A Notice of Filing Extension is an official document filed to request additional time for submitting required reports or tax returns. This extension provides taxpayers or organizations extra days beyond the original deadline to gather necessary information and complete their filings accurately. Filing this notice ensures compliance with legal deadlines and helps avoid penalties for late submissions.

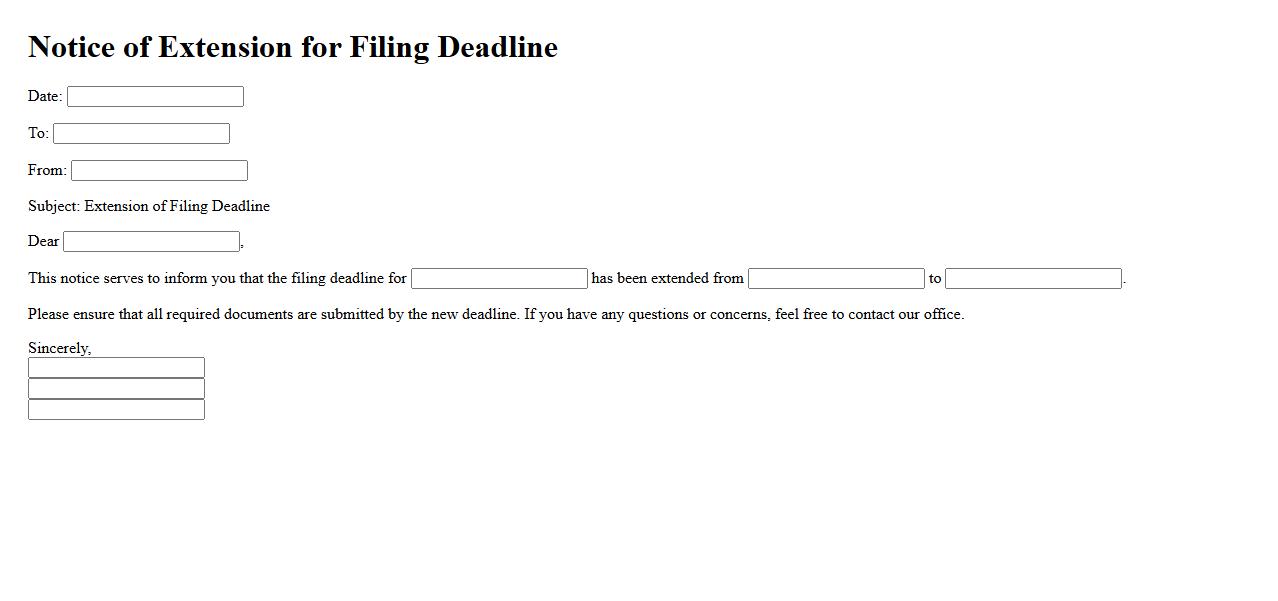

Notice of Extension for Filing Deadline

The Notice of Extension for Filing Deadline informs concerned parties about the granted additional time to submit required documents. This extension helps ensure compliance without penalties due to unforeseen circumstances. Timely action following this notice is crucial to avoid any late submission issues.

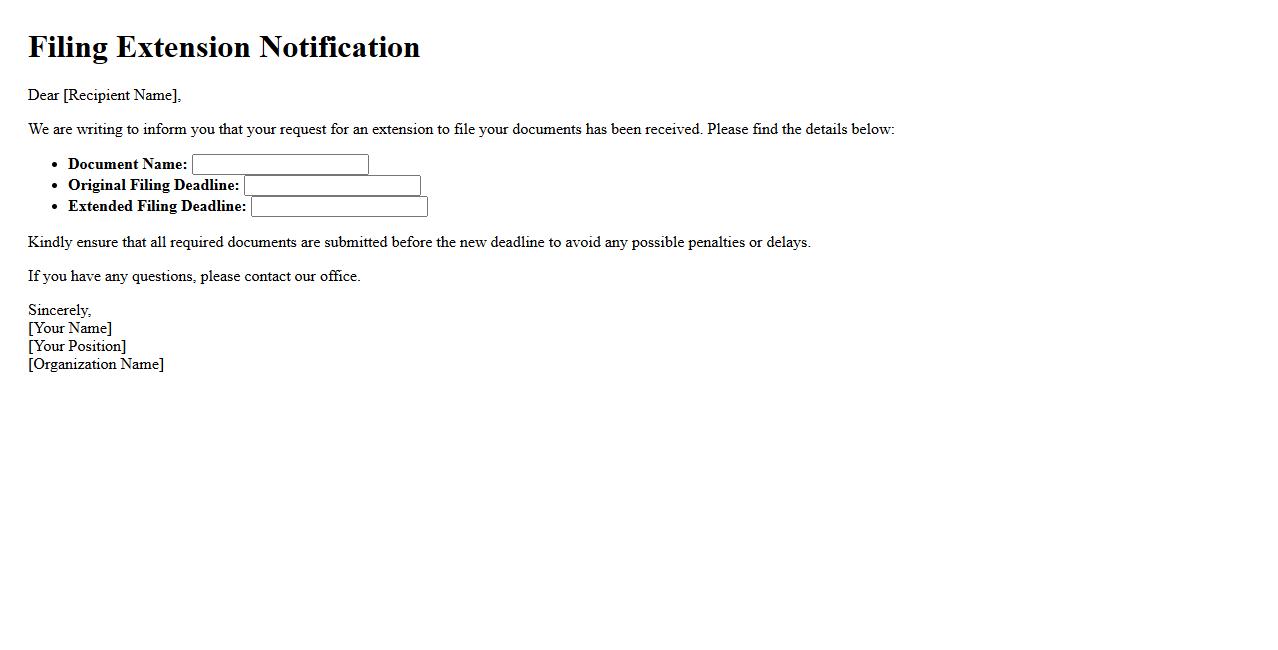

Filing Extension Notification

The Filing Extension Notification informs taxpayers of the approval to extend the deadline for submitting their tax returns. This notice ensures that individuals and businesses have additional time to gather necessary documents and complete accurate filings. Timely response to this notification helps avoid penalties and interest charges.

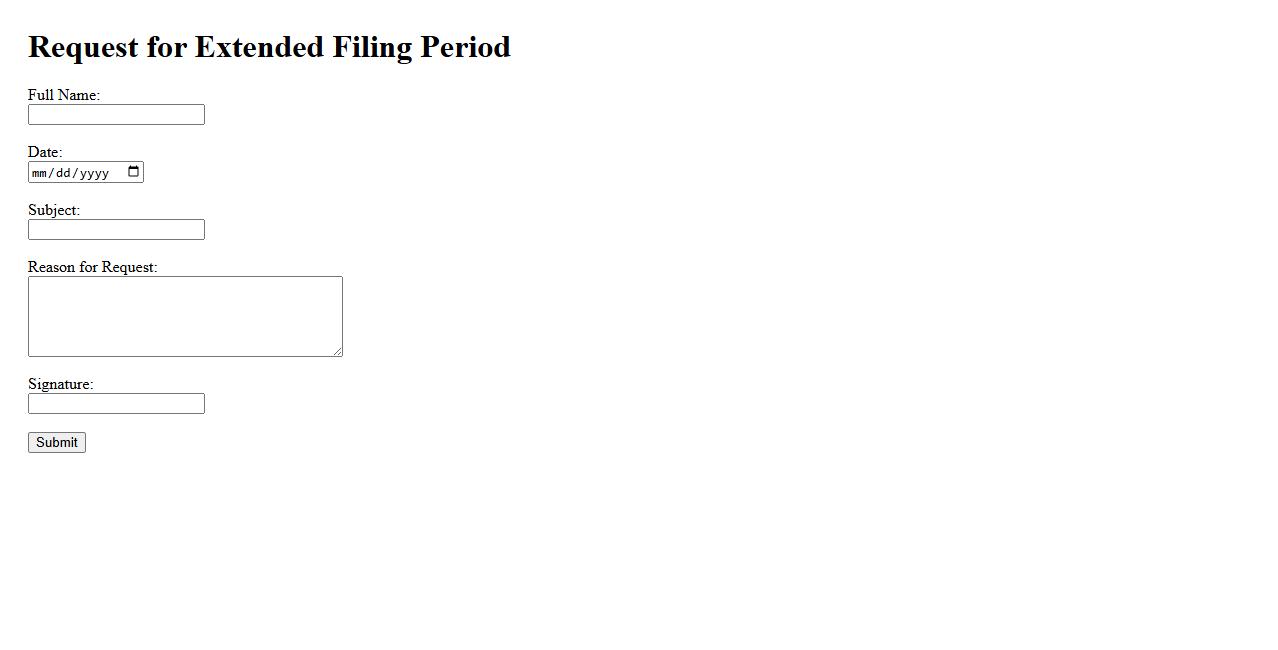

Request for Extended Filing Period

A Request for Extended Filing Period allows individuals or organizations more time to submit required documents or applications. This extension can be crucial for ensuring all information is accurate and complete. It helps avoid penalties or rejections due to late submissions.

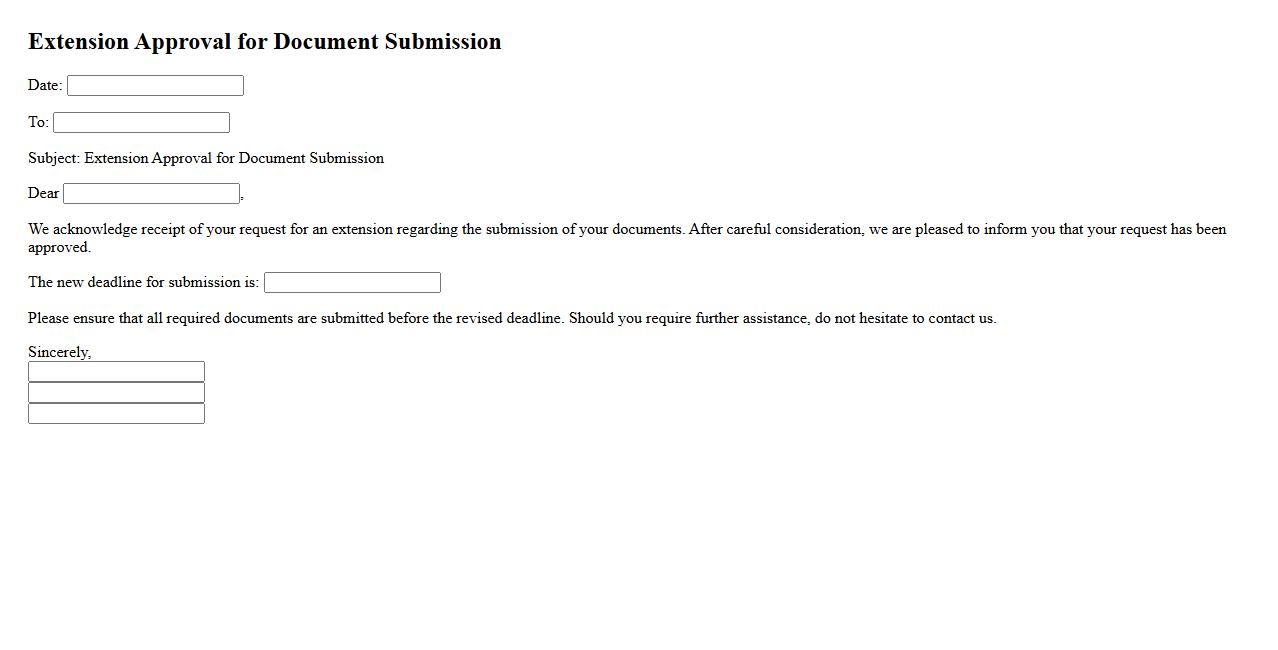

Extension Approval for Document Submission

The Extension Approval for Document Submission allows individuals or organizations to request additional time beyond the original deadline to submit required documents. This process ensures that all necessary paperwork is completed accurately without penalties for late submission. Timely approval is essential to maintain compliance with regulations and avoid disruptions.

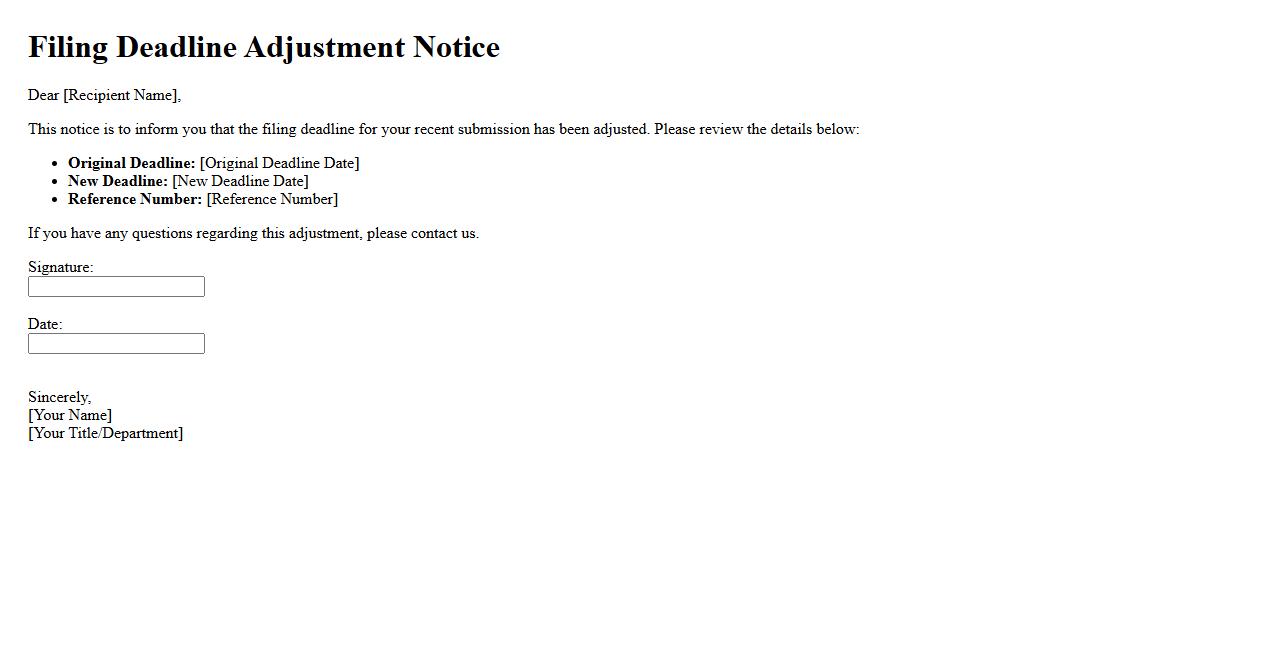

Filing Deadline Adjustment Notice

This Filing Deadline Adjustment Notice informs individuals and organizations of changes to submission dates for important documents. Timely awareness of these adjustments helps prevent penalties and ensures compliance with regulatory requirements. Stay updated to meet all revised deadlines efficiently.

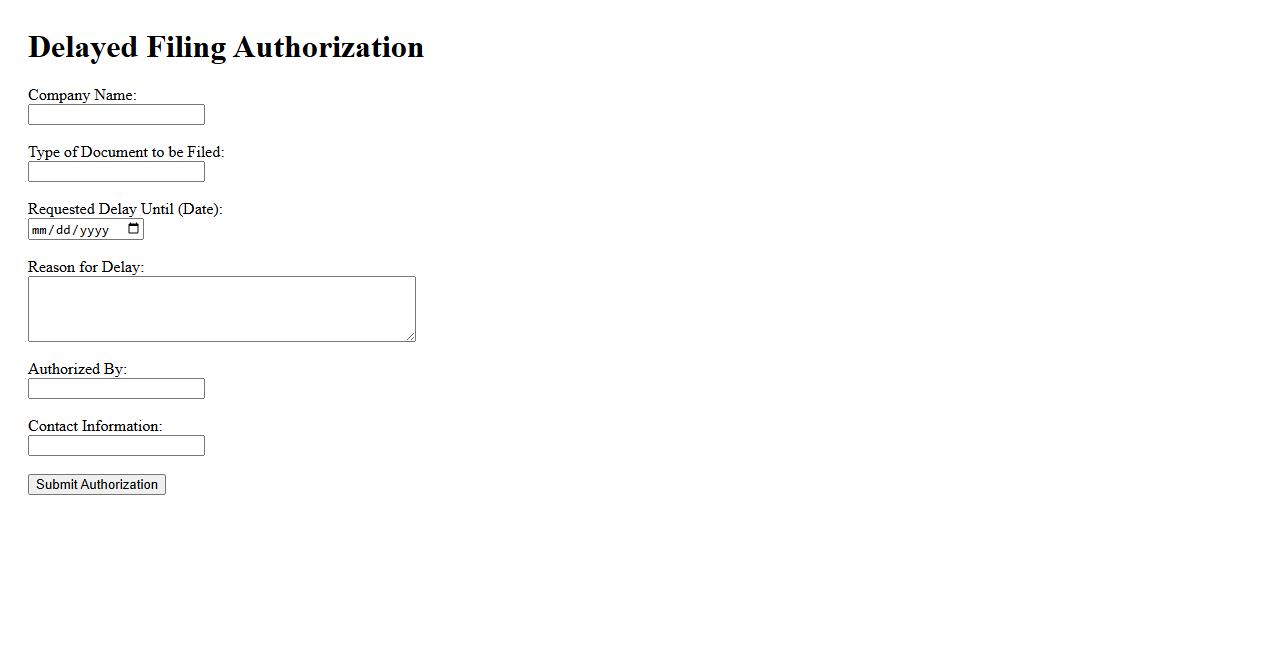

Delayed Filing Authorization

Delayed Filing Authorization allows organizations to postpone the submission of specific documents to regulatory bodies within an approved timeframe. This mechanism helps manage compliance deadlines more efficiently and ensures all necessary information is accurately compiled before filing. Utilizing delayed filing can reduce errors and improve the quality of submitted reports.

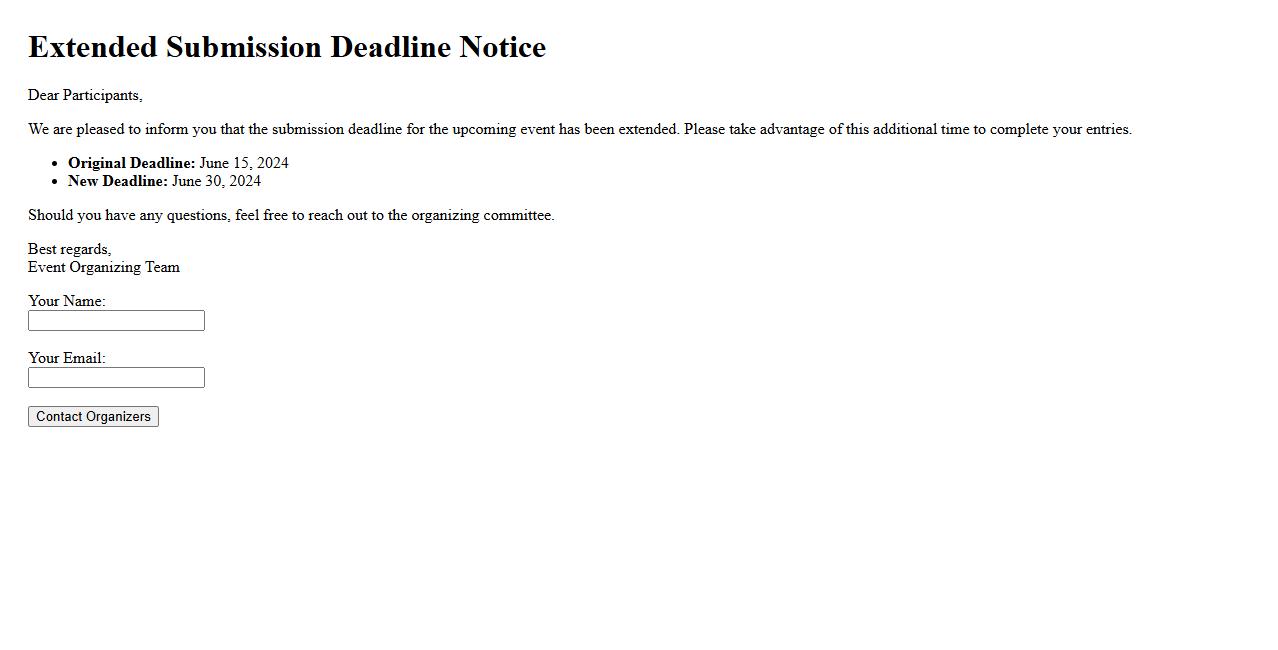

Extended Submission Deadline Notice

The Extended Submission Deadline Notice informs participants of additional time granted for submitting their entries. This extension ensures everyone has a fair chance to meet the requirements. Please check the new deadline details carefully to avoid missing the opportunity.

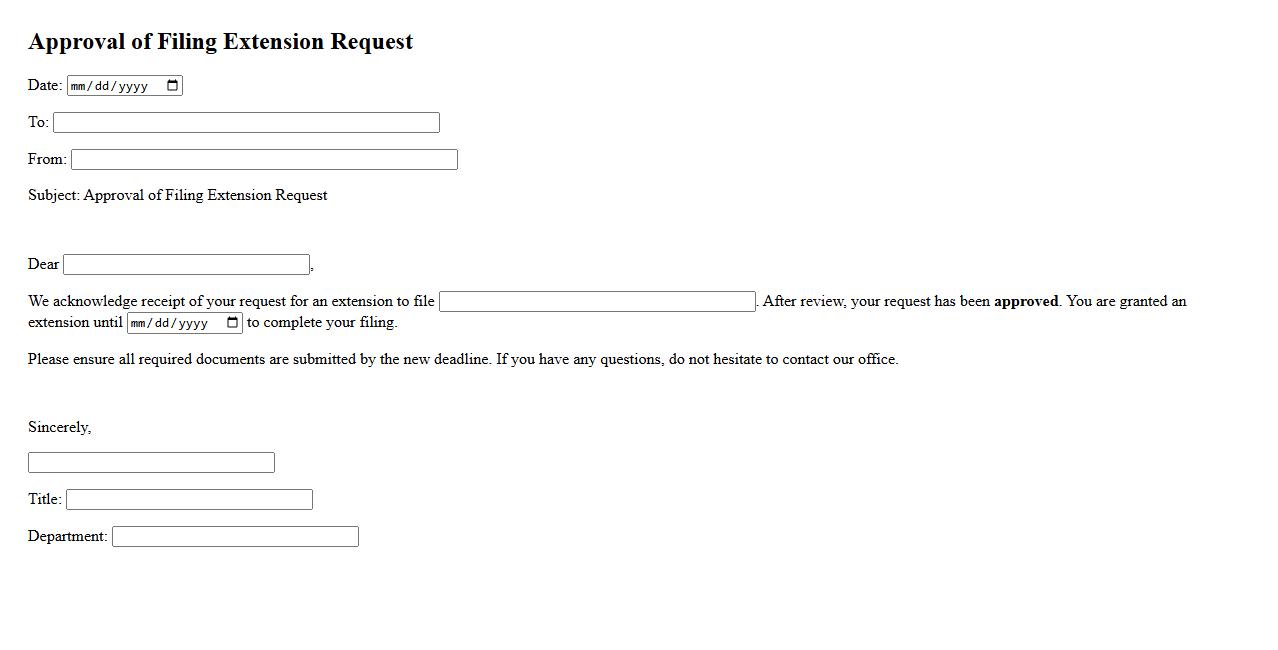

Approval of Filing Extension Request

The approval of filing extension request allows individuals or businesses additional time to submit necessary documents without penalty. This process ensures compliance with deadlines while providing flexibility. Timely approval is crucial to avoid any late fees or legal issues.

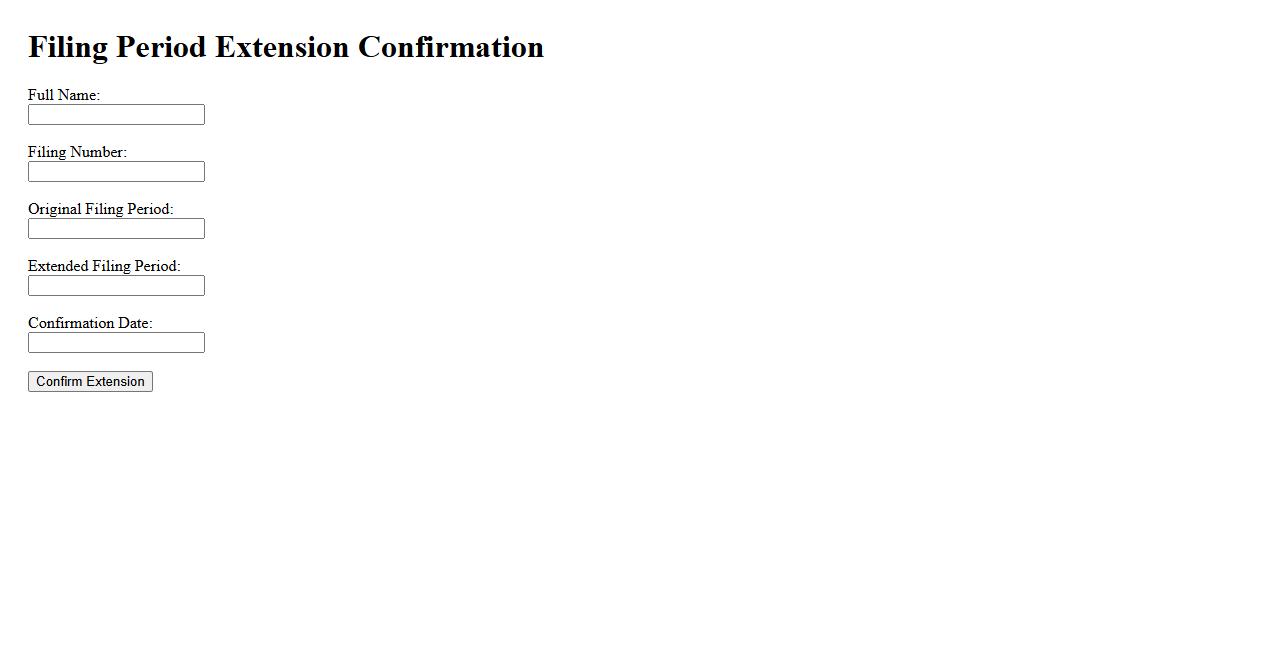

Filing Period Extension Confirmation

The filing period extension confirmation is an official acknowledgment that your request to extend the deadline for submitting tax documents has been approved. This confirmation ensures you have additional time to prepare and file your returns without incurring penalties. Keep this notice for your records as proof of the new filing deadline.

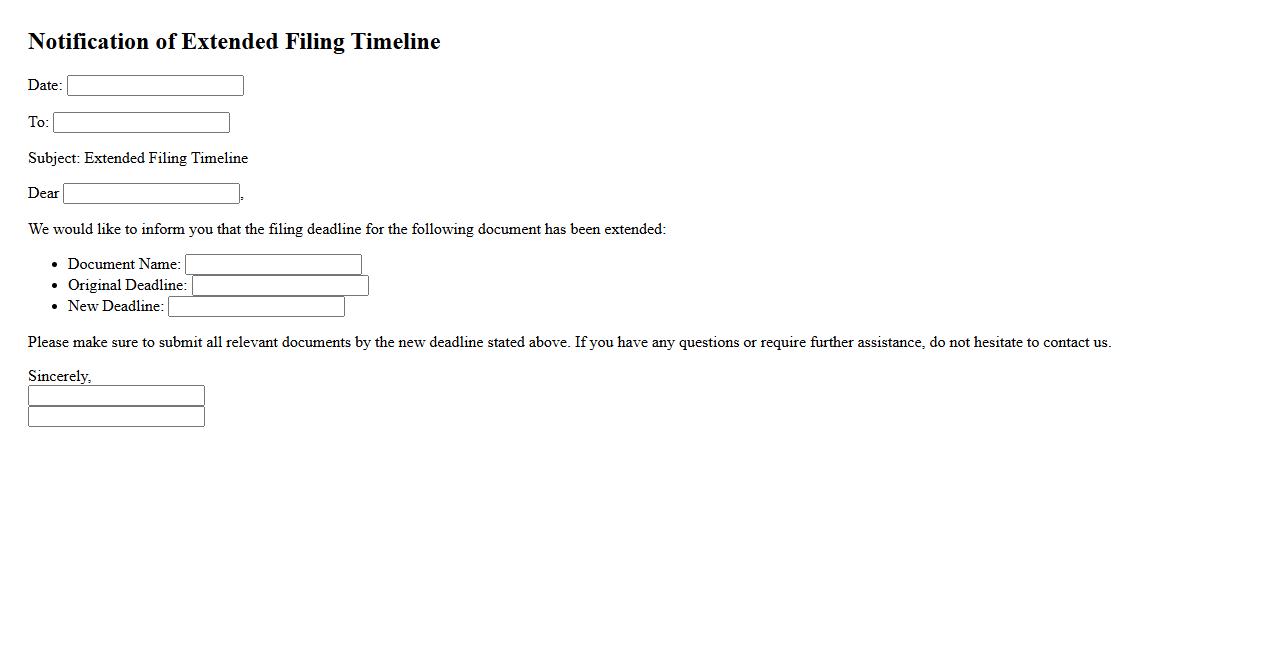

Notification of Extended Filing Timeline

The notification of extended filing timeline informs stakeholders about the revised deadlines for submitting necessary documents or reports. This extension allows additional time to ensure accuracy and completeness. Timely communication of such changes helps prevent penalties and supports compliance.

What specific reason prompted the request for a filing extension in the document?

The filing extension request was prompted by unforeseen circumstances that hindered timely submission. These could include unexpected delays in gathering necessary information or procedural challenges. The document explicitly mentions the need for additional time to ensure accuracy and complete compliance.

What is the newly proposed deadline mentioned in the Notice of Filing Extension?

The newly proposed deadline is clearly stated in the Notice of Filing Extension to provide clarity and ensure compliance. This revised date extends the original timeframe and allows for proper review and finalization. Meeting this updated deadline is critical to avoid penalties or dismissal.

Who is the recipient or governing authority addressed by the filing extension notice?

The extension notice is directed to the governing authority responsible for overseeing the filing process, such as a regulatory body or official department. Addressing the correct recipient ensures the request is processed without delay. This authority holds the power to approve or deny the extension based on submitted evidence.

What documentation or evidence is required to support the extension request?

The document specifies the need for supporting evidence like proof of extenuating circumstances or detailed explanations for delay. Proper documentation strengthens the extension request and demonstrates good faith. Such evidence ensures transparency and helps the authority make an informed decision.

What consequences or actions are outlined if the extension request is denied?

If the extension request is denied, the document outlines potential consequences such as penalties, late fees, or rejection of the filing. This emphasizes the importance of adhering to the original deadline if the extension is not approved. Additionally, it highlights possible next steps or appeals in case of denial.