A Certificate of Insurance is an official document that provides proof of insurance coverage. It outlines the type, limits, and effective dates of the policy, ensuring third parties that the insured holds valid protection. This certificate is commonly required in business contracts and property leases to verify risk management.

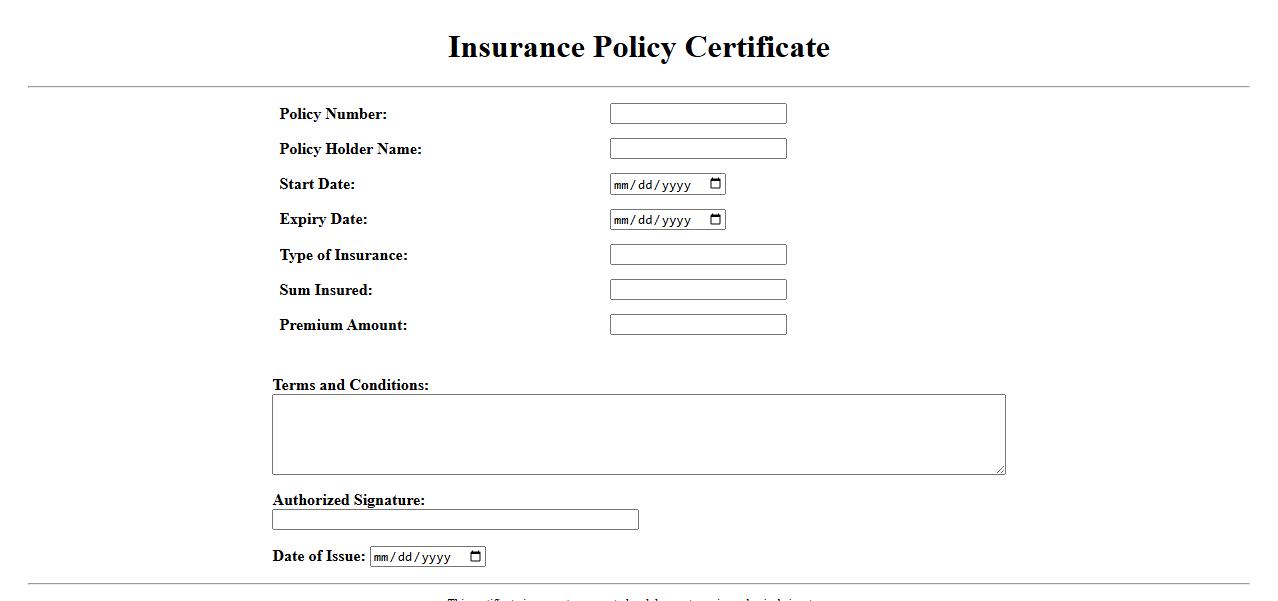

Insurance Policy Certificate

An Insurance Policy Certificate serves as official proof of insurance coverage, detailing the terms, conditions, and coverage limits of the policy. It provides policyholders and third parties with verification of the insured status. This document is essential for claims and legal purposes.

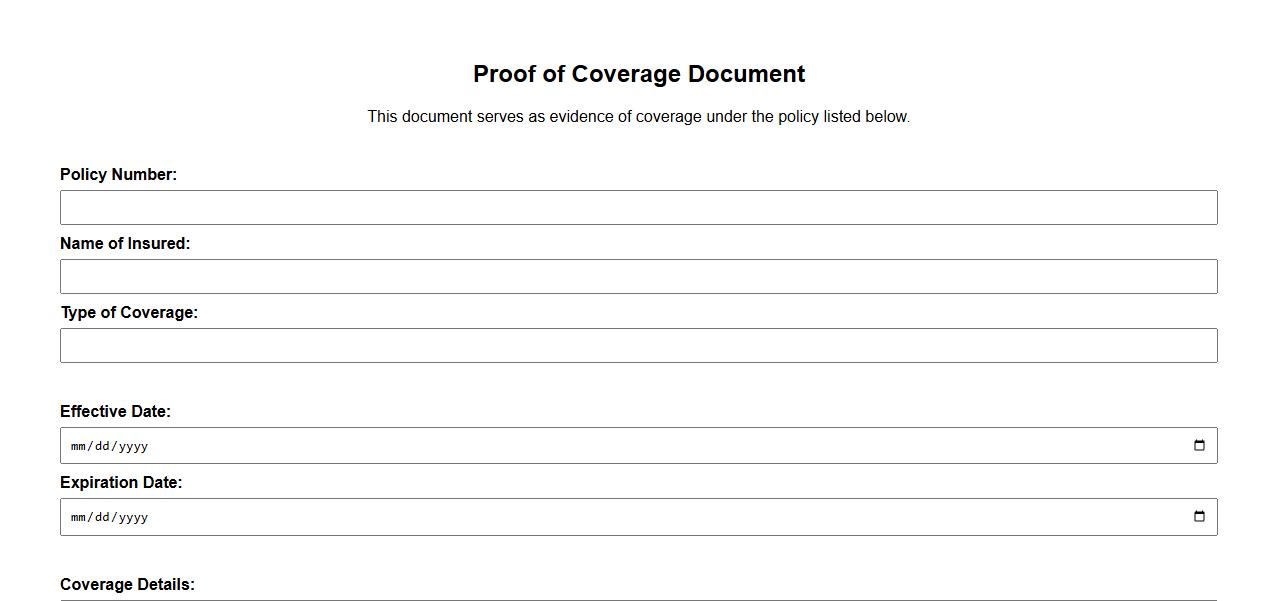

Proof of Coverage Document

The Proof of Coverage Document serves as official evidence confirming that an insurance policy is active and valid. It outlines the terms, coverage limits, and policyholder information to ensure transparency. This document is essential for resolving disputes and verifying protection status.

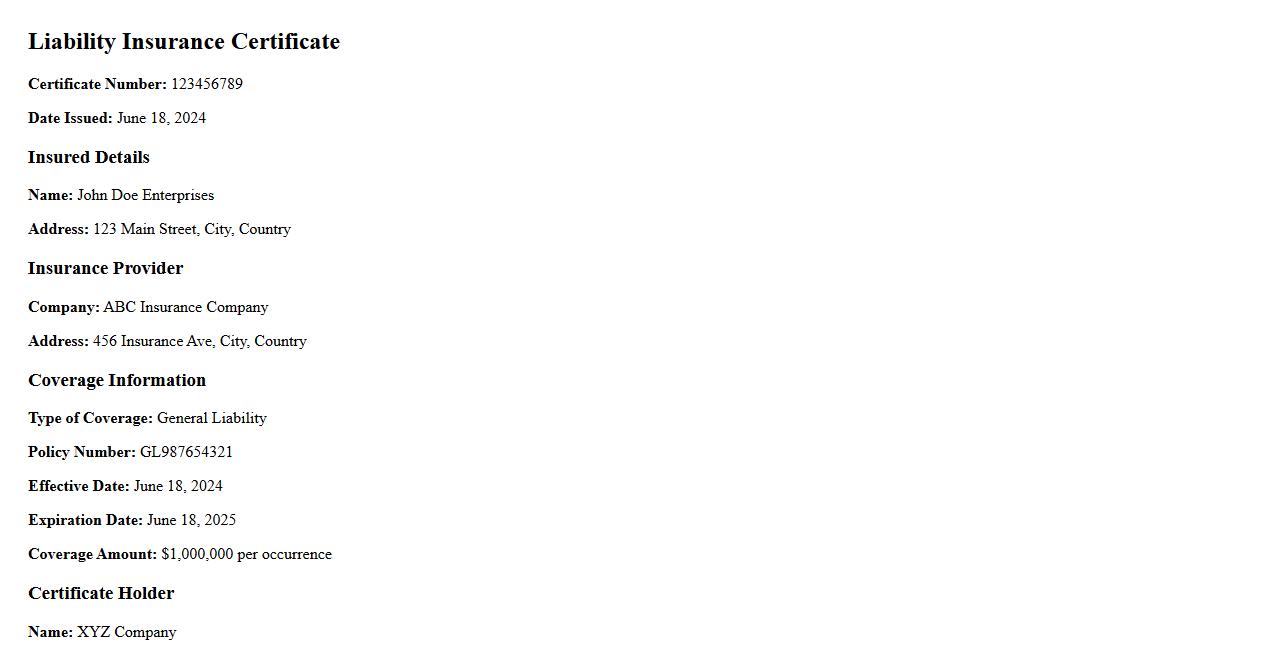

Liability Insurance Certificate

A Liability Insurance Certificate verifies that an individual or business holds liability insurance coverage. It serves as proof of protection against claims for bodily injury or property damage. This certificate is essential for contractors, vendors, and businesses to demonstrate their insurance compliance.

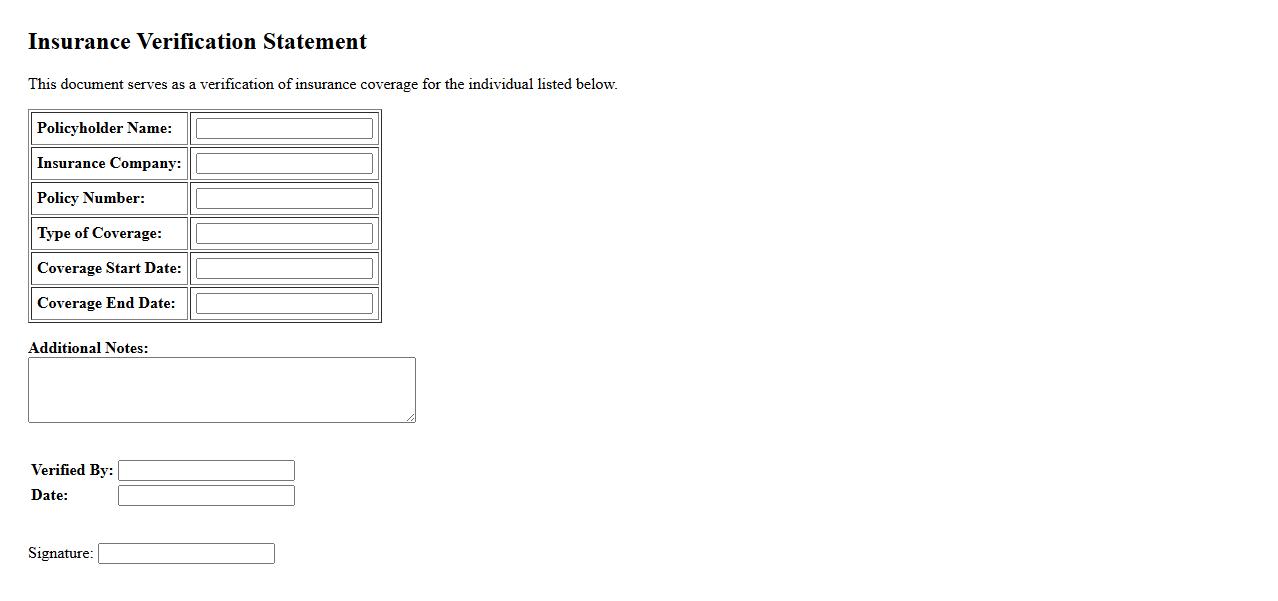

Insurance Verification Statement

An Insurance Verification Statement is a crucial document that confirms coverage details between the insurer and the insured. It ensures that all parties have accurate information regarding policy limits, effective dates, and coverage scope. This statement helps prevent misunderstandings and facilitates smooth claims processing.

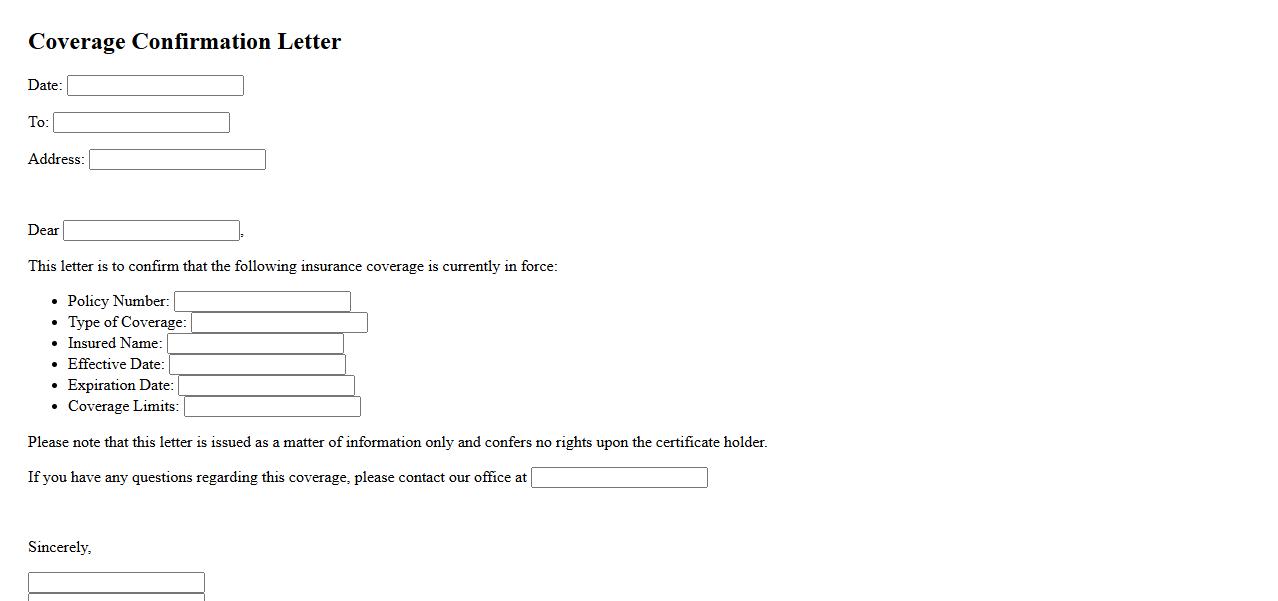

Coverage Confirmation Letter

A Coverage Confirmation Letter is an official document verifying an individual's insurance coverage status. It provides detailed information about the type, duration, and extent of the insurance policy. This letter is often required for employment, medical services, or legal purposes to confirm active coverage.

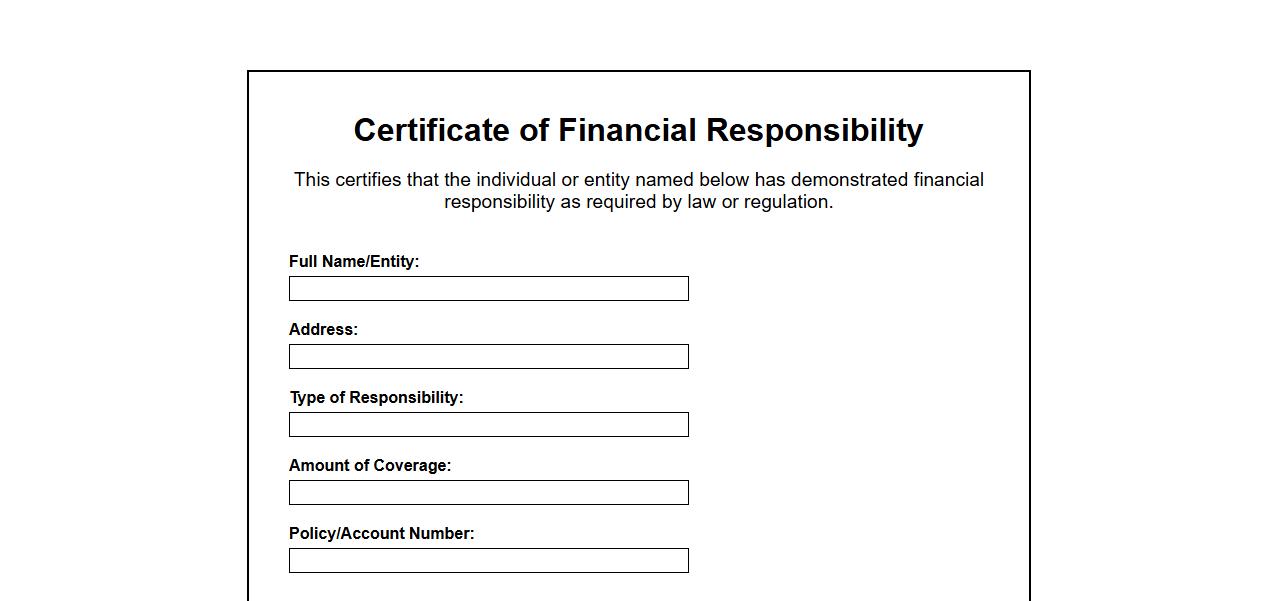

Certificate of Financial Responsibility

The Certificate of Financial Responsibility is an important document that verifies a person or company's ability to cover financial obligations related to specific activities. It is often required in industries such as transportation and environmental compliance. Obtaining this certificate ensures legal and financial accountability.

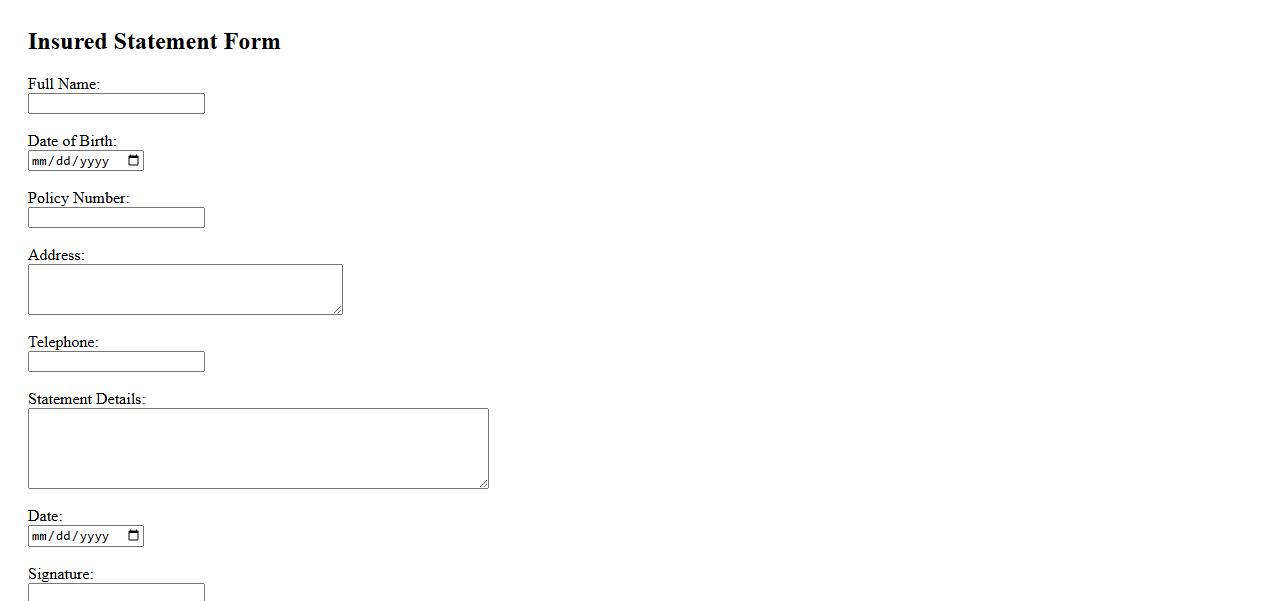

Insured Statement Form

The Insured Statement Form is a crucial document used to capture detailed information from the policyholder regarding an insurance claim. It helps provide accurate and comprehensive data to facilitate the claim processing efficiently. Proper completion of this form ensures timely resolution and support from the insurance provider.

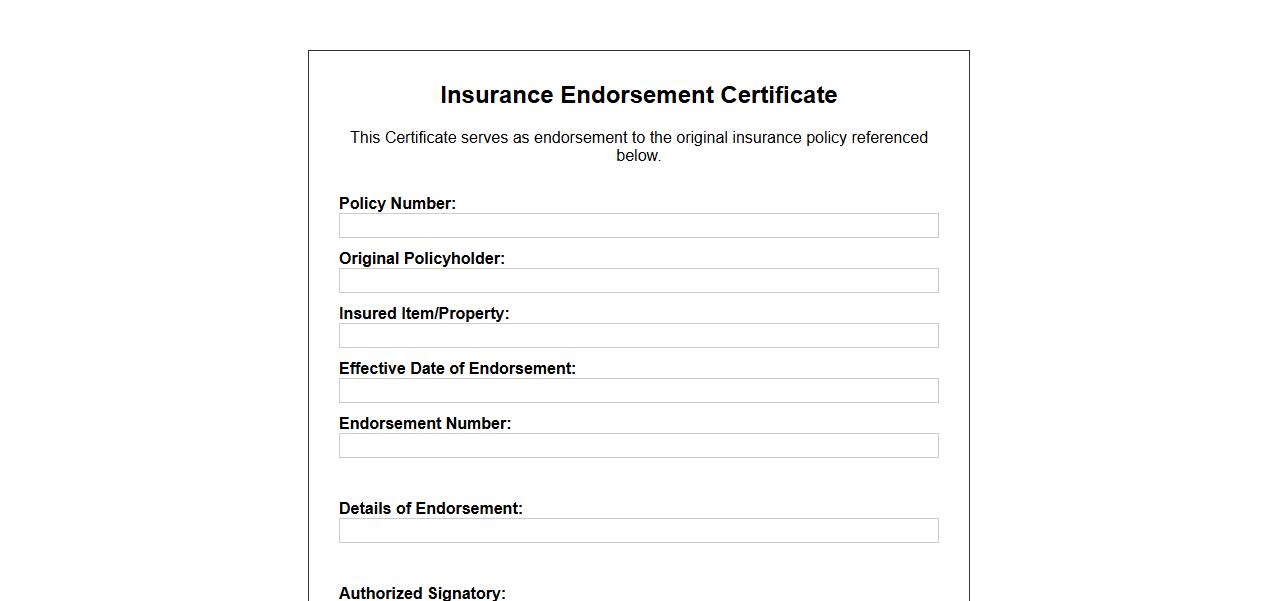

Insurance Endorsement Certificate

An Insurance Endorsement Certificate is a crucial document that provides proof of specific coverage amendments or additional protections within an existing insurance policy. It ensures that all parties are informed about changes, such as added insureds, revised limits, or modified policy terms. This certificate is often required by lenders, landlords, or project managers to verify compliance with insurance requirements.

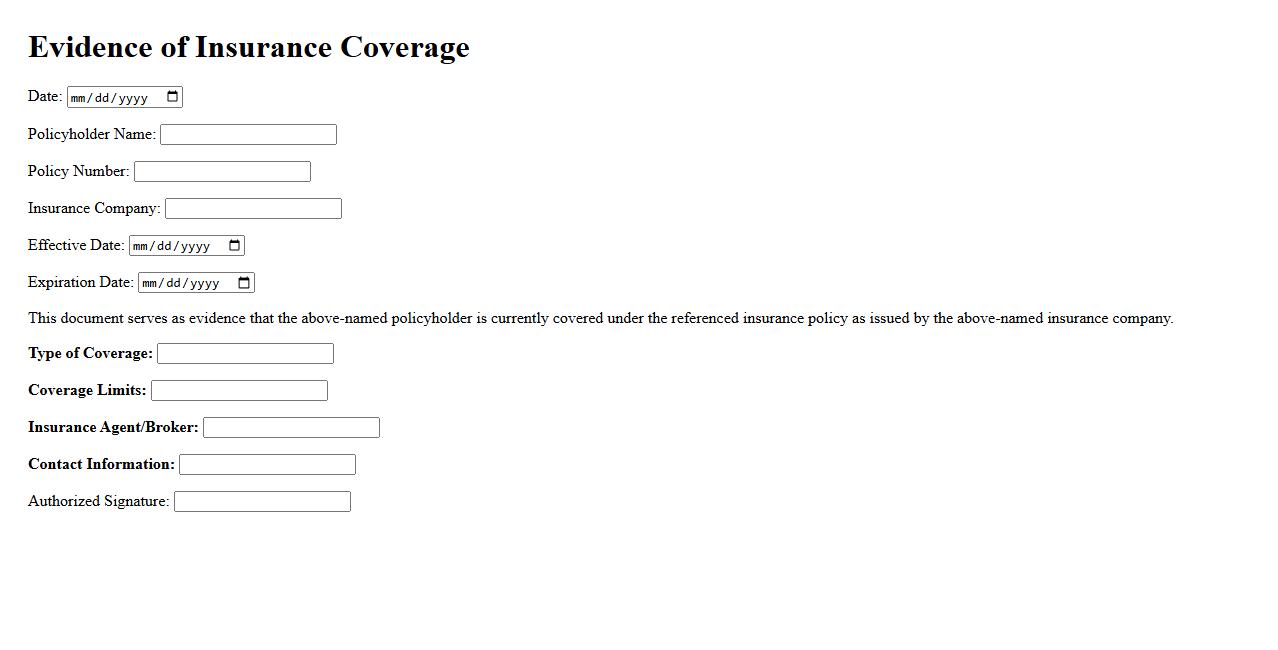

Evidence of Insurance Coverage

Evidence of insurance coverage is a document that confirms an individual or entity has an active insurance policy. It provides essential details such as the policyholder's name, coverage limits, and policy effective dates. This proof is often required for legal, business, or contractual purposes to ensure protection and compliance.

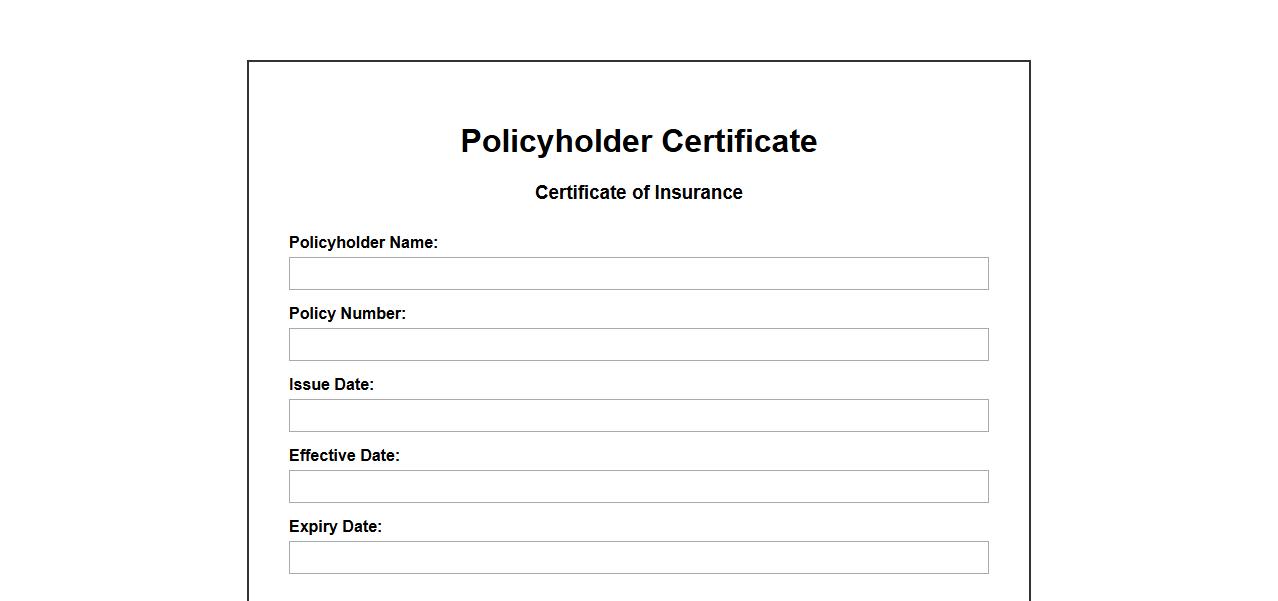

Policyholder Certificate

The Policyholder Certificate is an official document that verifies the details and coverage of an insurance policy. It serves as proof of insurance and outlines the policyholder's rights and responsibilities. This certificate is essential for both the insurer and policyholder to confirm the validity of the coverage.

What is the primary purpose of a Certificate of Insurance (COI) in contractual agreements?

The primary purpose of a Certificate of Insurance (COI) is to serve as proof of insurance coverage between parties involved in a contract. It verifies that the insured holds valid insurance policies meeting the contract's requirements. This helps mitigate risks and provides assurance that financial liabilities will be covered.

Which parties are typically named as insured and certificate holder on a Certificate of Insurance?

The insured party is usually the individual or business purchasing the insurance coverage. The certificate holder is typically the entity requesting proof of insurance, such as a client or project owner. Naming these parties clearly establishes the relationship and protection under the insurance policy.

What types of insurance coverage are commonly detailed within a COI?

Common insurance coverages listed on a COI include general liability, workers' compensation, and auto liability. Additional coverages might be detailed depending on the contract, such as professional liability or umbrella policies. The COI outlines the policy limits and effective dates to demonstrate adequate protection.

How does a Certificate of Insurance differ from an actual insurance policy?

A Certificate of Insurance is a summary document providing evidence of insurance, not the full policy details. The actual insurance policy contains comprehensive terms, conditions, and coverage specifics. Therefore, a COI cannot amend or extend coverage but serves as proof of existing insurance.

What information must be verified on a COI to ensure compliance with contract requirements?

Critical information to verify includes the policy number, coverage limits, effective and expiration dates, and named insured. It's essential to confirm that the certificate holder is included as an additional insured if required. Ensuring the insurance coverages match contractual obligations prevents liability gaps.