The Survey of Consumer Finance Form collects detailed data on household finances, including assets, debts, income, and expenses. This form helps researchers analyze consumer behavior and financial stability across different demographics. Accurate completion of the Survey of Consumer Finance Form ensures reliable insights into economic trends and policy impacts.

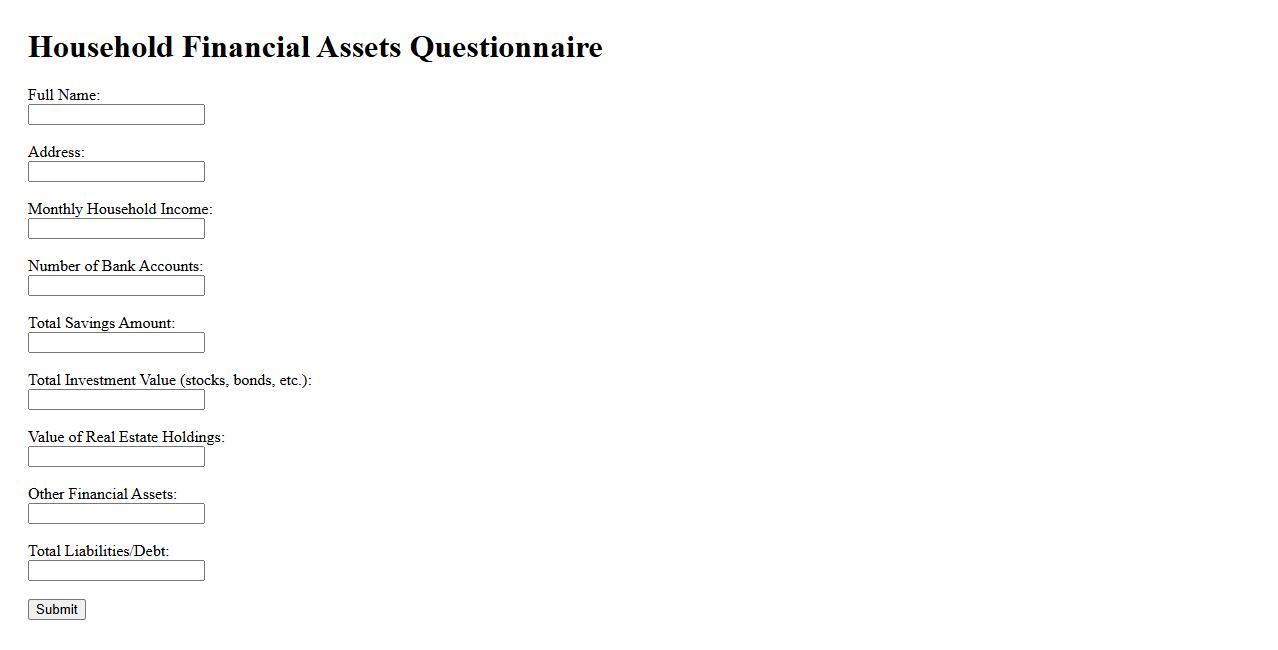

Household Financial Assets Questionnaire

The Household Financial Assets Questionnaire is designed to gather comprehensive information about a family's financial resources. It helps in assessing asset distribution including savings, investments, and property ownership. This data is essential for financial planning and economic research purposes.

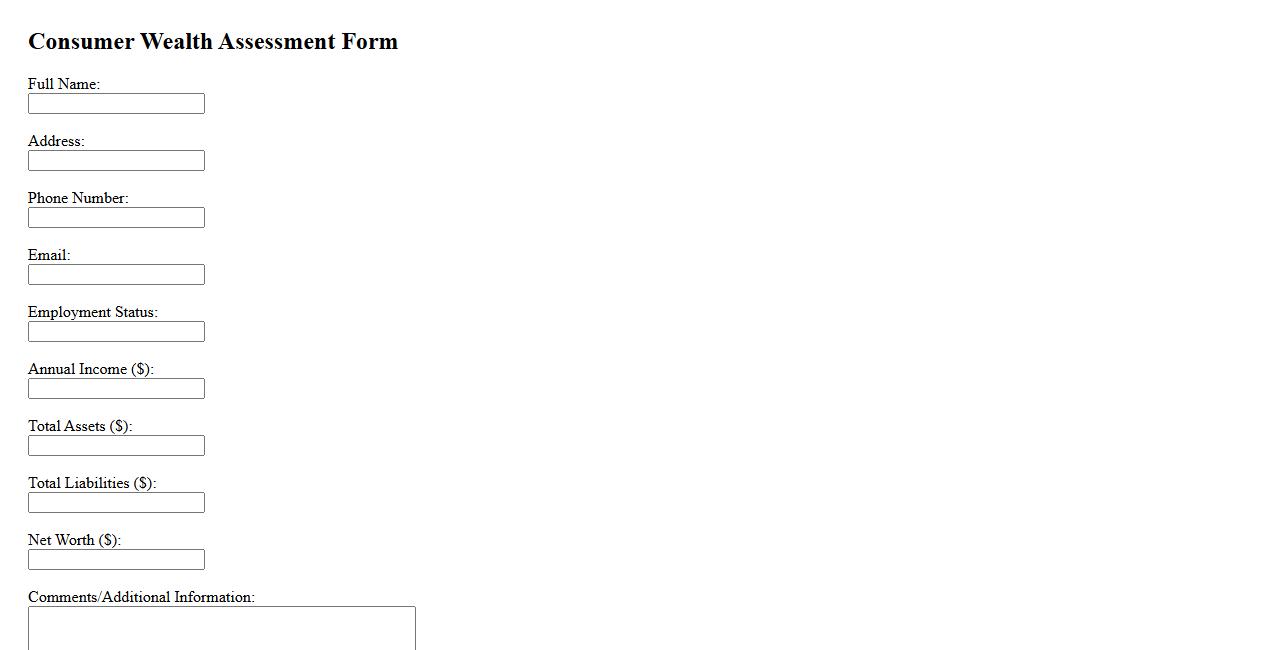

Consumer Wealth Assessment Form

The Consumer Wealth Assessment Form is a comprehensive tool designed to evaluate an individual's financial status and assets. It helps in understanding spending habits, savings, and investment portfolios. This form is essential for creating personalized financial plans and strategies.

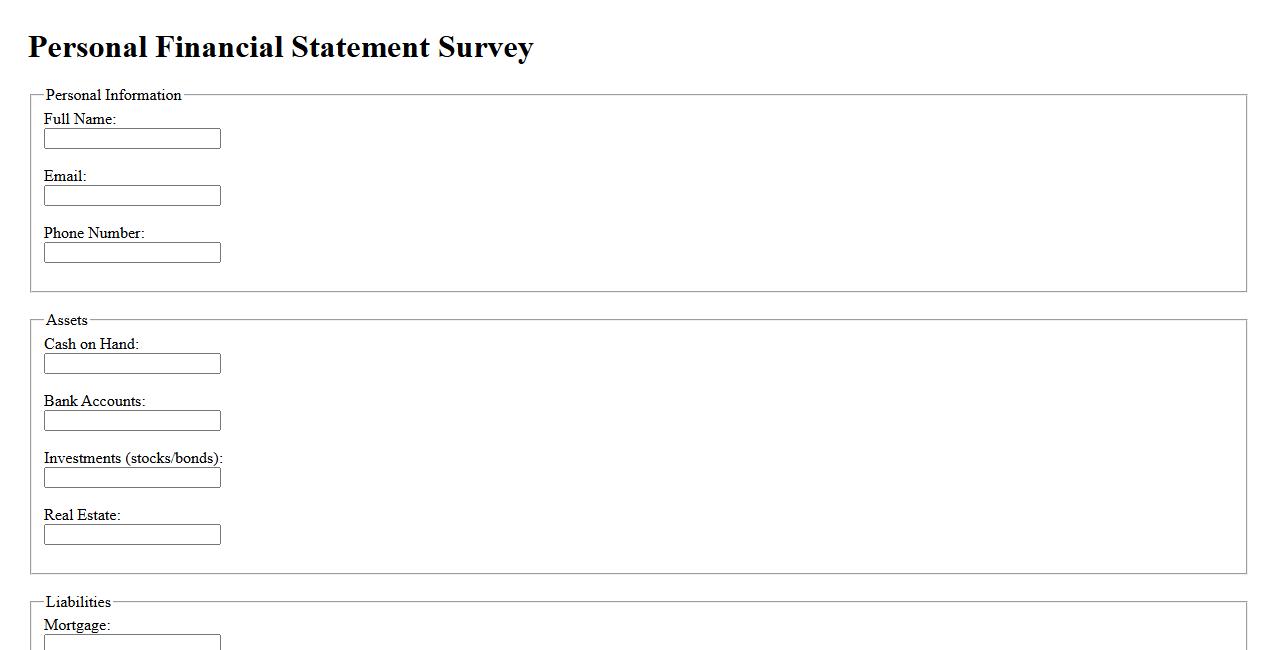

Personal Financial Statement Survey

The Personal Financial Statement Survey provides a comprehensive overview of an individual's financial status, including assets, liabilities, income, and expenses. This survey is essential for assessing creditworthiness and financial health. It helps lenders, investors, and financial planners make informed decisions based on accurate financial data.

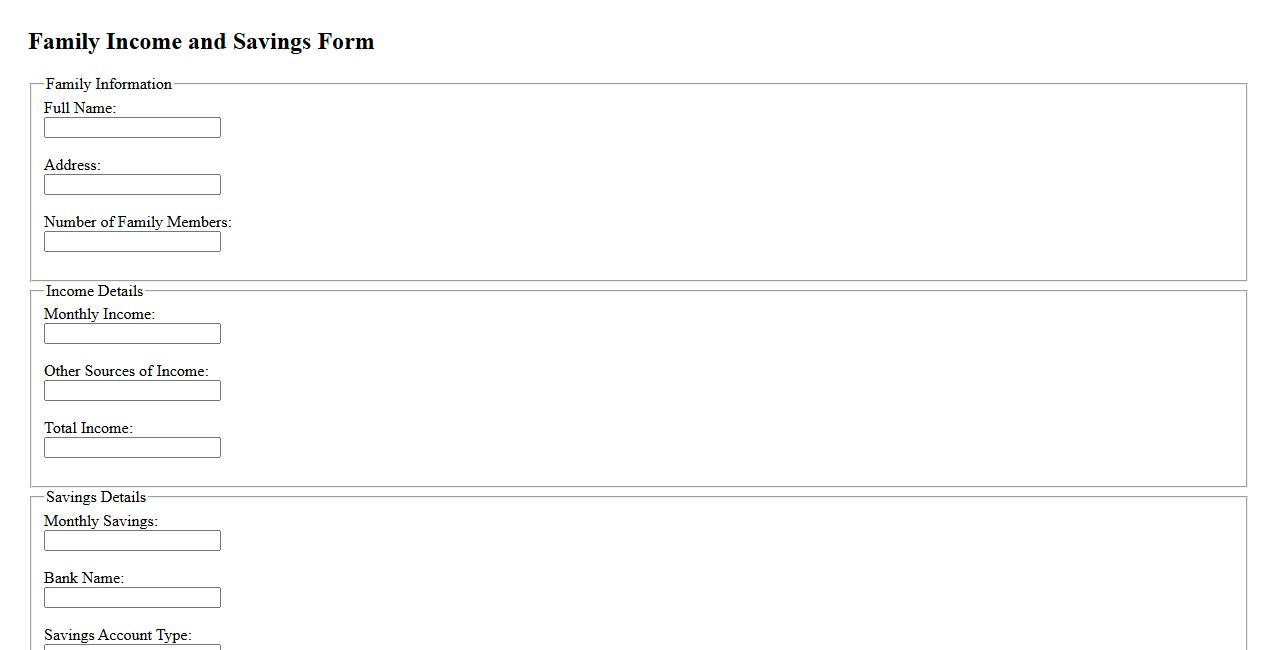

Family Income and Savings Form

The Family Income and Savings Form is essential for accurately documenting household earnings and financial reserves. This form helps in assessing the financial stability and planning for future expenses. It ensures transparency and aids in effective budget management for families.

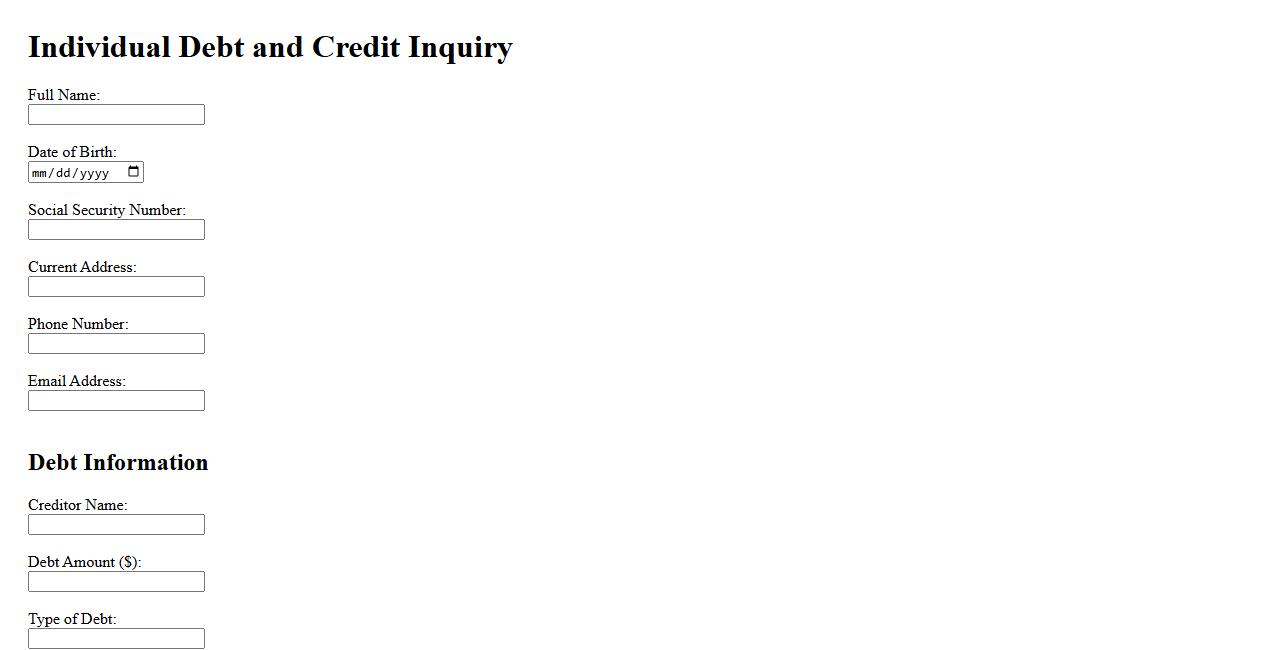

Individual Debt and Credit Inquiry

Individual Debt and Credit Inquiry involves reviewing a person's credit history to assess their financial behavior and outstanding obligations. This process helps lenders evaluate creditworthiness and make informed decisions about loan approvals. Monitoring credit inquiries regularly can improve financial management and prevent identity theft.

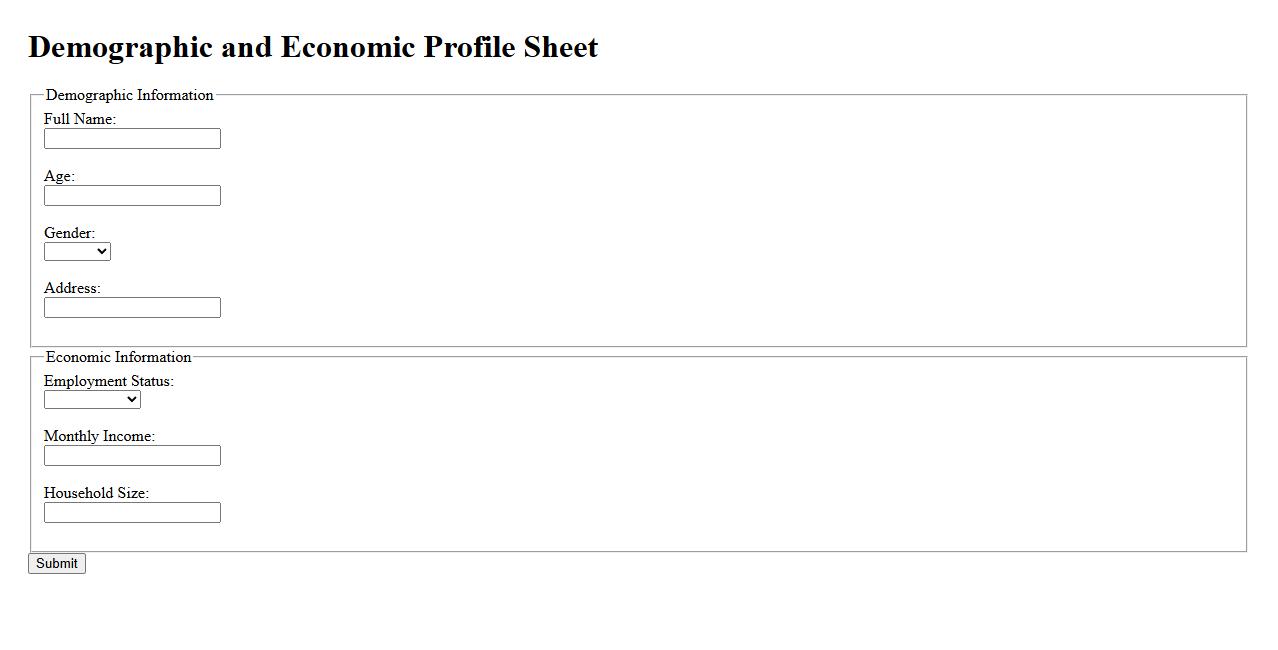

Demographic and Economic Profile Sheet

The Demographic and Economic Profile Sheet provides a comprehensive overview of population statistics and economic indicators. It helps businesses and policymakers understand trends and make informed decisions. This profile includes data such as age distribution, income levels, employment rates, and industry sectors.

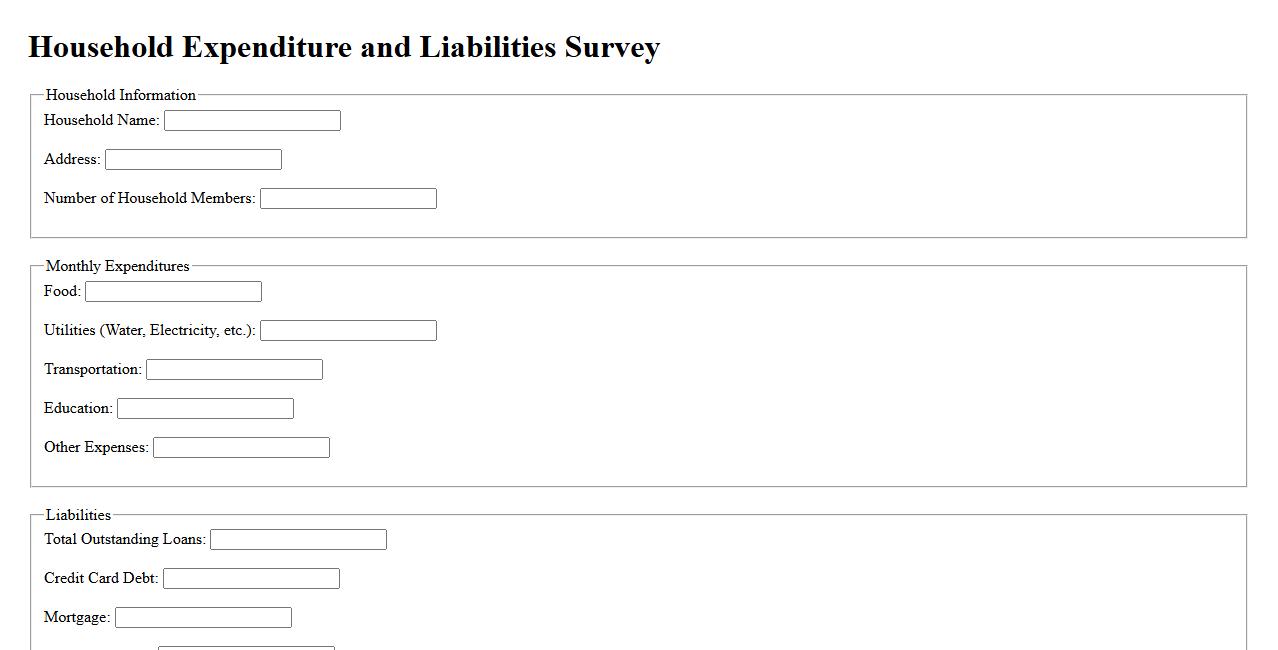

Household Expenditure and Liabilities Survey

The Household Expenditure and Liabilities Survey is a comprehensive study that collects detailed data on the spending habits and financial obligations of households. It provides valuable insights into consumption patterns, debt levels, and economic behavior. This survey is essential for policymakers and researchers to understand and address household financial health.

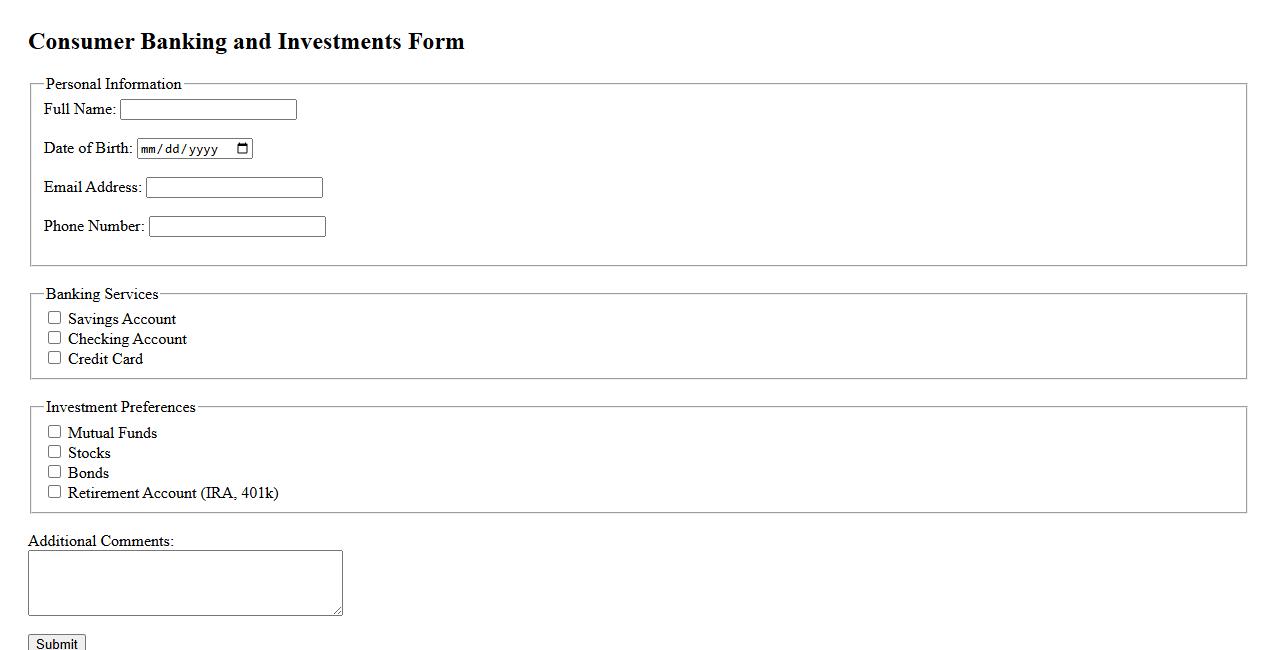

Consumer Banking and Investments Form

The Consumer Banking and Investments Form is designed to streamline the process of managing personal finances and investment options. It enables users to provide essential information for opening accounts, applying for loans, or making investment decisions. This form ensures secure and efficient handling of financial transactions and services.

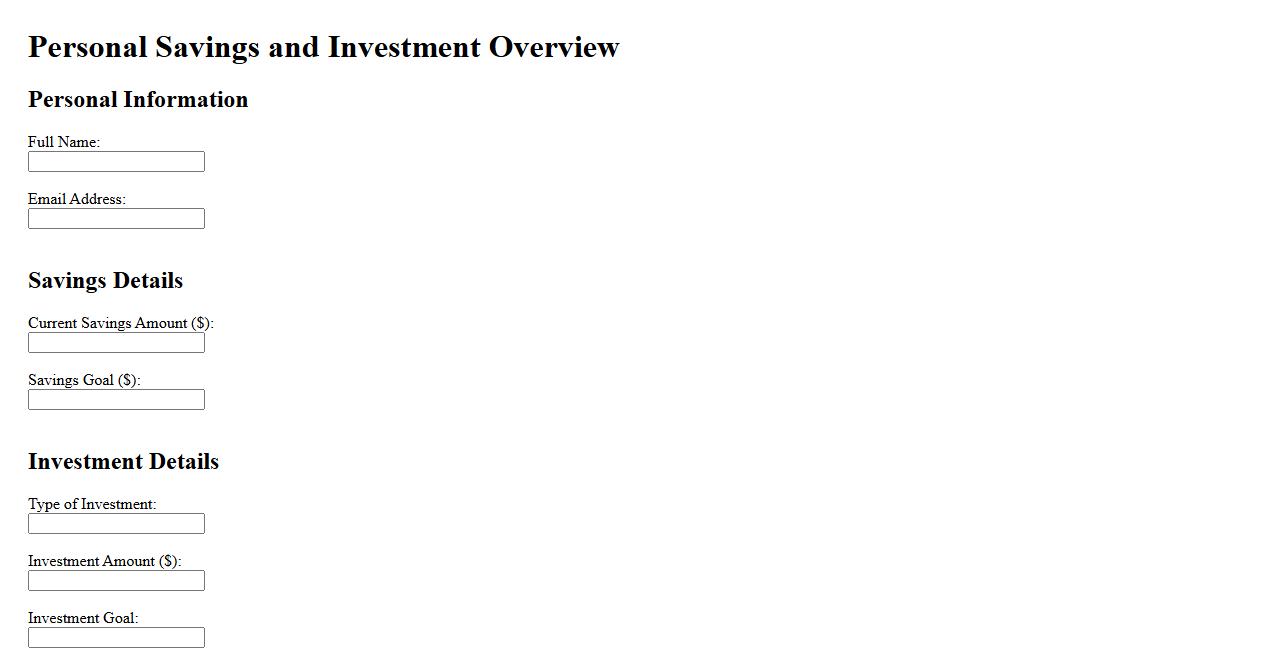

Personal Savings and Investment Overview

A personal savings and investment overview provides a clear snapshot of your financial status, highlighting your accumulated savings and investment portfolio. It helps in tracking growth, assessing risk, and planning future financial goals effectively. Regularly reviewing this overview ensures better money management and informed decision-making.

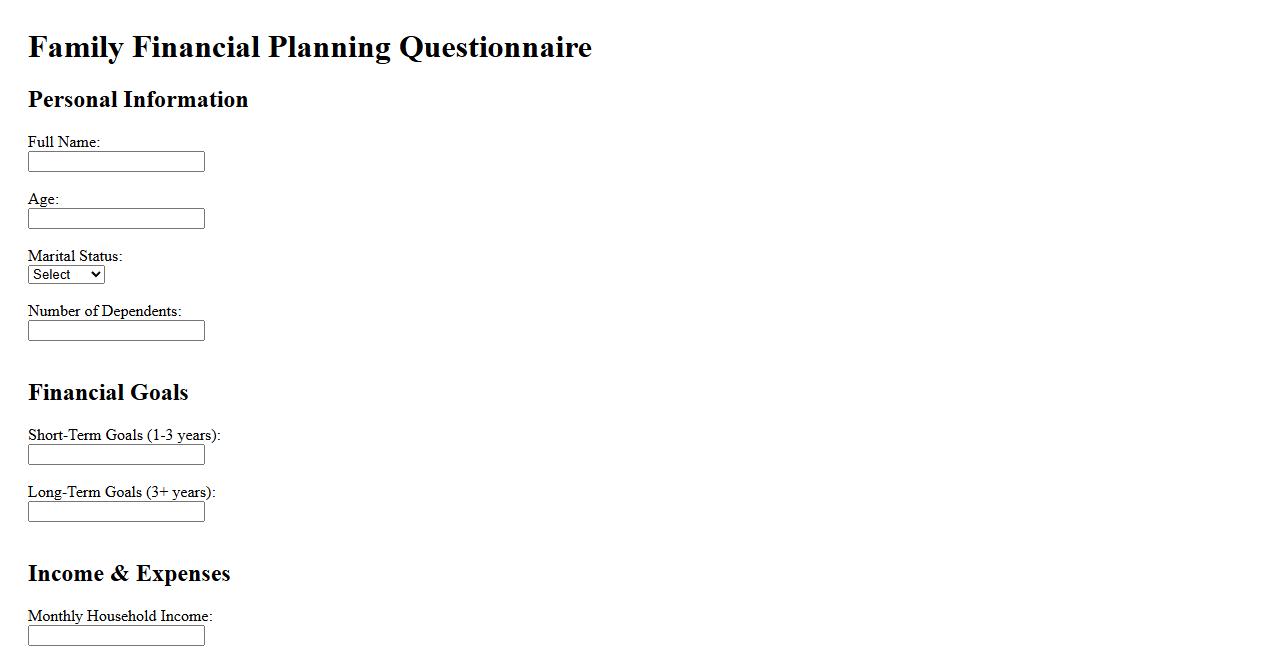

Family Financial Planning Questionnaire

The Family Financial Planning Questionnaire is a crucial tool designed to help families evaluate their current financial situation and set future goals. It covers income, expenses, savings, and investment priorities to provide a comprehensive overview. By completing this questionnaire, families can create personalized strategies for financial stability and growth.

What is the primary purpose of the Survey of Consumer Finance Form?

The primary purpose of the Survey of Consumer Finance Form is to collect detailed information on the financial status of U.S. households. This data helps policymakers understand consumer wealth, debt, and financial behavior. Accurate responses enable comprehensive economic analysis and support effective, targeted policy decisions.

Which types of financial assets does the form require you to report?

The form requires respondents to report a wide range of financial assets including checking and savings accounts, stocks, bonds, retirement accounts, and real estate holdings. It captures both liquid assets and long-term investments. This detailed asset information helps assess household wealth and financial stability.

How does the form categorize household income sources?

Household income sources on the form are categorized into wages and salaries, self-employment income, Social Security, pensions, and investment income. This breakdown provides a clear understanding of diverse income streams. It assists analysts in evaluating income patterns and economic well-being.

What demographic information is essential on the form for analysis?

Essential demographic information includes age, gender, race, education level, and household composition. These details help contextualize financial data within different population groups. This demographic insight is crucial for identifying economic disparities and trends.

How is debt or liability information structured for respondent disclosure?

Debt and liability information is structured to capture mortgages, credit card debt, student loans, auto loans, and other personal debts. Respondents must provide amounts owed and payment terms when applicable. This structured disclosure allows precise measurement of household financial obligations.