The Consent to Release Tax Information Form allows an individual or entity to authorize the IRS or other tax authorities to disclose specific tax information to a third party. This form is often used by tax professionals, financial institutions, or government agencies to verify income or tax status. It ensures compliance with privacy laws while facilitating necessary information sharing.

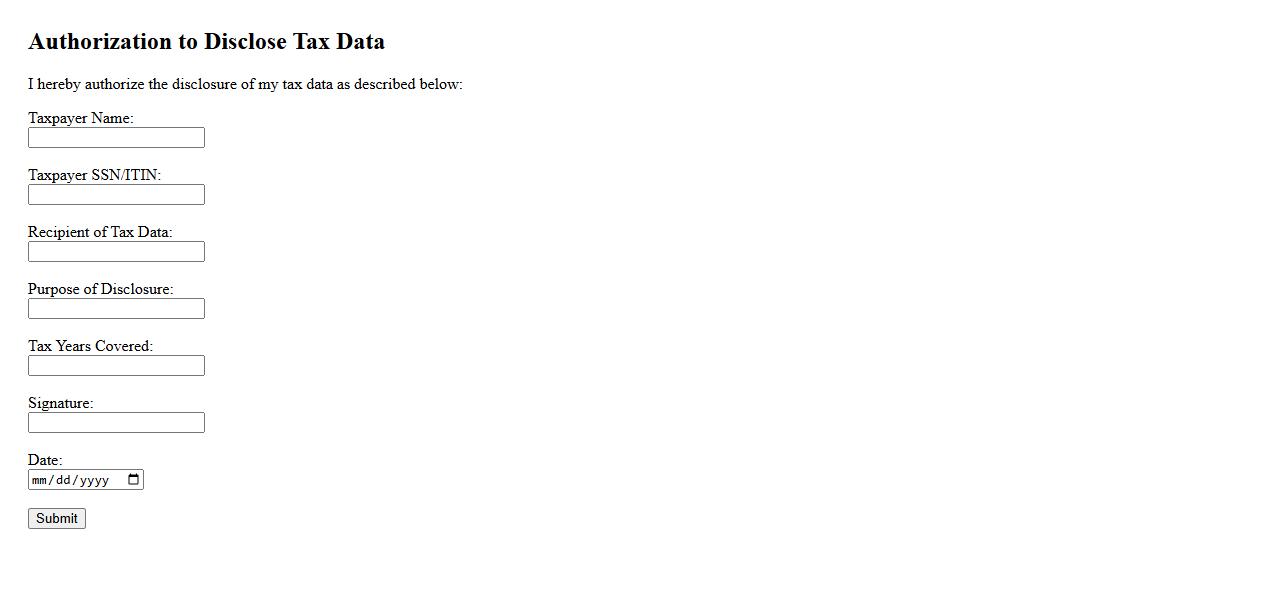

Authorization to Disclose Tax Data

The Authorization to Disclose Tax Data is a formal consent allowing third parties to access an individual's or organization's tax information. This authorization ensures that sensitive tax records are shared securely and only with permitted entities. It is essential for facilitating tax consultations, audits, and financial planning.

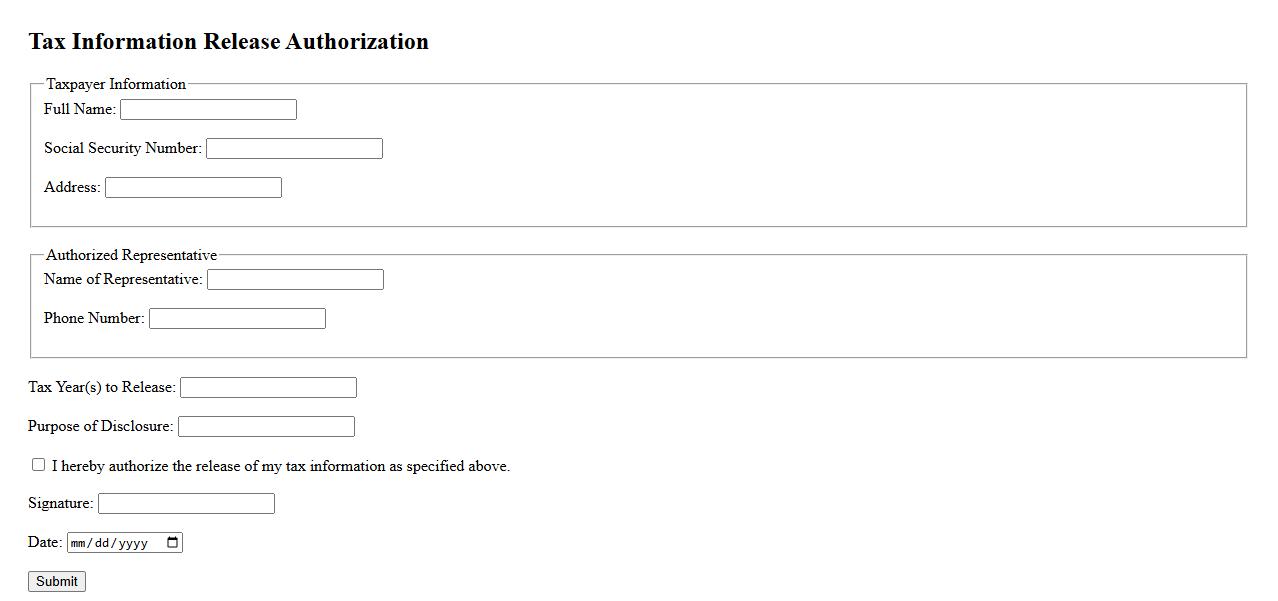

Tax Information Release Authorization

The Tax Information Release Authorization is a legal document that allows an individual or entity to authorize the release of their tax information to a third party. This authorization ensures that authorized parties can access necessary tax details while maintaining confidentiality. It is essential for facilitating communication between taxpayers and financial or legal representatives.

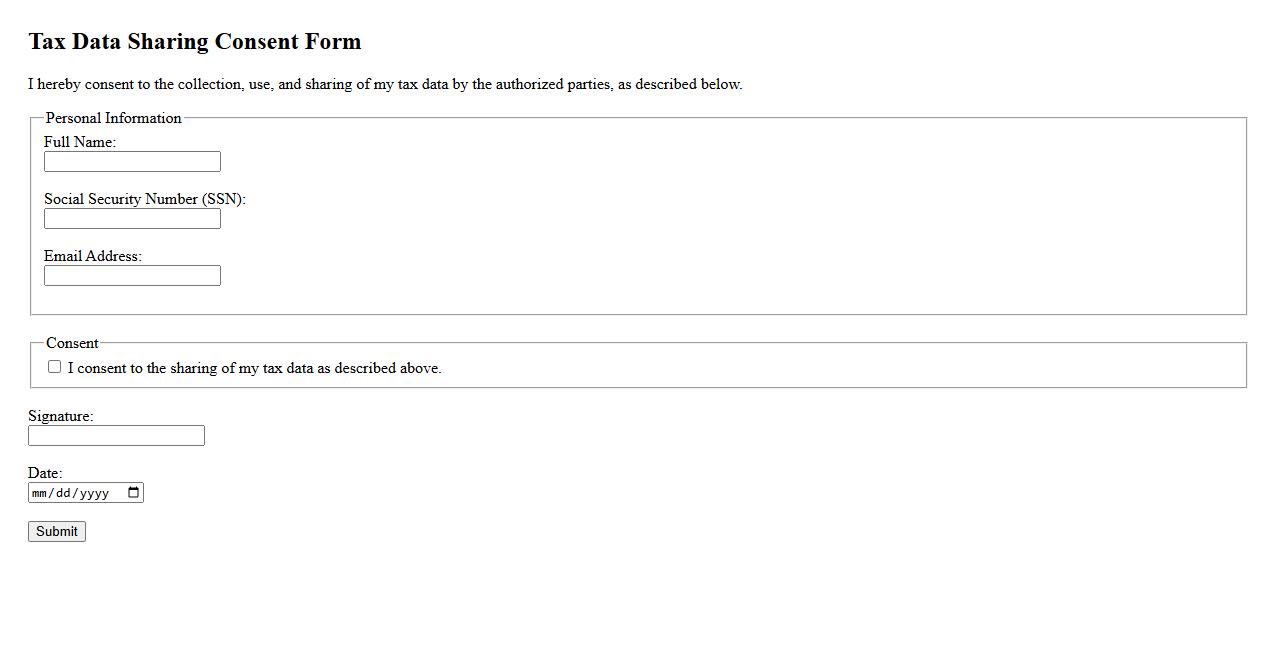

Tax Data Sharing Consent Form

The Tax Data Sharing Consent Form authorizes the sharing of your tax information with designated parties for processing and verification purposes. It ensures compliance with legal requirements while protecting your privacy. Signing this form streamlines communication between taxpayers and authorized representatives.

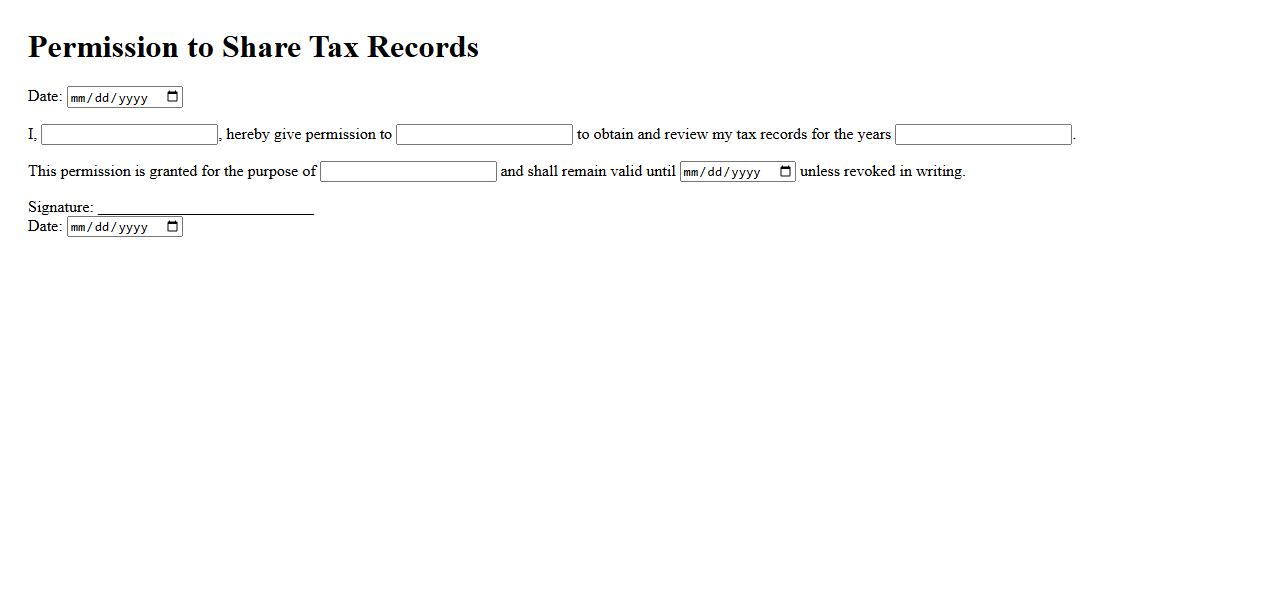

Permission to Share Tax Records

Permission to Share Tax Records is a formal authorization allowing authorized parties to access your tax information. This consent ensures that sensitive financial data is shared securely and only with designated individuals or organizations. Obtaining permission protects your privacy while facilitating necessary review or verification processes.

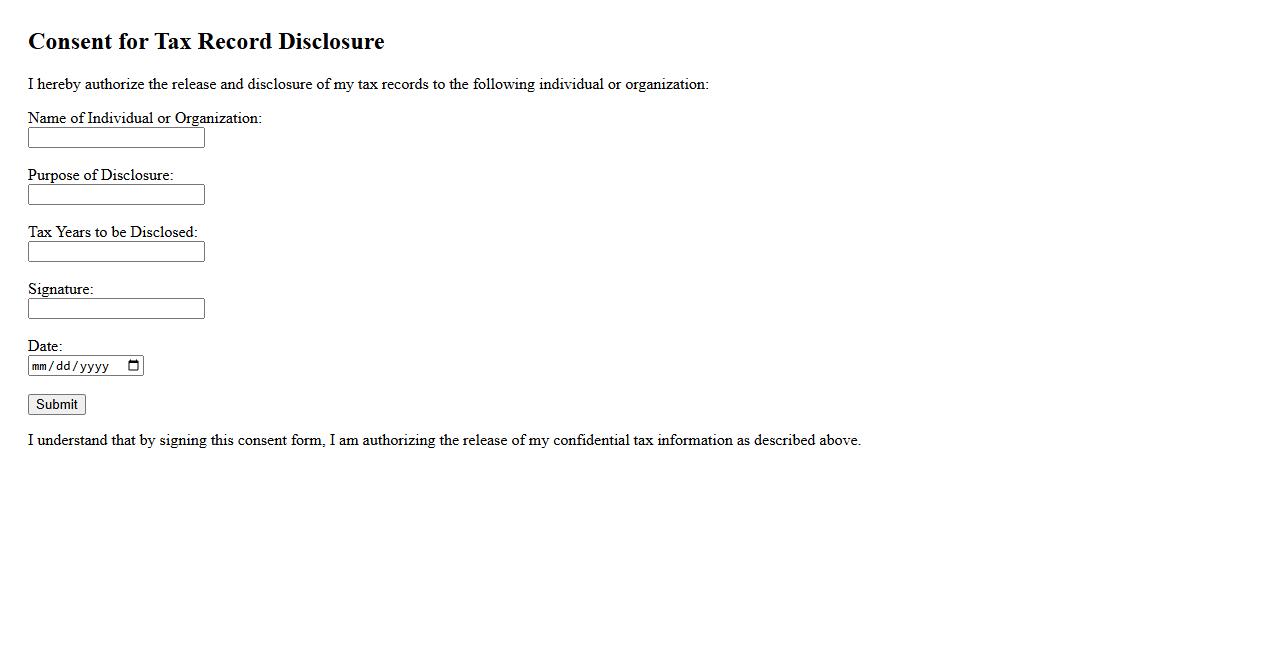

Consent for Tax Record Disclosure

Providing consent for tax record disclosure allows authorized parties to access your confidential tax information. This permission is essential for tax professionals or institutions to review and manage your tax affairs accurately. Ensuring proper consent protects your privacy and complies with legal requirements.

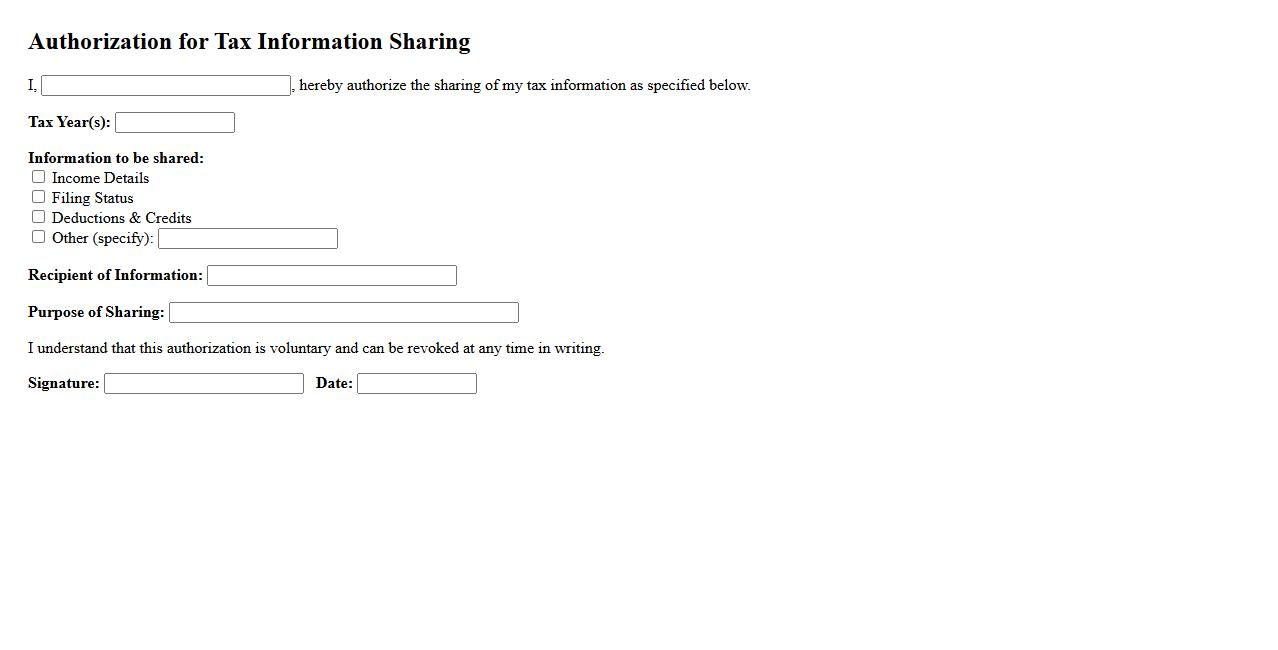

Authorization for Tax Information Sharing

The Authorization for Tax Information Sharing enables individuals and organizations to permit authorized parties to access their tax records securely. This document ensures compliance with privacy laws while allowing efficient information exchange between tax authorities and third parties. It is essential for facilitating transparent and accurate tax processing.

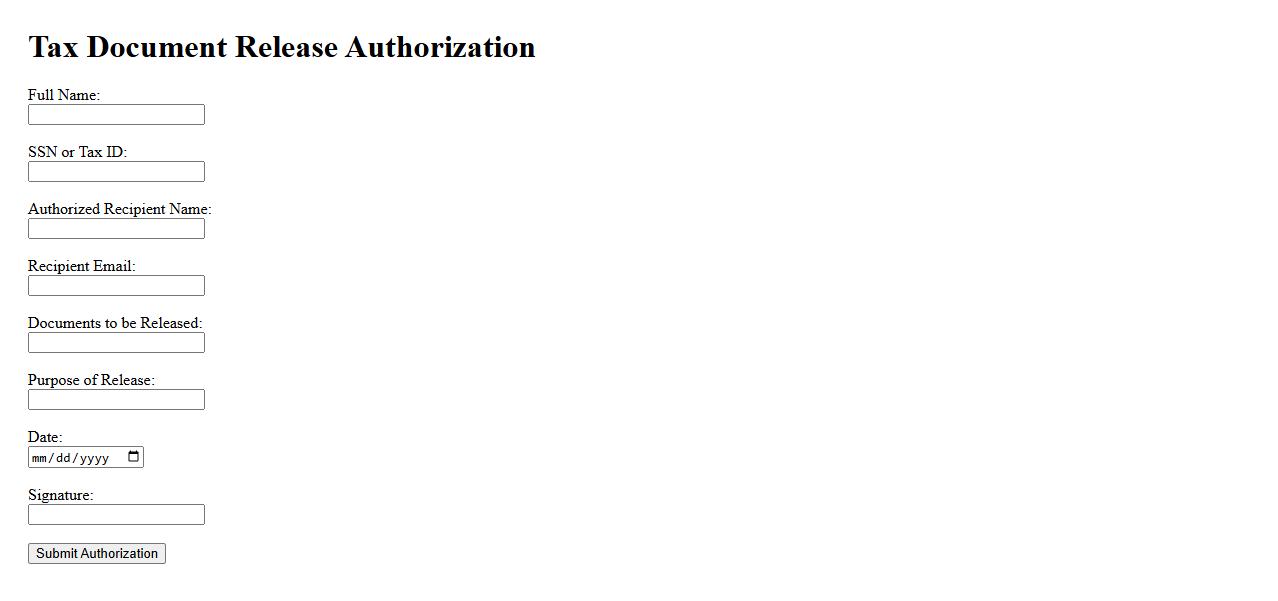

Tax Document Release Authorization

The Tax Document Release Authorization is a formal consent allowing an individual or organization to access and distribute tax-related documents on behalf of the taxpayer. This authorization ensures the secure handling of sensitive financial information in compliance with legal requirements. It streamlines the process of obtaining necessary tax documents for filing, auditing, or other official purposes.

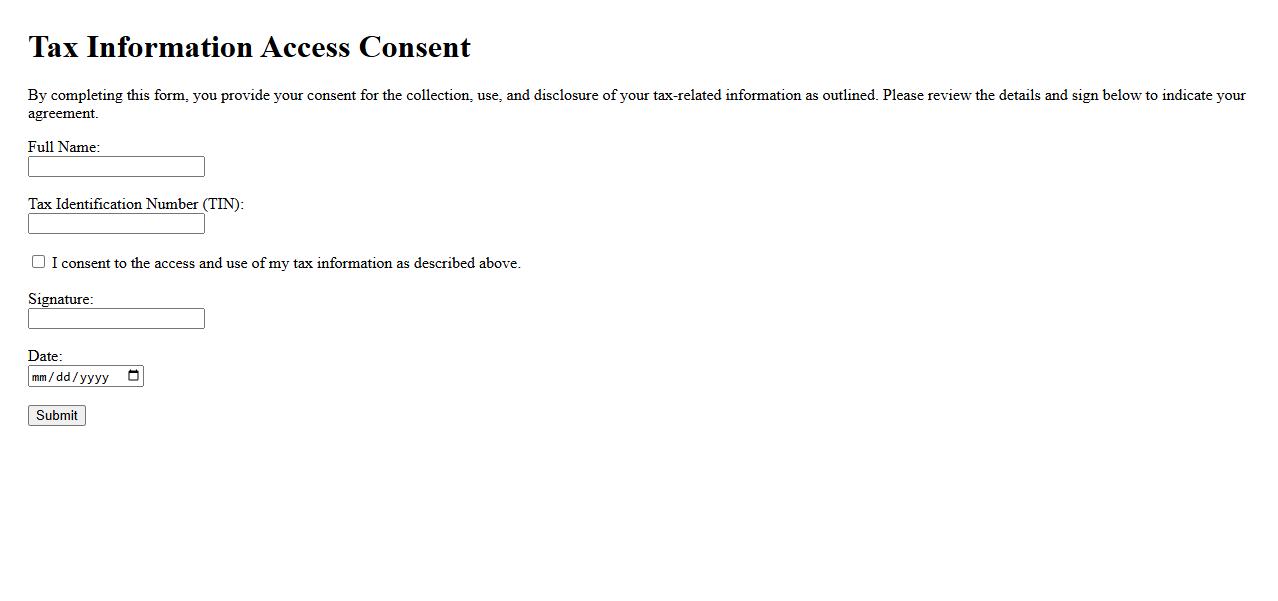

Tax Information Access Consent

Tax Information Access Consent is an authorization that allows authorized parties to view and obtain your tax records. This consent ensures secure handling of sensitive financial data while complying with legal requirements. It is essential for processes like loan approval, tax preparation, and financial audits.

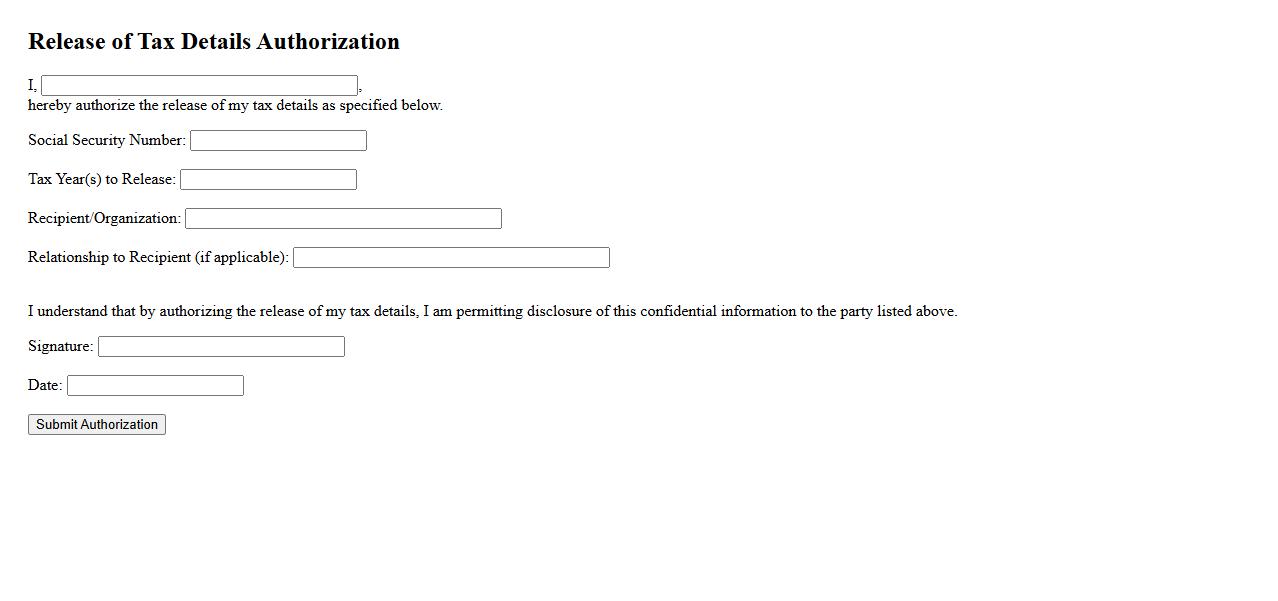

Release of Tax Details Authorization

The Release of Tax Details Authorization allows authorized parties to access and distribute specific tax information securely. This document ensures compliance with legal requirements while maintaining confidentiality. It is essential for facilitating tax-related processes and communications.

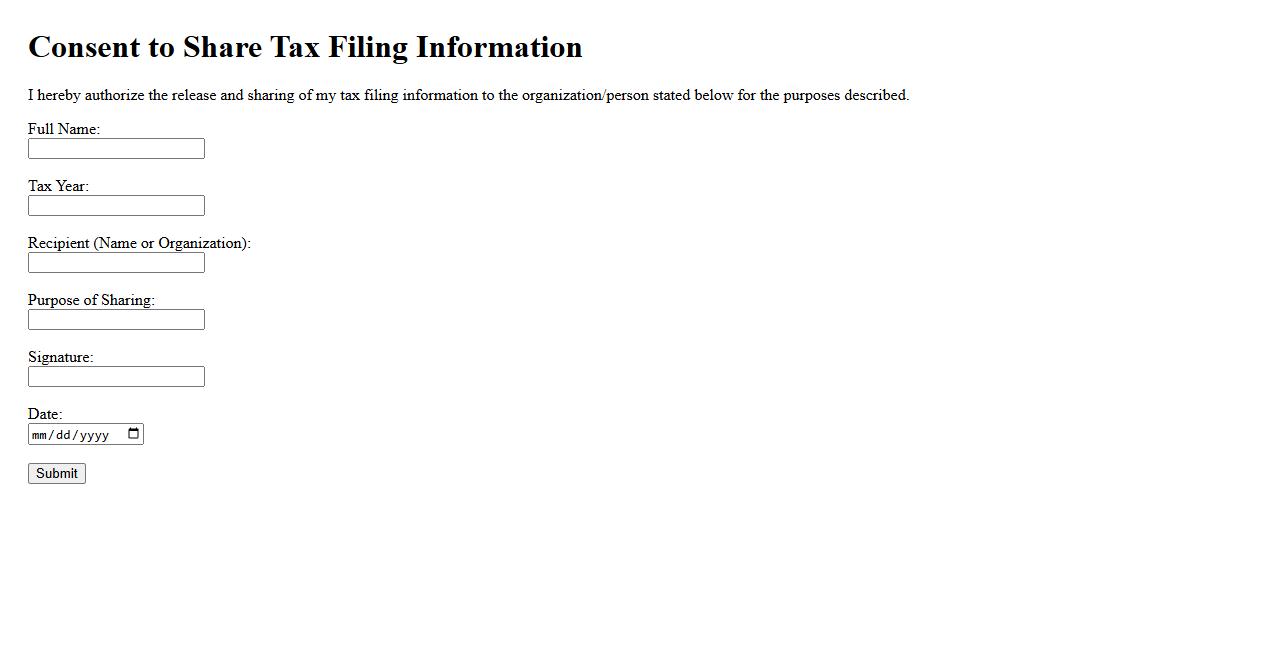

Consent to Share Tax Filing Information

Consent to Share Tax Filing Information allows individuals to authorize the disclosure of their tax return details to designated third parties. This consent is crucial for ensuring privacy while enabling efficient collaboration with tax professionals or financial institutions. It helps maintain transparency and compliance with legal requirements during information exchange.

What specific types of tax information are authorized for release by this form?

The form authorizes the release of tax return data and related financial documents to designated parties. This can include income statements, deductions, credits, and other relevant tax details. The precise scope of information released depends on the selections made within the form.

Who is permitted to receive the disclosed tax information under this consent?

Only individuals or entities explicitly named in the form are permitted to receive the disclosed tax information. Common recipients include tax professionals, financial advisors, or authorized third parties. Unauthorized sharing of this information is strictly prohibited.

What is the time period covered by the consent for releasing tax information?

The consent form specifies a clear time period during which tax information can be accessed. This period often spans specific tax years or a range of dates outlined by the taxpayer. After this interval, the consent automatically expires unless renewed.

What purposes are stated for which the released tax information may be used?

The released tax information is intended for specific purposes such as tax preparation, financial planning, or legal compliance. The form explicitly states these uses to ensure transparency and protect taxpayer rights. Any use beyond the stated purposes is restricted unless additional consent is provided.

What options exist to revoke or modify the consent after submitting the form?

Taxpayers have the right to revoke or modify their consent at any time by submitting a formal request. The form outlines procedures for how to submit these changes, ensuring timely cessation or adjustment of information sharing. It is important to act promptly to prevent unauthorized dissemination beyond the revised consent.