The Survey of Market Absorption of New Multifamily Units Form collects data on the rate at which newly constructed multifamily housing units are leased or sold in the market. This information helps developers and investors understand current demand, pricing trends, and the competitive landscape. Accurate market absorption rates are crucial for forecasting future project feasibility and investment risk.

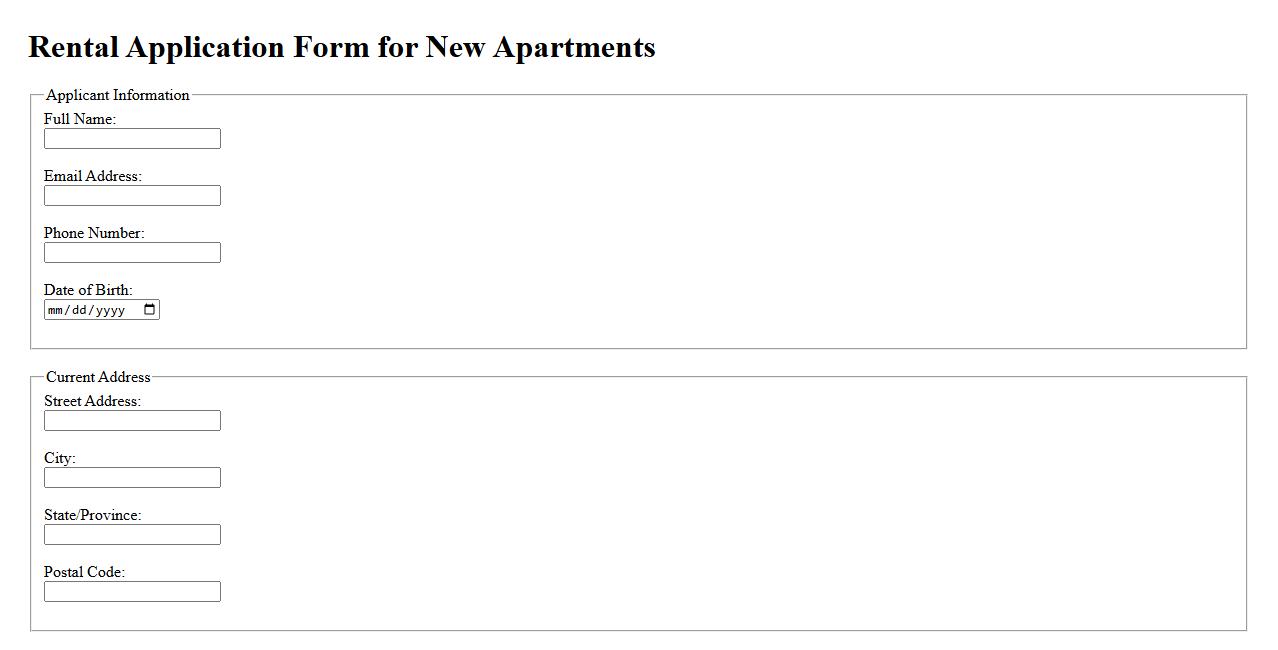

Rental Application Form for New Apartments

The Rental Application Form for New Apartments streamlines the process of securing your ideal living space by collecting essential tenant information efficiently. This form ensures accuracy and speeds up approval, making it easier for landlords to evaluate potential renters. Completing the application thoroughly increases your chances of moving into a new apartment smoothly and quickly.

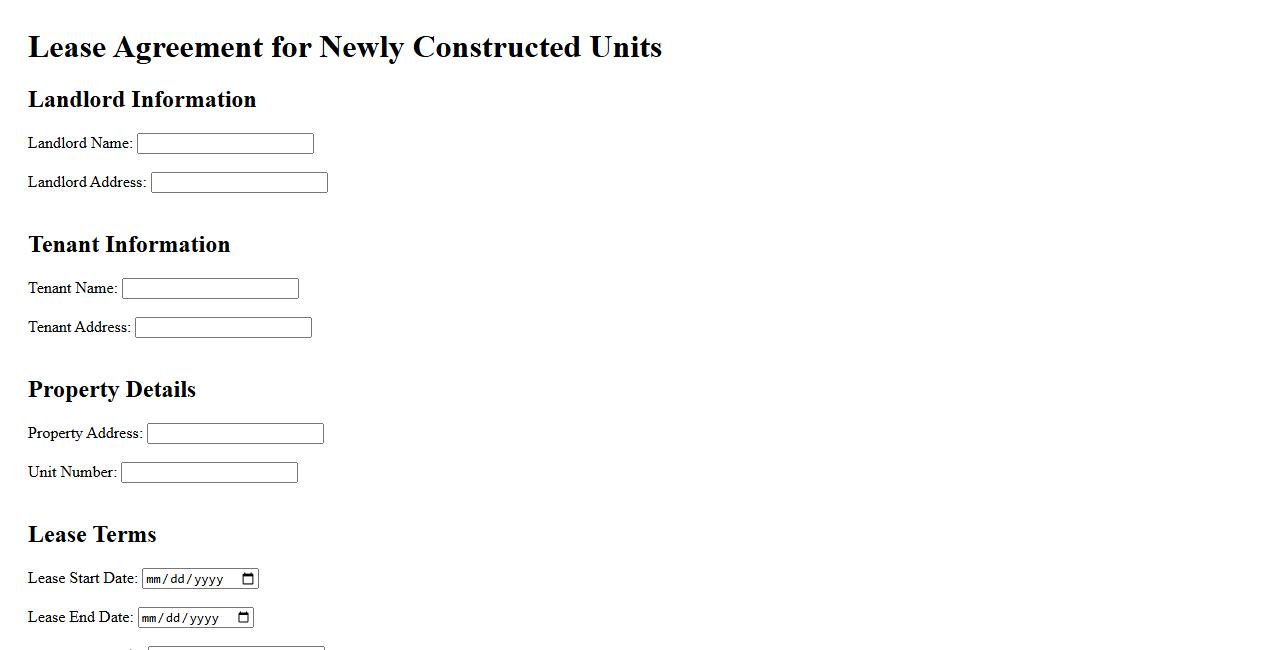

Lease Agreement for Newly Constructed Units

The Lease Agreement for Newly Constructed Units outlines the terms and conditions between the landlord and tenant for leasing brand-new properties. This contract ensures clarity on rent, duration, and maintenance responsibilities for the recently developed units. It protects both parties by defining their rights and obligations during the lease term.

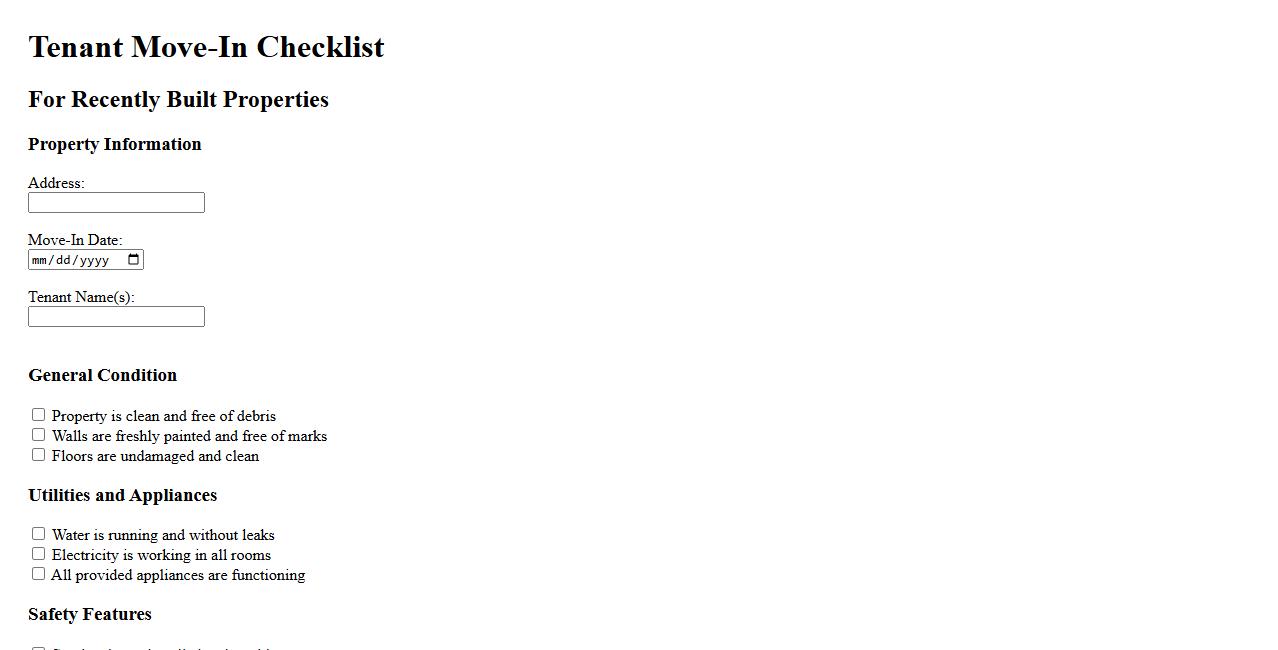

Tenant Move-In Checklist for Recently Built Properties

The Tenant Move-In Checklist for recently built properties ensures a smooth transition by verifying the condition and functionality of every aspect of the new home. This checklist helps tenants document any damages, check utility setups, and confirm that appliances are working properly. It's essential for protecting tenant rights and fostering clear communication with property managers.

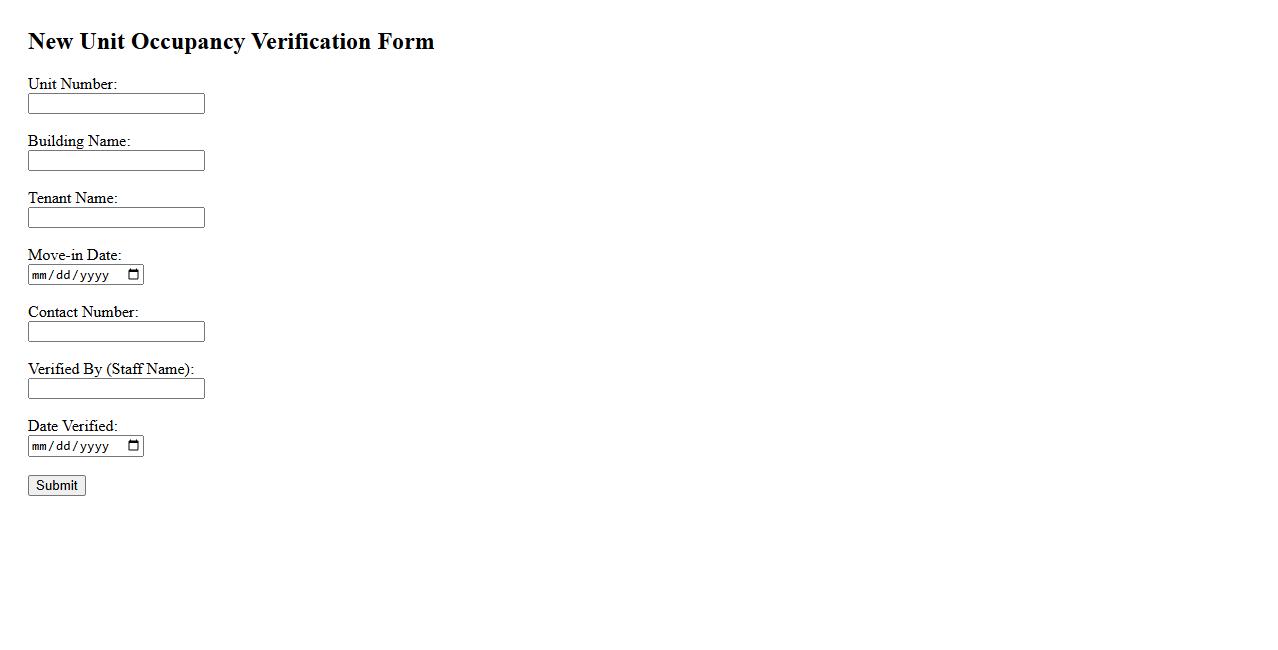

New Unit Occupancy Verification Form

The New Unit Occupancy Verification Form is a crucial document used to confirm the residency status of new tenants. It ensures accurate records for property management and compliance purposes. Completing this form helps maintain transparent communication between landlords and occupants.

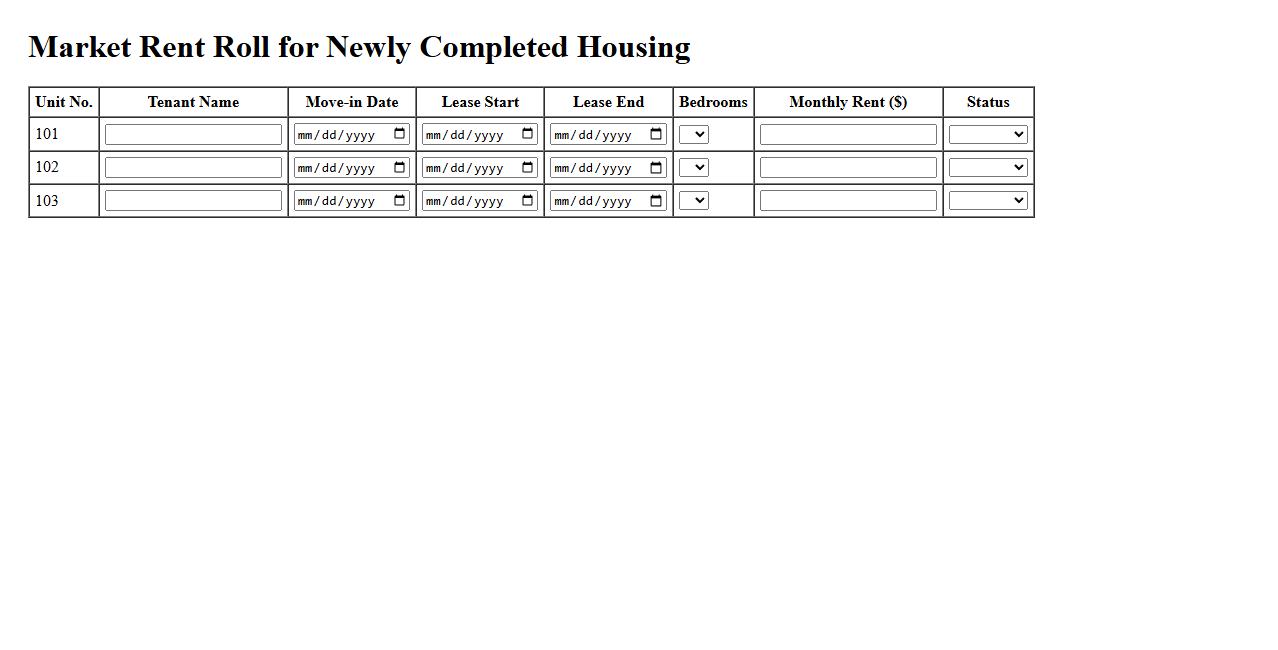

Market Rent Roll for Newly Completed Housing

The Market Rent Roll for newly completed housing provides a detailed overview of expected rental income, reflecting current market conditions. It helps investors and property managers assess the financial viability of a property by projecting rental revenue. Accurate rent rolls are essential for strategic planning and maximizing returns.

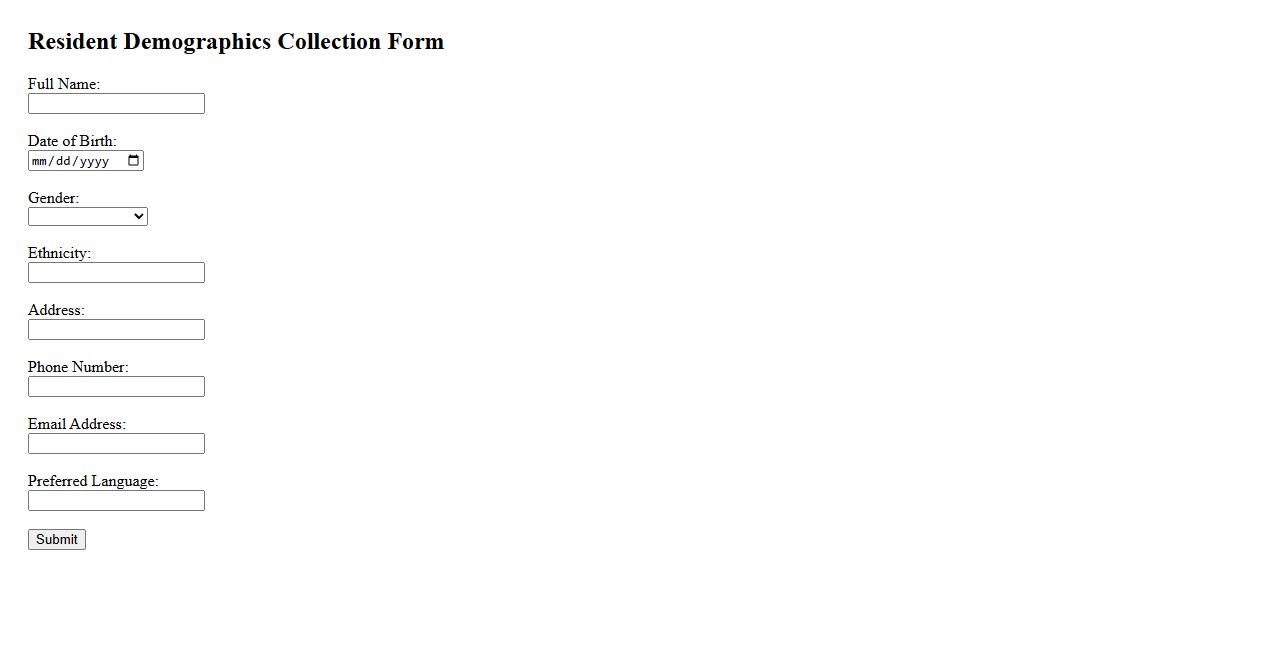

Resident Demographics Collection Form

The Resident Demographics Collection Form gathers essential information about individuals residing in a facility, including age, gender, and contact details. This data helps improve personalized care and ensure accurate record-keeping. Proper demographic collection supports compliance with regulatory requirements and enhances service delivery.

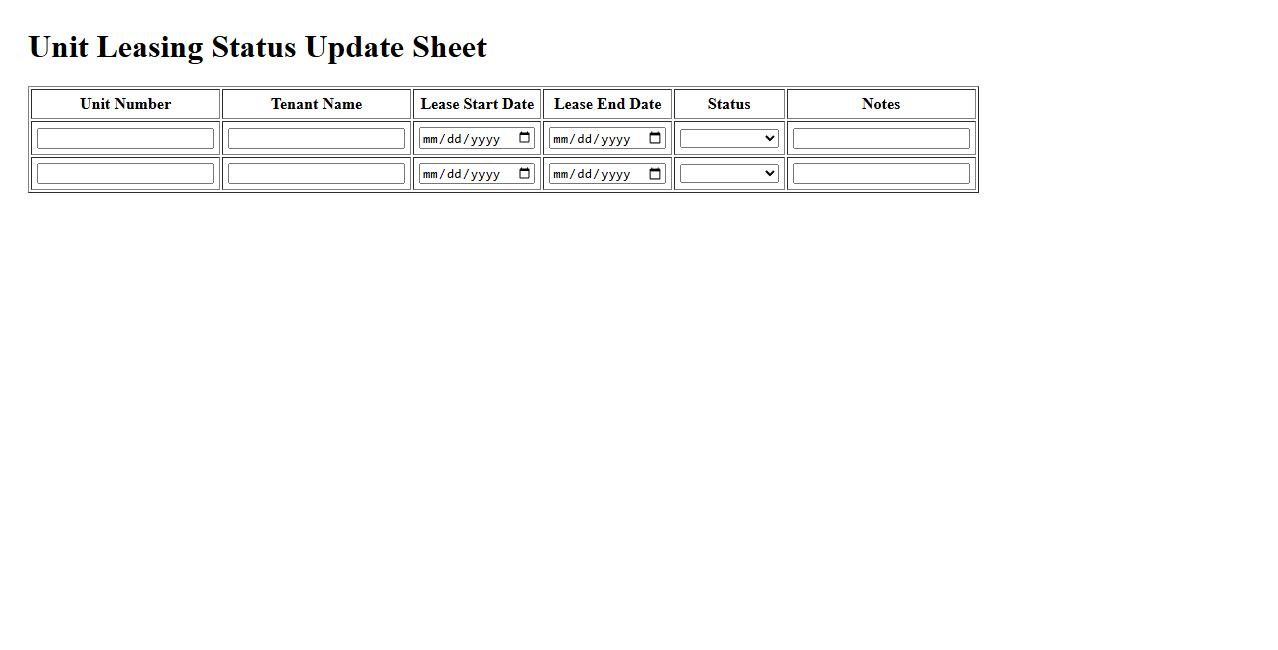

Unit Leasing Status Update Sheet

The Unit Leasing Status Update Sheet is an essential tool for tracking the current leasing progress of rental units. It provides a clear overview of occupancy rates, lease start and end dates, and tenant information. This sheet ensures efficient property management and timely decision-making.

Absorption Rate Analysis Worksheet

The Absorption Rate Analysis Worksheet is a valuable tool for real estate professionals to measure the speed at which properties sell in a specific market. This worksheet helps track inventory levels and sales pace, providing insights into market demand and pricing strategies. Utilizing this analysis ensures informed decision-making for buyers, sellers, and investors.

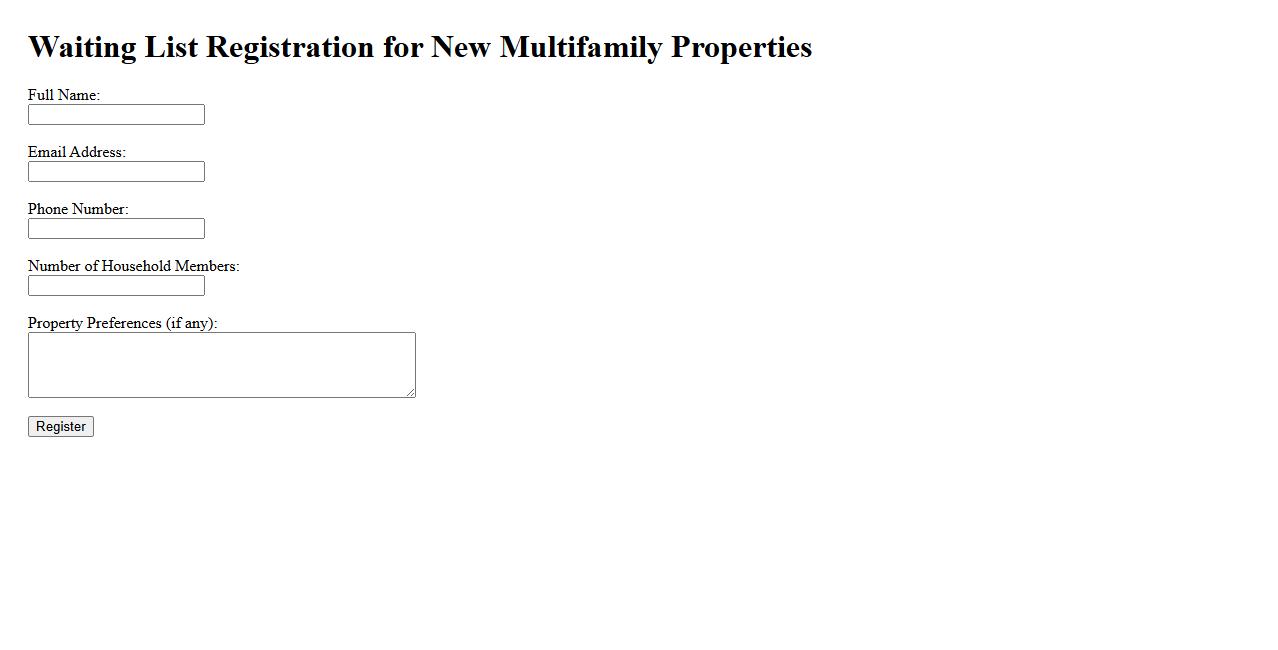

Waiting List Registration for New Multifamily Properties

Secure your spot today by joining our Waiting List Registration for new multifamily properties. This exclusive list offers early access to upcoming rentals and important updates. Don't miss the opportunity to find your perfect home before it's available to the general public.

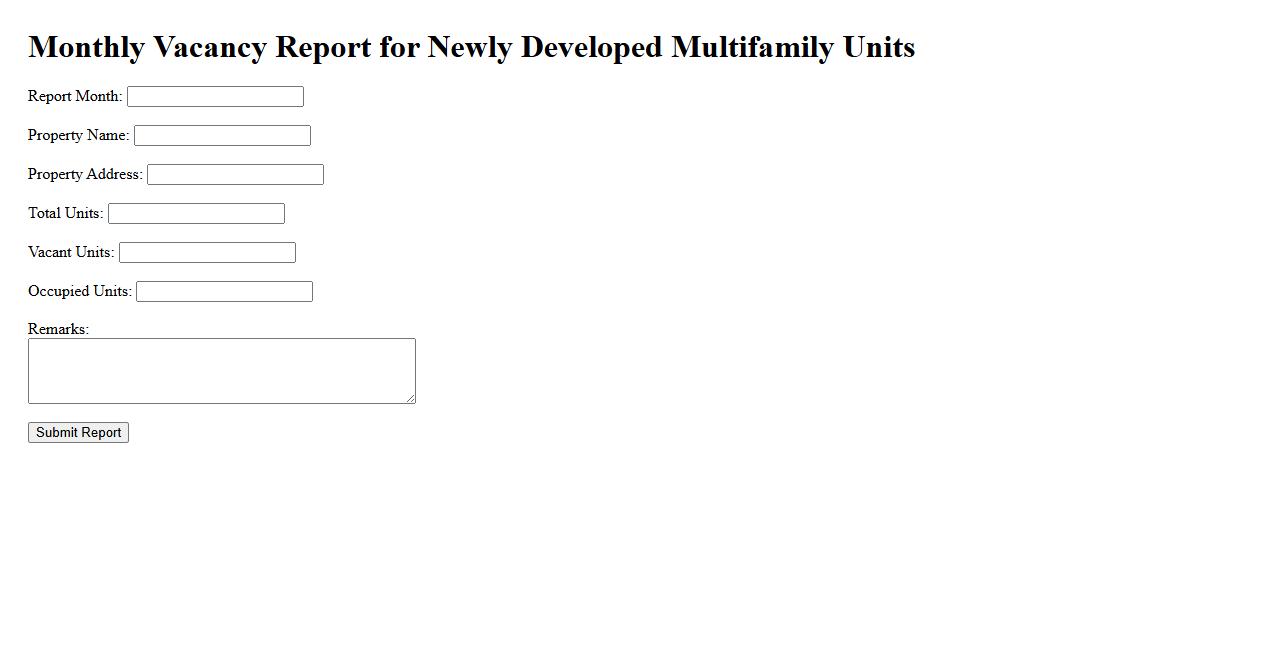

Monthly Vacancy Report for Newly Developed Multifamily Units

The Monthly Vacancy Report for Newly Developed Multifamily Units provides essential data on current occupancy trends and rental availability. This report helps investors and property managers track market performance and identify changes in demand. Accurate and timely insights support strategic decision-making in the multifamily housing sector.

What is the intended purpose of the Survey of Market Absorption of New Multifamily Units form?

The Survey of Market Absorption aims to track how quickly newly built multifamily units are rented or sold. This information helps developers, planners, and policymakers understand housing demand and market dynamics. Ultimately, the survey supports informed decision-making in residential real estate development.

Which types of residential properties qualify as "new multifamily units" in the context of this document?

New multifamily units refer to residential buildings with multiple separate housing units constructed recently. These typically include apartments, condominiums, and townhomes built within the last year or specified period. The survey excludes single-family homes and focuses solely on properties designed for multiple households.

What key data points does the survey collect regarding the absorption of multifamily units?

The survey gathers crucial data such as the number of units leased or sold, rental rates, and time on the market. It also records demographic information of occupants and unit characteristics like size and amenities. These key data points provide a comprehensive view of market absorption trends.

How does the form differentiate between market-rate and subsidized rental units?

The form categorizes units based on whether rent pricing is set by market conditions or through government subsidies. Market-rate units follow prevailing rental prices, while subsidized units have reduced rents under federal, state, or local assistance programs. This distinction clarifies the unit's economic accessibility and target tenant groups.

Over what time period does the survey measure absorption rates for new multifamily units?

The survey measures absorption over a defined period, typically quarterly or annually following unit completion. This timeframe captures initial leasing or sales velocity to assess market demand. The absorption rate reflects how quickly units are occupied post-construction, informing future development planning.