A Receipt for Payment of Fees serves as an official document confirming the successful payment made for specific services or charges. It typically includes details such as the payer's name, amount paid, date of payment, and the purpose of the fees. This receipt is essential for record-keeping and future reference in financial transactions.

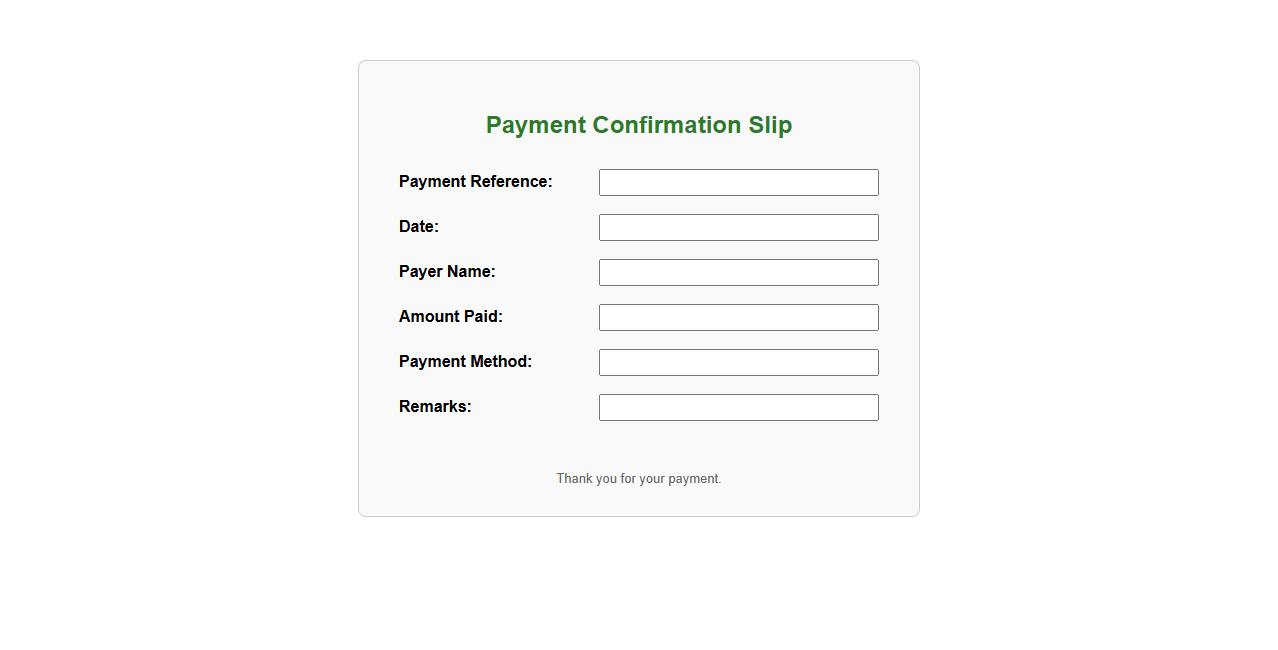

Payment Confirmation Slip

The Payment Confirmation Slip is a crucial document that verifies the completion of a payment transaction. It serves as proof for both the payer and payee, ensuring transparent financial communication. This slip typically includes details such as payment amount, date, and transaction ID for accurate record-keeping.

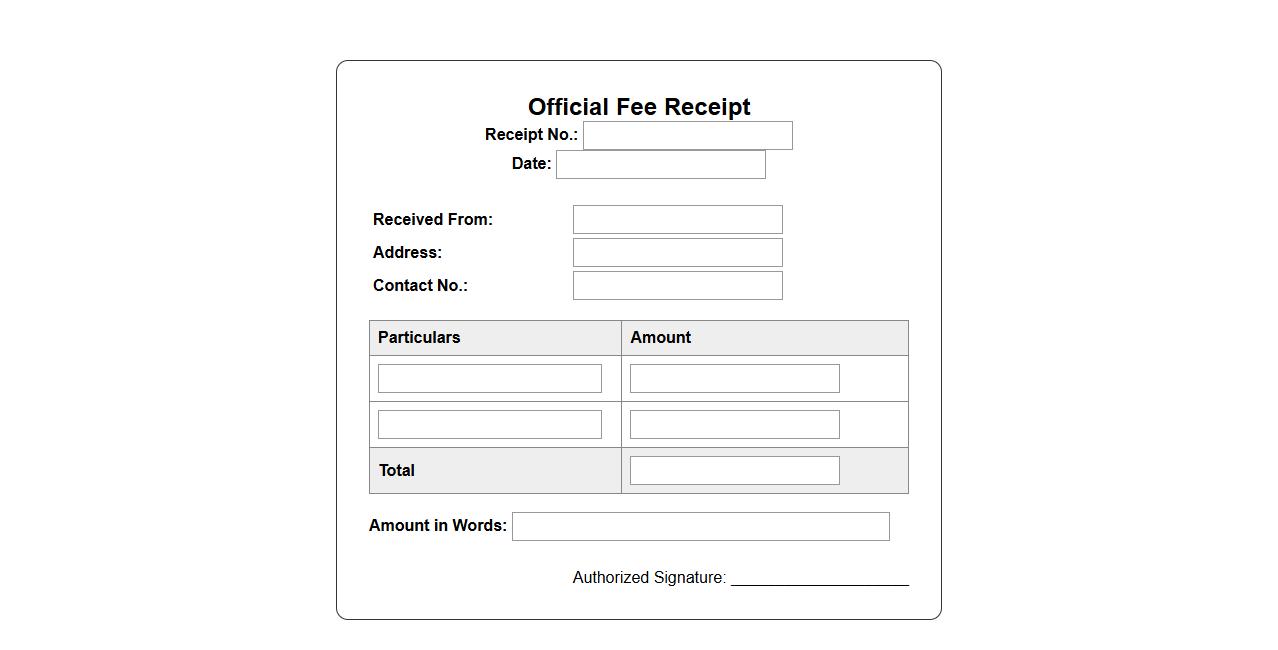

Official Fee Receipt

The Official Fee Receipt is a crucial document issued as proof of payment for fees. It serves as an authenticated record for both the payer and the institution. Always keep this receipt safely for future reference and verification.

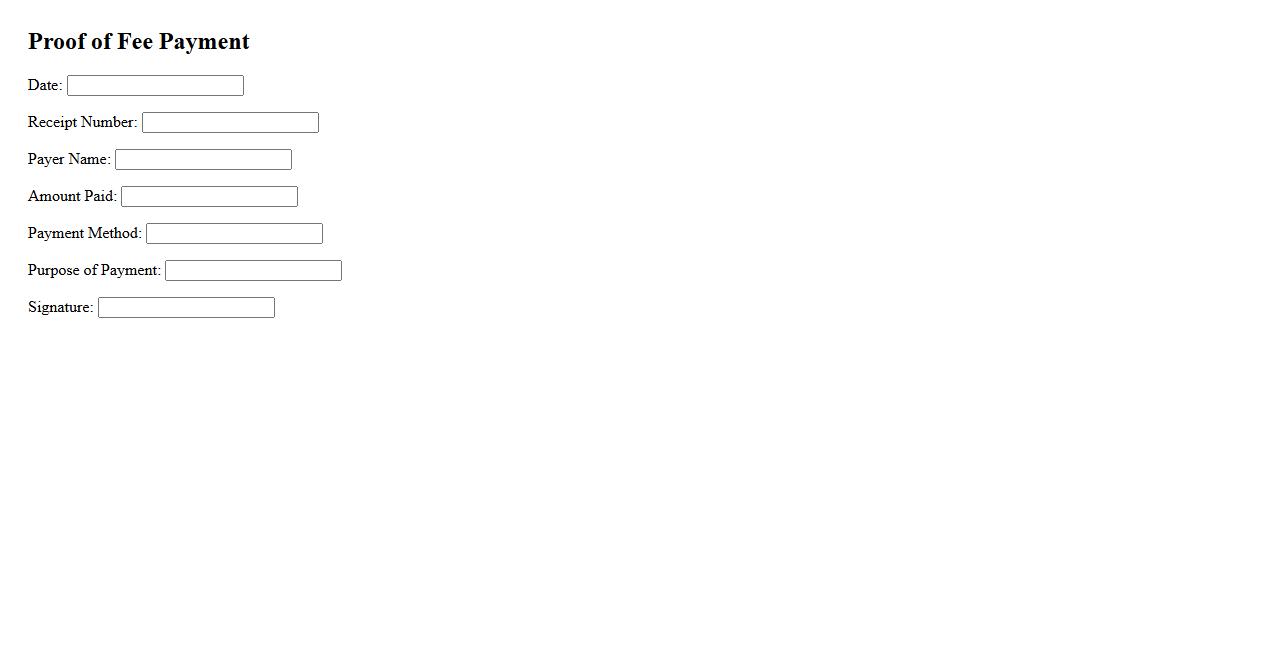

Proof of Fee Payment

Proof of Fee Payment is an essential document that confirms the successful transaction of fees between the payer and the recipient. It serves as official evidence for financial records and helps resolve any payment disputes. This document typically includes details such as the payment amount, date, and method.

Transaction Acknowledgement

The Transaction Acknowledgement confirms the successful receipt and processing of a transaction. It provides users with a clear notification that their action has been recorded. This acknowledgment ensures transparency and trust in financial or communication processes.

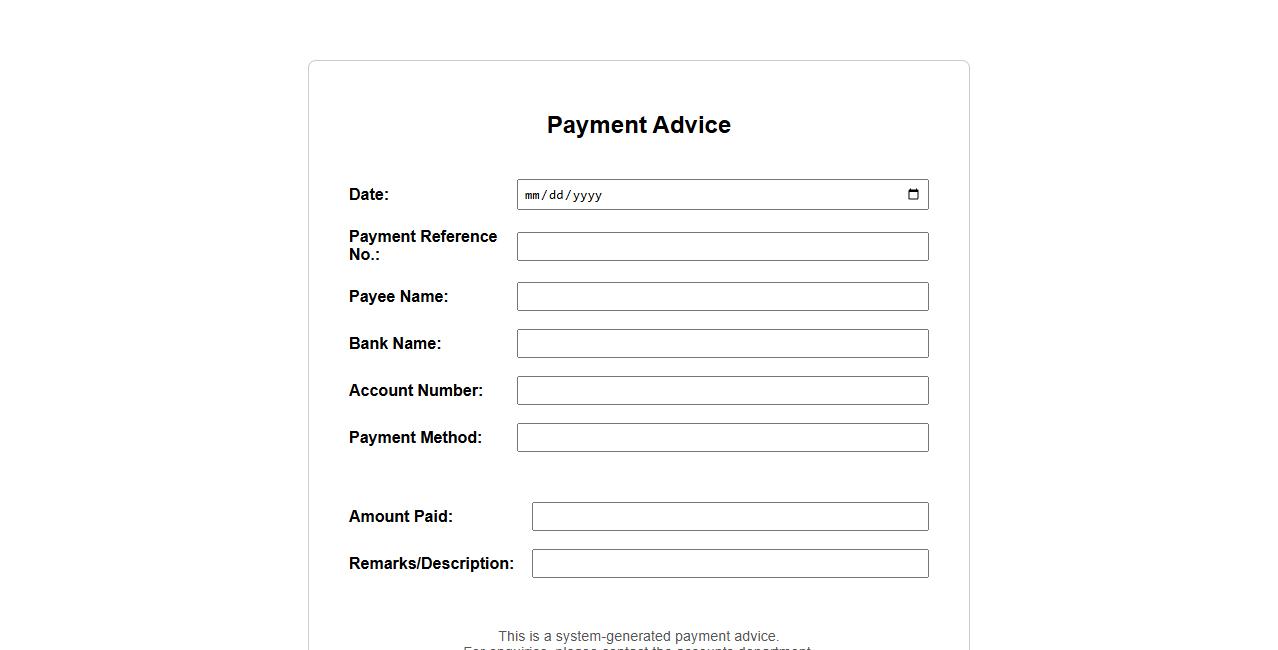

Payment Advice

Payment Advice is a document provided to a payee detailing the specifics of a payment, including amount, date, and purpose. It ensures transparency and helps reconcile accounts accurately. This communication is essential for maintaining clear financial records between parties.

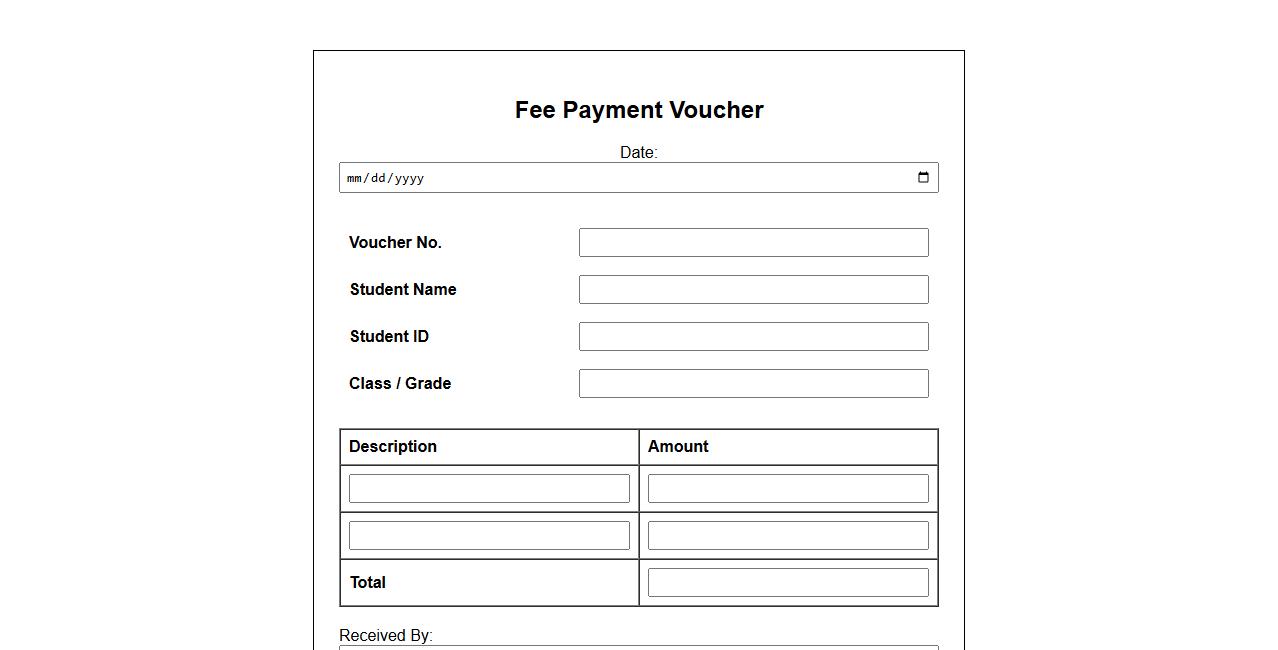

Fee Payment Voucher

A Fee Payment Voucher is an official document used to confirm the payment of fees for services or educational purposes. It serves as proof of transaction and helps in maintaining accurate financial records. This voucher typically includes details such as the payer's name, payment amount, and date of payment.

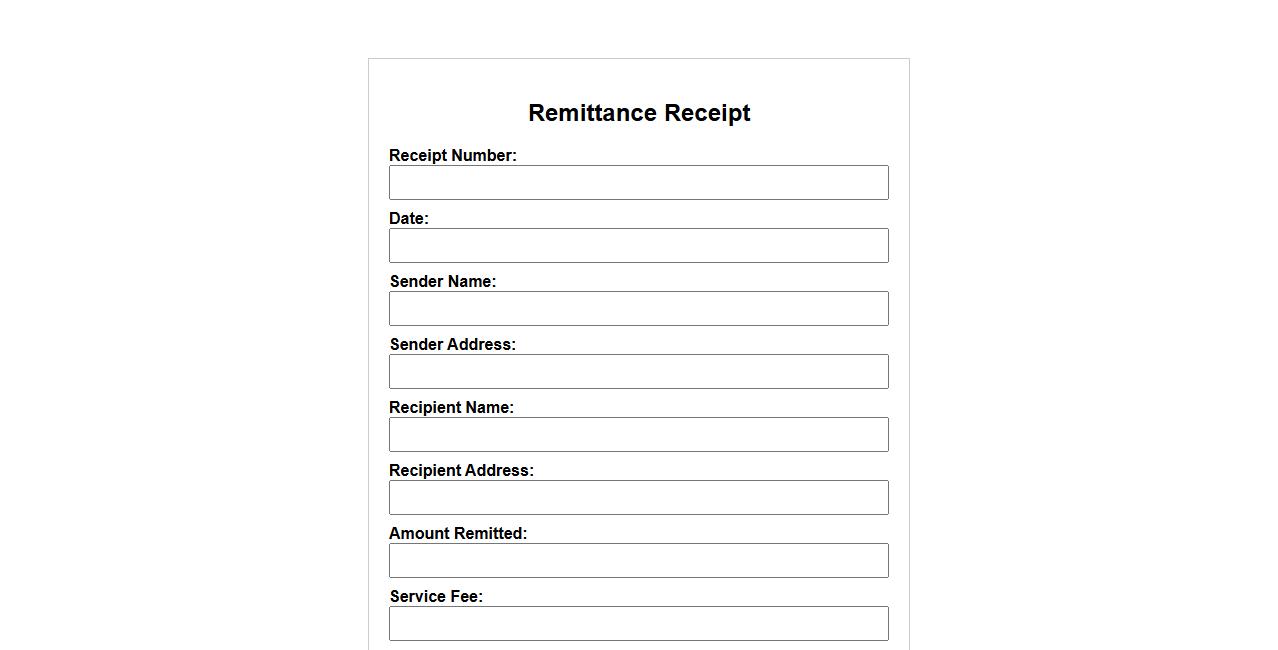

Remittance Receipt

A Remittance Receipt serves as proof of payment made by a sender to a recipient, detailing the amount and transaction date. It helps both parties track and confirm the transfer of funds securely. This document is essential for record-keeping and resolving any payment discrepancies.

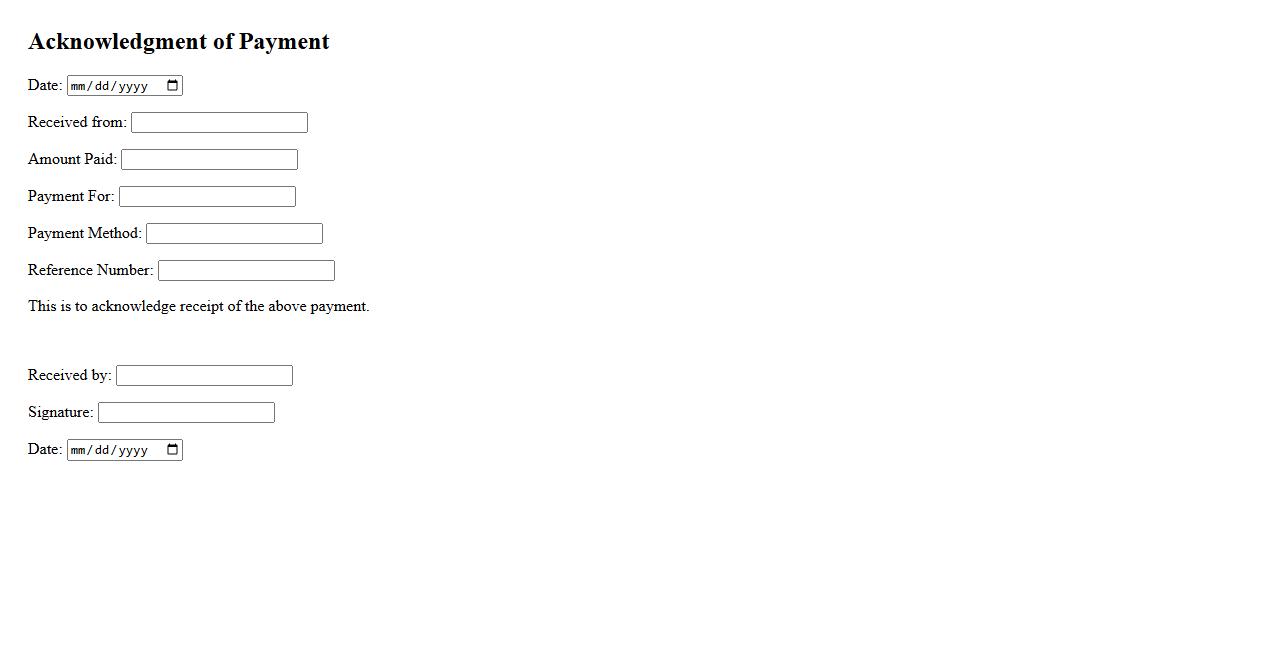

Acknowledgment of Payment

Acknowledgment of Payment is a formal document confirming the receipt of funds for goods or services rendered. It serves as proof that the payment has been successfully processed and received by the payee. This acknowledgment helps maintain transparent financial records and ensures clarity between involved parties.

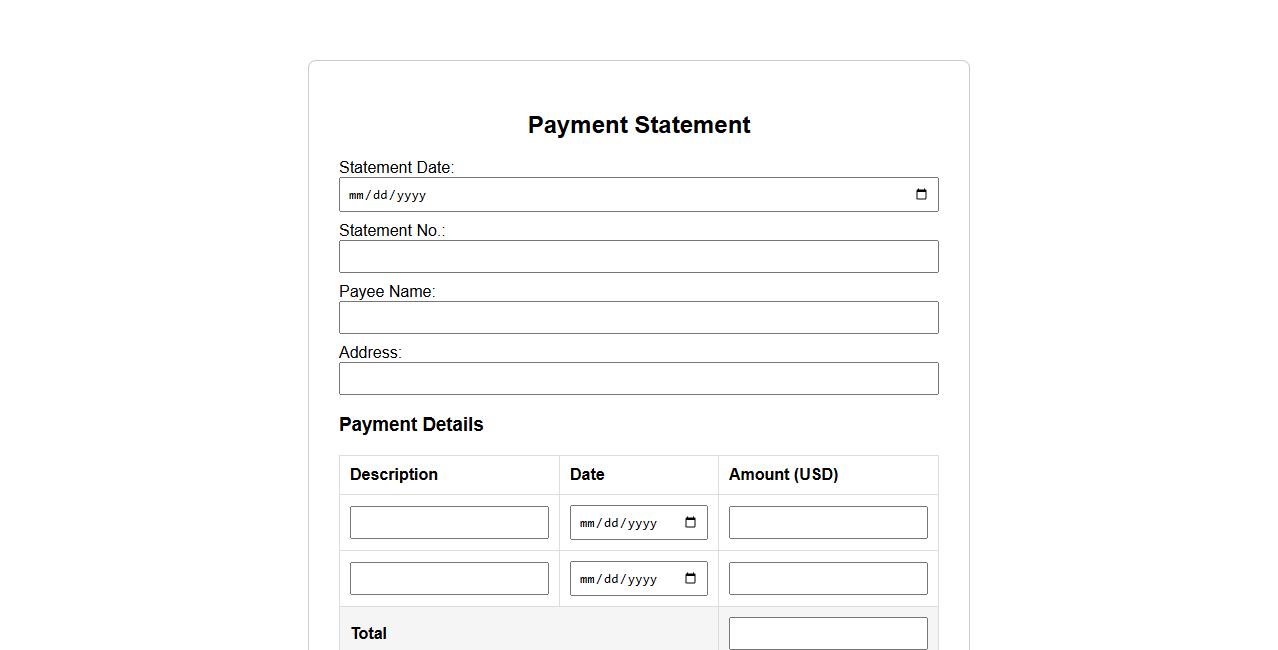

Payment Statement

A Payment Statement is a detailed record that outlines the transactions and payments made within a specific period. It provides transparency and clarity, helping both parties to verify financial exchanges. This document is essential for accurate accounting and budget management.

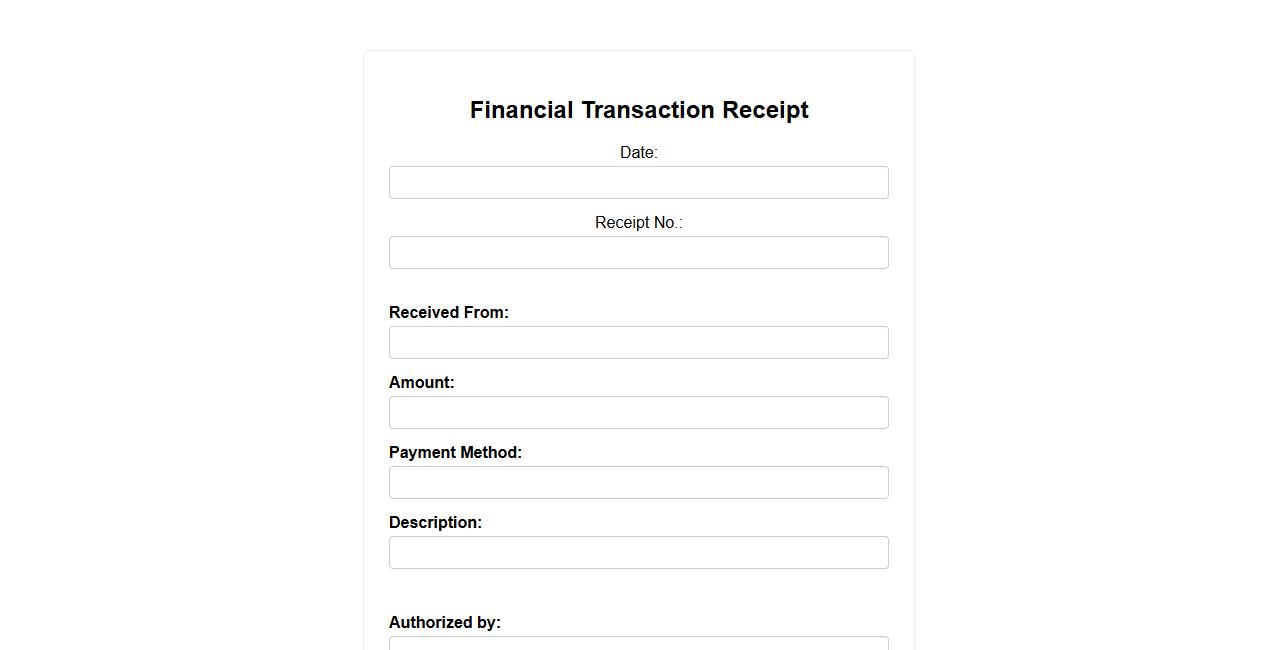

Financial Transaction Receipt

The Financial Transaction Receipt serves as a formal proof of payment, detailing the amount, date, and parties involved in a transaction. It ensures transparency and provides a record for both the payer and payee. This document is essential for maintaining accurate financial records and resolving any future disputes.

What specific fees are documented on the Receipt for Payment of Fees?

The receipt for payment of fees clearly lists the exact fees that were paid, which may include tuition, administrative charges, or service fees. Each fee is itemized with a description and the corresponding amount. This detailed documentation ensures transparency and accurate record-keeping for both payer and payee.

Who is the payer and payee listed on the receipt?

The receipt specifies the payer's name, typically the individual or entity making the payment. It also identifies the payee, often the institution or service provider receiving the funds. Including these details is crucial for validating the transaction and addressing any future inquiries.

What is the payment method and transaction date indicated?

The receipt documents the payment method, such as cash, credit card, bank transfer, or other options used. Alongside this, the transaction date is recorded, providing a clear timeline of the payment. These details help establish the legitimacy and timing of the financial exchange.

Is there an official reference or receipt number associated with the payment?

Each receipt typically features a unique reference or receipt number for identification purposes. This number is essential for tracking payments and facilitating audits or disputes. It ensures that the transaction can be easily located within accounting systems.

What services or goods correspond to the recorded payment?

The receipt outlines the specific services or goods for which the payment was made, such as course enrollment, equipment, or consulting services. This information verifies what the payer has received in exchange for their payment. Clear descriptions help avoid confusion and confirm the agreement between parties.