Waiver of Interest and Penalties (IRS Form 843) allows taxpayers to request the IRS to reduce or eliminate interest and penalties assessed on tax liabilities due to reasonable cause. This form is essential for those who can demonstrate that circumstances beyond their control prevented timely payment or filing. Properly completing IRS Form 843 can help minimize financial burdens associated with tax compliance issues.

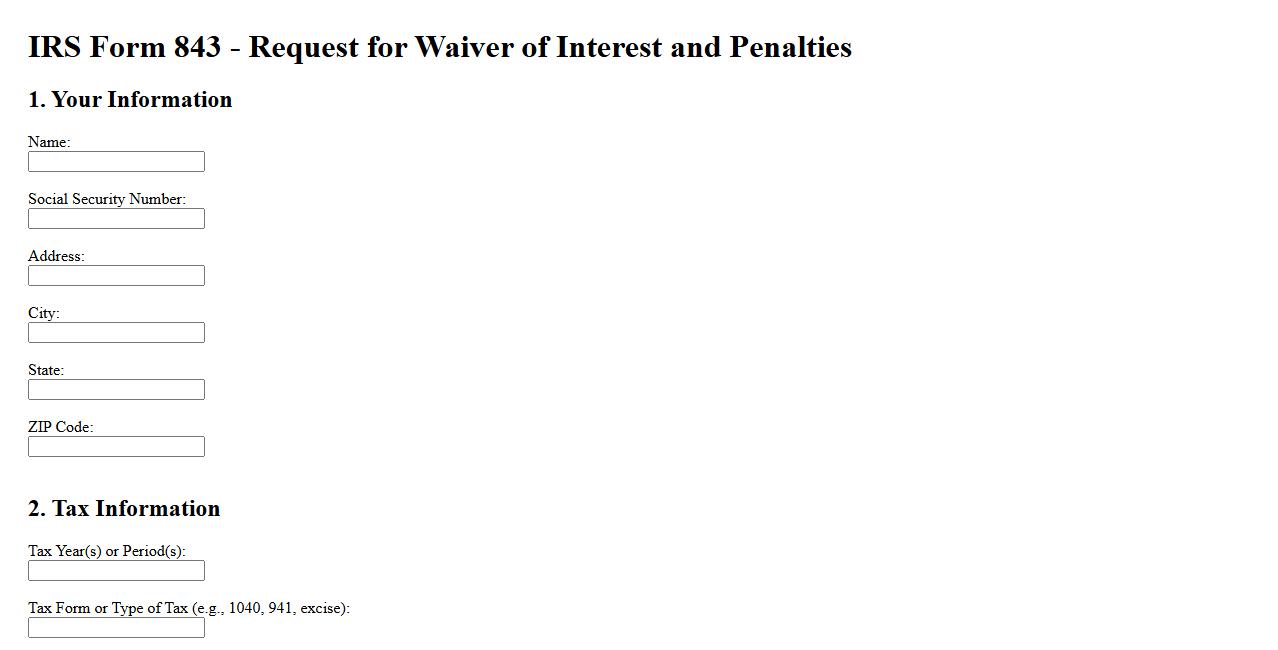

IRS Form 843 - Request for Waiver of Interest and Penalties

The IRS Form 843 is used to request a waiver of interest and penalties on tax underpayments or payments made in error. Taxpayers complete this form to appeal charges assessed due to reasonable cause or other qualifying conditions. Filing this request can help reduce or eliminate additional costs associated with tax liabilities.

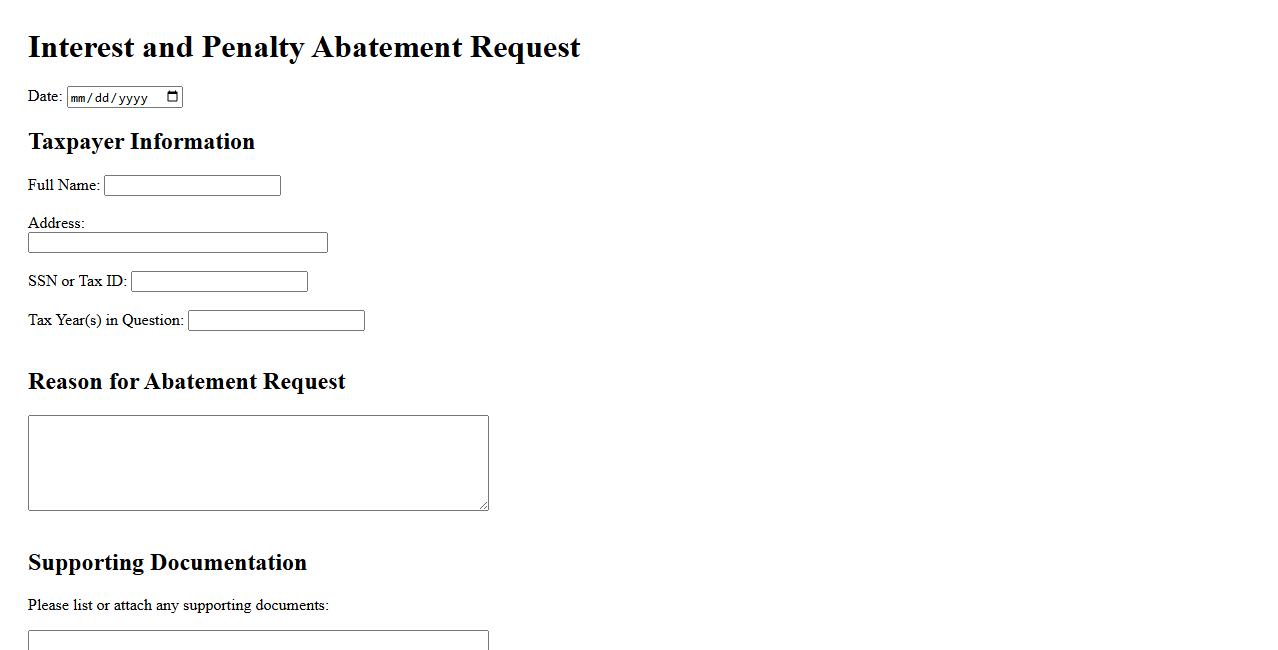

Interest and Penalty Abatement Request

An Interest and Penalty Abatement Request is a formal appeal submitted to tax authorities seeking relief from additional charges due to reasonable cause or errors. This request aims to reduce or eliminate accrued interest and penalties on unpaid or late taxes. Proper documentation and a clear explanation increase the chances of successful abatement.

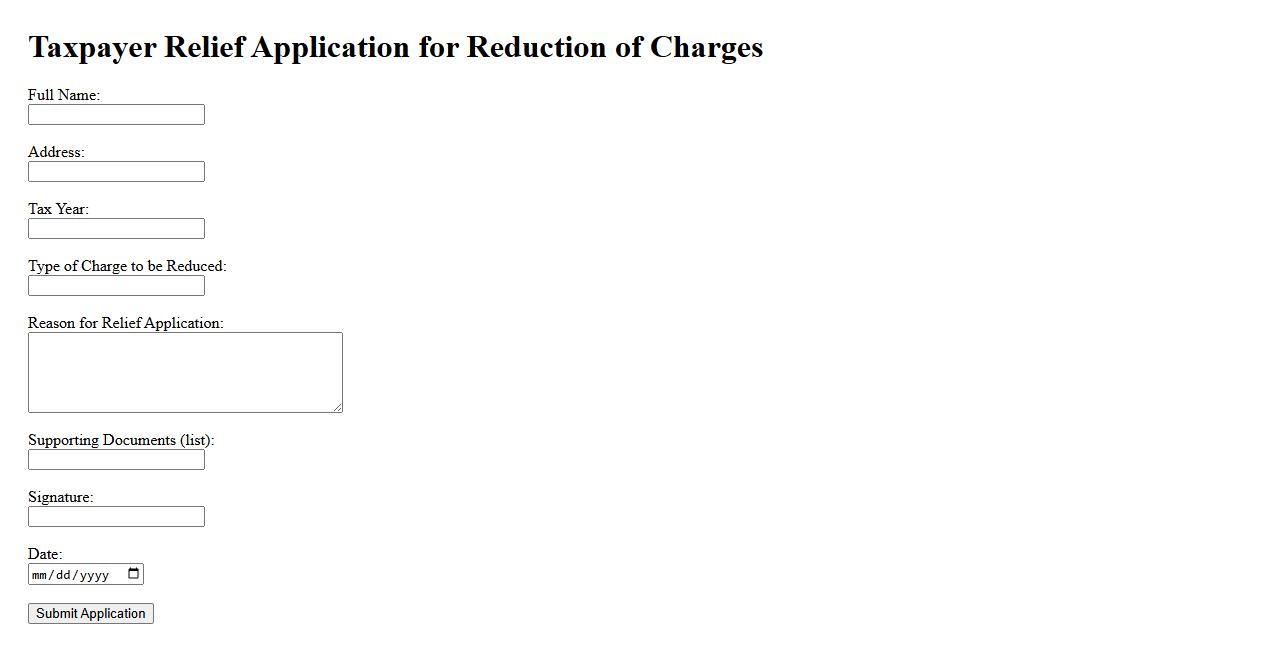

Taxpayer Relief Application for Reduction of Charges

The Taxpayer Relief Application for Reduction of Charges allows individuals to request a decrease in tax penalties due to circumstances beyond their control. This application helps taxpayers who experienced events like natural disasters, serious illness, or other reasonable causes. Submitting this form can provide financial relief by adjusting or waiving specific charges imposed by the tax authority.

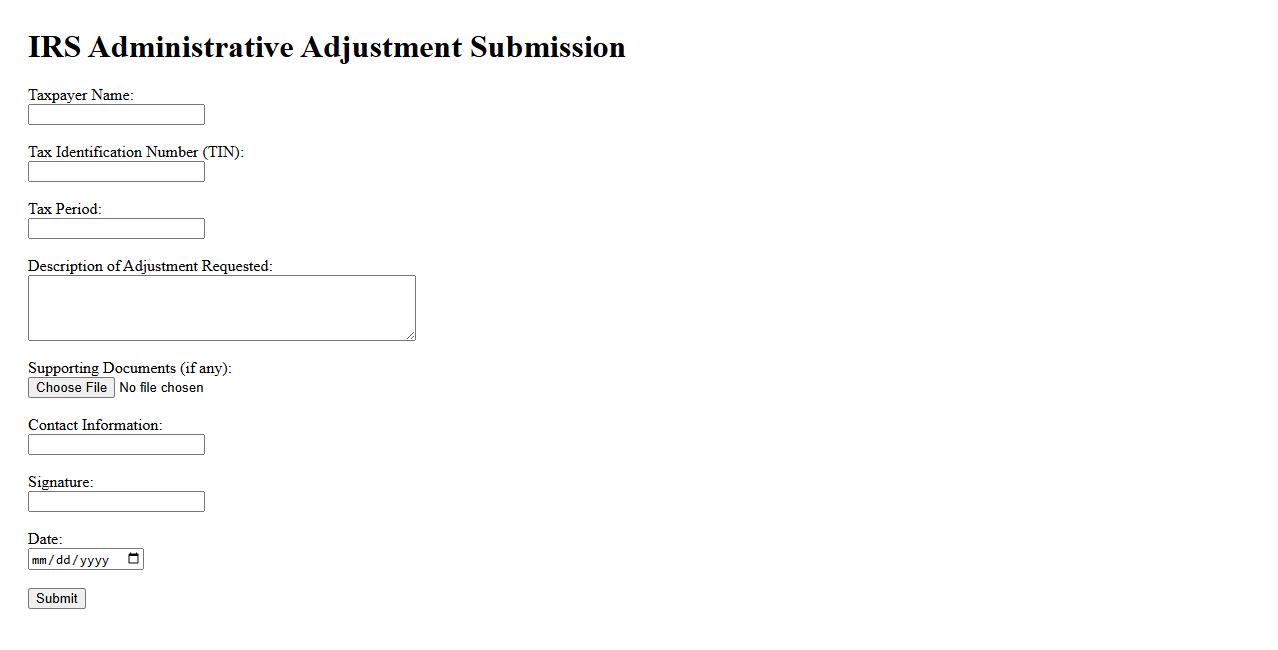

IRS Administrative Adjustment Submission

The IRS Administrative Adjustment Submission is a formal process used by partnerships to report changes to previously filed tax returns. This submission allows the IRS to make necessary adjustments without requiring the partnership to file an amended return. It streamlines the correction process while ensuring accurate tax compliance.

Petition for Removal of Tax Penalties

The Petition for Removal of Tax Penalties allows taxpayers to formally request the IRS to waive penalties due to reasonable cause or other qualifying circumstances. This process helps alleviate financial burdens when penalties were incurred despite efforts to comply with tax laws. Timely submission and proper documentation significantly increase the chances of a successful appeal.

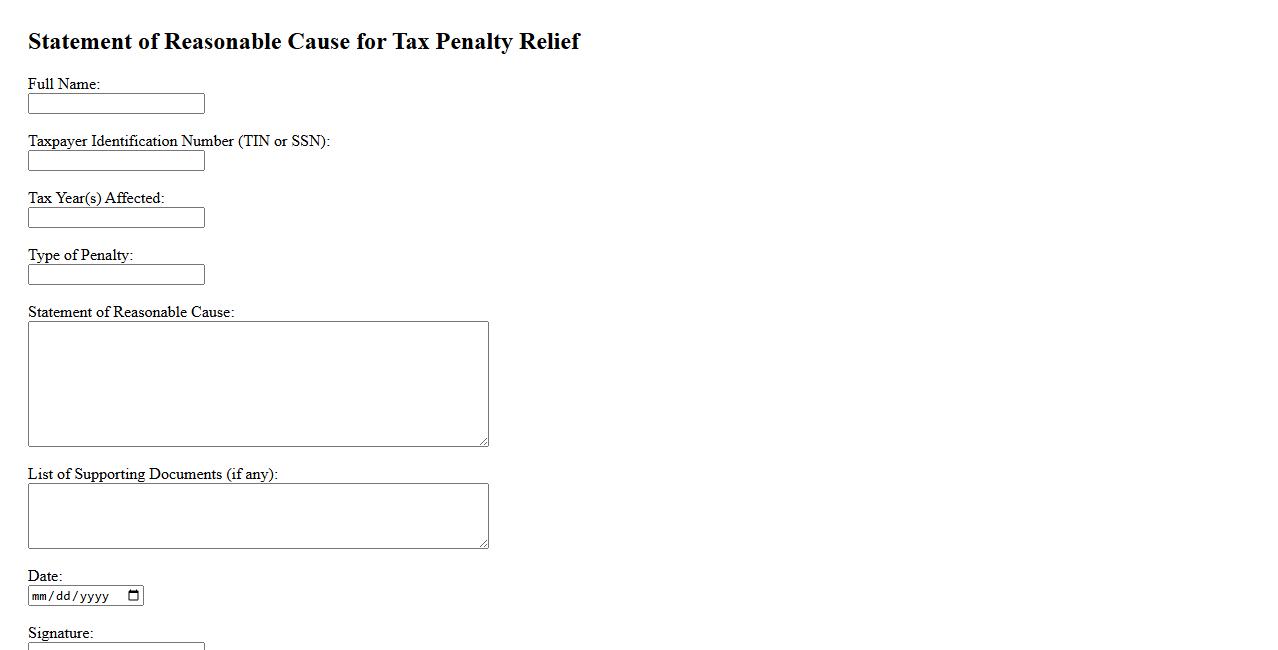

Statement of Reasonable Cause for Tax Penalty Relief

The Statement of Reasonable Cause for Tax Penalty Relief is a formal explanation provided by taxpayers to the IRS when requesting relief from penalties due to circumstances beyond their control. This statement must clearly outline the specific reasons and supporting facts that demonstrate why the taxpayer should not be held responsible for the penalty. Proper documentation and a well-crafted statement increase the chances of penalty abatement.

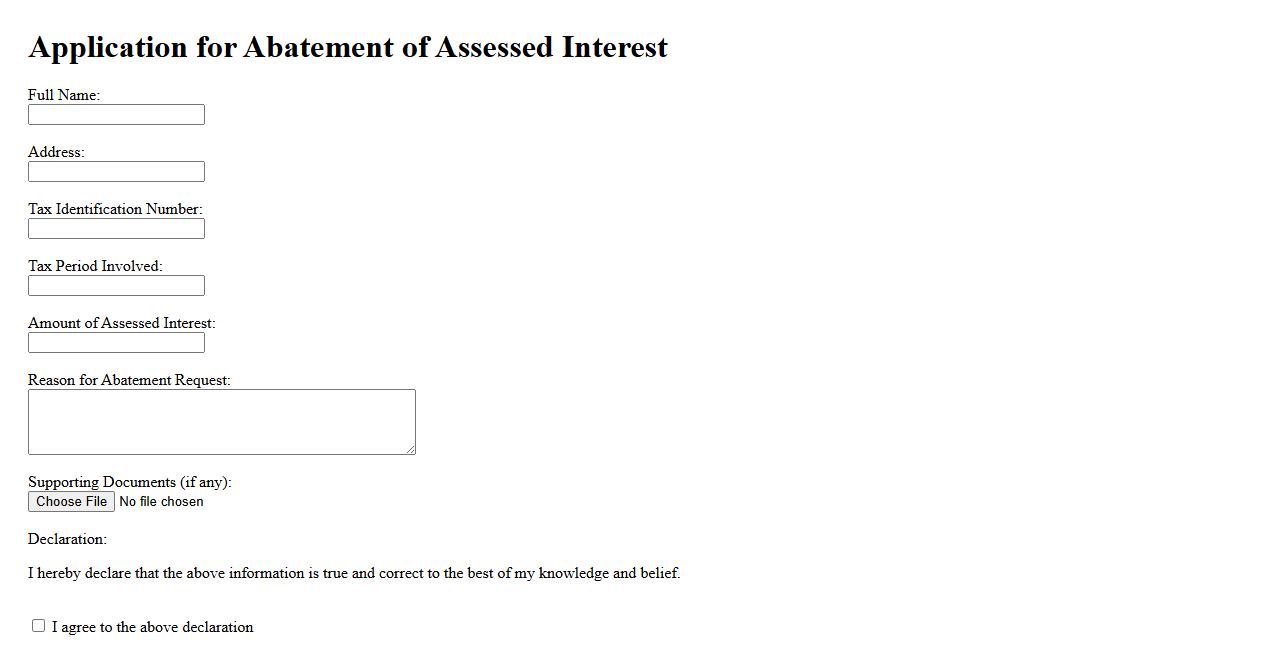

Application for Abatement of Assessed Interest

The Application for Abatement of Assessed Interest is a formal request submitted to reduce or eliminate interest charges on overdue tax payments. This application helps taxpayers resolve disputes related to interest assessments due to errors or hardships. Timely filing of this application can prevent additional financial penalties and provide relief in managing tax obligations.

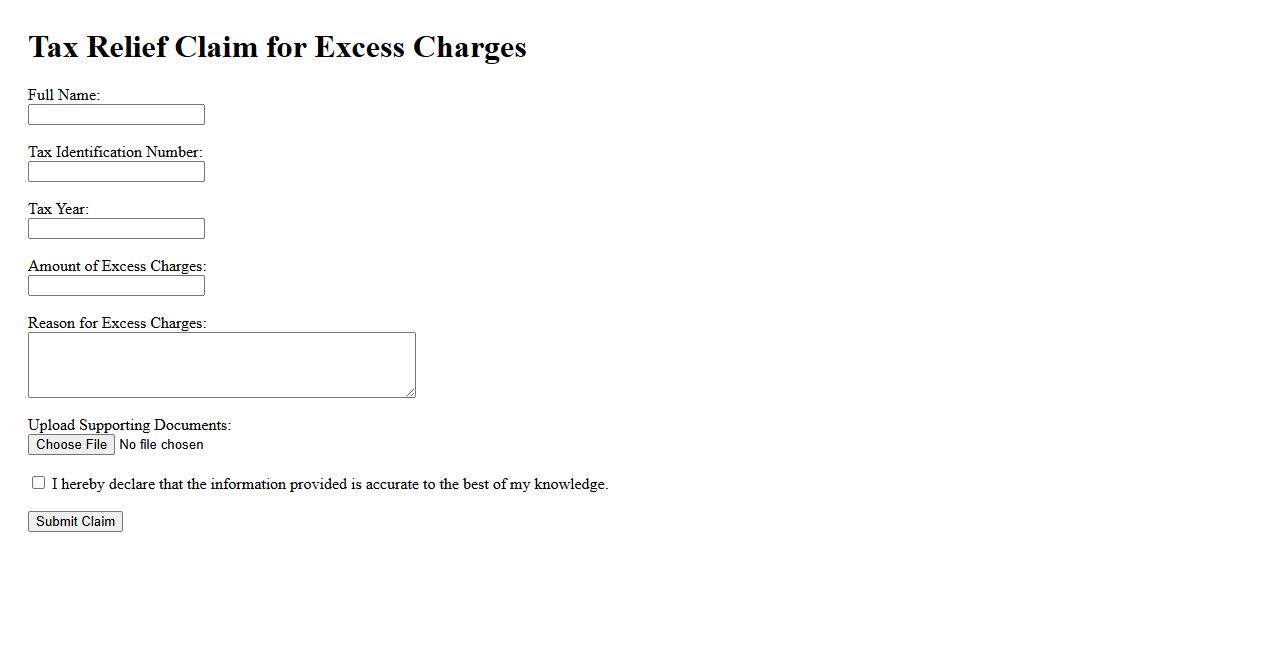

Tax Relief Claim for Excess Charges

If you believe you have been overcharged, you can file a Tax Relief Claim for Excess Charges to recover the additional amount paid. This process involves submitting evidence of the overcharge to the tax authority for review. Successfully claiming relief can result in a refund or credit on your tax account.

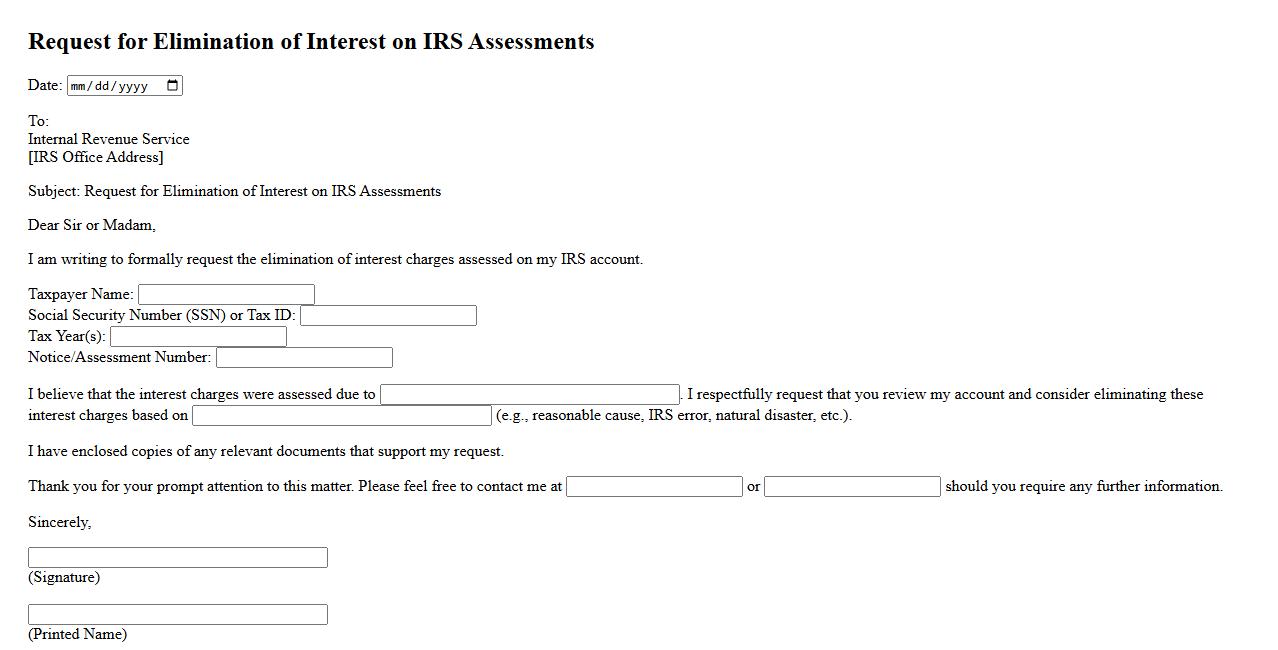

Request for Elimination of Interest on IRS Assessments

The Request for Elimination of Interest on IRS Assessments allows taxpayers to petition the IRS to remove or reduce interest charges applied to tax deficiencies. This process is typically pursued when interest accumulates due to circumstances beyond the taxpayer's control. Proper documentation and a valid reason are essential for a successful request.

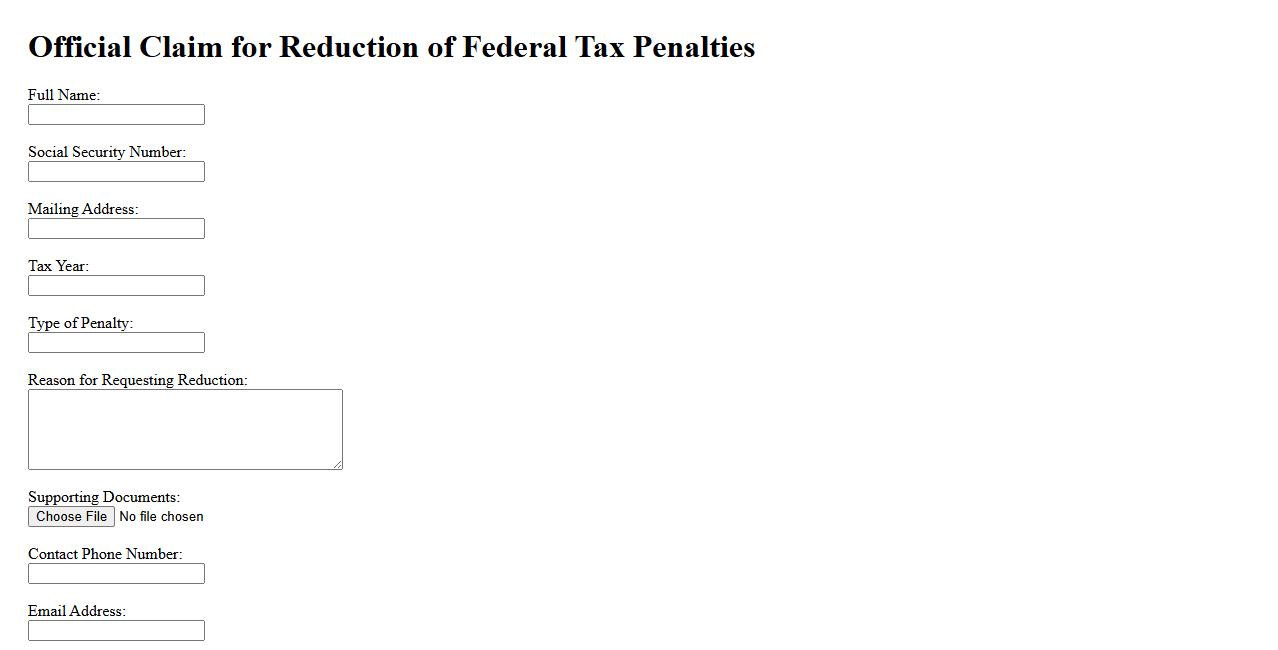

Official Claim for Reduction of Federal Tax Penalties

The Official Claim for Reduction of Federal Tax Penalties allows taxpayers to request a decrease or removal of penalties imposed by the IRS due to reasonable cause. This claim requires a detailed explanation and supporting evidence to justify the reduction. Proper submission can significantly alleviate financial burdens associated with tax penalties.

What is the primary purpose of filing IRS Form 843 for a Waiver of Interest and Penalties?

The primary purpose of filing IRS Form 843 is to request a waiver or abatement of interest and penalties imposed on a tax liability. Taxpayers use this form when they believe that the assessed interest or penalties were applied in error or under circumstances warranting relief. This form helps ensure that taxpayers can seek fairness in the enforcement of tax rules.

Under what circumstances does the IRS consider granting a waiver of interest and penalties through Form 843?

The IRS considers granting a waiver when there is a valid reason such as reasonable cause, including illness or natural disasters, that prevented timely payment or filing. Penalties and interest may also be waived when there is an IRS error or incorrect guidance given to the taxpayer. The IRS evaluates each case individually based on the facts and circumstances presented.

What specific information must be provided on Form 843 to support a waiver request related to interest or penalties?

Form 843 requires the taxpayer to provide detailed explanations of the reason for the waiver, including the facts and circumstances that justify relief. Documentation supporting the claim, such as medical records or correspondence with the IRS, should accompany the form. Accurate identification of the tax period and type of tax is also required for proper processing.

How does reasonable cause factor into eligibility for a waiver of interest and penalties on IRS Form 843?

Reasonable cause is a key factor in obtaining a waiver on Form 843, as it demonstrates that failure to comply was due to circumstances beyond the taxpayer's control. Examples include serious illness, natural disasters, or reliance on incorrect IRS advice. The taxpayer's efforts to comply and promptly address the issue also strengthen the reasonable cause claim.

What timeframe or statute of limitations applies when submitting Form 843 for abatement of interest and penalties?

Generally, Form 843 must be filed within three years from the date of the original tax return or within two years from the date the tax was paid, whichever is later. This timeframe aligns with the statute of limitations set by the IRS for refund claims or adjustments. Submitting the form outside these limits may result in denial of the waiver request.