Filing an Application for Disability Insurance involves submitting necessary medical and personal information to prove eligibility for benefits. This process ensures that individuals unable to work due to a disabling condition receive financial support. Proper documentation and timely submission significantly increase the chance of approval.

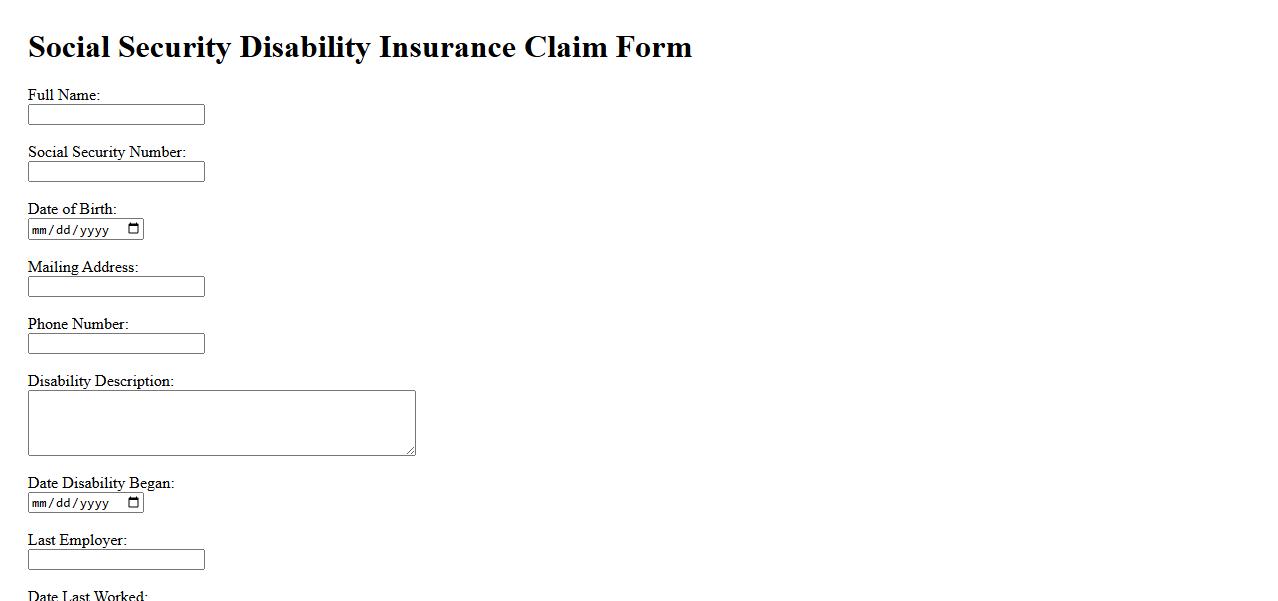

Social Security Disability Insurance claim form

The Social Security Disability Insurance claim form is a vital document used to apply for disability benefits through the Social Security Administration. It collects essential information about the claimant's medical condition, work history, and personal details to determine eligibility. Accurate completion of this form ensures a smoother and faster review process for disability benefits approval.

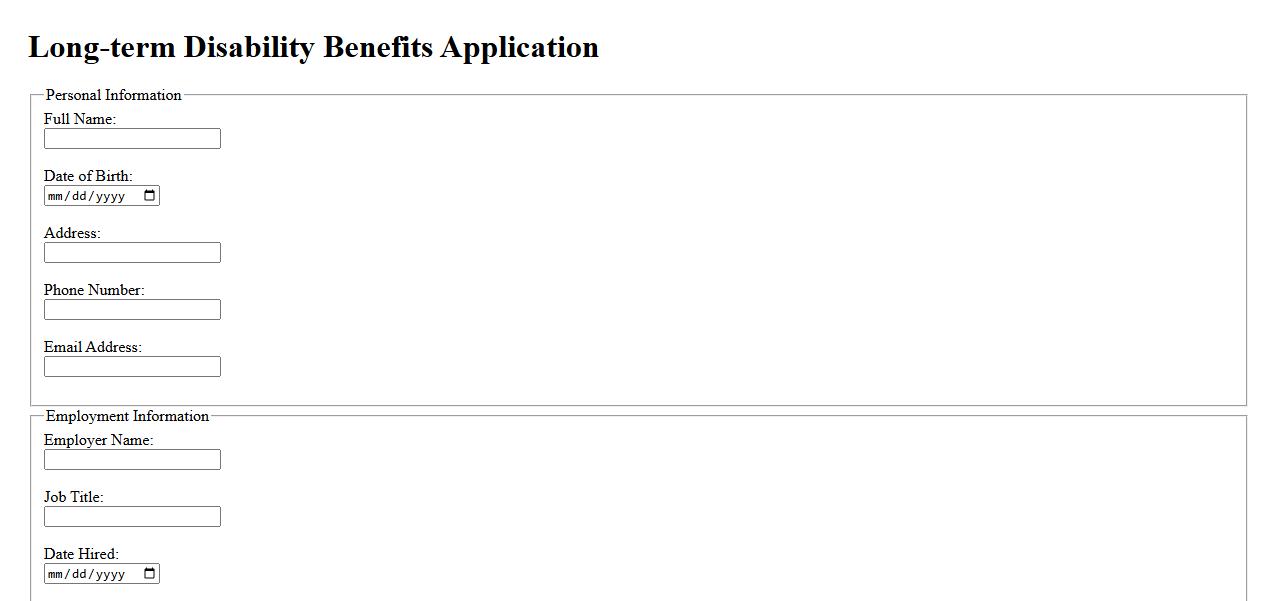

Long-term disability benefits application

The long-term disability benefits application is a crucial process for individuals seeking financial support during extended periods of inability to work. It involves submitting medical evidence and documentation to establish eligibility for ongoing income replacement. Understanding the application requirements ensures a smoother approval process and timely assistance.

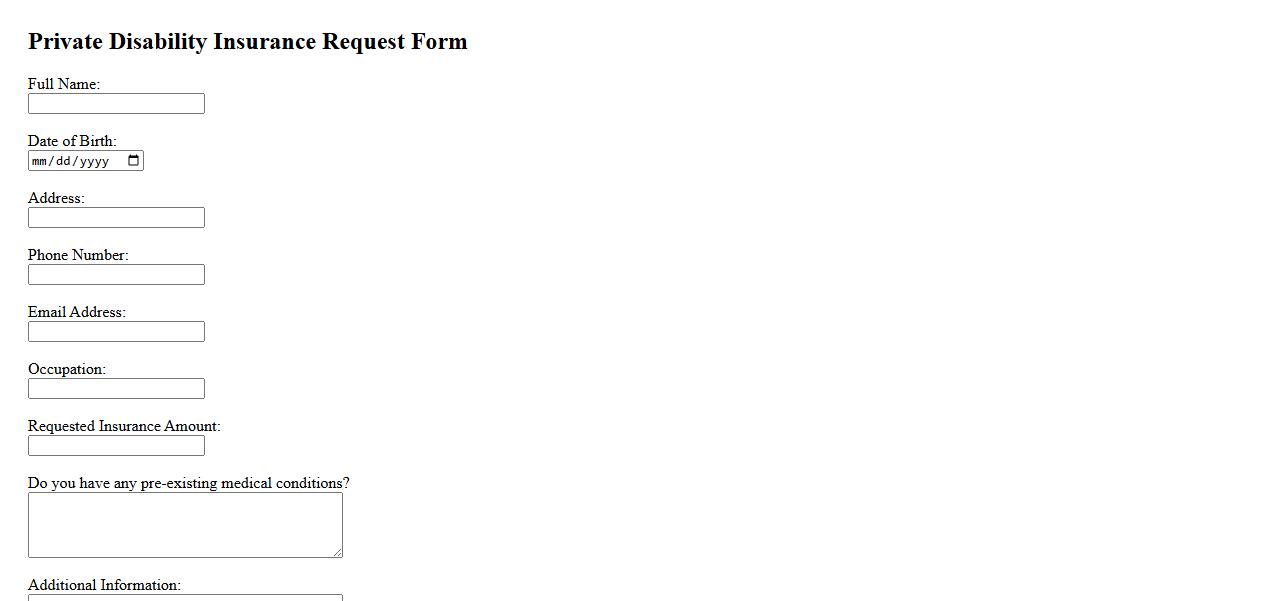

Private disability insurance request form

The private disability insurance request form is an essential document used to apply for coverage that provides income protection in case of illness or injury. This form captures personal and medical information necessary for the insurer to assess eligibility and benefits. Timely and accurate completion of the request form ensures a smooth approval process for private disability insurance.

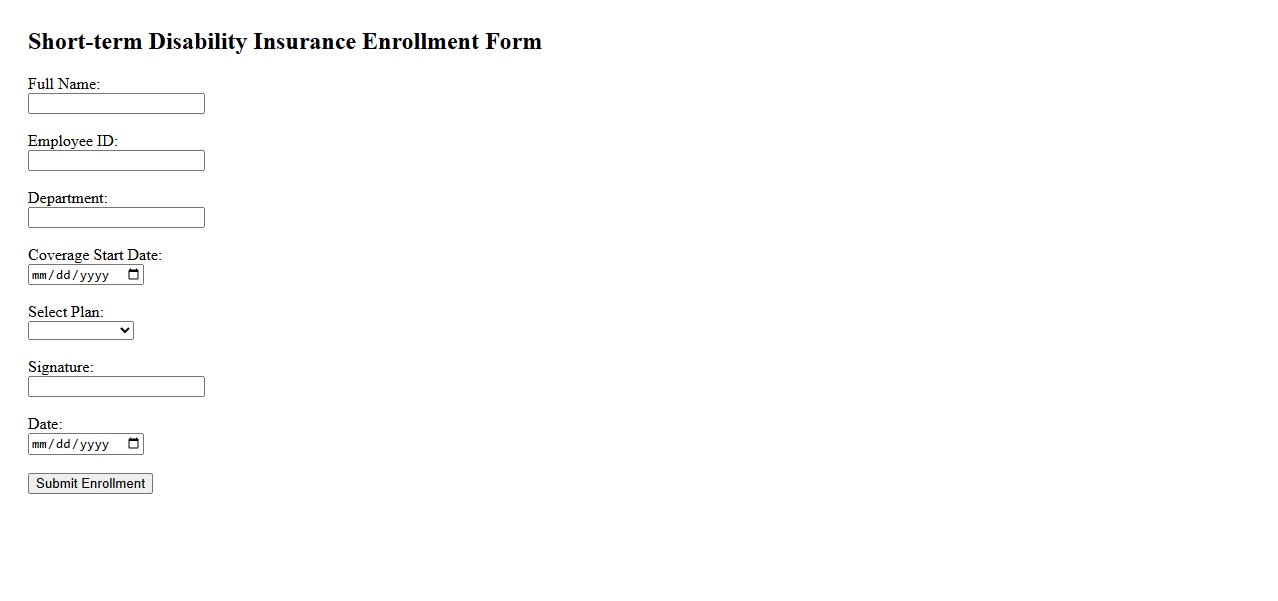

Short-term disability insurance enrollment

Short-term disability insurance enrollment allows employees to secure income protection during temporary illnesses or injuries. By opting into short-term disability coverage, individuals ensure financial stability without the worry of lost wages. This enrollment process is crucial for maintaining peace of mind during unexpected health challenges.

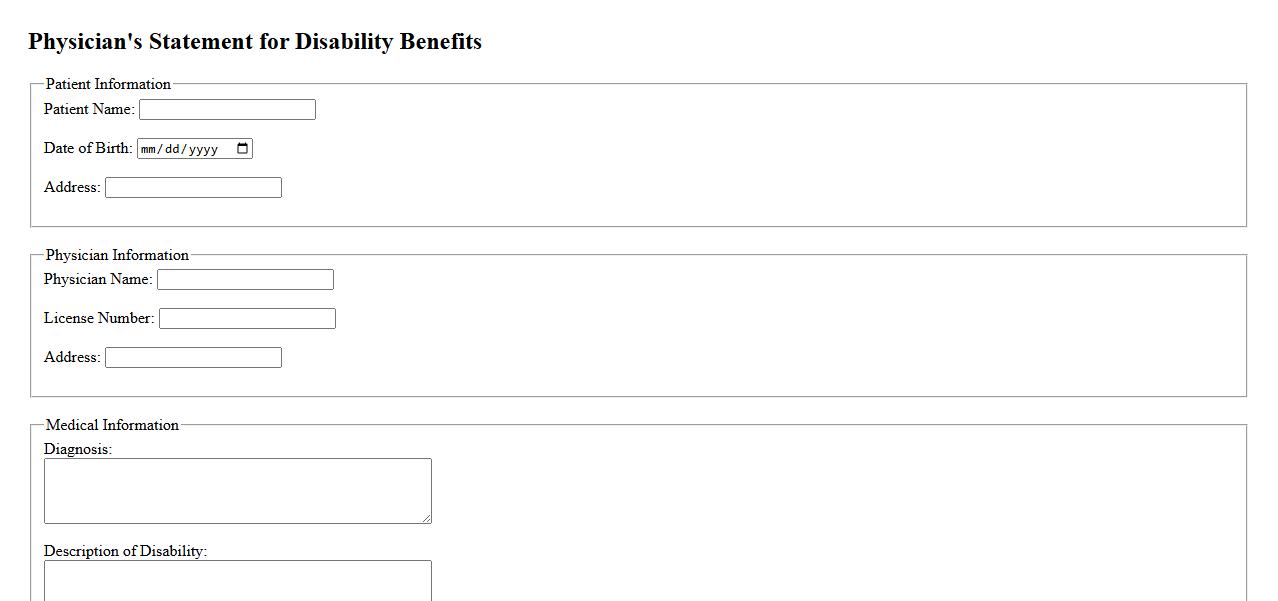

Physician's statement for disability benefits

A physician's statement for disability benefits is a crucial document that provides medical evidence supporting an individual's claim for disability. It details the patient's diagnosis, treatment history, and limitations affecting their ability to work. This statement helps insurance companies or government agencies determine eligibility for disability benefits.

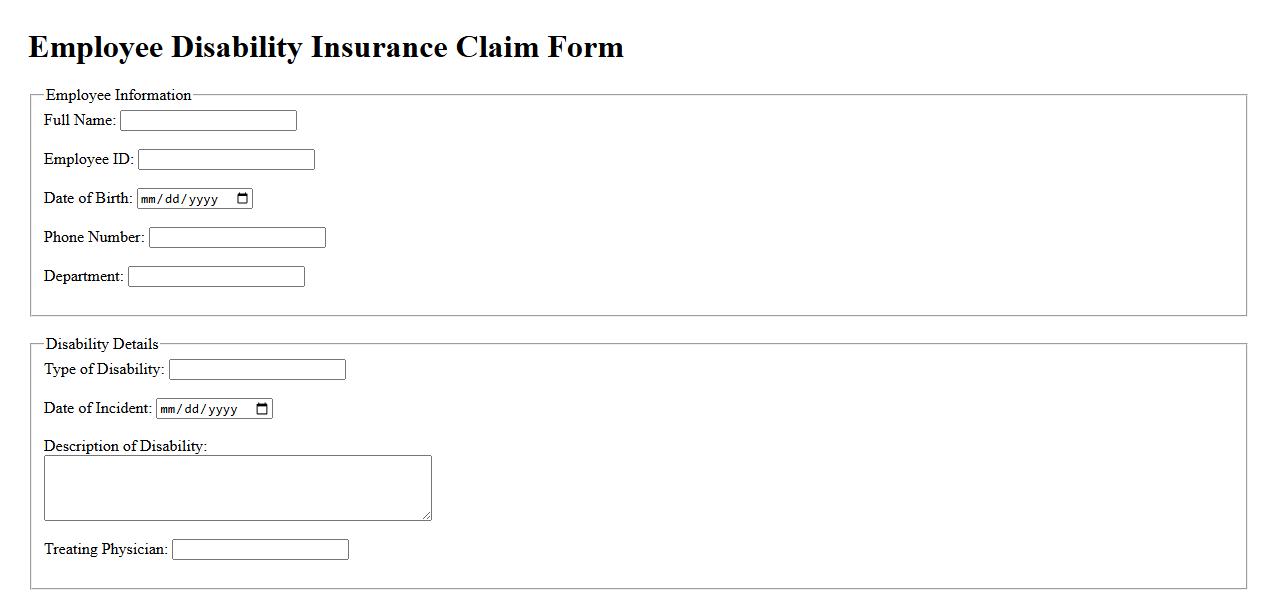

Employee disability insurance claim

An employee disability insurance claim provides financial support to workers who are unable to perform their job due to illness or injury. This insurance helps cover lost income during the period of disability. Filing a claim promptly ensures timely benefits and peace of mind for affected employees.

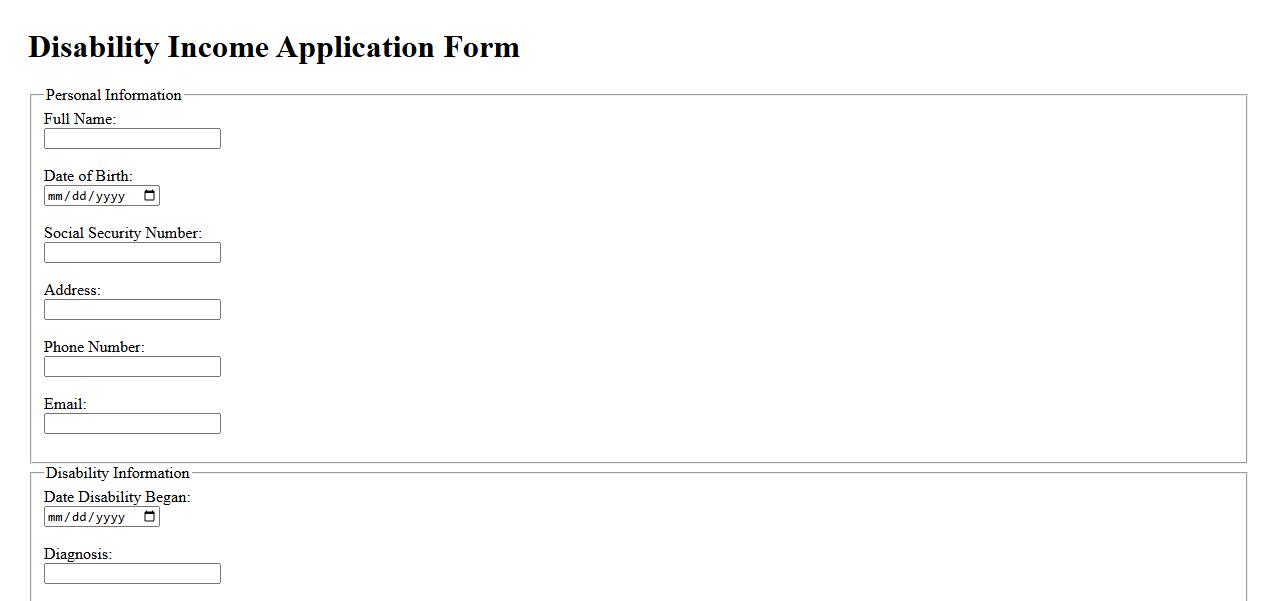

Disability income application

The disability income application is a crucial process for individuals seeking financial support during periods of disability. This application collects essential personal and medical information to evaluate eligibility for income replacement benefits. Ensuring accurate and complete submission helps expedite the approval and delivery of funds.

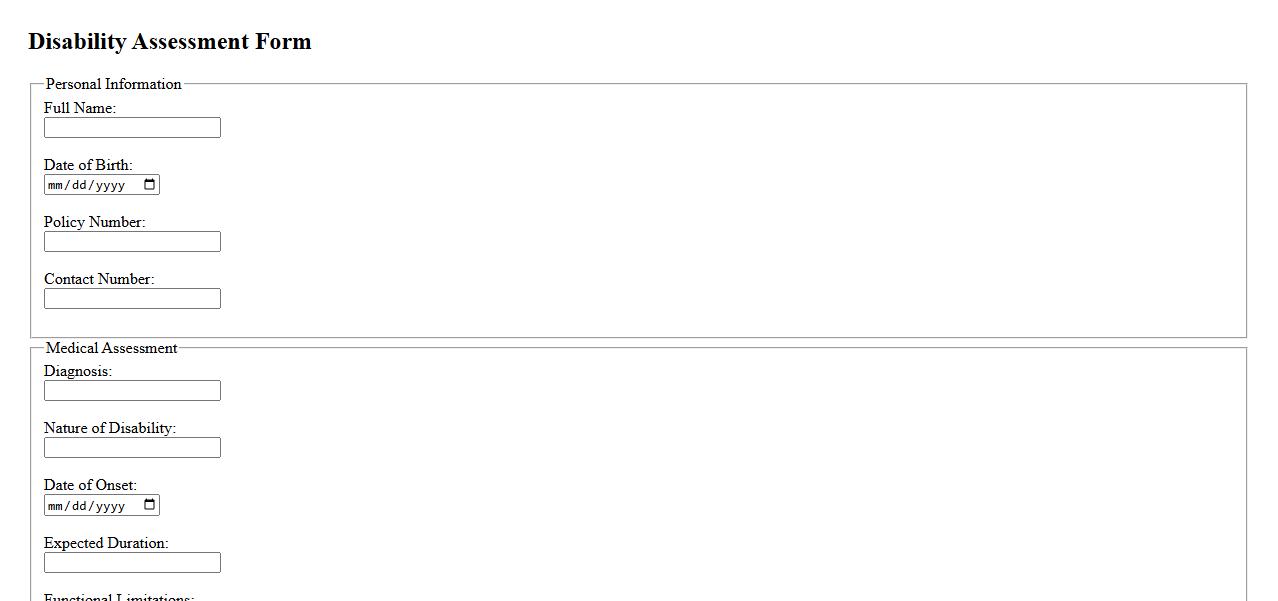

Insurance carrier disability assessment form

The Insurance carrier disability assessment form is a crucial document used to evaluate an individual's eligibility for disability benefits. It gathers detailed information about the claimant's medical condition and functional limitations. This form ensures accurate and fair determination of disability claims by insurance providers.

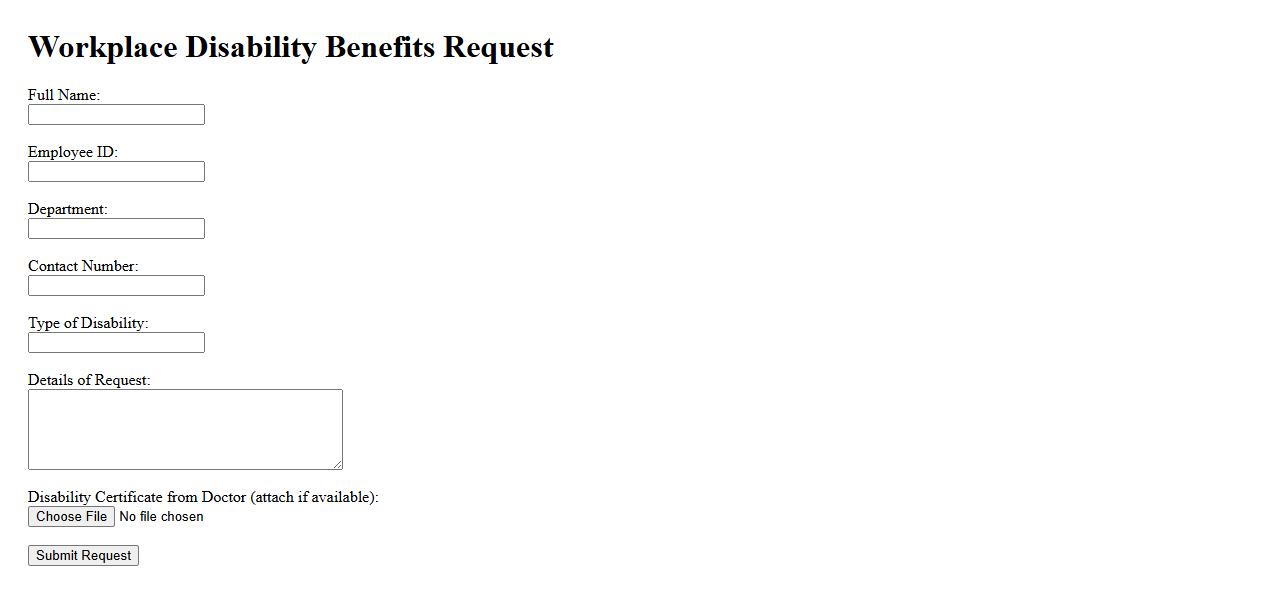

Workplace disability benefits request

Submitting a workplace disability benefits request ensures employees receive financial support during periods of inability to work due to illness or injury. The process typically involves providing medical documentation and completing specific forms required by the employer or insurance provider. Timely and accurate submission of these requests helps protect workers' rights and facilitates access to necessary benefits.

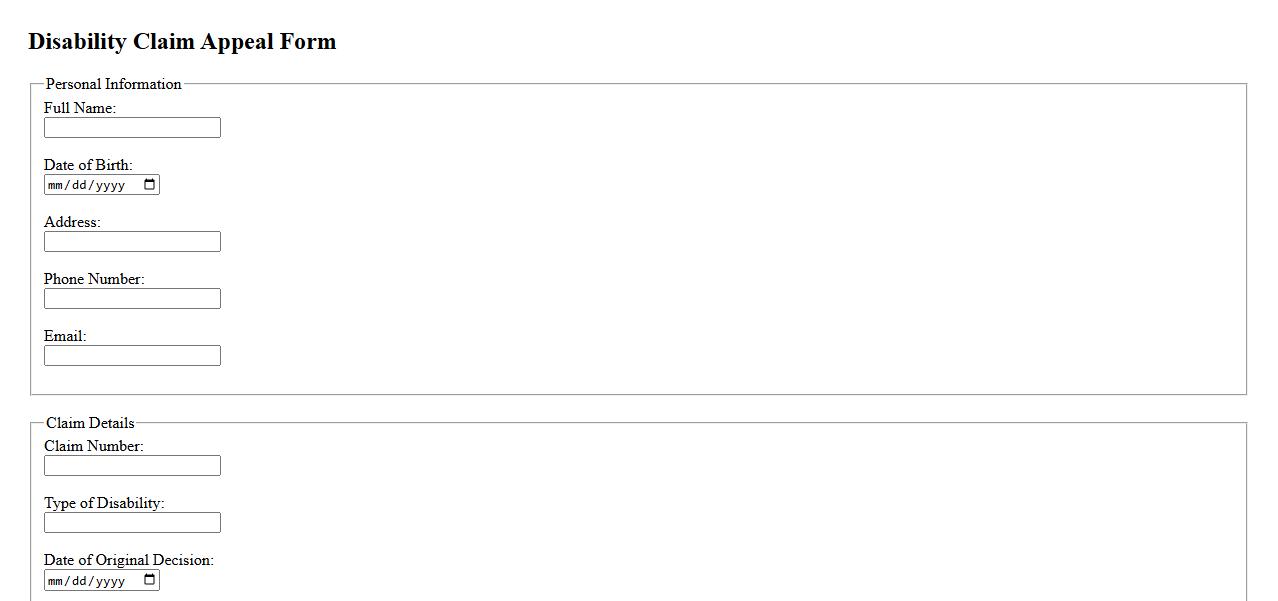

Disability claim appeal form

The disability claim appeal form is a crucial document used to contest a denied disability benefits decision. It allows claimants to provide additional evidence and clarify information to support their case. Timely submission of this form is essential for a successful appeal process.

Type of Disability Coverage

This application pertains to both short-term and long-term disability coverage. The coverage options allow applicants to choose based on their individual needs and employment status. Offering dual coverage ensures comprehensive protection against various disability durations.

Qualifying Medical or Health Conditions

The applicant must have a medically documented condition that prevents them from performing their job duties. Common qualifying conditions include physical injuries, chronic illnesses, and mental health disorders. The insurance provider evaluates each case based on medical evidence and severity.

Required Documentation for Verification

Applicants must submit medical reports and physician statements to verify their disability status. Additional documents may include hospital records, lab tests, and treatment history. Timely and accurate documentation is critical to expedite the approval process.

Impact of the Waiting Period on Benefits

The waiting period is the time between disability onset and when benefits begin. Typically, benefits commence only after the waiting period is fully satisfied. This period ensures that only legitimate, long-lasting disabilities receive financial support.

Eligibility Criteria and Exclusions

Eligibility requires proof of continuous employment and a qualifying medical condition under the policy terms. Certain exclusions may apply, such as disabilities due to pre-existing conditions or self-inflicted injuries. Understanding these criteria helps applicants know their coverage limits and avoid claim denials.