Registering for a Taxpayer Identification Number (TIN) is essential for individuals and businesses to comply with tax regulations. This unique identifier facilitates tax filing, payment, and tracking by the tax authorities. The registration process typically requires submitting personal or business information through the designated government agency.

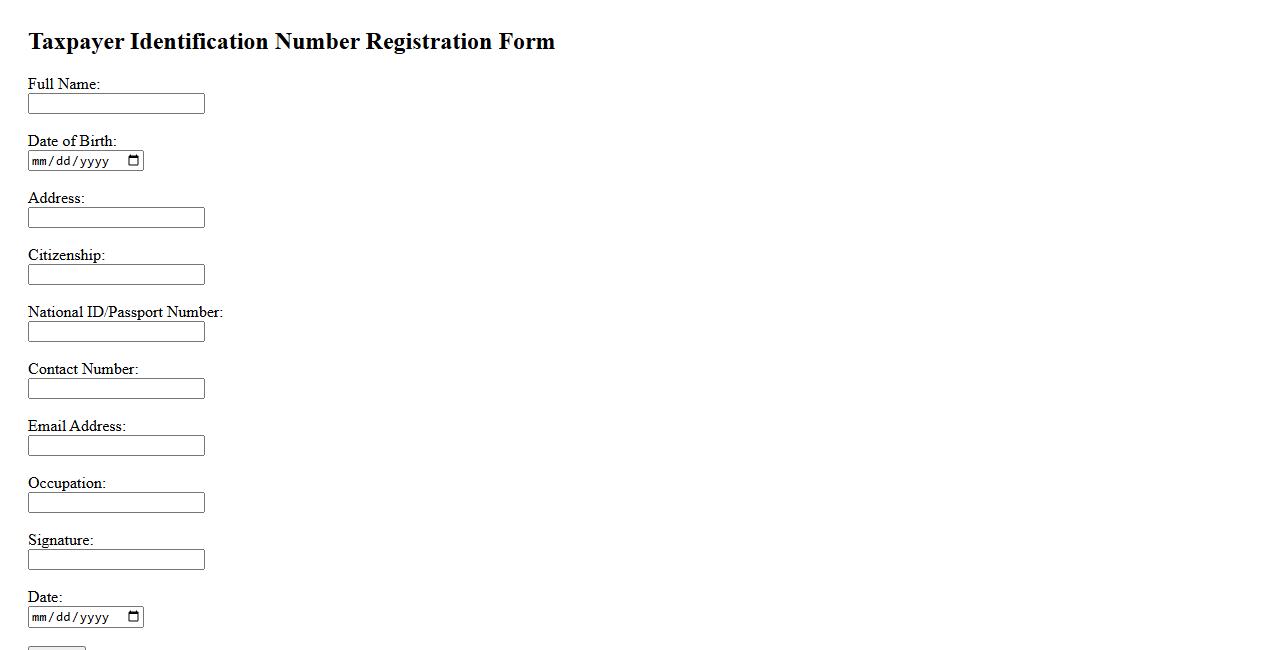

Taxpayer Identification Number Registration Form

The Taxpayer Identification Number Registration Form is an essential document used to register or update a taxpayer's identification details with the relevant tax authorities. It ensures accurate tracking of individual or business tax obligations and compliance. Completing this form correctly helps facilitate efficient tax processing and reporting.

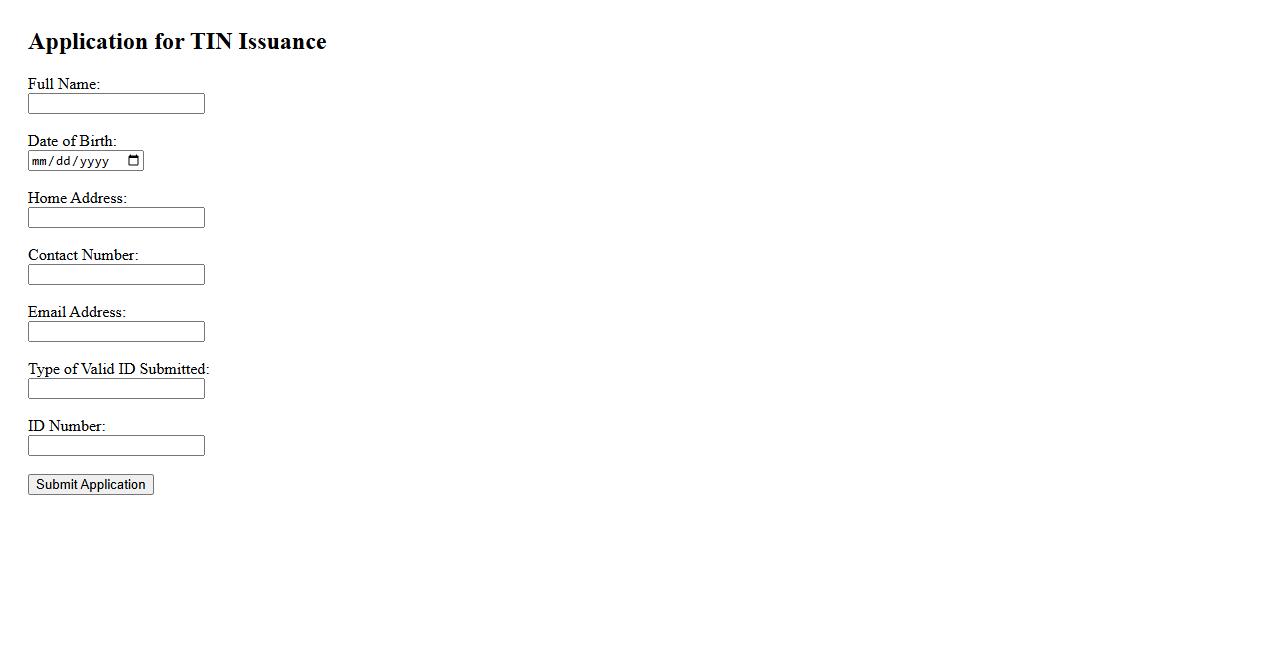

Application for TIN Issuance

The Application for TIN Issuance is a formal process required to obtain a Tax Identification Number, essential for tax-related transactions and compliance. This application must be submitted to the relevant tax authority with accurate personal or business information. Securing a TIN enables efficient tax reporting and legal recognition for individuals and entities.

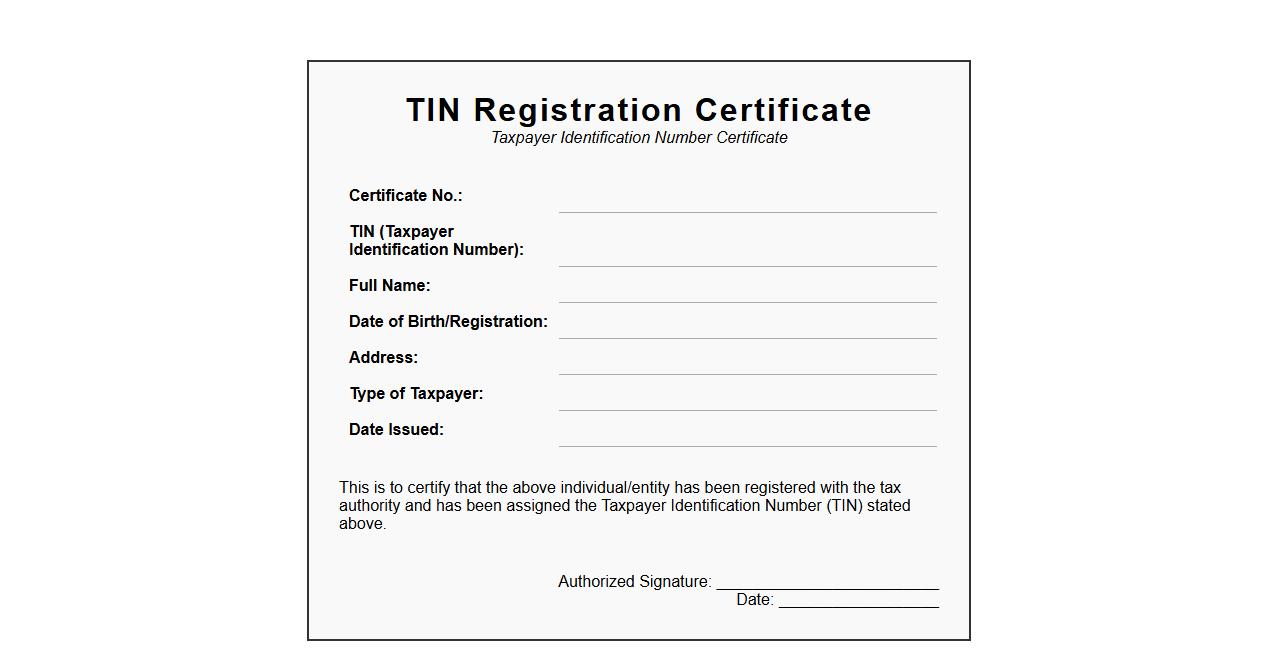

TIN Registration Certificate

The TIN Registration Certificate is an essential document that verifies a business's Tax Identification Number, ensuring compliance with tax regulations. It facilitates smooth tax filing and transaction processes with government authorities. This certificate serves as proof of legal business operations within the tax system.

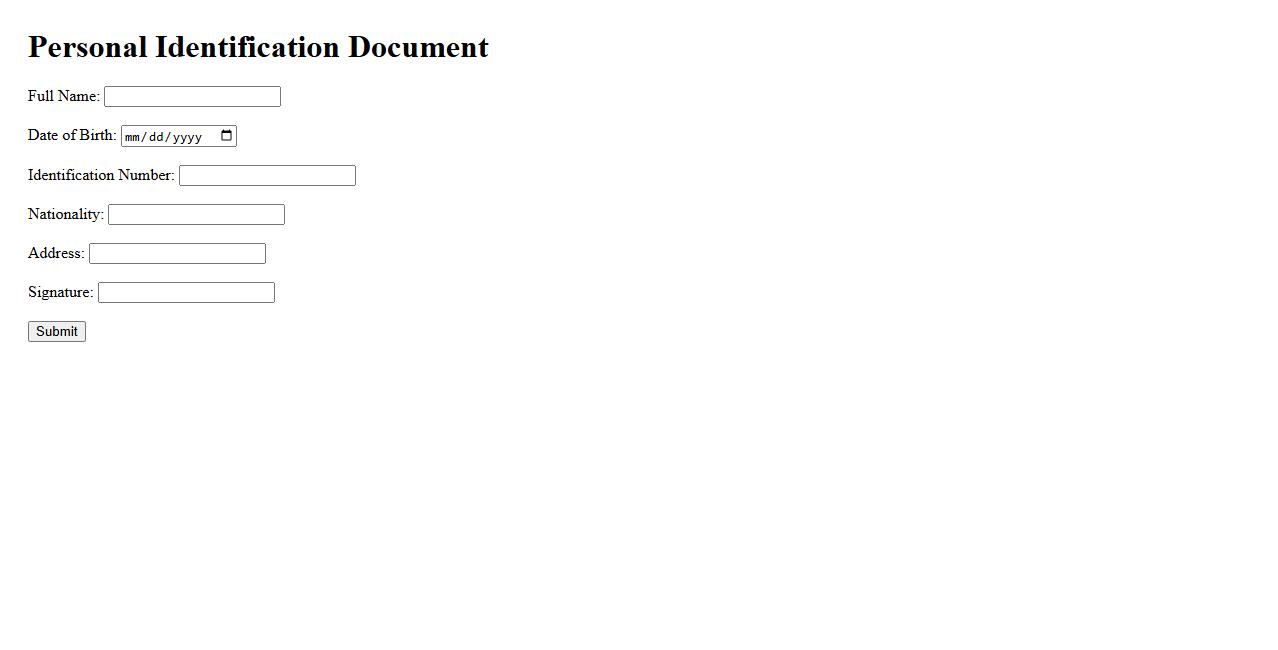

Personal Identification Document

A Personal Identification Document is an official paper or digital card that verifies an individual's identity. It typically contains key information such as name, date of birth, photograph, and a unique identification number. These documents are essential for accessing services, traveling, and proving legal status.

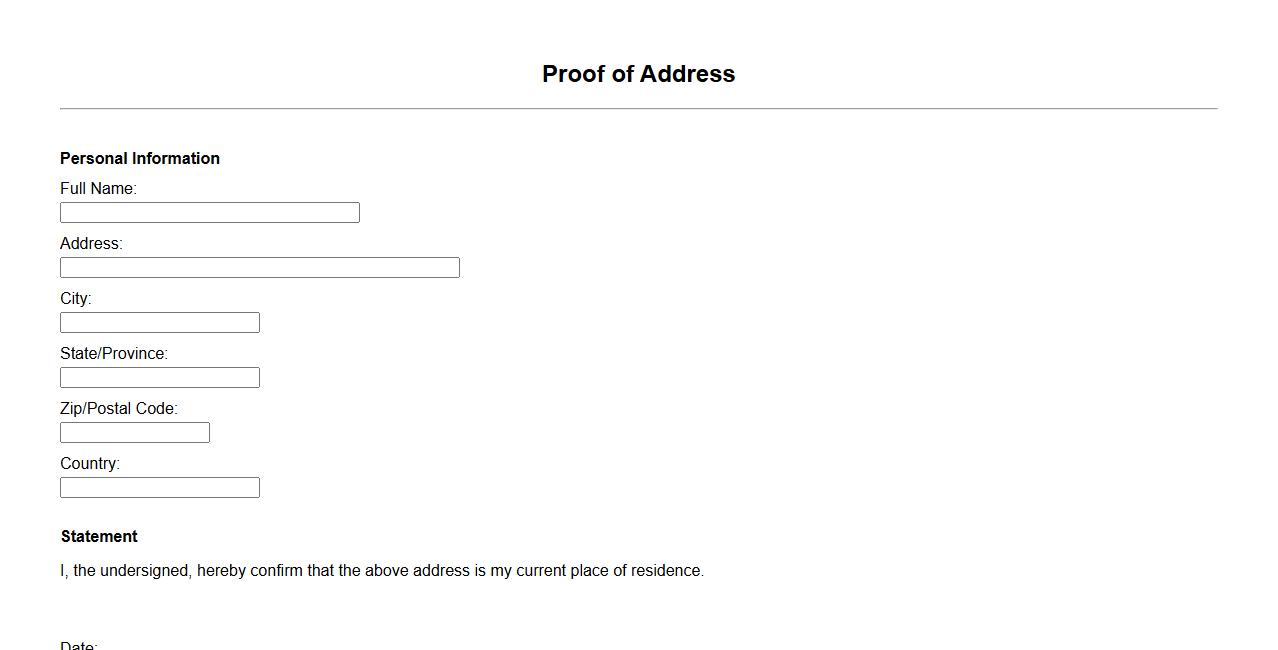

Proof of Address

Proof of Address is an important document used to verify a person's residential location. It is commonly required for official processes such as opening bank accounts or applying for government services. Examples include utility bills, rental agreements, and official correspondence.

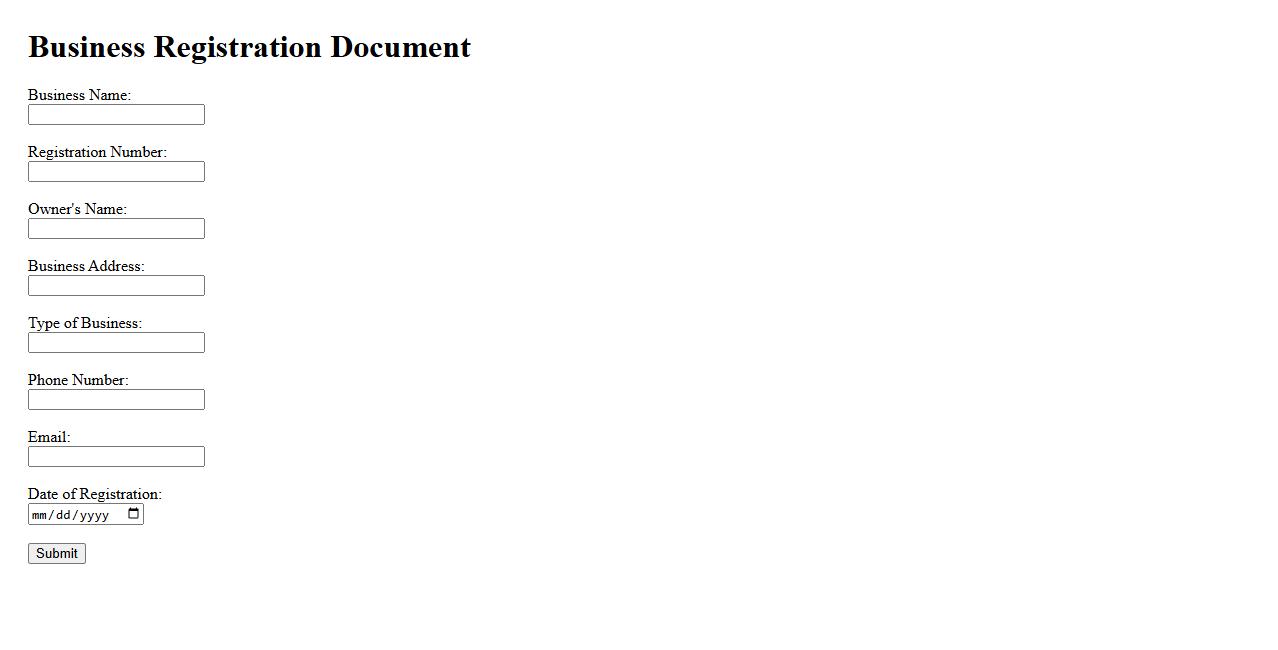

Business Registration Document

The Business Registration Document serves as an official certificate that validates the establishment and legal recognition of a company. It contains essential details such as the business name, registration number, and date of incorporation. This document is crucial for conducting legal, financial, and operational activities.

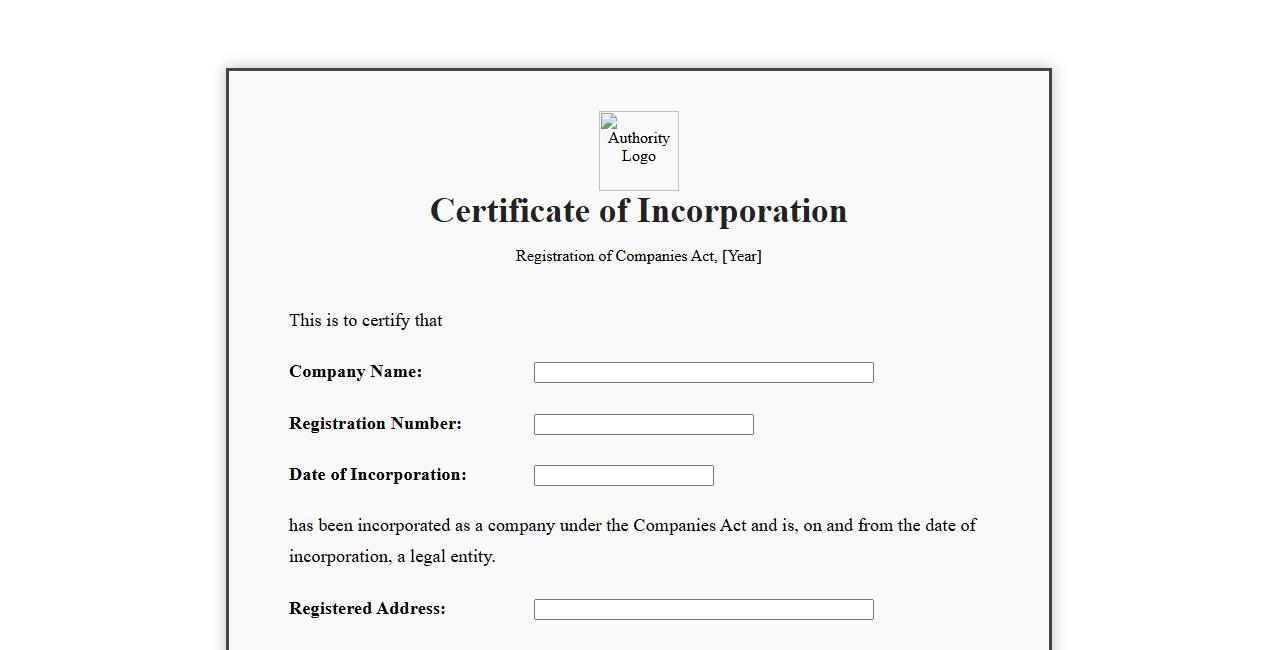

Company Incorporation Certificate

A Company Incorporation Certificate is an official document issued by the government that verifies the legal formation of a company. It serves as proof that the company is recognized as a separate legal entity and is authorized to conduct business. This certificate typically includes important details such as the company name, registration number, and date of incorporation.

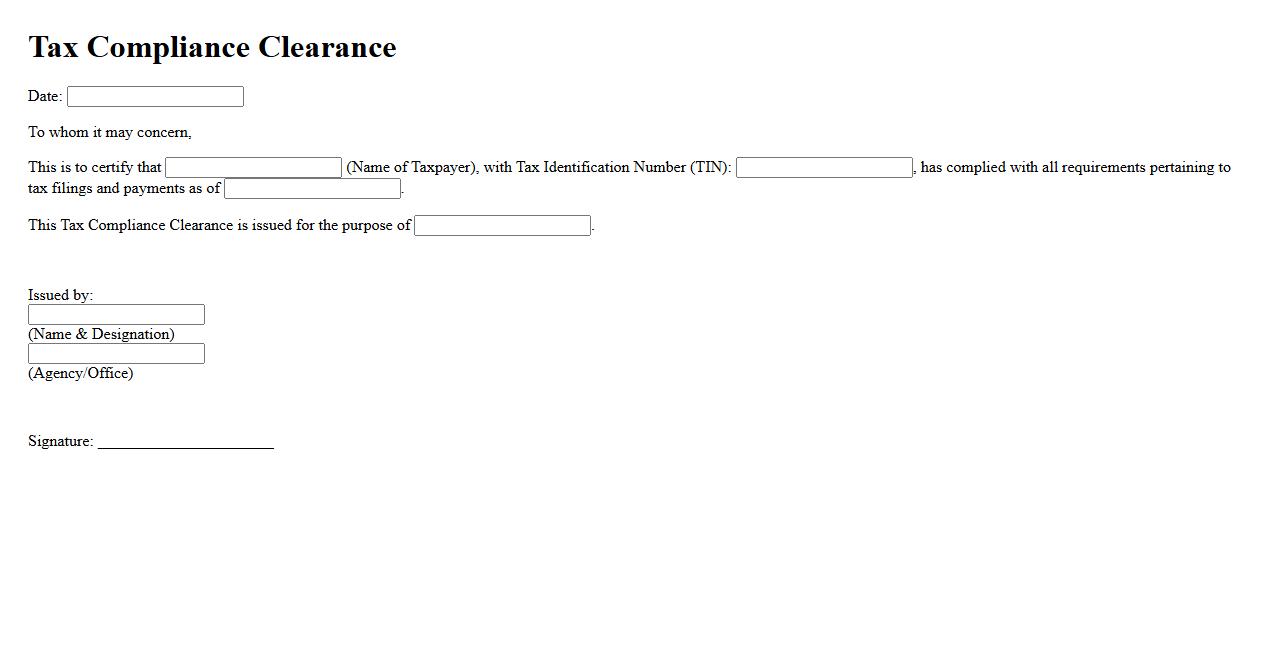

Tax Compliance Clearance

Tax Compliance Clearance is an official certification issued by tax authorities confirming that an individual or business has fulfilled all tax obligations. This document is essential for various financial and legal transactions, ensuring compliance with tax regulations. Obtaining this clearance helps avoid penalties and supports transparent fiscal practices.

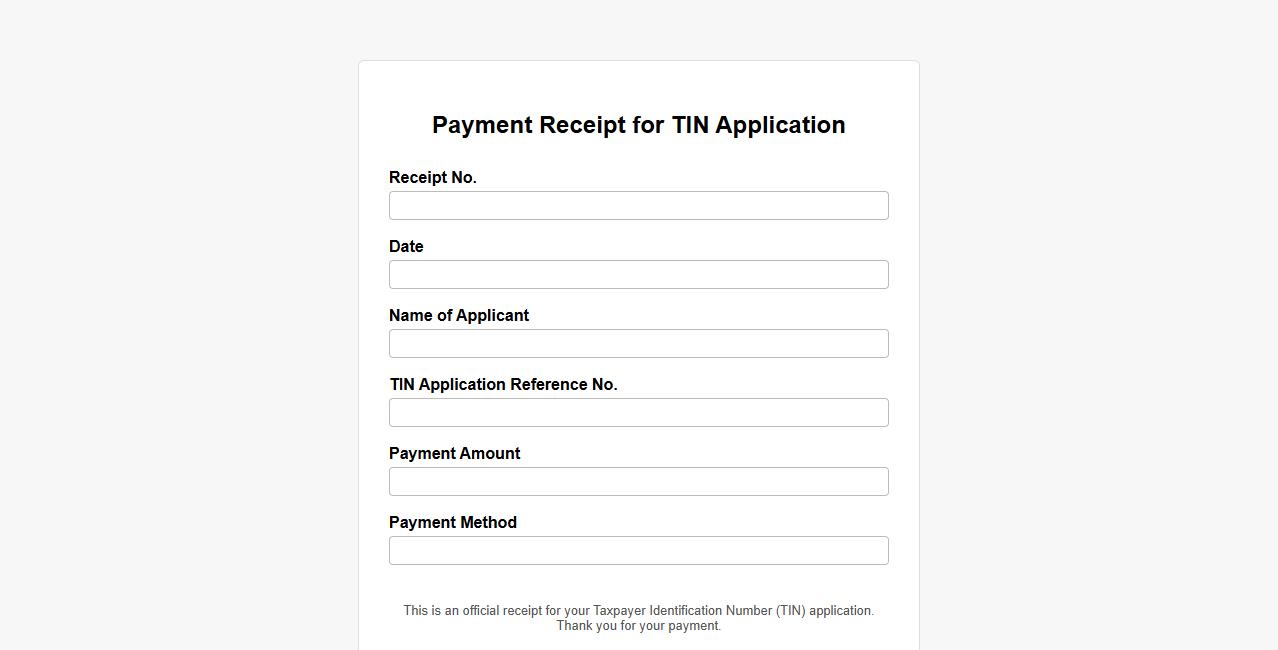

Payment Receipt for TIN Application

Your Payment Receipt for TIN Application confirms the successful submission of your Tax Identification Number payment. It serves as proof of transaction and is necessary for further processing and verification. Keep this receipt for your records and future reference.

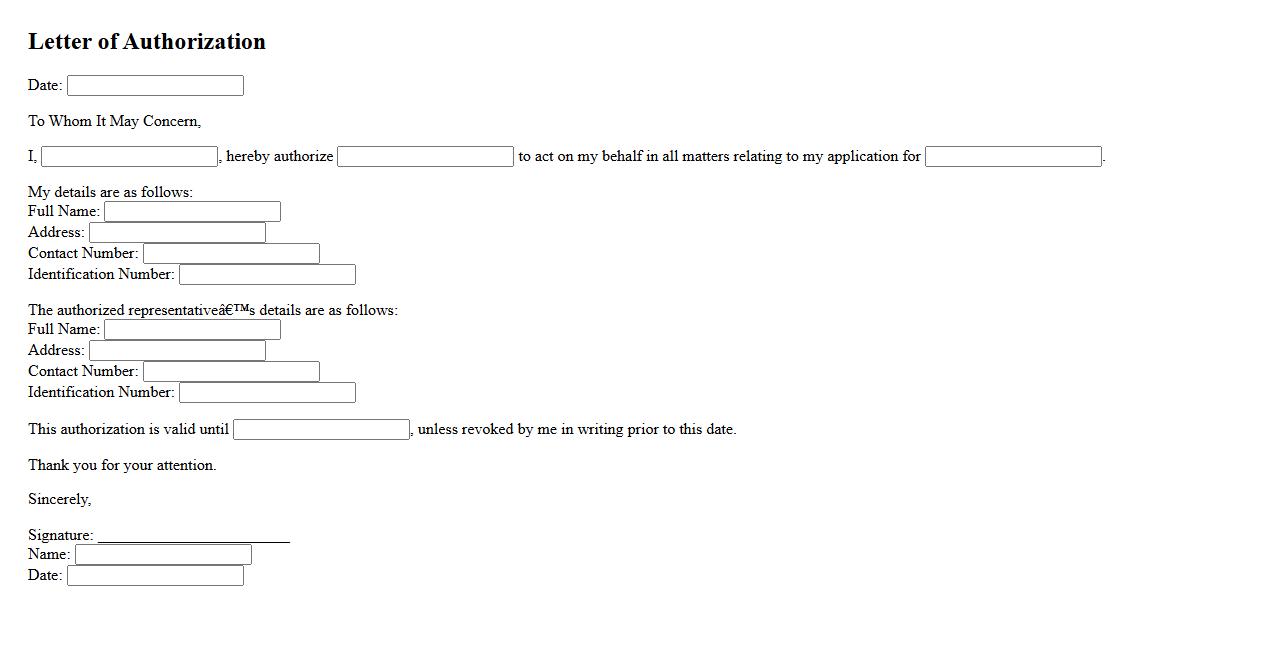

Letter of Authorization (if applying through a representative)

A Letter of Authorization is required when applying through a representative, granting them permission to act on your behalf. This document ensures that the representative can legally manage your application process. It must be signed and clearly state the scope of authorization.

What is the primary purpose of obtaining a Taxpayer Identification Number (TIN)?

The primary purpose of obtaining a Taxpayer Identification Number (TIN) is to uniquely identify taxpayers within the tax system. This number facilitates accurate tracking of tax obligations and payments by tax authorities. It is essential for ensuring proper tax administration and compliance.

Which documents are typically required to complete the TIN registration process?

To complete the TIN registration process, applicants usually need to provide valid government-issued identification, such as a passport or national ID card. Additional documents may include proof of address and completed application forms. These documents ensure the accuracy and legitimacy of the taxpayer's registration.

Who is eligible or required to register for a TIN in the given jurisdiction?

Individuals and entities engaging in taxable activities within the jurisdiction are typically required to register for a TIN. This includes employees, self-employed persons, businesses, and organizations. The registration ensures that all responsible parties comply with the local tax laws.

What are the key steps involved in submitting a TIN application?

The key steps in submitting a TIN application include completing the registration form, gathering the necessary identification documents, and submitting them to the relevant tax authority. Some jurisdictions offer online registration portals to simplify this process. Following verification, applicants receive their unique TIN.

How does TIN registration affect an individual's or entity's tax compliance obligations?

Registering for a TIN establishes the taxpayer's legal identity and accountability within the tax system. It enables efficient processing of tax returns, payments, and audits by tax authorities. Consequently, TIN registration is a crucial step toward fulfilling tax compliance obligations.