The Application for Student Loan Forgiveness is a formal request submitted by borrowers seeking relief from their student loan debt under specific forgiveness programs. It requires providing documentation that verifies eligibility criteria such as employment in qualifying public service roles or meeting income-driven repayment thresholds. Successfully completing this application can result in partial or full cancellation of the outstanding loan balance, easing financial burdens.

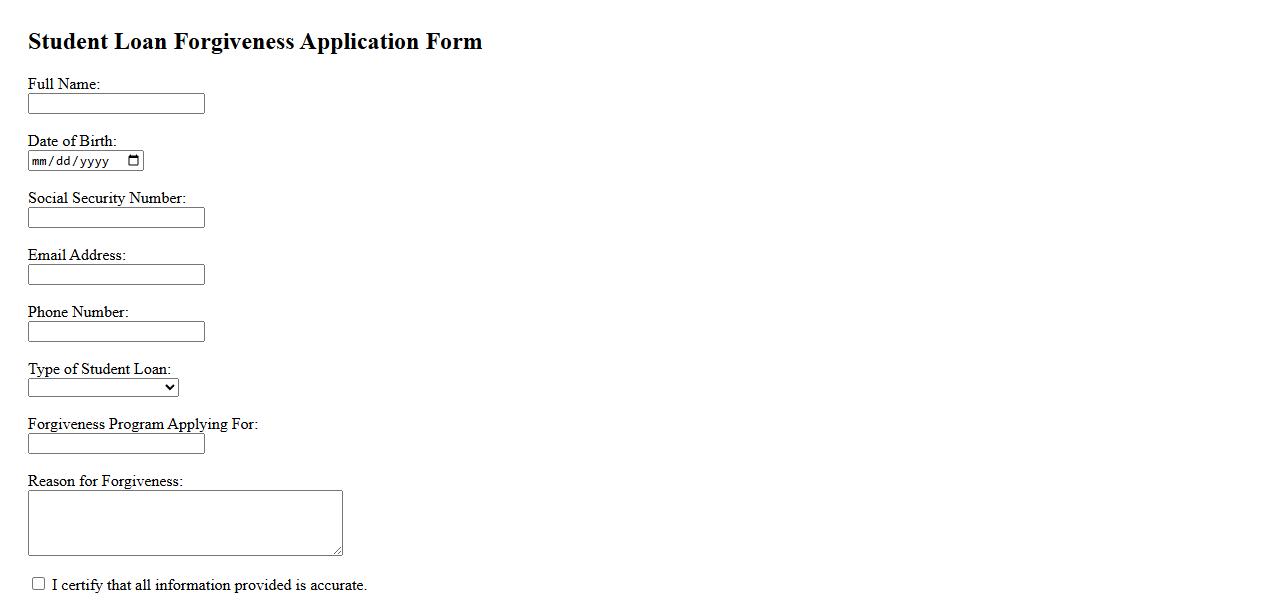

Student Loan Forgiveness Application Form

The Student Loan Forgiveness Application Form is a crucial document for borrowers seeking relief from their student loan debt. It collects essential personal and financial information to determine eligibility for loan forgiveness programs. Submitting this form accurately and promptly can significantly reduce or eliminate your student loan payments.

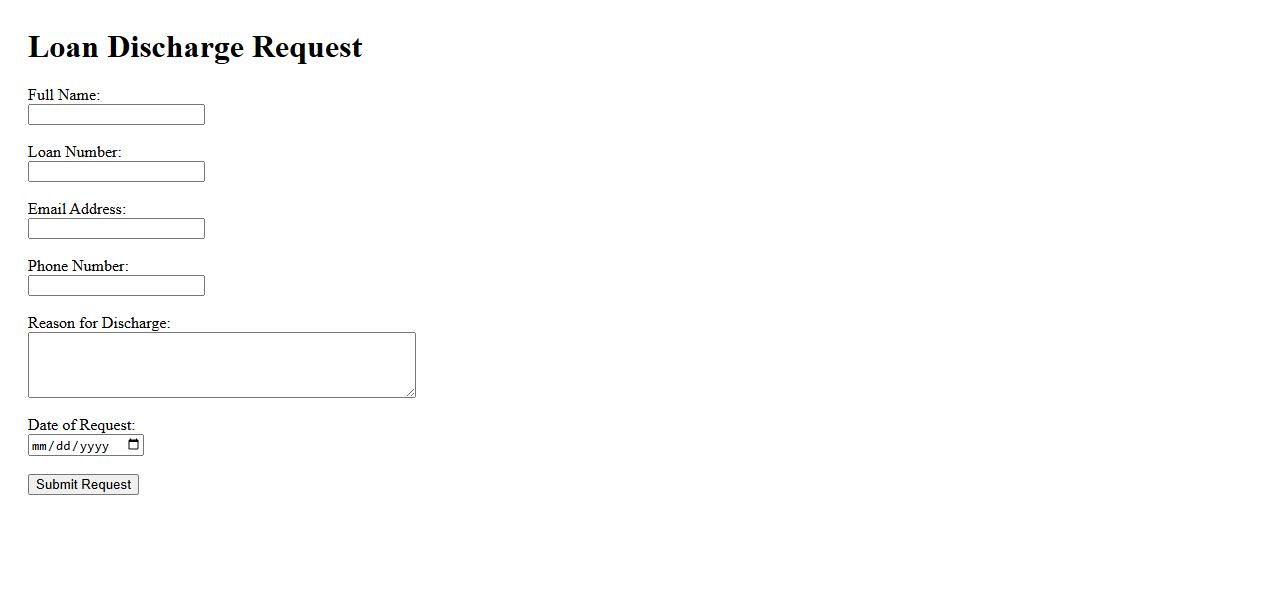

Loan Discharge Request Document

A Loan Discharge Request Document is an official paper submitted by a borrower to formally request the closure or payoff of their loan account. It includes essential details such as the borrower's information, loan account number, and proof of full repayment. This document helps ensure the lender acknowledges the loan has been settled, preventing any future liabilities.

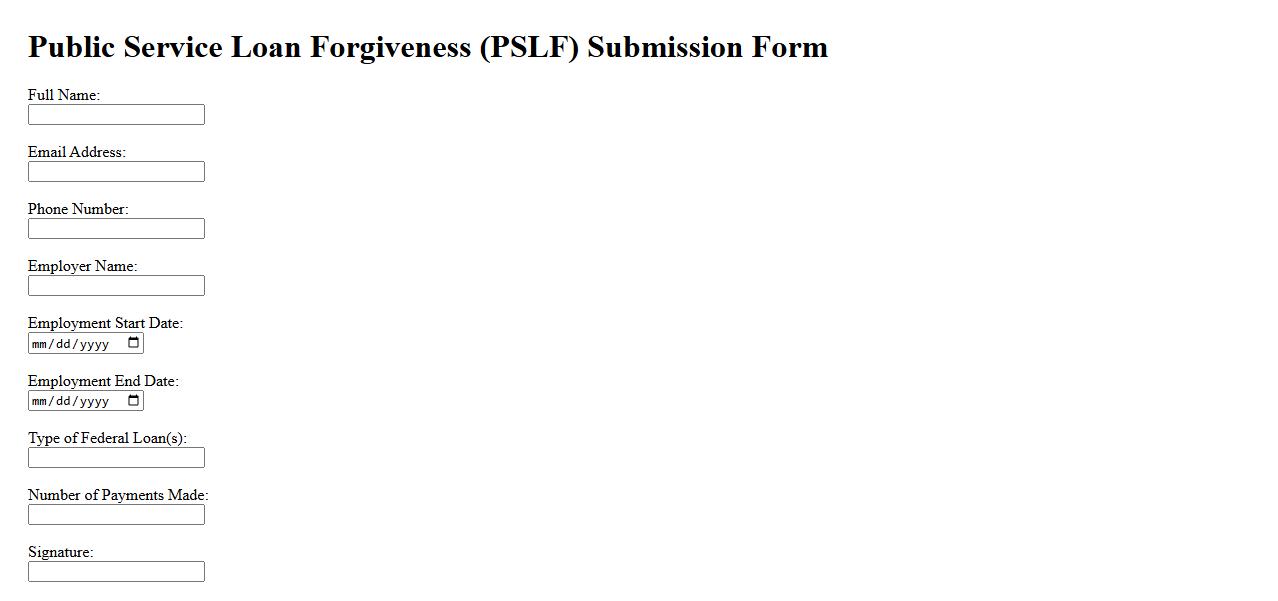

Public Service Loan Forgiveness (PSLF) Submission

The Public Service Loan Forgiveness (PSLF) submission process allows eligible borrowers to apply for forgiveness of their federal student loans after making 120 qualifying payments while working in public service jobs. It is essential to submit the Employment Certification Form annually to track progress. Proper submission ensures borrowers can benefit from loan forgiveness under this federal program.

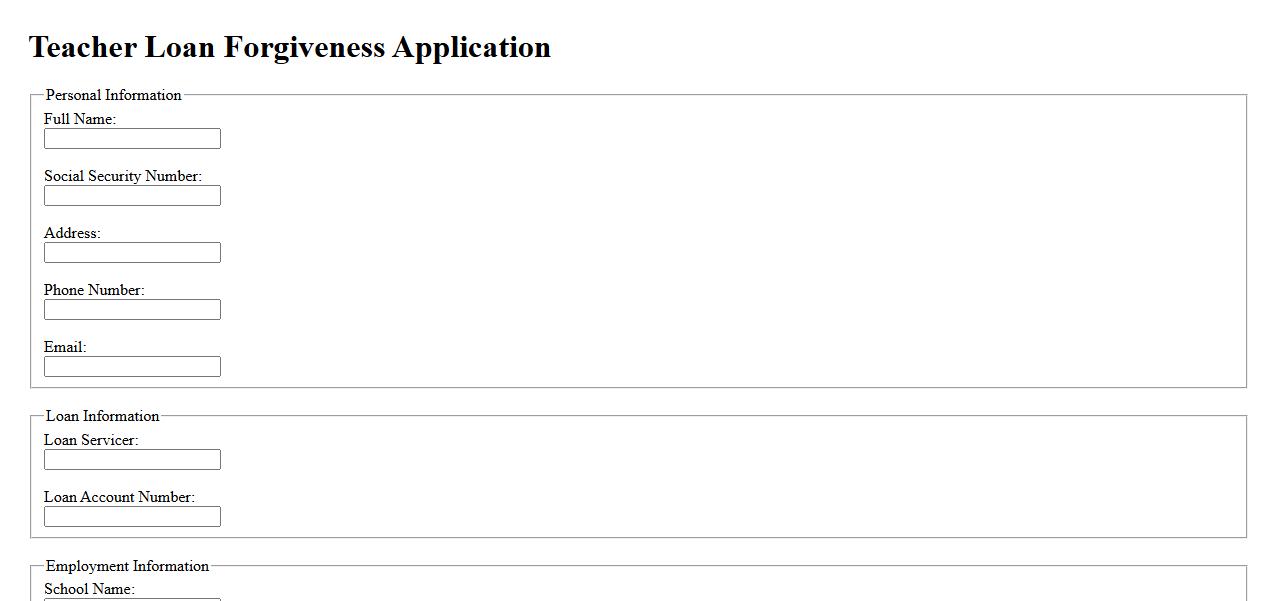

Teacher Loan Forgiveness Application

The Teacher Loan Forgiveness Application allows eligible educators to reduce their federal student loan debt by teaching in low-income schools for a designated period. This program provides financial relief to committed teachers, helping them continue their vital work in underserved communities. Submitting a complete and accurate application is essential to benefit from this forgiveness opportunity.

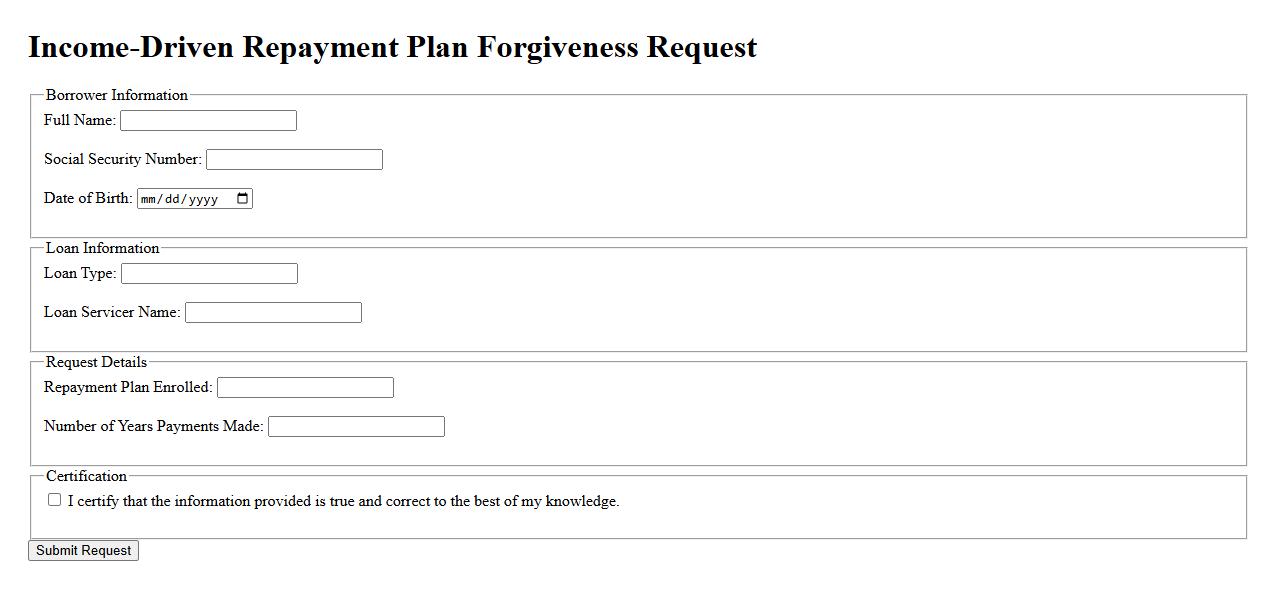

Income-Driven Repayment Plan Forgiveness Request

The Income-Driven Repayment Plan Forgiveness Request allows borrowers to apply for loan forgiveness after making qualifying payments under an income-driven repayment plan. This option helps reduce the remaining balance on federal student loans for those with low income relative to their debt. It is essential to submit the proper documentation to ensure eligibility and maximize benefits.

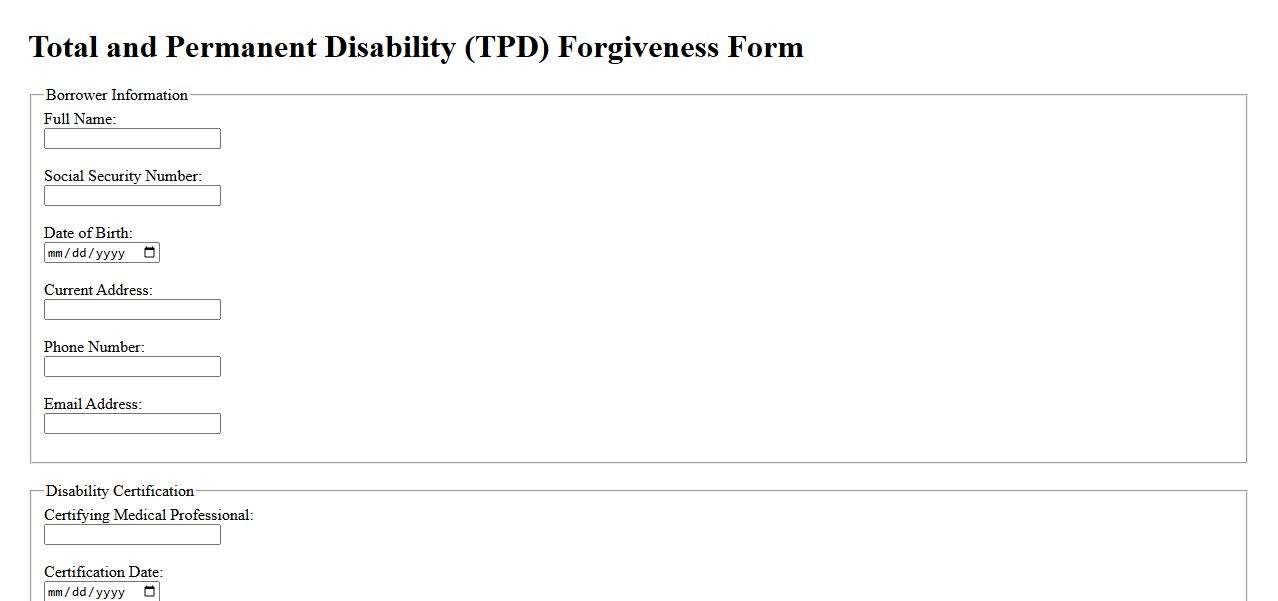

Total and Permanent Disability Forgiveness Form

The Total and Permanent Disability Forgiveness Form is a crucial document used to request loan forgiveness due to a borrower's complete and permanent disability. This form helps ensure that individuals who are unable to work because of long-term disabilities can have their financial obligations reviewed or potentially forgiven. Proper completion and submission of this form can provide significant relief to eligible borrowers.

Closed School Loan Forgiveness Request

The Closed School Loan Forgiveness Request allows borrowers to apply for loan forgiveness if their school closes while they are enrolled or soon after they withdraw. This benefit helps alleviate financial burdens by canceling eligible federal student loans. It ensures students are not left responsible for loans when their education is interrupted unexpectedly.

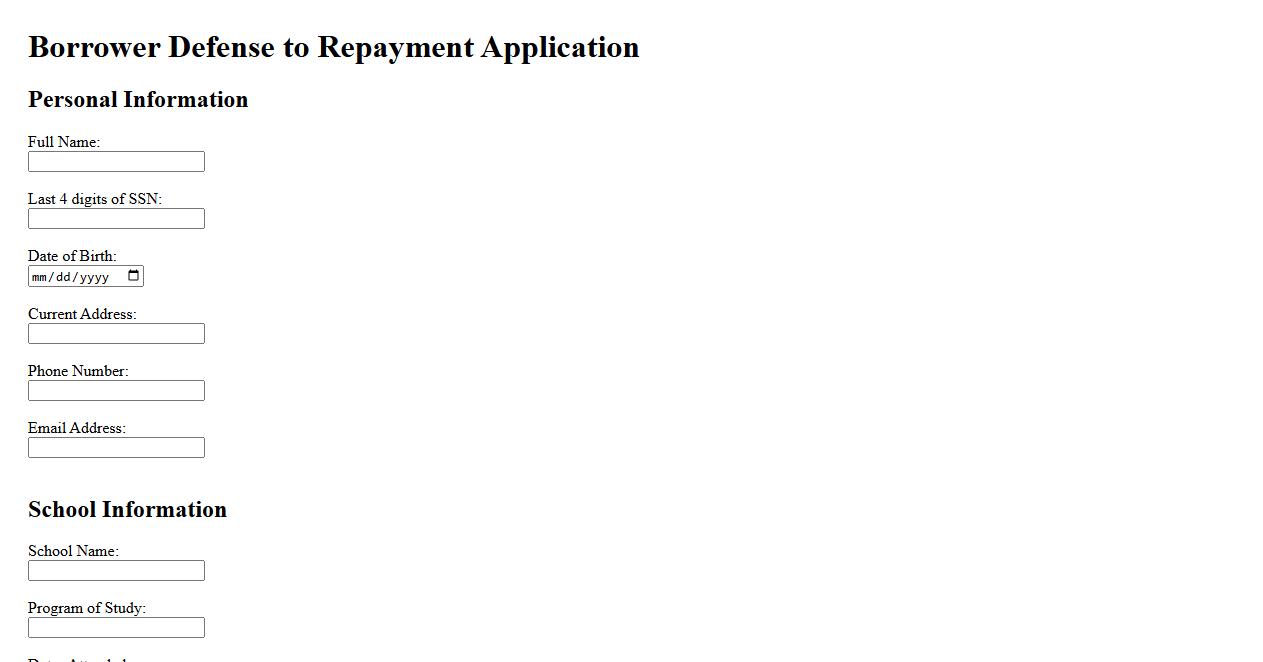

Borrower Defense to Repayment Application

The Borrower Defense to Repayment Application allows students to apply for loan forgiveness if they were defrauded by their college or if the school violated certain laws. This application helps borrowers reduce or eliminate their federal student loan debt under specific circumstances. It is a critical tool for protecting students from financial harm caused by unfair educational practices.

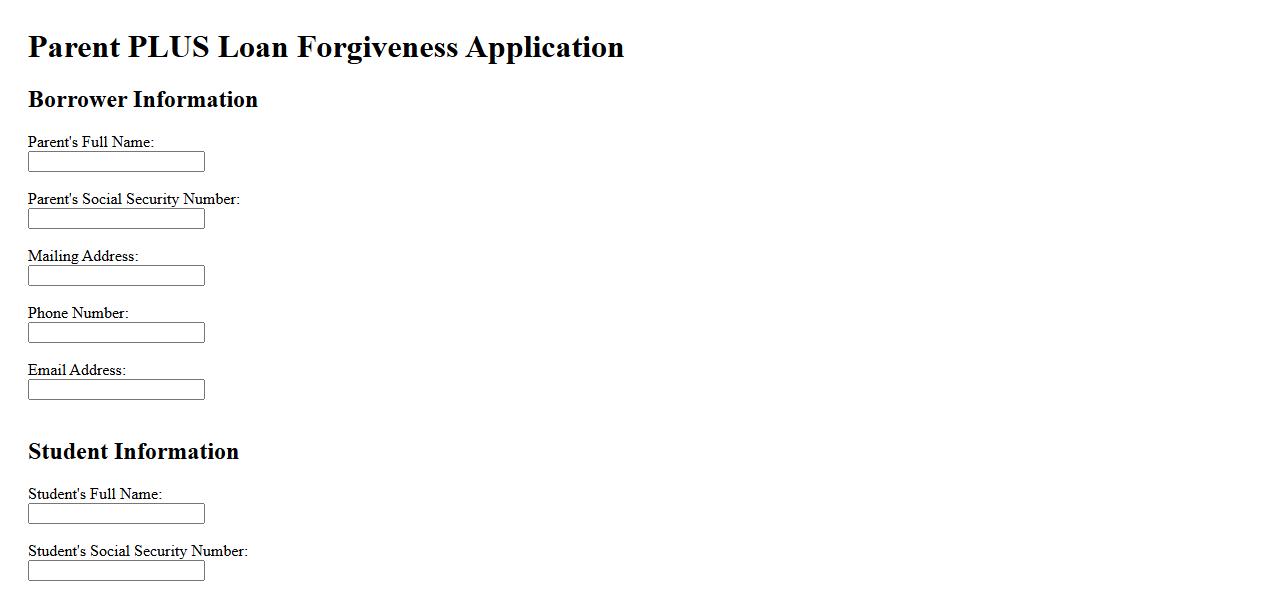

Parent PLUS Loan Forgiveness Application

The Parent PLUS Loan Forgiveness Application allows eligible parents to apply for loan forgiveness on their federal Parent PLUS Loans. This application streamlines the process of reducing or eliminating debt for those who qualify under specific forgiveness programs. Timely submission is crucial to maximize the benefits of loan forgiveness options available.

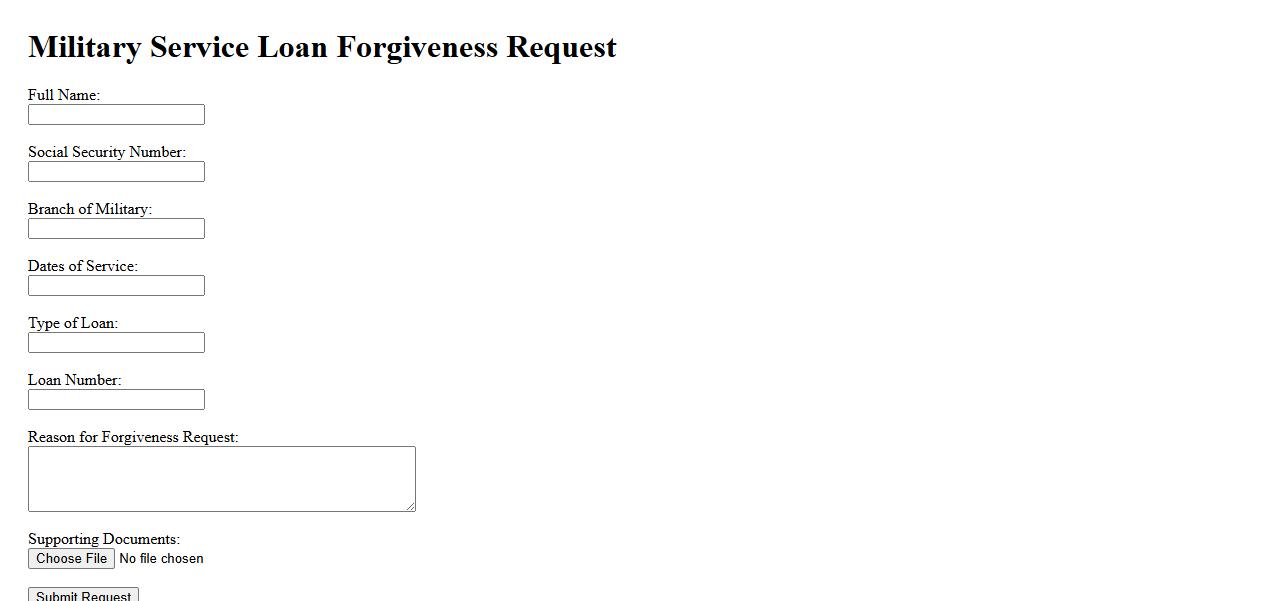

Military Service Loan Forgiveness Request

If you have served in the armed forces, you may be eligible for Military Service Loan Forgiveness Request programs that help reduce or eliminate your student loan debt. These programs recognize the sacrifices made by military personnel and offer financial relief as a token of appreciation. Submitting a formal request can initiate the process to benefit from this valuable loan forgiveness opportunity.

What criteria must be met for a student loan to qualify for forgiveness under this application?

To qualify for student loan forgiveness, the borrower must meet specific income and employment requirements. The loan must have been used for eligible educational purposes, typically tied to attendance at an accredited institution. Additionally, the borrower must have made a minimum number of qualifying payments or demonstrate financial hardship under the program guidelines.

Which types of student loans are eligible for forgiveness through this program?

This program primarily covers federal student loans such as Direct Loans and Federal Family Education Loans (FFEL). Private loans or loans not originated or guaranteed by the federal government are typically excluded. Eligibility may also depend on whether the loan is consolidated or in a particular repayment plan.

What supporting documentation is required to process an application for student loan forgiveness?

Applicants must submit proof of employment history, loan statements, and income verification documents. Official pay stubs, tax returns, or employer certification forms are often necessary to confirm eligibility. Additional documentation like proof of enrollment and repayment history may also be required to complete the assessment.

How does employment status or employer type affect eligibility for student loan forgiveness?

Eligibility may depend on whether the borrower works full-time for a qualifying employer, such as a government agency or non-profit organization. Part-time employment or working for a private sector employer might not meet program requirements. The type of employment plays a crucial role in validating the borrower's participation in forgiveness programs like Public Service Loan Forgiveness (PSLF).

What is the expected timeline for reviewing and receiving a decision on a student loan forgiveness application?

The review process for student loan forgiveness applications typically takes between 3 to 6 months after submission. Delays may occur if additional documentation is required or if verification processes take longer. Borrowers are usually notified via email or postal mail regarding the decision or any needed follow-up actions.