Registration of Charity is the process through which a nonprofit organization officially obtains legal recognition to operate within a specific jurisdiction. This procedure involves submitting necessary documents, such as bylaws and proof of purpose, to the relevant government authority. Completing the registration of charity ensures eligibility for tax exemptions and public trust.

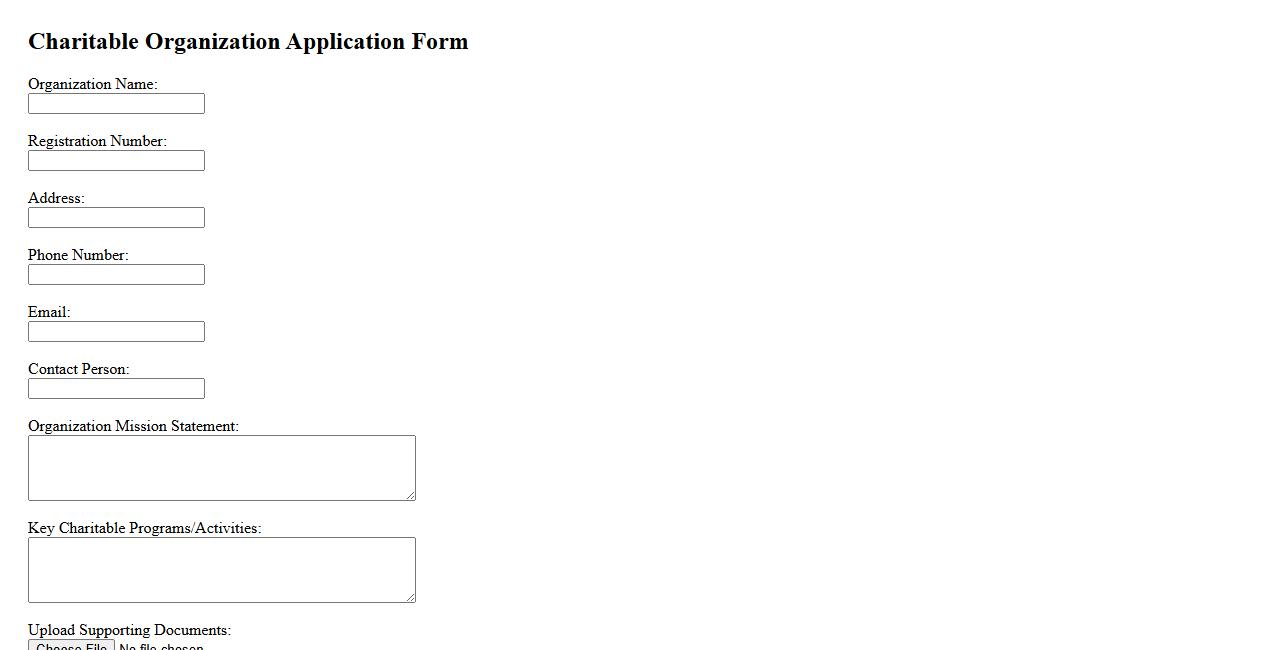

Charitable Organization Application Form

The Charitable Organization Application Form is designed to collect essential information from nonprofits seeking registration or partnership. This form ensures transparency and compliance by gathering details about the organization's mission, activities, and financial status. Accurate completion of this document is crucial for approval and ongoing support.

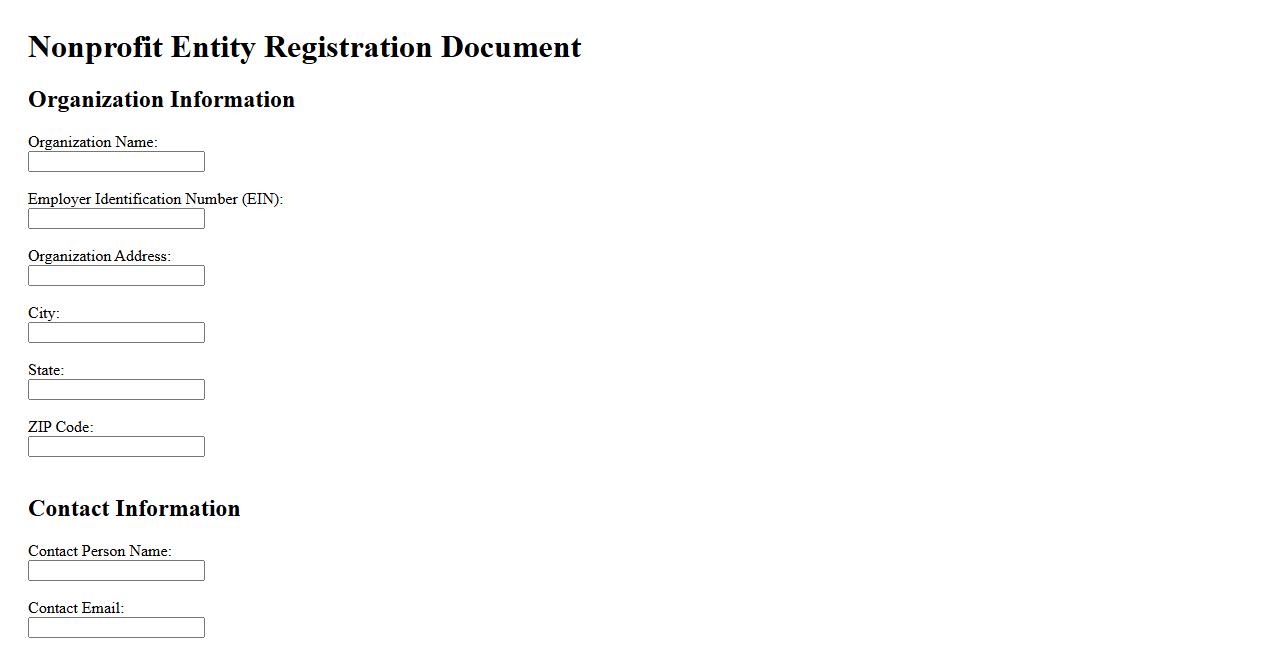

Nonprofit Entity Registration Document

The Nonprofit Entity Registration Document is an essential legal form required to officially establish a nonprofit organization. This document ensures compliance with government regulations and enables the entity to operate as a tax-exempt organization. Proper registration facilitates transparency and builds trust with donors and stakeholders.

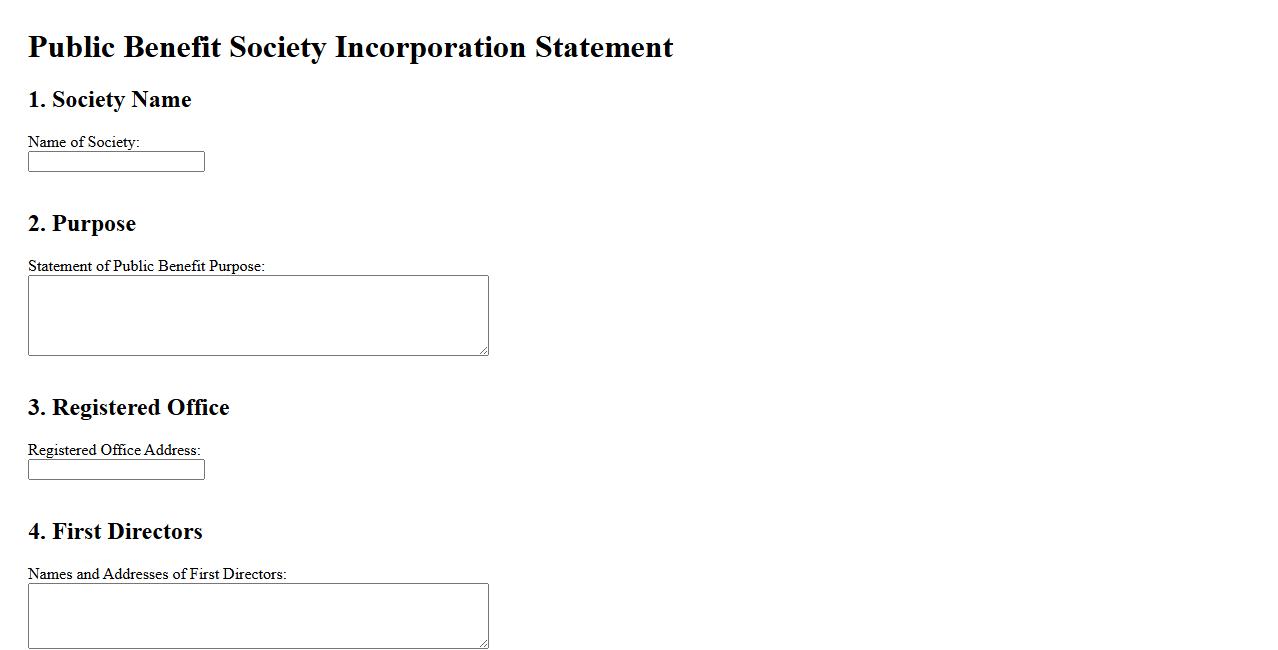

Public Benefit Society Incorporation Statement

The Public Benefit Society Incorporation Statement is a crucial legal document that formalizes the establishment of a society dedicated to serving the public good. It outlines the objectives, governance structure, and operational guidelines to ensure transparency and accountability. This statement is essential for obtaining legal recognition and demonstrating commitment to community welfare.

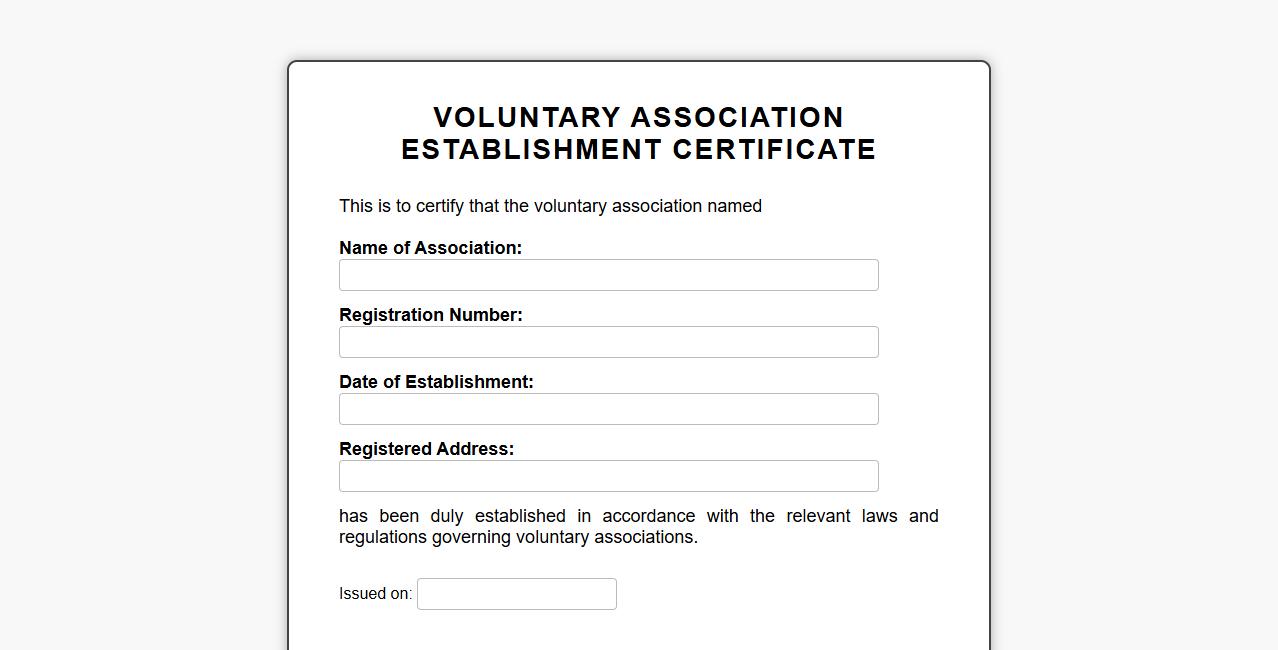

Voluntary Association Establishment Certificate

The Voluntary Association Establishment Certificate is an official document that validates the formation of a voluntary association. It ensures the group is legally recognized and can operate within the specified regulations. This certificate is essential for establishing credibility and accessing various benefits for the association.

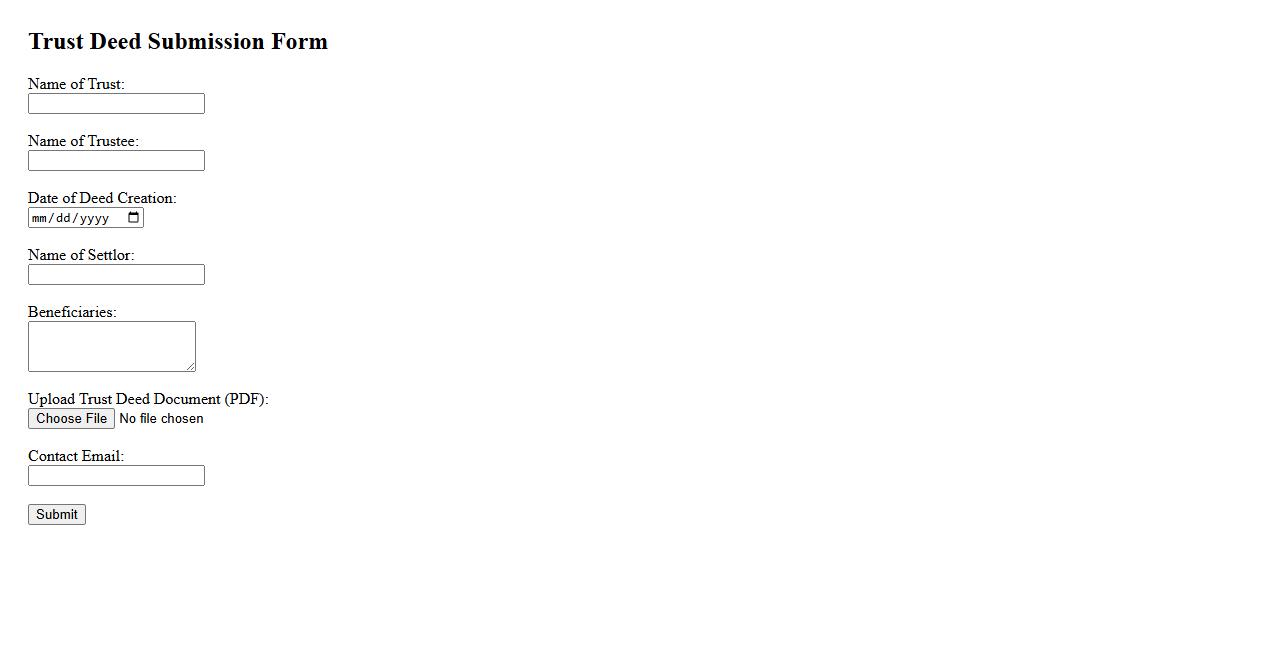

Trust Deed Submission Form

The Trust Deed Submission Form is a vital document used to formally register a trust deed with relevant authorities. It ensures all necessary details about the trust and involved parties are accurately recorded. Proper submission aids in legal compliance and protects the interests of beneficiaries.

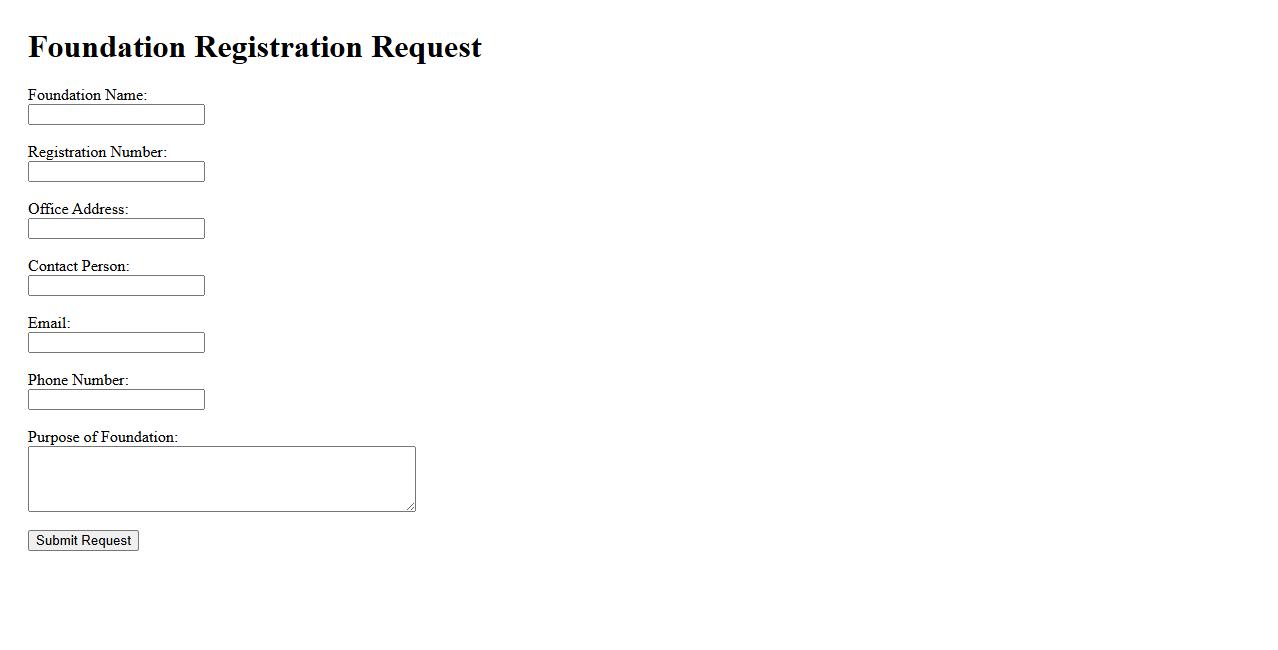

Foundation Registration Request

A Foundation Registration Request is a formal application submitted to legally establish a foundation as a recognized entity. This process ensures compliance with governmental regulations and allows the foundation to operate officially. Proper registration is essential for transparency, credibility, and access to funding opportunities.

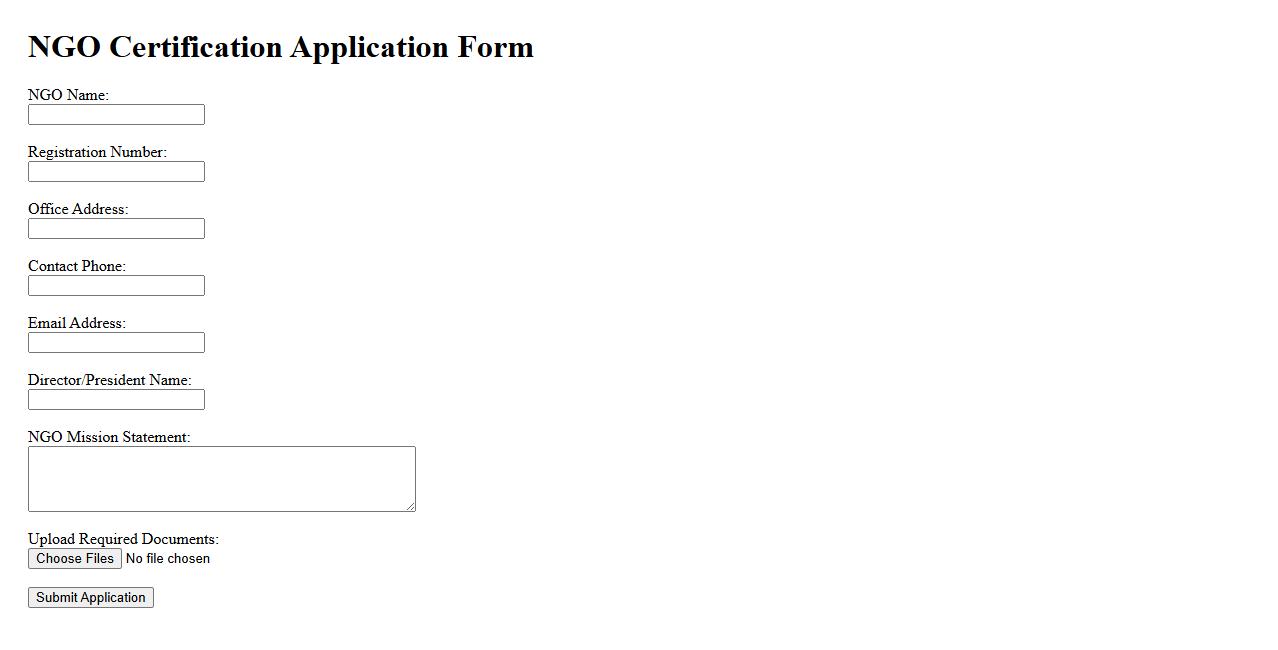

NGO Certification Application

The NGO Certification Application process ensures that non-governmental organizations meet specific standards for transparency and accountability. This certification helps build trust among donors and stakeholders. Completing the application accurately is essential for gaining official recognition.

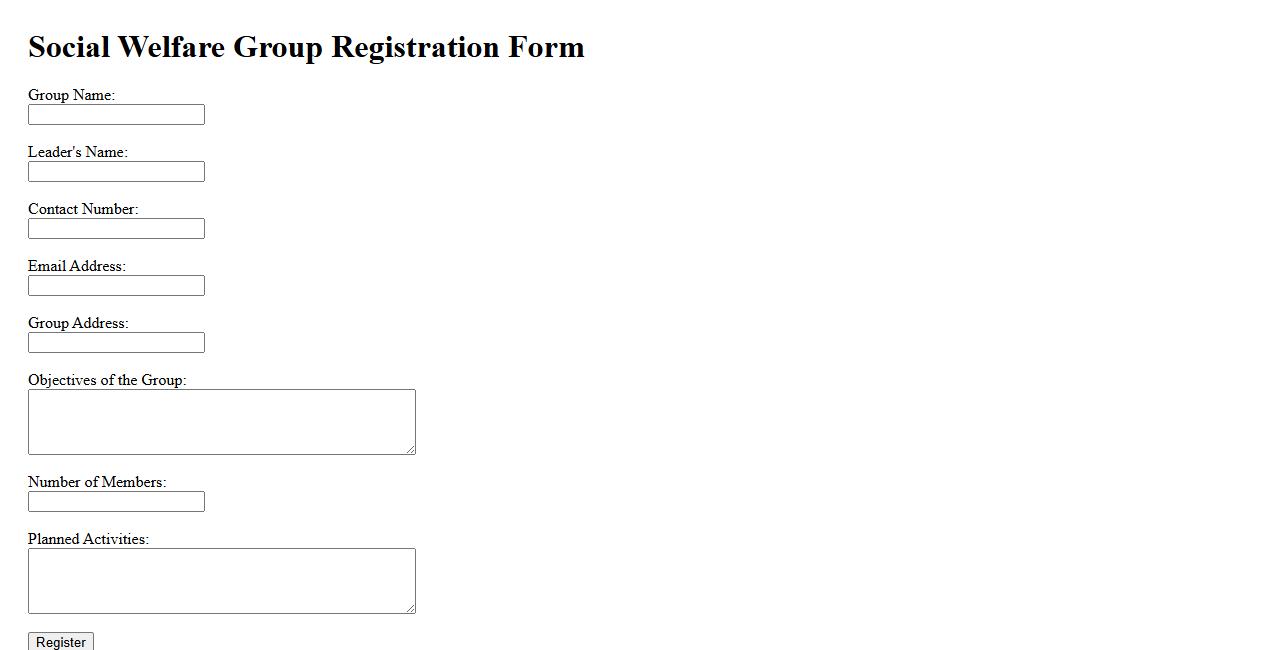

Social Welfare Group Registration Form

The Social Welfare Group Registration Form is a crucial document for officially recognizing social welfare organizations. It collects essential information about the group's objectives, members, and activities to ensure compliance with legal requirements. This form facilitates transparency and accountability in delivering social services to the community.

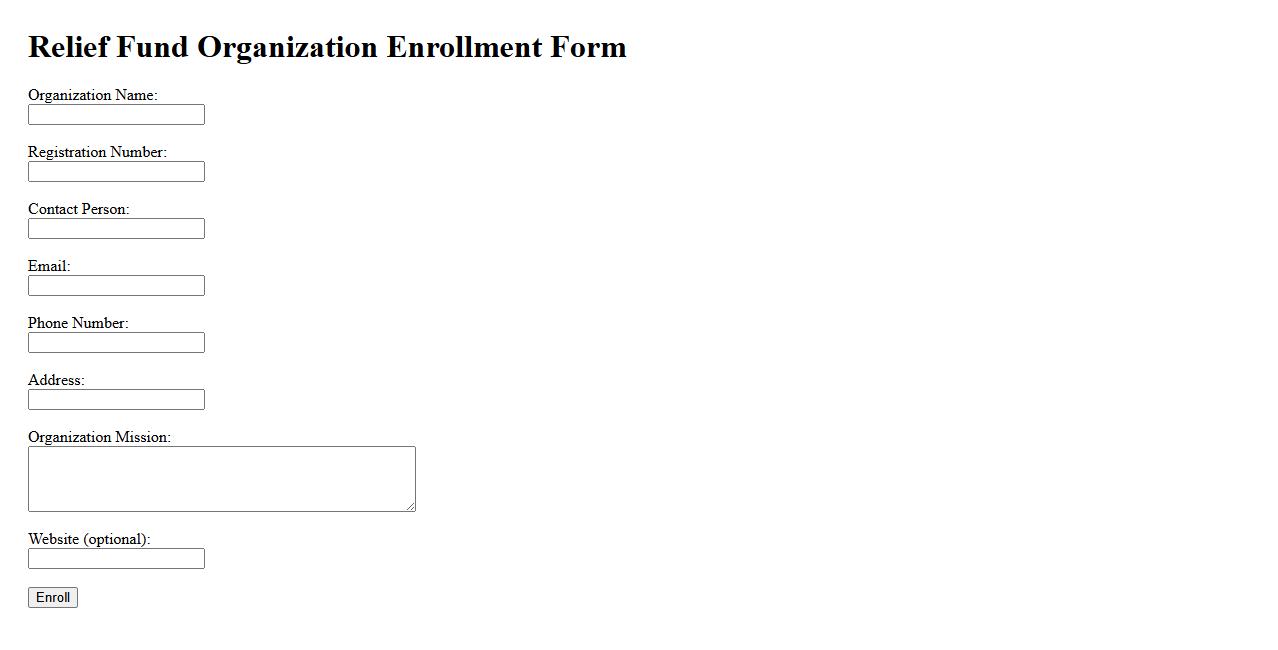

Relief Fund Organization Enrollment

The Relief Fund Organization Enrollment process allows individuals and groups to register for access to vital financial aid during emergencies. This enrollment ensures timely support and efficient distribution of resources to those in need. Participants can easily complete the application online to secure assistance quickly.

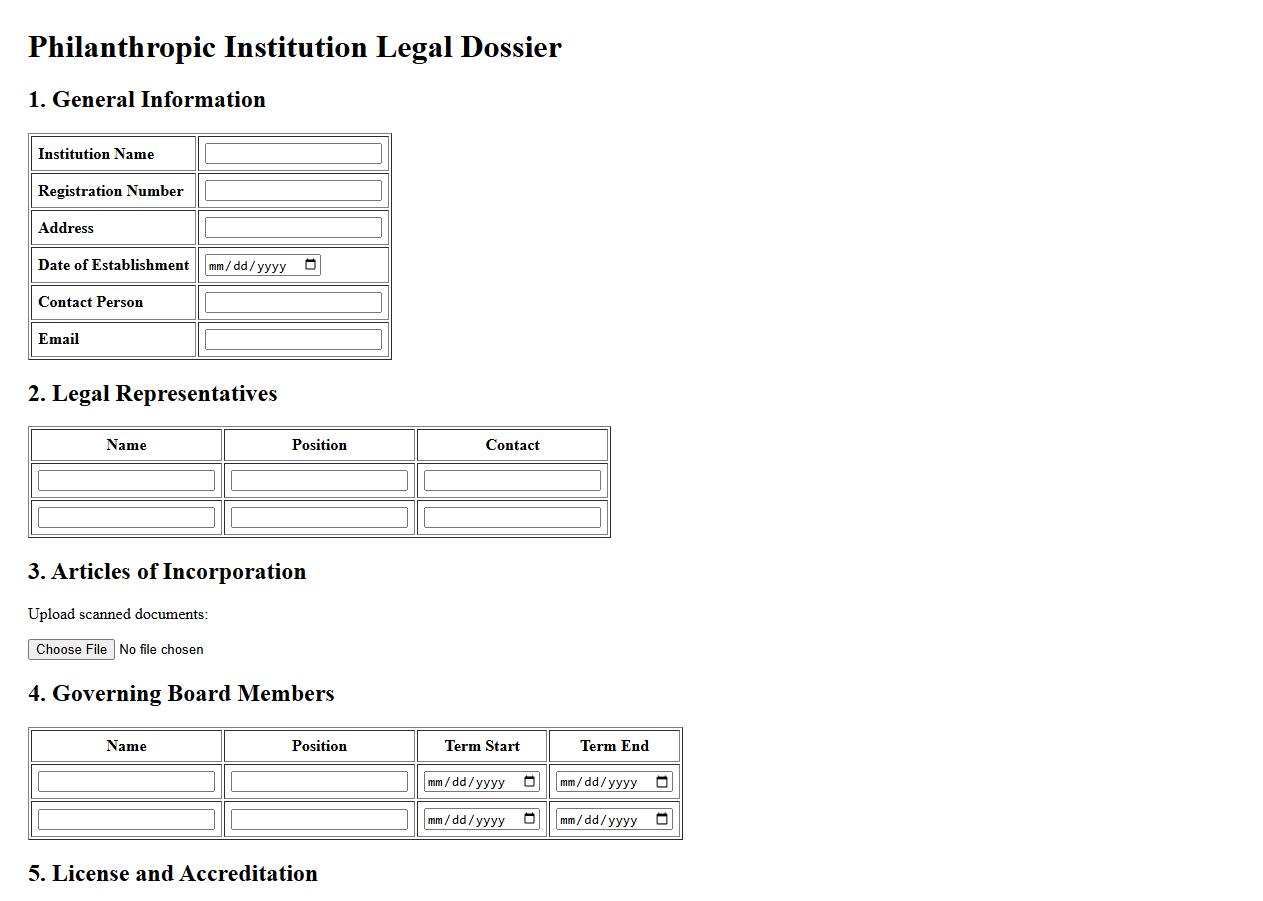

Philanthropic Institution Legal Dossier

The Philanthropic Institution Legal Dossier serves as a comprehensive record detailing the legal framework and compliance requirements for nonprofit organizations. It ensures transparency and accountability by documenting governance policies, tax statuses, and regulatory adherence. This dossier is essential for maintaining trust and legitimacy in philanthropic activities.

What are the essential legal requirements for registering a charity?

To register a charity, an organization must have a clear charitable purpose that benefits the public. Legal documents such as a governing document (e.g., articles of incorporation or trust deed) are required to define the charity's structure. Additionally, organizations must comply with specific jurisdictional laws and demonstrate proper governance and financial management.

How does an organization determine its eligibility for charity status?

Eligibility depends primarily on whether the organization's purpose aligns with recognized charitable objectives such as education, relief of poverty, or advancement of religion. The organization must also demonstrate that its activities provide a public benefit and are not primarily for private gain. Confirming eligibility often involves reviewing local charity laws and guidelines provided by regulatory bodies.

What documents and information must be submitted during the charity registration process?

The submission typically includes the organization's governing document, detailed description of its activities, and a financial plan or budget. Founders need to provide personal details, such as identification and roles within the charity. Some jurisdictions require evidence of public benefit and a statement of compliance with relevant laws and regulations.

What are the key differences between charitable registration and other nonprofit entities?

Charitable registration grants an organization tax-exempt status and the ability to issue tax-deductible receipts to donors, unlike many other nonprofits. Charities are strictly regulated, with specific reporting and operational standards to ensure public benefit. Other nonprofit entities may focus on member services or advocacy without the same legal obligations and benefits.

How does registration impact a charity's compliance and reporting obligations?

Registered charities must adhere to annual reporting requirements, including financial statements and activity reports submitted to regulatory authorities. Compliance ensures transparency, accountability, and maintenance of tax-exempt status. Failure to meet these obligations can result in penalties or loss of registration.