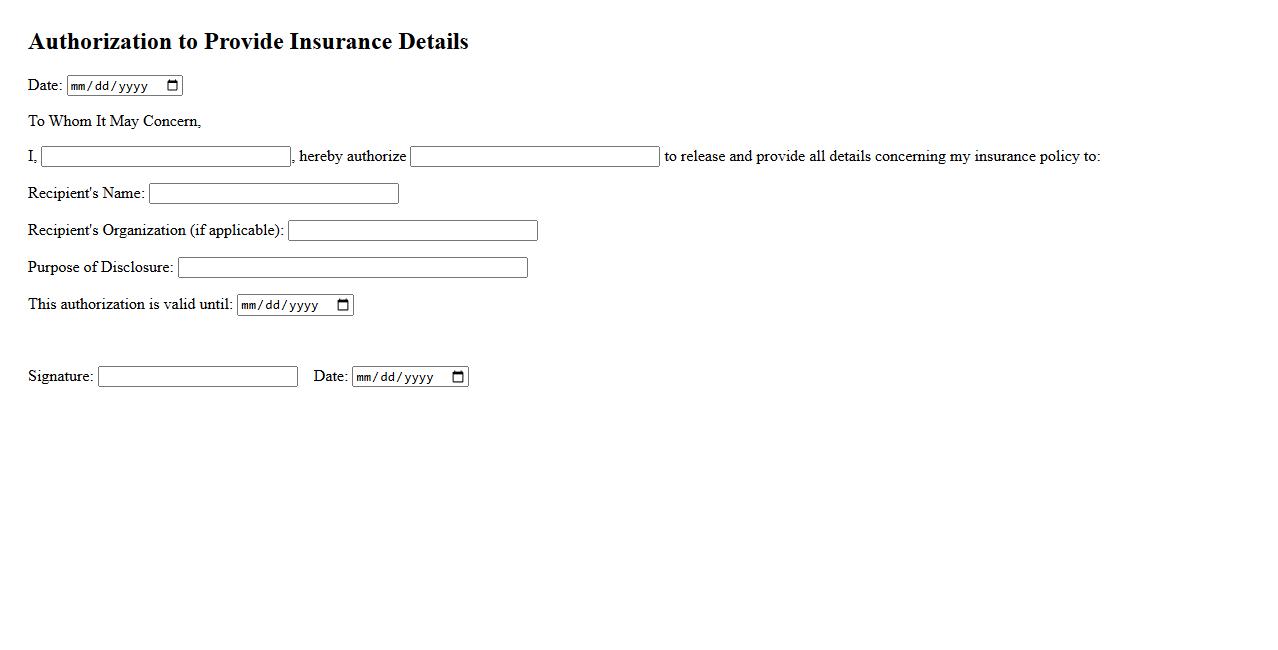

Authorization to Provide Insurance Details

The authorization to provide insurance details is a formal consent allowing a third party to access and share your insurance information. This process ensures transparency and facilitates claims or service approvals efficiently. Maintaining this authorization helps protect your privacy while enabling necessary communication between insurers and service providers.

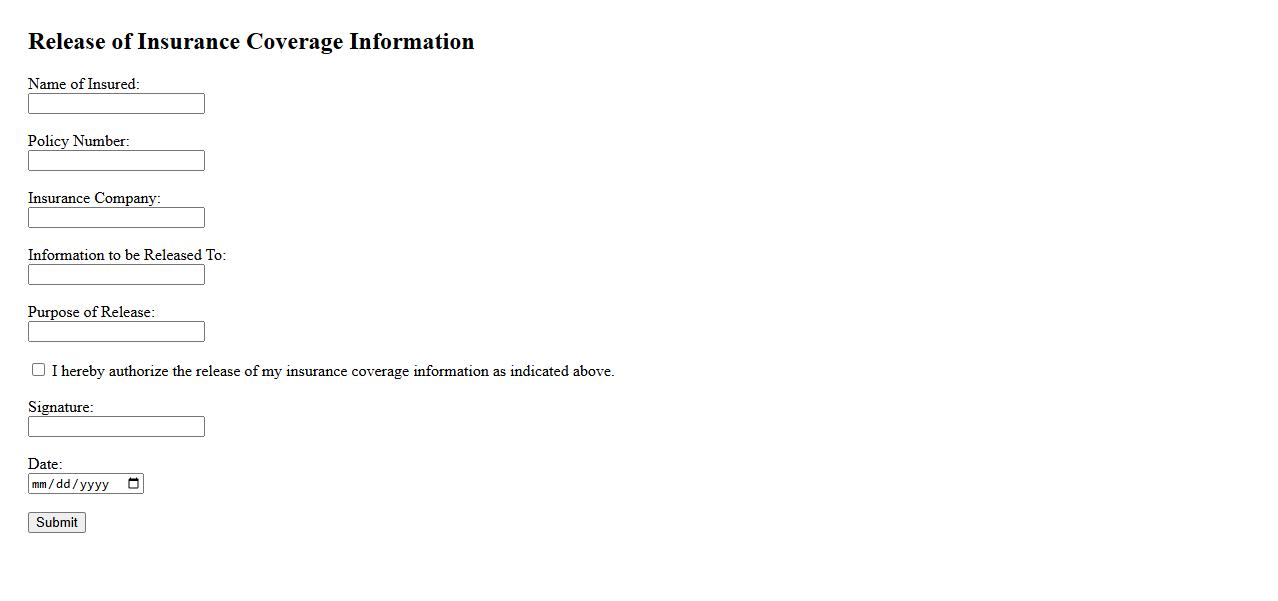

Release of Insurance Coverage Information

The Release of Insurance Coverage Information is a critical process that allows authorized parties to access details about an individual's insurance policy. This information is essential for verifying coverage and facilitating claims. Ensuring timely and accurate release helps streamline communication between policyholders and providers.

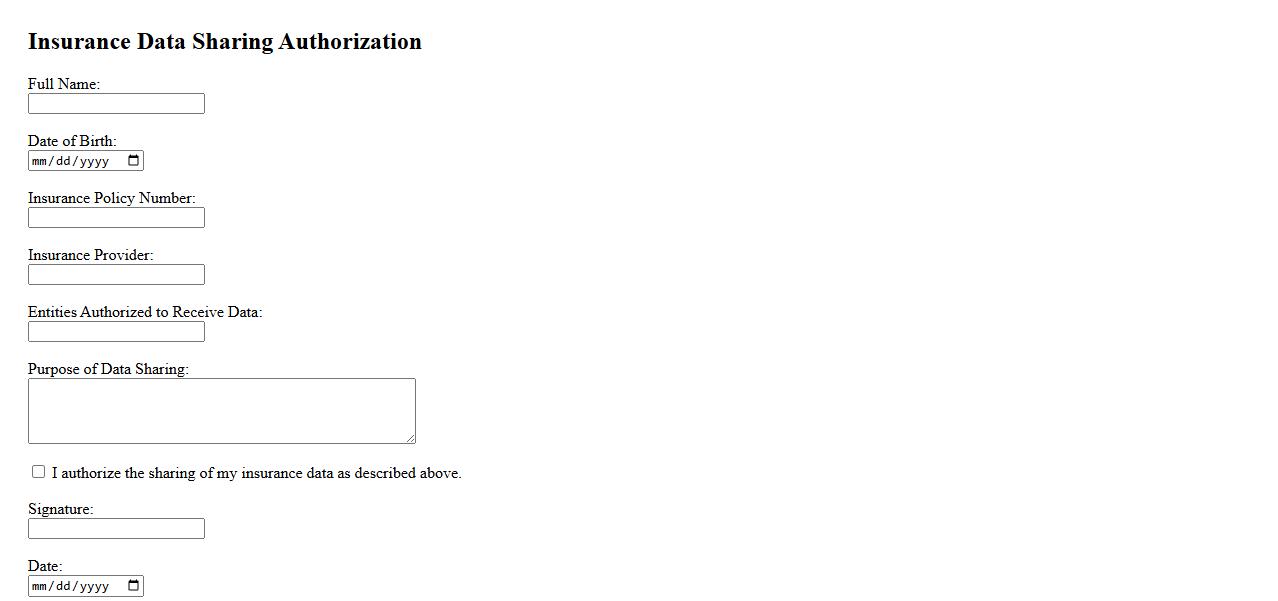

Insurance Data Sharing Authorization

Insurance Data Sharing Authorization is a process that allows policyholders to grant permission for their insurance information to be shared securely between authorized parties. This authorization ensures transparency and facilitates efficient claims processing and policy management. By enabling seamless data exchange, it helps improve customer service and reduces administrative delays.

What specific insurance information is authorized to be shared under this document?

This document authorizes the sharing of insurance policy details, including coverage limits, claim history, and premium information. It may also include personal identification data linked to the insurance policy. Only the information explicitly listed in the authorization is permitted to be disclosed.

Who is permitted to receive the insurance information according to this authorization?

The authorization permits specific individuals or entities such as insurance companies, legal representatives, or designated third parties. Recipients must be clearly identified within the document to ensure compliance. Unauthorized parties are strictly prohibited from accessing the shared information.

What is the duration or expiration date of the authorization to share insurance information?

The authorization includes a clearly defined expiration date or duration, after which sharing of insurance information is no longer permitted. This period is usually specified in days, months, or tied to the completion of a particular process. Once expired, any sharing of insurance data requires renewed consent.

For what purpose(s) can the insurance information be used by the authorized recipients?

The shared insurance information can only be used for purposes explicitly stated in the authorization, such as claims processing, verification, or legal proceedings. Recipients are prohibited from using the data for unrelated activities. This ensures the insurance information is handled with strict confidentiality and within authorized limits.

Can this authorization be revoked, and if so, what is the process for revocation?

This authorization can be revoked at any time by the individual granting access through a written revocation notice. The process typically involves notifying all relevant parties about the withdrawal of consent. Upon revocation, no further insurance information may be shared unless a new authorization is granted.